Many individuals are curious about the implications of obtaining a medical card on their insurance coverage. This paragraph aims to address that concern: When you apply for a medical card, it's important to understand that your insurance provider may be notified. Medical cards are designed to provide financial assistance for healthcare costs, and insurance companies often have agreements with healthcare providers to facilitate these services. While your insurance might be informed about your medical card, it's essential to remember that this notification doesn't necessarily impact your insurance coverage or premiums. The primary purpose of a medical card is to streamline access to healthcare services, and insurance companies typically work to ensure a smooth transition for policyholders.

| Characteristics | Values |

|---|---|

| Type of Insurance | Health Insurance, Life Insurance, Auto Insurance, Homeowners Insurance, etc. |

| Impact on Premiums | May or may not affect premiums, depending on the insurance company and policy. |

| Notification Process | Insurance companies typically do not proactively notify policyholders about a medical card. |

| Privacy Considerations | Insurance companies are bound by privacy laws and may not disclose personal health information without consent. |

| Potential Benefits | Access to healthcare services, reduced out-of-pocket expenses, and potential discounts. |

| Disclaimers | Obtaining a medical card does not guarantee coverage or eligibility for all medical services. |

| Policy Review | Reviewing your insurance policy is essential to understand the implications and coverage details. |

| Consultation | Consulting with your insurance provider or a financial advisor is recommended for personalized advice. |

What You'll Learn

- Eligibility and Coverage: Insurance policies vary; check your plan's specifics regarding medical cards

- Claims Process: Understand how medical cards affect claim submissions and reimbursement

- Network Considerations: Insurance companies may have specific networks for medical card holders

- Cost Implications: Medical cards can impact out-of-pocket costs and insurance premiums

- Privacy and Data Sharing: Insurance companies may share information with medical card providers

Eligibility and Coverage: Insurance policies vary; check your plan's specifics regarding medical cards

When considering the impact of obtaining a medical card on your insurance, it's crucial to understand that insurance policies can vary significantly. The relationship between insurance coverage and medical cards is not universally defined, and the specifics can depend on your insurance provider and the type of policy you hold. Therefore, it is essential to carefully review your insurance plan's terms and conditions.

Medical cards, also known as healthcare or medical assistance cards, are often associated with government-provided healthcare services, offering financial assistance for medical expenses. These cards can be particularly useful for individuals who require regular medical care or have chronic conditions. However, the extent to which insurance companies recognize and interact with medical card holders can vary. Some insurance policies might explicitly state that they cover medical card holders, while others may not, depending on the policy's scope and the insurance provider's policies.

To ensure you understand your insurance's stance, it is recommended to contact your insurance provider directly. They can provide clear information about how medical cards are treated under your specific policy. This proactive step will help you avoid any surprises when seeking medical care and ensure you are aware of your coverage. Additionally, understanding the nuances of your insurance policy can help you make informed decisions about your healthcare and financial planning.

In some cases, insurance companies might require additional documentation or proof of eligibility for medical card holders. This could include providing medical records, doctor's notes, or other relevant information to demonstrate the need for the medical card. It is important to be prepared and have the necessary documentation readily available to facilitate the claims process if you anticipate needing to use your medical card for insurance purposes.

In summary, the relationship between insurance and medical cards is not standardized, and it is the responsibility of the insured individual to understand their policy. By reviewing your insurance plan and seeking clarification from your provider, you can ensure that you are aware of any specific requirements or limitations related to medical card usage under your coverage. This knowledge will enable you to navigate your healthcare and insurance needs with confidence.

Medicaid vs. Medicare: Which Insurance is Best for You?

You may want to see also

Claims Process: Understand how medical cards affect claim submissions and reimbursement

The process of submitting insurance claims can be intricate, especially when it involves medical cards. Understanding how medical cards impact your claim is crucial to ensure a smooth and efficient reimbursement process. Here's a breakdown of how medical cards can affect your insurance claims:

Claim Submission and Documentation: When you have a medical card, it indicates that you have been granted access to a specific healthcare service or benefit. Insurance companies often require detailed documentation to process claims accurately. This includes providing proof of the medical services you've received, such as receipts, invoices, or medical reports. With a medical card, you'll need to submit this documentation along with your claim to demonstrate the services covered by your insurance. The insurance provider will verify the authenticity and relevance of the services to ensure proper reimbursement.

Reimbursement Process: Medical cards can streamline the reimbursement process in some cases. If your insurance plan covers specific services or treatments associated with the medical card, the insurance company may automatically process the claim for reimbursement. This is particularly useful for pre-approved or frequently requested services. However, it's essential to ensure that your insurance policy clearly outlines the coverage related to the medical card to avoid any discrepancies during the reimbursement phase.

Impact on Claim Approval: The presence of a medical card can influence the likelihood of claim approval. Insurance companies often have specific criteria and guidelines for covering certain medical services. If the medical card aligns with the services covered by your insurance policy, the claim is more likely to be approved. However, it's important to note that insurance providers may still require additional documentation or verification, especially for more complex or specialized treatments.

Communication and Transparency: Open communication with your insurance provider is key when dealing with medical cards. Inform your insurance company about the medical card and the associated services you intend to utilize. This proactive approach ensures that your insurance policy is up-to-date and reflects the changes accurately. Regularly reviewing your insurance coverage and staying informed about any updates related to medical cards can help you navigate the claims process with confidence.

In summary, medical cards play a significant role in the insurance claims process, affecting how and when your insurance company reimburses you for medical services. By understanding the impact of medical cards on claim submissions and reimbursement, you can ensure a more efficient and accurate handling of your insurance claims. Always maintain transparency and provide the necessary documentation to support your claims, especially when utilizing medical cards.

Life Insurance Payouts: Medicaid's Complex Relationship

You may want to see also

Network Considerations: Insurance companies may have specific networks for medical card holders

When considering the implications of obtaining a medical card, it's important to understand the potential impact on your insurance coverage and network. Insurance companies often have intricate relationships with healthcare providers and facilities, and these networks can vary significantly. Here's an overview of how network considerations come into play when you have a medical card:

Insurance companies frequently establish specific networks of healthcare providers, including doctors, hospitals, and specialists, to ensure efficient and cost-effective care for their policyholders. These networks are carefully curated to offer a range of medical services while maintaining a certain level of quality and control. When you have a medical card, you are essentially associated with this network, and your insurance coverage may be tailored to these specific providers. This means that your insurance company has pre-negotiated rates and terms with these healthcare professionals, making it more convenient and potentially more affordable for you to access medical services within this network.

The network associated with your medical card can provide several benefits. Firstly, it ensures that you have access to a wide range of medical services, including primary care, specialist consultations, and even hospital services, all within a well-organized system. This network approach allows insurance companies to manage costs effectively, as they have agreements with providers to offer services at predetermined rates. As a result, you may find that certain medical procedures or treatments are covered more comprehensively when you use the network providers.

However, it's essential to be aware of the limitations and potential challenges. Insurance companies may restrict coverage to specific providers within their network, and any services received outside this network might not be fully covered or could incur higher out-of-pocket expenses. This is a common strategy for insurance providers to encourage policyholders to utilize the network, ensuring better control over costs and service quality. Therefore, it's crucial to understand the terms and conditions of your insurance policy, especially regarding the network associated with your medical card.

In summary, when you obtain a medical card, your insurance coverage may be tied to a specific network of healthcare providers. This network consideration is a strategic approach by insurance companies to manage costs and provide a structured system for policyholders. Understanding the network associated with your medical card is vital to ensure you receive the appropriate coverage and access quality healthcare services. Always review your insurance policy and network details to make informed decisions about your healthcare choices.

Understanding Medical Expense Insurance: A Comprehensive Guide

You may want to see also

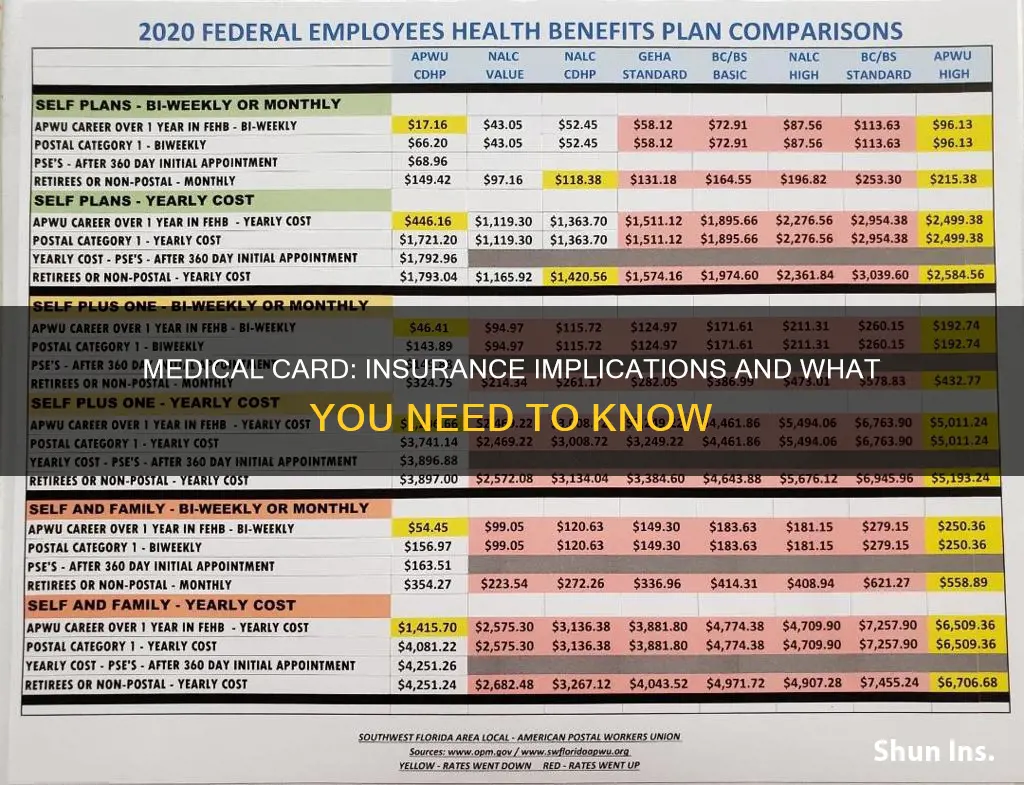

Cost Implications: Medical cards can impact out-of-pocket costs and insurance premiums

The introduction of a medical card can significantly influence an individual's healthcare expenses and insurance coverage, leading to both immediate and long-term cost implications. One of the primary benefits of a medical card is the reduction of out-of-pocket costs for healthcare services. With a medical card, individuals are entitled to certain healthcare services at reduced or no cost, depending on the specific services and the country's healthcare system. This can include reduced fees for doctor visits, prescription medications, and even hospital stays. As a result, individuals with medical cards may experience a decrease in their overall healthcare expenses, especially for those with chronic conditions or frequent medical needs.

However, the impact on insurance premiums is a crucial consideration. Medical cards often provide coverage for specific services, and this can affect the way insurance companies assess risk and determine premiums. When an individual obtains a medical card, their insurance provider may need to adjust their coverage to align with the benefits offered by the card. This adjustment could lead to changes in the insurance policy, potentially increasing premiums for other covered services or requiring the individual to pay more out-of-pocket for services not included in the medical card. For instance, if a medical card covers routine check-ups and prescription drugs, the insurance company might reduce the premium for these services but may need to increase it for other medical expenses to maintain profitability.

In some cases, individuals with medical cards might experience a shift in their insurance coverage, where certain services are covered by the medical card, and the insurance policy adjusts to exclude those services. This could result in higher premiums for the remaining coverage, as the insurance company aims to balance the costs and benefits of the policy. It is essential for individuals to understand the specific terms and conditions of their medical card and insurance policy to anticipate any potential changes in costs.

Furthermore, the impact on insurance premiums can vary depending on the country's healthcare system and the specific medical card program. Different countries and regions may have varying levels of integration between medical card systems and insurance providers. In some cases, the medical card might be directly linked to the individual's insurance policy, ensuring seamless coverage. In other instances, the medical card may provide separate benefits, requiring the individual to manage two distinct coverage systems, which could lead to more complex cost implications.

In summary, while medical cards offer significant advantages in reducing out-of-pocket healthcare costs, they also have implications for insurance premiums and coverage. Individuals should carefully review their medical card benefits and insurance policy details to understand how these changes might affect their overall healthcare expenses. Being aware of these cost implications can help individuals make informed decisions about their healthcare and insurance choices.

Cigna Insurance: Unlocking Medical Marijuana Coverage

You may want to see also

Privacy and Data Sharing: Insurance companies may share information with medical card providers

The process of obtaining a medical card can sometimes raise concerns about privacy and data sharing, especially when it comes to insurance companies. Many individuals wonder if their insurance provider will be notified when they apply for or receive a medical card. It's important to understand the potential data exchange between insurance companies and medical card providers to ensure you are aware of your personal information's flow.

When you apply for a medical card, the relevant authorities or healthcare providers will collect your personal and medical information. This data is then shared with the medical card provider to assess your eligibility and process the application. In some cases, insurance companies may also be involved, especially if they have a partnership or agreement with the medical card provider. For instance, insurance companies might share information with medical card providers to verify an individual's health status, especially if the medical card is linked to specific health insurance coverage.

The sharing of information between insurance companies and medical card providers is often a result of collaborative efforts to streamline healthcare services. Insurance providers may use the data to offer tailored health plans or to understand the medical needs of their policyholders. However, it is crucial to note that such data sharing should be conducted securely and in compliance with privacy regulations. Insurance companies must adhere to strict guidelines to protect personal information and ensure that data sharing is only done with authorized entities.

Privacy laws and regulations, such as the General Data Protection Regulation (GDPR) in Europe, provide individuals with rights regarding their personal data. These laws ensure that insurance companies and medical card providers must obtain explicit consent for data sharing and handle personal information with care. As a result, individuals can have more control over their data and how it is shared between different organizations.

In summary, while insurance companies may share information with medical card providers, it should be done responsibly and with the necessary legal frameworks in place. Understanding the potential data exchange can help individuals make informed decisions about their healthcare and insurance coverage, ensuring their privacy remains protected throughout the process.

Cataract Surgery: Unlocking Insurance Coverage and Costs

You may want to see also

Frequently asked questions

No, your insurance company will not be directly informed if you obtain a medical card. Medical cards are typically issued by government health services and are used to provide access to healthcare services at reduced or no cost. The process of obtaining a medical card is confidential, and your insurance provider is not involved in this process.

Medical cards are a form of identification that allows individuals to access healthcare services without incurring high costs. They are often used for primary care, such as general practitioner visits, and may also provide coverage for certain medications and treatments. The specific benefits and eligibility criteria can vary depending on the region and the issuing health service.

In most cases, having a medical card will not directly impact your insurance premiums. Insurance companies typically base premiums on factors like age, health status, and lifestyle, not on the presence of a medical card. However, it's important to review your insurance policy to understand any potential changes or exclusions related to pre-existing conditions or government-provided healthcare.

Yes, you can often use both your medical card and private insurance coverage. The medical card may cover certain basic healthcare services, while your insurance policy could provide additional benefits, such as specialist referrals, hospital stays, or coverage for specific treatments. It's best to understand the terms and conditions of both to ensure you receive the appropriate care.

Privacy is a valid concern, but medical cards are designed to protect your personal information. The data on these cards is typically used to verify your eligibility for the healthcare services and is not shared with insurance companies or other third parties without your consent. It's essential to keep your medical card secure and only share it with authorized healthcare providers.