Life insurance is often seen as a reliable way to provide for loved ones after you're gone, and one of its biggest advantages is the tax relief it offers. In most cases, life insurance proceeds are not considered taxable income, but there are some exceptions. The type of policy, the size of the estate, and how the benefit is paid out can determine whether or not life insurance distributions are taxable. For example, if the benefit is paid out in installments, any interest accrued may be taxed. Similarly, if the policyholder surrenders or sells their whole life policy, they may have to pay income taxes on the proceeds if they exceed the cumulative premiums. Understanding the tax implications of life insurance distributions is crucial for both policyholders and beneficiaries to avoid unexpected tax burdens.

What You'll Learn

Interest on instalments

If the beneficiary of a life insurance policy chooses to receive the payout in instalments instead of a lump sum, any interest that builds up on those payments is generally taxed as regular income. This is because, although the death benefit is typically not taxed, the interest on instalment payments is considered taxable income. Therefore, beneficiaries should be prepared to report this interest on their taxes.

The interest on instalments is calculated from the date of the insured person's death until the date the insurance company sends the final instalment payment to the beneficiary. This interest is taxable, and insurance companies are responsible for reporting it to the Internal Revenue Service (IRS).

It is important to note that the death benefit itself is generally not considered taxable income. However, if the policy is transferred for cash or other valuable consideration, the exclusion for the proceeds may be limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. There may also be exceptions to this rule.

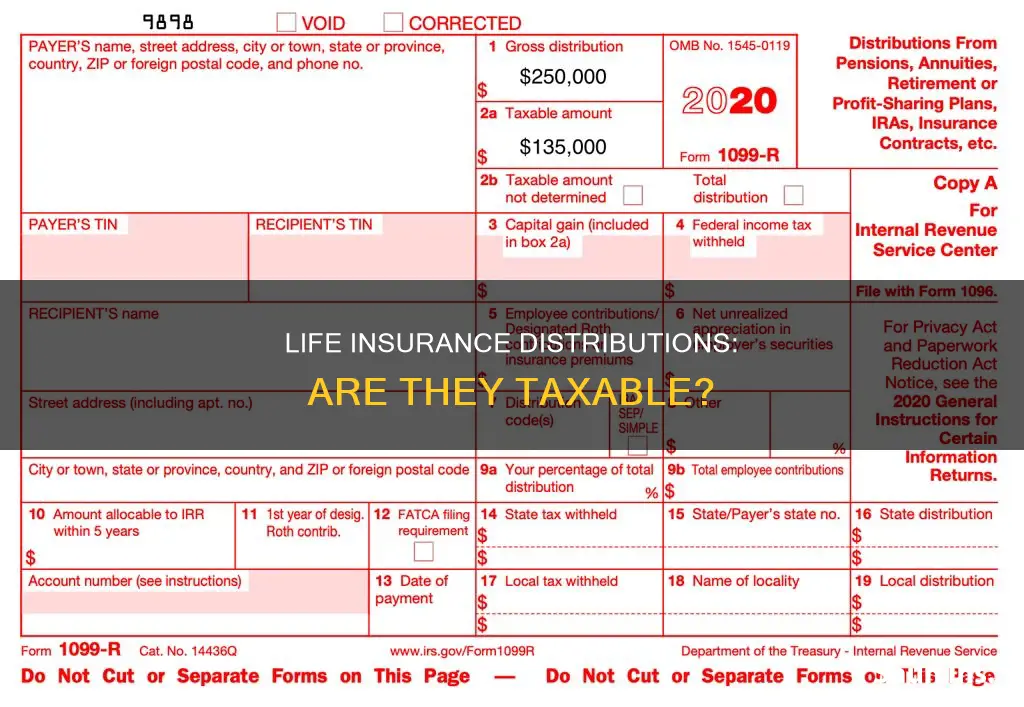

To determine the taxable amount, beneficiaries should refer to the type of income document received, such as a Form 1099-INT or Form 1099-R. Additionally, they can refer to IRS publications, such as Publication 525, "Taxable and Nontaxable Income," and Publication 907, "Tax Highlights for Persons with Disabilities," for more information.

Hep C Detection: Life Insurance Blood Tests Explained

You may want to see also

Policy loans

When you take out a policy loan, you don't have to go through an approval process, and there is no repayment schedule or repayment date. In fact, you don't have to repay a life insurance loan at all. However, if the loan isn't repaid before the insured person's death, the insurance company will reduce the face amount of the policy by the amount still owed, and the beneficiary will receive a lower death benefit as a result.

If a policy loan is outstanding when the policyholder dies, the beneficiary would receive a lower payout, but this benefit is typically not taxed. On the other hand, if you surrender your policy or it lapses and the amount you owe exceeds what you paid in, you may have to pay income tax on any earnings from the investment.

It's important to be mindful of the risks associated with policy loans. If you take out too many loans, the insurance company may force you to surrender your policy to cover the outstanding debt. Additionally, if the loan value surpasses the cash value of your insurance, your policy could lapse and be terminated by the insurance company, resulting in income taxes on the overall investment gains.

Global Life Insurance: A Good Investment?

You may want to see also

Estate taxes

Life insurance is a common tool for estate planning, as it allows for the quick and easy transfer of assets upon death. However, it's important to understand how life insurance can impact estate taxes.

If a life insurance policy has no named beneficiaries, the proceeds may be included in the deceased's estate. This can increase the value of the estate, potentially pushing it above the federal estate tax exemption threshold, which was $13.61 million in 2024. In such cases, estate taxes must be paid on the amount that exceeds the limit. Some states also have their own estate or inheritance taxes, which may apply depending on the value of the estate and the state of residence.

To avoid estate taxes, it's crucial to ensure that the estate is not designated as the beneficiary of the policy. One way to achieve this is by setting up an irrevocable life insurance trust (ILIT) and naming it as the owner and beneficiary of the policy. If structured properly, the trust can help pay estate taxes without increasing the value of the estate.

It's also important to consider the ownership rights associated with the policy. Even if someone else holds the legal title to the policy, certain "incidents of ownership" can cause the proceeds to be taxed as part of your estate. These rights include the ability to change beneficiaries, assign or revoke the policy, pledge the policy as loan security, borrow against the policy's cash surrender value, or surrender or cancel the policy.

Additionally, the death benefit from a life insurance policy can be included in the value of the estate if it exceeds certain limits. According to the IRS, if the life insurance proceeds, combined with the value of the estate, exceed the federal estate tax threshold, estate taxes must be paid on the amount over the limit. This threshold was $12.92 million in 2023.

By understanding these rules and carefully planning your estate, you can help ensure that your beneficiaries receive the maximum benefit from your life insurance policy while minimising potential tax liabilities.

Group Life Insurance: Cash Surrender Value Explained

You may want to see also

Whole life policy withdrawals

Whole life insurance policies are a type of permanent life insurance that combines life insurance with an investment component. They are called "whole life" because they cover you for your whole life, rather than for a specific term.

Whole life insurance policies have two components: the face value or death benefit, and the cash value. The death benefit is the amount of money your beneficiary will receive, while the cash value is a savings or investment account that you can withdraw from or borrow against.

Withdrawals from whole life insurance policies are generally treated as coming out of your policy basis first. Your basis in the policy is the amount of premiums you have paid into the policy, minus any prior dividends paid or previous withdrawals. Withdrawals up to your basis in the policy are typically tax-free because you have already paid income tax on those dollars.

However, if you make a withdrawal over and above your basis in the policy, a portion of the withdrawal will be considered taxable income. For example, if you have a cash value of $18,000 in your policy and your basis is $12,000, a withdrawal of $12,000 or less would have no income tax consequences. But if you withdraw $15,000, you will have to pay income tax on the additional $3,000 (at ordinary income rates, not capital gains rates).

It's important to note that certain types of whole life insurance policies may not allow withdrawals at all, or may charge an early withdrawal fee if you are under a certain age. Additionally, withdrawals could cause your policy to lapse, resulting in a loss of coverage. Therefore, it's crucial to understand the specific rules and consult a tax advisor or financial professional before making any withdrawals from your whole life insurance policy.

Life Insurance and Prostate Cancer: What's Covered?

You may want to see also

Whole life policy surrender

Surrendering a whole life insurance policy means giving up the right to the death benefit and accessing the cash value of the policy. While the cash value of life insurance is not usually taxable, there are some cases where you will have to pay taxes on it.

The cash surrender value of a life insurance plan is the amount you'll receive if you surrender your policy to your insurer. This amount is based on your cash value, the component of a permanent life insurance policy that can help you build cash value through regular premium payments.

The cash surrender value of a life insurance policy can be taxable. Any amount you receive over the policy's basis, or the amount you paid in premiums, can be taxed as income. There are several other scenarios that may result in potential tax consequences when you surrender your policy:

- You receive more funds than the policy's cost basis.

- You have outstanding policy loans that exceed the policy's cost basis.

- Your cost basis changed while you had the policy, such as reducing the death benefit or adding riders.

If you surrender your policy during the early years of ownership, when the value is relatively low, the insurance company will likely charge surrender fees, reducing your cash value. These charges vary depending on how long you've had the policy and, often, on the amount being surrendered. Some policies can levy surrender charges for many years after the policy is issued.

In addition, when you surrender your policy for cash, the gain on the policy is subject to income tax. Additional taxes could be incurred if you have an outstanding loan balance against the policy.

While surrendering a whole life insurance policy can get you the cash you need, you're giving up the right to the death benefit protection afforded by the insurance. If you want to replace the lost death benefit later, getting the same coverage might be more complicated or more expensive.

Therefore, it is generally recommended to consult a financial advisor before surrendering a whole life insurance policy to understand the potential tax implications and explore alternative options for accessing cash.

Life Insurance: Halal or Haram According to Hanafi School

You may want to see also

Frequently asked questions

For the most part, beneficiaries don't need to pay taxes on the life insurance death benefit they receive, especially if they receive it as a lump sum. However, there are some very specific scenarios where you may have to pay federal or state taxes.

If the life insurance policy goes into an estate, you choose to receive the death benefit as an annuity, you withdraw or take out a loan against your whole life policy's cash value, you surrender your whole life insurance policy, or you sell your whole life policy.

Inheritance or estate taxes, and income taxes.

Having the proper ownership, payor and beneficiary structure is a good start. Working with a professional insurance agent and a qualified tax advisor can provide significant value as well on the tax implications of life insurance proceeds.