Navigating through severe weather conditions can be challenging, and it's crucial to understand your insurance coverage when facing extreme weather events. In this context, we'll explore the question: Am I insured to drive in a red weather warning? Understanding the implications of driving during a red weather warning and the associated insurance considerations is essential for drivers to make informed decisions and ensure they are adequately protected.

What You'll Learn

- Weather Warnings and Insurance Coverage: Understanding the impact of weather warnings on insurance policies

- Red Weather Warnings and Road Conditions: How red warnings affect road safety and insurance claims

- Driving Restrictions and Policy Exclusions: Exploring the limits and exclusions of insurance during weather warnings

- Insurance Claims for Weather-Related Incidents: The process of filing claims for incidents during red weather warnings

- Weather Alerts and Policy Updates: Staying informed about weather alerts and adjusting insurance coverage accordingly

Weather Warnings and Insurance Coverage: Understanding the impact of weather warnings on insurance policies

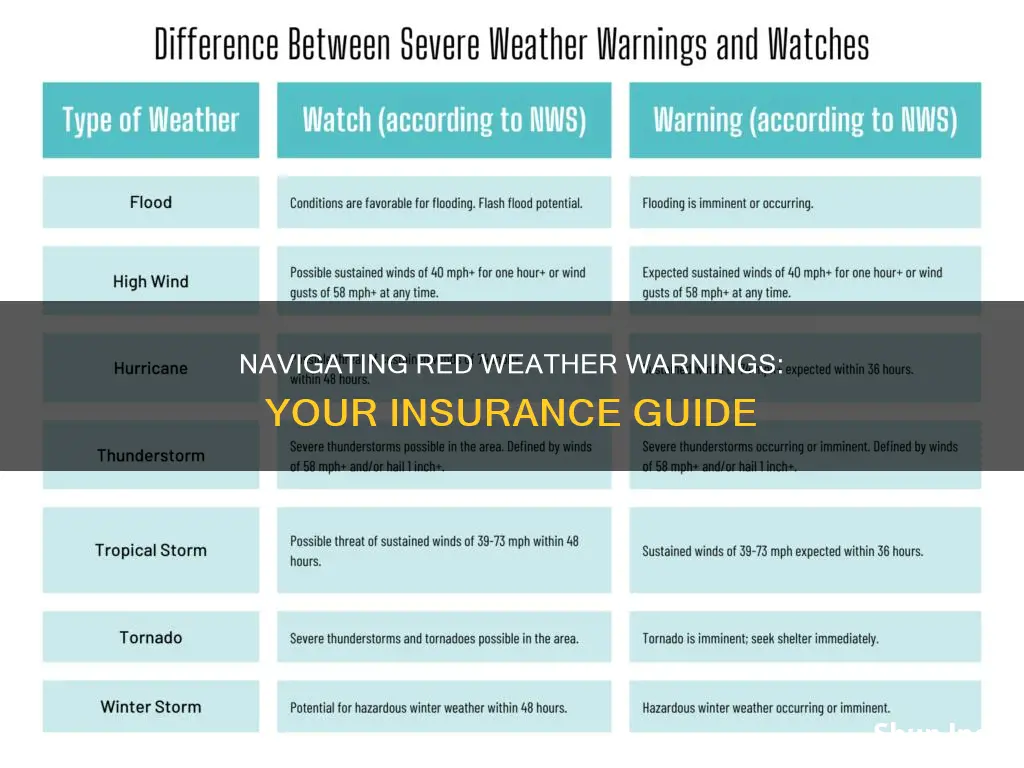

Weather warnings, especially those issued by meteorological services, can significantly impact various aspects of our lives, including our insurance policies. When a red weather warning is issued, it indicates an extreme weather event, such as a severe storm, hurricane, or blizzard, which can pose a serious risk to life and property. In such situations, understanding the implications for your insurance coverage is crucial to ensure you are adequately protected.

Many insurance policies, particularly those covering vehicles, property, and health, may be influenced by weather warnings. For instance, car insurance policies often include coverage for damage caused by natural disasters, including severe weather events. However, the extent of coverage can vary. Some policies may provide comprehensive protection, covering damage to your vehicle regardless of the weather warning level. Others might have specific exclusions or limitations for extreme weather conditions, such as flooding or wind damage. It is essential to review your policy documents to understand what is covered and what is not.

In the case of a red weather warning, your insurance provider may take certain actions. They might offer additional coverage or discounts to policyholders in affected areas. For example, they could provide extended coverage for vehicle damage caused by severe weather, ensuring that you are not left without protection during critical times. Additionally, insurance companies may introduce temporary policy adjustments to accommodate the increased risk associated with extreme weather events. These adjustments could include temporary coverage extensions or special provisions to handle claims efficiently.

To ensure you are adequately insured during a red weather warning, consider the following steps. Firstly, contact your insurance provider to inquire about any specific coverage options or discounts available for severe weather events. They might offer additional protection plans tailored to your needs. Secondly, review your policy documents thoroughly to understand the coverage limits and exclusions. Pay close attention to any weather-related clauses and ensure you are aware of any potential gaps in your insurance. Finally, consider increasing your coverage limits or adding specific endorsements to your policy to ensure comprehensive protection.

In summary, weather warnings, particularly red alerts, can have a direct impact on your insurance policies. It is essential to be proactive and review your coverage to ensure you are adequately protected during extreme weather events. By understanding the potential implications and taking the necessary steps, you can minimize the risks associated with severe weather and have peace of mind knowing that your insurance provides the required support. Remember, staying informed and taking appropriate action can make a significant difference in managing the financial implications of weather-related disasters.

Reckless Driving Ticket: How It Affects Your Insurance Premiums

You may want to see also

Red Weather Warnings and Road Conditions: How red warnings affect road safety and insurance claims

Red weather warnings are issued by meteorological services to alert the public about severe weather conditions, including heavy rain, snow, and strong winds. These warnings are a critical part of the early warning system, helping to prepare communities for potential hazards and mitigate risks. When a red weather warning is in effect, it indicates a high level of danger and potential disruption to daily life, including travel. Understanding the implications of these warnings is essential for road users, as it can significantly impact road safety and insurance claims.

During a red weather warning, road conditions can become hazardous due to reduced visibility, slippery surfaces, and potential flooding. These factors contribute to an increased risk of accidents and incidents on the roads. Drivers are advised to exercise extreme caution and consider whether their journey is essential. If possible, it is recommended to postpone travel until the warning has been lifted. However, for those who must drive, there are several key considerations to ensure safety and minimize the risk of accidents.

One important aspect is maintaining a safe following distance from other vehicles. In poor weather conditions, it takes longer to stop, so allowing extra space between cars is crucial. Additionally, drivers should reduce their speed to a level that allows for better control of the vehicle and increased reaction time. This is particularly important on roads with poor drainage or those prone to flooding, as water on the surface can cause hydroplaning, making tires lose traction.

Another critical factor is being aware of the limitations of one's vehicle and its equipment. Ensure that headlights, windshield wipers, and defrosters are in good working order to maintain optimal visibility. It is also advisable to carry essential items in your vehicle, such as a first-aid kit, flashlight, and warm clothing, in case of emergencies or prolonged delays.

In terms of insurance, red weather warnings can have an impact on claims. Insurance companies often have specific policies regarding weather-related incidents. Some policies may cover accidents caused by severe weather, while others might have exclusions or limitations. It is essential to review your insurance policy and understand the coverage provided. If you are involved in an accident during a red weather warning, it is crucial to report the incident to your insurance provider promptly and provide all necessary details to facilitate the claims process.

Updating Commute Auto Insurance: A Quick Guide to Savings

You may want to see also

Driving Restrictions and Policy Exclusions: Exploring the limits and exclusions of insurance during weather warnings

When faced with a red weather warning, it's crucial to understand the implications for your insurance coverage and the potential restrictions on your driving. While insurance policies generally provide coverage for various weather-related incidents, there are specific limitations and exclusions that drivers should be aware of. These exclusions can vary depending on the insurance provider and the jurisdiction, so it's essential to review your policy carefully.

One common exclusion is for driving in hazardous conditions, especially during severe weather events. Insurance policies often explicitly state that coverage does not extend to accidents caused by reckless or negligent driving in dangerous weather. This means that if you choose to drive during a red weather warning, and an accident occurs due to poor visibility, slippery roads, or other weather-related hazards, your insurance might not cover the damages. It is important to remember that insurance companies typically require drivers to exercise reasonable care and avoid unnecessary risks.

Additionally, some insurance policies may have specific exclusions related to flooding or severe storms. For instance, if a red weather warning is issued for a potential flood, and you drive into a flooded area, your insurance might not cover any damage to your vehicle or third-party liabilities. It is advisable to check your policy's definitions and exclusions regarding natural disasters and extreme weather events.

Furthermore, driving restrictions imposed by authorities during a red weather warning should be taken seriously. Local or national governments may issue travel advisories or even implement road closures to ensure public safety. If you ignore these restrictions and drive in areas that are not essential or safe, your insurance coverage could be compromised. It is always best to follow the advice of emergency services and local authorities during severe weather warnings.

To ensure you are adequately protected, consider the following steps: review your insurance policy's terms and conditions, especially the sections related to weather events and driving restrictions; understand the specific exclusions for your region and the type of weather warning; and, if in doubt, consult your insurance provider for clarification. Being well-informed about your insurance coverage will help you make responsible decisions when facing challenging weather conditions.

Auto Insurance: Connecticut's General Rules

You may want to see also

Insurance Claims for Weather-Related Incidents: The process of filing claims for incidents during red weather warnings

When severe weather warnings are issued, it's crucial to understand your insurance coverage and the process for filing claims in the event of an incident. In the context of a 'red weather warning', which typically indicates a high-risk weather event such as a severe storm, flood, or hurricane, being prepared and knowing your insurance options is essential.

Understanding Your Policy:

Before venturing out during a red weather warning, review your insurance policy, especially the section covering natural disasters or extreme weather events. Different insurance companies may have varying terms and conditions, so it's important to be aware of any specific exclusions or inclusions related to weather-related incidents. Some policies might provide coverage for property damage, vehicle damage, or liability claims, while others may have limitations or require additional coverage.

Documenting the Incident:

If you experience an incident during a red weather warning, it's crucial to document the event thoroughly. Take photographs or videos of any damage to your vehicle, property, or any other relevant evidence. Also, make notes about the weather conditions, the time of the incident, and any witnesses. This documentation will be essential when filing a claim.

Reporting the Claim:

Contact your insurance company as soon as possible after the incident. Most insurance providers have a dedicated claims hotline or an online portal for reporting claims. When reporting, provide the insurance representative with the following information:

- A detailed description of the incident.

- The date and time of the event.

- Your policy number and personal details.

- Any relevant documentation or evidence you have gathered.

The insurance company will guide you through the claims process, which typically involves an adjuster assessing the damage and determining the coverage. They may request additional information or evidence to support your claim.

Claim Processing:

After the initial report, the insurance company will initiate the claims process. This may include an investigation, where an adjuster will visit the site of the incident to assess the damage. They will also review your policy and the evidence provided to determine the extent of coverage. The adjuster will then provide a settlement offer, which you can accept or negotiate if you disagree with the amount.

Timely Action:

It is important to act promptly when filing a weather-related insurance claim. Many policies have time limits for reporting incidents and making claims, so ensure you adhere to these deadlines to avoid any potential issues with coverage.

Remember, each insurance company may have its own specific procedures, so it's essential to follow their guidance and provide all the necessary information to ensure a smooth claims process.

Cancelling Auto Insurance: Arizona Fees Explained

You may want to see also

Weather Alerts and Policy Updates: Staying informed about weather alerts and adjusting insurance coverage accordingly

In regions prone to severe weather conditions, it's crucial to stay informed about weather alerts and understand their implications on your insurance coverage. Weather warnings, especially those issued by meteorological agencies, provide essential information about impending storms, floods, or other extreme events. These alerts are designed to ensure public safety and preparedness, but they also have direct implications for your insurance policies.

When a red weather warning is issued, it indicates a high-risk situation, often associated with severe weather conditions like heavy rain, strong winds, or even snowstorms. During such alerts, insurance companies may offer specific guidance or recommendations to policyholders. For instance, they might advise on temporary policy adjustments or provide information on how to ensure your home and belongings are protected. It is essential to pay attention to these updates, as they can help you understand the extent of your coverage and any additional measures you might need to take.

Staying informed about weather alerts can be done through various channels. Many meteorological agencies provide real-time updates on their websites, social media, or dedicated mobile apps. Subscribing to these services can ensure you receive timely notifications about weather warnings in your area. Additionally, insurance companies often have their own communication channels, such as email newsletters or customer portals, where they disseminate important policy updates and recommendations.

If you receive a red weather warning, it is advisable to review your insurance policy and understand the terms and conditions related to severe weather events. Some policies may offer additional coverage or discounts for specific weather-related risks. For example, you might be able to add a rider to your home insurance policy to cover potential damage from flooding or windstorms. It is also a good practice to document any necessary precautions you take during such warnings, as this information can be useful if you ever need to make an insurance claim.

In summary, being proactive and staying informed about weather alerts is essential for both your safety and your insurance coverage. By paying attention to official weather warnings and insurance company updates, you can ensure that you are prepared for potential risks and that your insurance policies are tailored to your specific needs. Remember, being aware of the weather and its impact on your insurance can help you make informed decisions and potentially save on costs in the long run.

Auto Insurance and Flood Damage: What's Covered?

You may want to see also

Frequently asked questions

Insurance coverage during a red weather warning depends on your specific policy and the circumstances of your journey. It's essential to check your policy documents or contact your insurance provider to understand the terms and conditions regarding driving in adverse weather conditions.

A red weather warning is typically issued by meteorological services to indicate a severe weather event, such as a hurricane, tornado, or intense storm. It signifies that there is an immediate threat to life and property, and people are advised to take action and stay indoors if possible.

Driving during a red weather warning can be risky and potentially dangerous. In some cases, if your actions contribute to an accident or incident, you may be held liable for any damages or injuries caused. It's crucial to prioritize safety and follow official guidelines during severe weather alerts.

Certain exceptions may apply, such as essential travel for work or medical emergencies. However, these cases are usually subject to specific conditions and limitations. It's advisable to contact your insurance company or local authorities to understand the permitted exceptions and any additional coverage you might have.