Renters insurance is a set of coverages that protect tenants and their property in the case of a covered loss. While renters insurance is relatively inexpensive, there are instances where rates may rise, such as the frequency of claims. Filing a claim with your renters insurance company will likely impact the cost of future premiums as a person who files a claim is more likely to file another one. However, bundling renters and auto insurance can lower total insurance costs and streamline policy management.

| Characteristics | Values |

|---|---|

| Will renters insurance claim raise auto insurance? | Usually, yes. |

| Reason | A person who files a renters insurance claim is more likely to file another one. The insurer will raise the rates to account for this. |

| Exception | The insurance company might not raise the rates if they have a no-raise policy or if the policy price already accounted for the fact that the insured lives in an area prone to natural disasters. |

| How to avoid a price spike | Compare insurance costs from at least three companies. |

| Bundling renters and auto insurance | Can lower your total insurance costs and streamline policy management. |

What You'll Learn

Renters insurance claims can increase your premium

The reason for the rate increase is that a person who has filed a renters insurance claim is more likely to file another one. The insurer raises the rates to account for the increased likelihood of future claims. While the rate increase is not always significant, it is something to be aware of when considering filing a claim.

Additionally, the type of claim also impacts the increase in premium. Claims for theft and fire, for example, typically result in higher increases of about 25%. It is worth noting that not all incidents are covered by standard renters insurance policies, and water and flood damage are often excluded.

When deciding whether to file a renters insurance claim, it is important to consider the cost of replacing your property and compare it to your deductible. If the cost of replacing your property exceeds your deductible, then filing a claim makes financial sense. However, if the cost is only slightly above the deductible, it might be better to pay out of pocket to avoid a potential increase in your premium.

In conclusion, renters insurance claims can indeed lead to an increase in your premium, and it is essential to carefully consider the impact of filing a claim on your future rates.

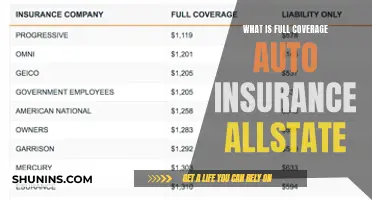

Affordable Auto Insurance: Finding the Cheapest Companies

You may want to see also

Filing a claim is not always necessary

Secondly, consider the frequency of your claims. Spacing out your claims as much as possible can help you avoid being dropped by your insurer or facing higher premiums. Try to avoid filing more than one claim every five to ten years. Additionally, review your policy to determine if the cause of the loss is covered. Not all incidents are covered by standard renters insurance policies, and some exclusions may apply. For example, water and flood damage are typically excluded, while liability coverage can be affected by the addition of a person or pet to your household. Certain dog breeds, such as Huskies, Dobermans, and Pit Bulls, may also be excluded from coverage.

Before filing a claim, it is advisable to have the damage assessed and compare the cost of the incident to your deductible. If the cost does not exceed your deductible, it may be more cost-effective to pay out of pocket to avoid potential increases in your insurance rates. Remember that filing a claim is most beneficial in cases of catastrophic or large losses, and the more claims you file, the higher your insurance rates may become.

Auto Insurance and Credit Scores: What's the Connection?

You may want to see also

Bundling renters and auto insurance can save money

Insurance can be expensive, especially when you need multiple types of coverage. A way to save money on insurance is to bundle policies, which means combining more than one type of insurance with the same company. This is often called a multi-policy discount.

Pros of Bundling Renters and Auto Insurance

Save Money

Many insurers offer a discount when you combine your auto and renters insurance policies. The amount of money you could save depends on factors including your insurance company, the amount of insurance coverage you need, and your location. Discounts advertised by major insurers suggest that consumers may save between 4% and 20% by bundling.

Convenience

Dealing with only one insurance company means everything is streamlined. There’s only one set of login information to remember to manage all of your policies online. And, if there’s ever a problem, you know exactly who to call without having to remember which insurance company provides which policy.

Your Agent Gets To Know Your Insurance Needs

When your agent has access to all of your policies, they can more easily see any gaps in coverage. This bird’s eye view can make them better equipped to help you get the insurance you need to be fully protected.

Cons of Bundling Renters and Auto Insurance

The Savings Might Not Be Worth Switching Insurers

Renters insurance is generally pretty cheap, often around $12 a month for $30,000 worth of coverage. Since a renters policy is already fairly inexpensive, bundling it may not offer the same potential savings as a higher-priced homeowners policy might. These savings may not be worth the hassle of switching to a new insurer, especially if you like your current provider and policy terms.

It Could Stop You From Shopping Around

By bundling your renters and car insurance together, you’re sticking with the same company. Because of the added convenience, you may not take the time to shop around regularly for different insurance options. This means you could be missing out on lower rates from another company.

Bundling Your Insurance May Be Time-Consuming

Since your eligibility for bundling discounts depends on so many factors, you may not be able to get an instant quote that reflects these savings. You may need to speak with an agent and provide information before getting a quote for bundled insurance, which may take additional time.

Lower Auto Insurance Rates Before Renewal

You may want to see also

Renters insurance covers personal property in a vehicle

Renters insurance provides protection in case your belongings are destroyed or stolen, and it also offers liability protection. One of the benefits of renters insurance is that its coverage follows your belongings wherever they are, whether inside or outside your home. So, if your bag with your laptop is stolen while you're in class, it's covered, and if it's stolen from your car, it's covered too.

It's important to note that renters insurance has special limits, also known as category limits or maximum limits, which vary by policy. These limits generally apply to categories like electronics, jewelry, art, cash, and property used for business purposes, restricting the amounts that can be reimbursed for each category. Personal property coverage outside the home is also subject to a special limit, which could mean you are only eligible for reimbursement of a few hundred dollars if you lose thousands of dollars worth of stuff. Therefore, it is recommended to talk to your insurance company and, if necessary, purchase additional coverage to increase the limits on certain categories in your policy or specifically cover certain high-value items.

Regarding the impact of filing a claim on insurance rates, while a standard renter's insurance policy may be relatively inexpensive, there are instances where your rates may increase. One such factor is the frequency of claims. The more claims you file, the higher the risk you pose to the insurer, which may result in higher rates for the same policy after multiple claims.

To save money on insurance policies, you can consider bundling your renters and auto insurance. Bundling is a common strategy used by insurance companies, and it can lower your total insurance costs and simplify policy management. However, it may also make it more challenging to compare policies or switch companies later. To find the best deals, it is recommended to compare insurance bundle quotes from several companies, ensuring that you select the same coverage and input the same details for an accurate comparison.

Linking Your Auto and Renter's Insurance: A Smart Move

You may want to see also

Renters insurance does not cover a vehicle's physical structure

Renters insurance is a set of coverages meant to protect tenants who live in a house or flat following a covered loss. It is an affordable way to protect against the financial impact of unexpected events, such as fire, wind, water damage, theft, and more. While renters insurance covers the cost of replacing your belongings if they are destroyed, damaged, or stolen, it does not cover the physical structure of a vehicle.

Renters insurance does not provide protection against damage and theft of your vehicle. Instead, it covers the items inside it. The physical structure of a vehicle is protected by car insurance, while renters insurance covers personal belongings both inside and outside the home, including inside a vehicle. For example, if your car is stolen, you would make a claim through your car insurance to reimburse you for the value of the car. However, you would make a separate claim through your renters insurance to replace any personal belongings that were inside the stolen vehicle.

Similarly, if your car is damaged, your renters insurance will not cover the cost of repairs to the vehicle itself. Your car insurance policy would be responsible for covering the damage to the physical structure of your car. Nevertheless, your renters insurance may cover any personal belongings that were damaged or destroyed in the incident. For instance, if your car window is smashed and your laptop is stolen, your car insurance may cover the broken window, while your renters insurance would cover the stolen laptop.

It is important to understand the limitations of renters insurance when it comes to vehicle-related incidents. While renters insurance provides valuable protection for your personal belongings, it does not extend to the physical structure of a vehicle. Therefore, if you own a car, it is essential to have separate auto insurance to ensure comprehensive coverage for both your vehicle and the items within it.

Alabama's Commercial Auto Insurance Requirements: What You Need to Know

You may want to see also

Frequently asked questions

Usually, yes. The more claims you file, the higher risk you pose to the insurer, so they may charge higher rates for the same policy post multiple claims. However, this is not always the case, as some companies have a no-raise policy, or your policy price already accounts for factors that make you more likely to file a claim.

You can try shopping around for a better deal, but this is not always effective as all insurance companies have access to the same information about you. You could also try to avoid filing a claim unless the cost of the incident will exceed your deductible.

The frequency of claims is a major factor in determining renters insurance rates. Other factors include your credit score, the crime rate in your locality, and your proximity to a fire station.

Bundling renters and auto insurance can lower your total insurance costs and make policy management more convenient. However, it can also make it harder to compare policies or switch companies.