There are many factors that determine whether auto insurance rates are going down. Age is one of the most important factors, with rates decreasing as drivers get older and gain more experience. Rates tend to be lowest for drivers in their 50s. A good driving record is also important, as rates usually decrease after a few years of safe driving. Additionally, switching insurance companies can sometimes lead to lower rates. While auto insurance rates have historically increased over time, there have been instances of rate decreases, especially after profitable periods for insurance companies.

| Characteristics | Values |

|---|---|

| Age | Car insurance rates decrease as you age, with the lowest rates for drivers in their 50s. Rates level off between the age groups of 35 and 55, then rise slightly for senior drivers. |

| Driving Record | Rates decrease if you drive safely for three years following an accident or infraction. Rates increase if you have accidents or violations on your record, usually for a period of three years. |

| Insurance Company | Switching insurance companies can lead to lower rates, as rates vary widely between providers. |

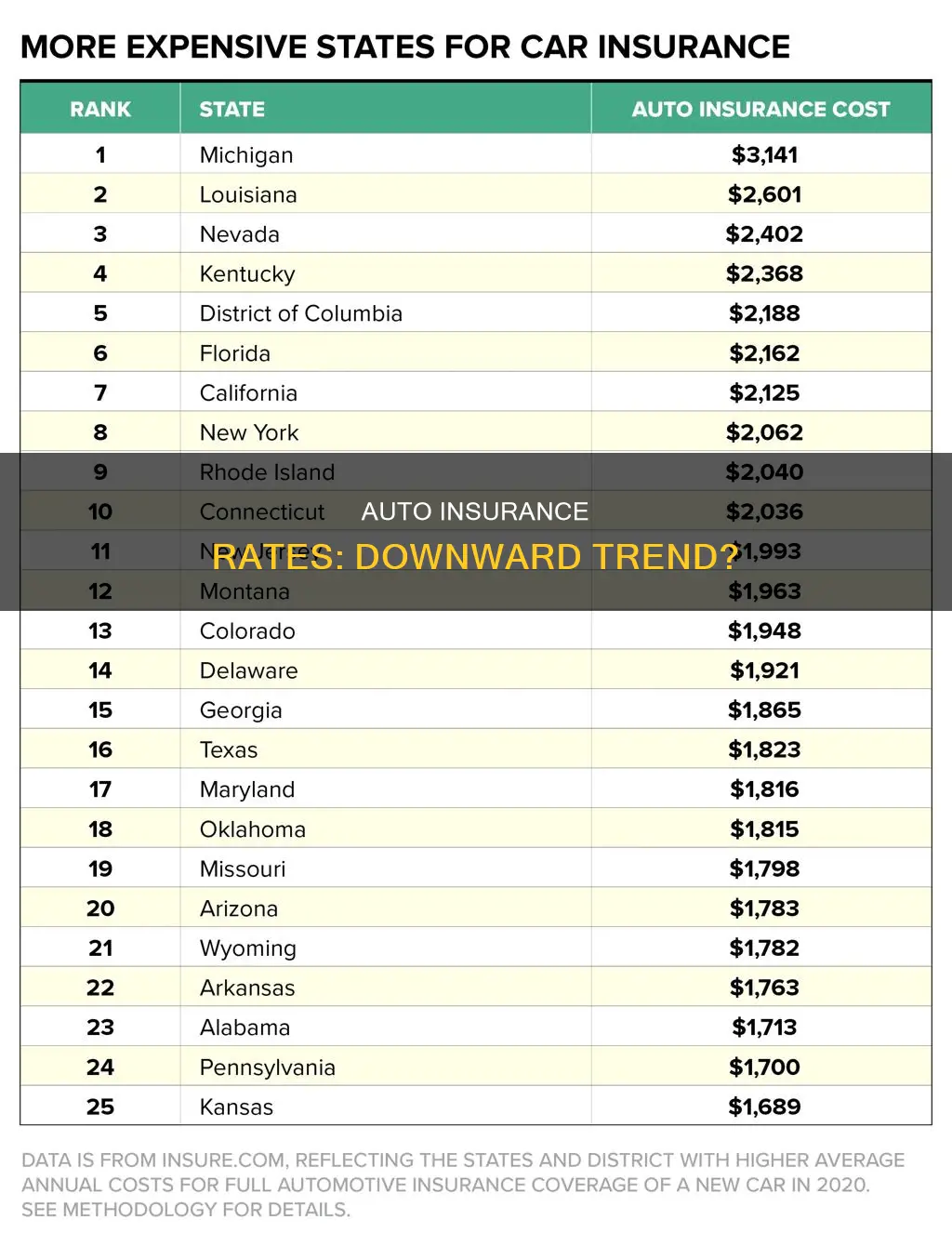

| Location | Rates can increase or decrease depending on the location, with some states and regions experiencing significant premium changes over time. |

| Claims and Fraud | Substantial claims loss and widespread insurance fraud can lead to rate increases. |

What You'll Learn

Auto insurance rates decrease as you age

Auto insurance rates are largely influenced by age, with younger drivers generally facing higher premiums. This is because younger drivers are more likely to have accidents or take risks on the road due to their inexperience, making them riskier to insure. As a result, auto insurance rates tend to decrease as drivers age and gain more experience, provided they maintain a clean driving record.

The most significant drop in auto insurance rates typically occurs when drivers transition from their teens to their early 20s. During this period, insurance rates can decrease by as much as $1,595 per year. By the time drivers reach their mid-20s, they are often considered less risky, which leads to lower insurance premiums. For instance, at Progressive, rates drop by an average of 9% when a driver turns 25. However, it is important to note that other factors, such as claims history, can also influence insurance rates.

As drivers continue to age, insurance rates usually stabilize or decrease slightly until around the age of 75. This is because experienced drivers are less likely to make accident claims, making them cheaper to insure. However, after the age of 75, insurance rates begin to trend upward due to factors such as physical, cognitive, or visual impairments, which can increase the risk of accidents.

While age is a significant factor in determining insurance rates, it is important to remember that other factors, such as gender, driving record, credit score, and location, can also impact the cost of auto insurance. Additionally, insurance rates can fluctuate due to changes in state regulations, total claims in an area, and company-specific factors.

Eyecare Insurance: Filling the Gap

You may want to see also

Safe driving for three years can lower insurance rates

Insurance companies also offer incentives for safe driving through safe driving apps. These apps monitor your driving habits and can lead to lower insurance rates or discounts. For example, State Farm's Drive Safe & Save offers customers up to 30% off by practising certain driving habits. Progressive's Snapshot app offers a discount for signing up and bases your insurance rate on how much you drive. Nationwide's SmartRide gives a 10% discount for signing up and tracks your driving behaviour, with safer driving earning up to 40% off rates when your policy renews. GEICO's DriveEasy tracks your driving behaviour and gives you a personal score, along with tips to improve your skills.

In addition to safe driving, there are other ways to lower your insurance rates. One way is to review your policy and eliminate any coverage you may not need, such as comprehensive coverage on an older vehicle, rental reimbursement, or emergency roadside service. You can also save by bundling your insurance policies, for example, by using the same insurer for home and auto insurance.

Your age is also a factor in determining your insurance rate. Car insurance is most expensive for teen drivers and then decreases as they get older, levelling off between the age groups of 35 and 55. This is because younger drivers are more likely to get into car accidents and are, therefore, riskier to insure.

Auto Insurance Coverage: What You Need to Know

You may want to see also

Switching insurance companies can decrease rates

Switching car insurance companies can save you hundreds of dollars a year, and it won't cost you anything to shop around for cheaper rates. You can switch your car insurance at any time, not only when your insurance policy is up for renewal. Even if you've paid for your car insurance yearly, you can still get a prorated refund if you cancel your policy mid-year—although you may need to pay a small fee, depending on your current insurance company.

- You found a cheaper policy: Motorists often change car insurance providers due to receiving more competitive rates elsewhere.

- You found better service or coverage: Certain auto insurance carriers have stronger service standards, claims processes, and coverage than others.

- You added vehicles or people to your policy: If the details of your auto insurance change, you can expect the rates from your current insurer to change. Shop around to learn whether other choices could be better than your current insurance company.

- You found potential discounts: Car insurance discounts can greatly decrease the cost of coverage. If you find that you're eligible for additional savings opportunities, switching car insurance could be a good idea.

- Your credit score went up: Credit history plays a major role in determining car insurance premiums in all states except California, Hawaii, and Massachusetts. You could see large rate drops if your credit score improves, so it's worth seeing which company will reward you the most.

- You moved to a new area: Your car insurance costs will change if you relocate, so this is a good opportunity to consider new coverage options to find better rates.

- You're experiencing poor customer service: If you're unhappy with the customer service you're receiving, switching insurance companies can help you find a provider that better meets your needs.

- You're seeing a spike in your car insurance premium: If your current insurer has increased your premium, shopping around for a new policy can help you find a better rate.

- You're adding a new driver to your policy: Whether you're getting married or adding a teen driver to your policy, switching insurance companies can help you find a more affordable rate for your changing circumstances.

- You're buying or adding a new car to your policy: Adding a new car to your policy can change the cost of your insurance. By switching insurance companies, you may be able to find a better rate that reflects the updated value of your vehicle.

- You're seeing a drastic increase or decrease in your credit score: In most states, car insurance companies can increase rates based on credit information. If you've experienced a change in your credit score, switching insurance companies can help you find a rate that better reflects your current creditworthiness.

When deciding whether to switch car insurance companies, it's important to compare multiple quotes, contact your current company to see if they can match any lower offers, and ensure that your new policy starts the same day your old policy expires to avoid fees or legal trouble for having a lapse in coverage.

Auto Insurance Laws: Unconstitutional?

You may want to see also

Teen drivers are offered discounts by some companies

Teen drivers are considered high-risk, and their insurance rates are usually very high. However, some companies offer discounts to teen drivers, which can help bring down the cost of insurance. Here are some ways to secure discounts for teen drivers:

Good Student Discounts

It is common for car insurance companies to offer discounts for full-time students who maintain good grades. For example, Allstate offers a good student discount to unmarried drivers under 25 who have at least a B- average. State Farm also offers up to a 25% savings for students with good grades, up to age 25 or their last year of school.

Safe Driving Courses

At-fault accidents on a teen's record can significantly increase their insurance rates. Many insurers promote driver safety courses to teach young, inexperienced drivers the rules of the road and offer discounts upon completion. Geico, State Farm, Allstate, and Travelers are examples of insurers that reward drivers with premium discounts upon completion of required driver safety training courses.

Multi-Vehicle Family Plans

If your teen has their own car, it is usually more cost-effective to add them to your current policy and bundle the vehicles together rather than getting them a separate policy. Many insurance companies will automatically apply savings for having a multi-vehicle policy.

Used Vehicles with High Safety Ratings

Older, simpler cars with high safety ratings often get better insurance rates. Older cars are cheaper to repair if there is a collision, and safety features decrease the likelihood of accidents and serious injuries. According to The Zebra, purchasing a vehicle that is at least five years old can save you 18% on your car insurance.

Low-Mileage Discounts

If your teen driver doesn't put a lot of miles on their car each month, ask your insurer about a low-mileage discount. Some companies, like Nationwide, offer a pay-per-mile option, providing coverage with a premium that changes each month, depending on the number of miles driven.

Insurance: Transporting Vehicles

You may want to see also

State insurance requirements can cause rates to fluctuate

State insurance requirements can cause auto insurance rates to fluctuate. Each state has its own laws and minimum coverage requirements, with different categories of mandatory coverage. The more coverage you are required to purchase, the more expensive your policy will be.

State-mandated minimum coverage levels can change over time. If a state lowers its minimum car insurance requirements, the cost of minimum coverage in that state could decrease. On the other hand, moving to a state with higher minimum insurance coverage requirements will cause your rates to go up.

Additionally, states enact regulations for how car insurance companies can set their rates. According to the Insurance Information Institute, car insurance rates must be adequate to maintain company operations, not be excessive or lead to exorbitant profits, and not be unfairly discriminatory. State governments may require car insurance companies to adjust their rates based on these factors.

Furthermore, insurance rates can be influenced by factors outside of your control, such as claim costs and the total number of claims in your area. For example, a year of calm weather and fewer natural disasters can lead to reduced rates in a state. Conversely, an increase in claims in your ZIP code, due to factors like a high rate of theft, accidents, or weather-related incidents, can result in higher rates, even if you have a perfect driving record.

Toggle Auto Insurance: Good or Not?

You may want to see also

Frequently asked questions

Yes, auto insurance rates tend to decrease as drivers get older, with rates typically lowest for drivers in their 50s. This is because younger drivers are seen as riskier to insure due to their inexperience.

Yes, auto insurance rates tend to decrease if you have a good driving record, with most driving infractions and at-fault accidents falling off your insurance record after three years.

Yes, auto insurance rates can decrease if you switch insurance companies, as rates can vary widely depending on the company.

Possibly. Some insurance companies offer low-mileage discounts, so switching to a company that offers this could lead to lower rates.