Life insurance is a tricky business, and it's important to know what you're getting into. A 30-year term life insurance policy is a big commitment, and it's natural to wonder if you're locked in for the entire duration. The short answer is: it depends. While term life insurance policies typically have a fixed duration, such as 10, 20, or 30 years, there may be options to extend or convert your policy. It's important to carefully review the terms and conditions of your specific policy to understand your options.

When you purchase a term life insurance policy, you are guaranteed coverage for the specified term at a locked-in premium rate. This means your premiums will remain the same throughout the duration of the policy. However, if you decide to renew or extend your policy after the initial 30-year term, your premiums will likely increase significantly. The cost of renewing a term life insurance policy after 30 years may not be financially feasible for many people.

Alternatively, you may have the option to convert your term life insurance policy into a permanent life insurance policy. Permanent life insurance provides coverage for as long as premiums are paid and often includes a cash value component that can accumulate over time. Converting your policy will also result in higher premiums, but it may be a more suitable option if you still require coverage beyond the initial 30-year term.

It's worth noting that the younger you are when you purchase life insurance, the lower your premium payments are likely to be, especially if you're in good health. Age is a significant factor in determining life insurance rates, as the likelihood of health issues and mortality increases with age. Additionally, certain life events, such as getting married, having children, or acquiring significant debt, may influence your decision to opt for a longer term life insurance policy.

| Characteristics | Values |

|---|---|

| Length of coverage | 30 years |

| Premium payments | Same amount each month |

| Payout | Death benefit to beneficiaries |

| Renewal | Possible, but at a much higher rate |

| Conversion | Can be converted to permanent life insurance |

| Ideal for | Newlyweds, primary breadwinners, those with substantial debt, etc. |

What You'll Learn

What is a 30-year term life insurance policy?

A 30-year term life insurance policy is a type of plan that offers coverage for a set period of 30 years. This type of policy is typically more affordable than whole life insurance and provides temporary but long-term financial protection.

Term life insurance is designed to provide coverage for a specific period, usually 10, 15, 20, or 30 years. It is a simple and affordable option for those who want to ensure their loved ones are financially protected during that time. The death benefit of a term policy can be used by the beneficiaries in any way they choose.

A 30-year term life insurance policy offers several benefits. Firstly, it provides peace of mind, knowing that your loved ones will be taken care of in the event of your death during the 30-year period. Secondly, it is a cost-effective option as it typically costs less than whole life insurance and has level premiums that remain constant throughout the policy, making financial planning easier. Additionally, a 30-year term life insurance policy can be converted into permanent life insurance without additional medical exams, providing continued coverage beyond the initial 30-year term.

When considering a 30-year term life insurance policy, it is important to weigh the benefits against the drawbacks. While it offers protection for a fixed period, it does not build up cash value like other types of policies. However, it is an ideal option for individuals and families seeking temporary coverage during significant life events such as starting a family or managing long-term debts.

Overall, a 30-year term life insurance policy can be a valuable tool for financial planning and ensuring the financial security of your loved ones. By understanding the features and benefits of this type of policy, you can make an informed decision about whether it is the right choice for your needs.

Charities Collecting Death Benefits: The Life Insurance Loophole

You may want to see also

How does it work?

When you purchase a 30-year life insurance policy, you decide on two things: how much coverage you want and who should receive the payout. You can name just one beneficiary or multiple beneficiaries. The payout can be used for anything, including funeral or burial expenses, day-to-day living expenses, tuition or mortgage debt.

A 30-year term life insurance policy offers coverage over a period of 30 years with a guaranteed cost. You pay the same amount each month, and if you die before the term ends, the policy pays out a death benefit to your beneficiaries. Term life insurance is intended to cover you for a set term. During that time, you pay level premiums that do not change. If you pass away while coverage is in force, your beneficiaries receive the death benefit prescribed by the policy. If you don't pass away, the policy will expire at the end of the term, but you may have the option to renew at a much higher rate.

When the 30-year level term ends, your life insurance policy expires if you don't renew it. Not all life insurance companies offer a renewal option. No further premiums need to be paid, and your beneficiaries will no longer be able to collect a death benefit if you have outlived the policy.

A 30-year term life insurance policy can often be extended beyond the initial term if you'd like to maintain your coverage. However, extending a life insurance 30-year term policy will significantly raise your premiums. The high cost of renewing a term life insurance policy after 30 years doesn't make financial sense for most people.

Instead of extending a 30-year term life insurance policy, you may have the option to convert it to permanent life insurance. With permanent life insurance, you're covered as long as premiums are paid, and policies can also accumulate cash value. Converting term life to permanent life insurance will also result in higher premiums. Understanding your life insurance coverage needs can help you decide which type of policy is more appropriate for your situation and budget.

How to Get Life Insurance for Your Boyfriend

You may want to see also

Who is it for?

A 30-year term life insurance policy is a good option for people with long-term financial obligations, such as a mortgage or college debt. It is also suitable for young applicants who want to cover the majority of their earning years.

For example, if you're married with young children, a 30-year life insurance policy can help your beneficiaries with:

- Paying off the mortgage

- Funding retirement for your surviving spouse

- Helping children with higher education expenses

- Covering basic living expenses

- Clearing credit cards, medical bills, or other debts

If you're a newlywed, a 30-year term life insurance policy can increase your financial strength as a couple. It's likely that you both rely on each other for some kind of financial contribution, whether for large bills like your mortgage or smaller day-to-day expenses. If you and your partner are in your early 30s, a 30-year term can protect both of you until your early 60s, a time when many people hope to be winding down debt and closing in on retirement plans.

If you're the primary breadwinner, a 30-year term life insurance policy can help protect your income until your children are adults and your partner is at or near retirement.

If you have a special needs child, a 30-year term life insurance policy can offer an affordable way to help financially protect your family while you save for emergencies, retirement, and other financial needs.

If you have substantial debt, a 30-year term life insurance policy can offer a long enough window to resolve any outstanding debts, with the reassurance that money would be available to repay them if needed.

In general, term life insurance is for people who want affordable coverage that locks in their rate for the duration of the term, even if their health changes.

New York Life Insurance: App Availability and Features

You may want to see also

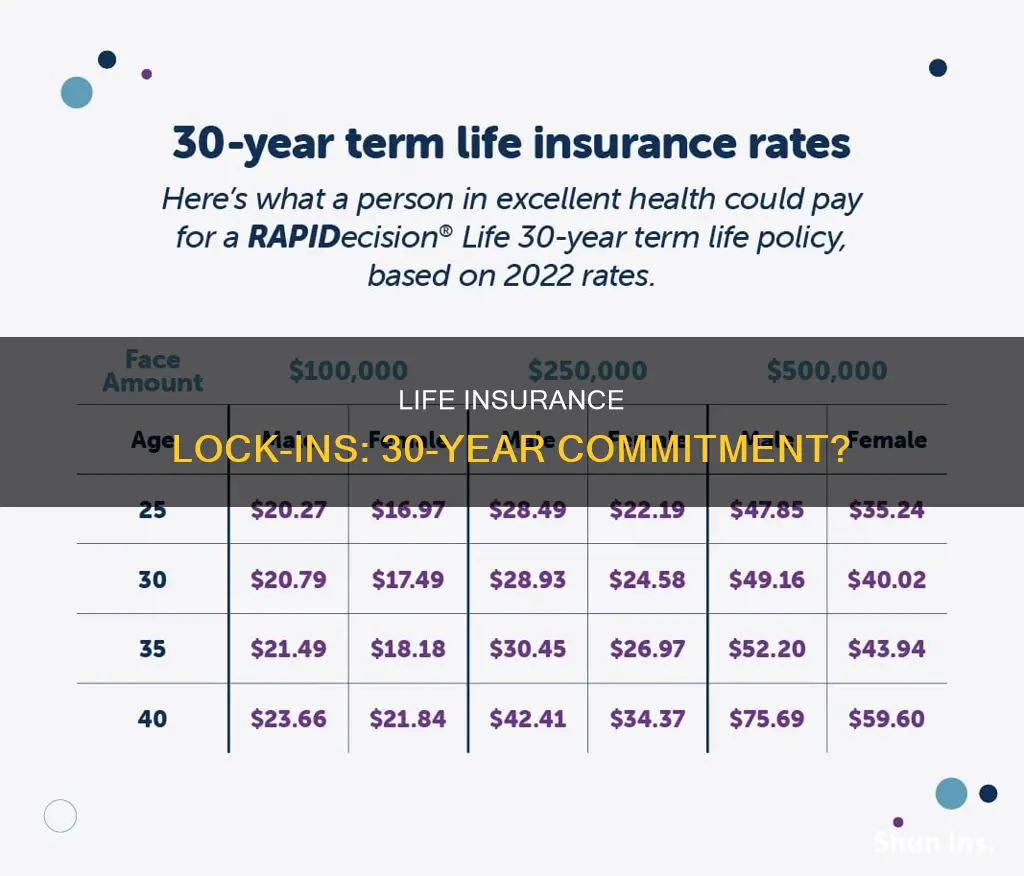

How much does it cost?

The cost of life insurance varies depending on several factors, and understanding these factors is crucial to comprehending the overall cost of a 30-year life insurance policy. Here is a detailed breakdown to help you estimate the potential expenses associated with such a long-term commitment:

Policy Type and Structure:

The type of life insurance policy you choose will significantly impact the cost. There are two primary types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. Permanent life insurance, on the other hand, offers coverage for your entire life as long as premiums are paid. Within these categories, there are also variations, such as whole life, universal life, and variable life insurance, each with its unique cost structure.

Death Benefit Amount:

A key factor in determining the cost of life insurance is the death benefit amount. The death benefit is the payout your beneficiaries will receive upon your death. Generally, higher death benefits result in higher premiums. It is important to note that insurance companies may have different pricing tiers, so increasing the death benefit may not lead to a linear increase in cost but could place you in a higher pricing bracket.

Age and Health:

Your age and health status at the time of purchasing the policy play a critical role in determining the cost. Younger individuals usually benefit from lower premiums because they have a higher life expectancy and are statistically likely to outlive the policy term. Additionally, your current health, medical history, and family medical history can influence the cost. Pre-existing health conditions or a family history of illness may result in higher premiums.

Lifestyle and Risk Factors:

Insurance providers also take into account your lifestyle choices and risk factors. Certain activities, such as skydiving or rock climbing, are considered dangerous and may increase your premiums. Other factors, including smoking status, alcohol consumption, occupation, and travel habits, can also impact the cost.

Policy Add-ons and Riders:

Life insurance policies often provide the option of adding additional benefits or "riders" to the base policy for an extra cost. These may include accidental death benefits, waiver of premium riders (waiving premiums if you become disabled), or guaranteed insurability riders (enabling you to purchase additional coverage at set intervals without further health examinations). Each of these add-ons will increase the overall expense of your policy.

Payment Frequency and Mode:

The frequency of your premium payments can also impact the total cost. Some insurers may offer discounts for annual payments, while paying monthly or quarterly may incur small additional fees. Additionally, the method of payment, such as electronic funds transfer or credit card, could come with different charges.

To obtain an accurate and personalized quote for a 30-year life insurance policy, it is advisable to consult with multiple insurance providers. They will consider your age, health, desired coverage amount, and any additional benefits you require to provide you with detailed quotes. Remember to carefully review the terms and conditions before committing to any long-term insurance contract.

Lincoln Life Insurance: Suicide Coverage and Exclusions

You may want to see also

Is it worth it?

Life insurance is a crucial step in financial planning, especially if you have people depending on your income or have debt that will be passed on after your death. A 30-year term life insurance policy is a popular option for those seeking lengthy coverage at locked-in rates. While it offers peace of mind and financial protection for your loved ones, it's important to consider if it aligns with your specific needs and budget. Here's an in-depth look at the pros and cons to help you decide if a 30-year term life insurance policy is worth it.

Pros:

- Long-term peace of mind: A 30-year term provides coverage for three decades, ensuring peace of mind for you and your family. It's especially beneficial if you have long-term financial commitments, such as a 30-year mortgage, and want to ensure your family can stay in the home even in your absence.

- Locked-in rates: Opting for a 30-year term at a young and healthy age allows you to lock in affordable rates for the entire period. As rates increase with age and health issues, securing a long-term policy early on can result in significant savings.

- No need to reapply: With a 30-year term, you won't have to worry about reapplying for life insurance until the end of the term. This means you're covered, and so are your loved ones, without the hassle of frequent renewals.

- Financial protection for dependents: If you have children or a spouse who relies on your income, a 30-year term can provide financial protection until your children are adults and your spouse is at or near retirement. This ensures their financial stability in the event of your untimely death.

- Covers special circumstances: A 30-year term is ideal if you have a special needs child who may require lifelong care. It also helps cover substantial debts, such as student loans, credit card debt, or business loans, which may otherwise be passed on to your cosigner or spouse.

Cons:

- Higher premiums: Longer-term policies come with higher premiums than shorter-term ones. A 30-year term might not fit everyone's budget, and it's crucial to assess your financial goals and capabilities before committing.

- Limited cash value: Term life insurance policies, including 30-year terms, typically don't accumulate cash value. If you're interested in a policy that builds cash value over time, you may want to consider permanent life insurance options.

- Renewal challenges: While some companies offer renewal options, the premiums for extending a 30-year term can be significantly higher. The high cost of renewal often makes it financially impractical for most people.

- May exceed your needs: If your financial commitments, such as a mortgage or children's education, will be fulfilled before the 30-year term ends, a shorter-term policy might be more suitable and cost-effective.

In conclusion, a 30-year term life insurance policy is worth considering if you're seeking lengthy coverage with locked-in rates. However, it's important to weigh your personal circumstances, financial goals, and budget constraints before making a decision. Remember, the right choice depends on your unique situation, and it's beneficial to seek expert advice to navigate the various options available.

Gina and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

No, you are not locked in for 30 years. You can cancel or change your policy at any time.

Yes, you can make changes to your policy at any time. Simply contact our customer support team and they will be happy to assist you.

If you cancel your policy, you will no longer be covered by the insurance and you may be subject to cancellation fees or penalties.

No, refunds are not available for cancelled policies. Any premiums paid up to the date of cancellation will not be refunded.

If you miss a payment, your coverage may be suspended until the payment is made. It's important to keep your payments up to date to ensure continuous coverage.