Farmers Insurance and MetLife are not the same. In April 2021, Farmers Insurance, a subsidiary of Zurich Insurance Group, bought MetLife's home and auto insurance business for $3.94 billion. This included all existing MetLife home and auto insurance policies, which now fall under the Farmers brand. However, MetLife continues to operate independently of Farmers as it still offers other insurance options, including life, health, and pet insurance.

| Characteristics | Values |

|---|---|

| Farmers Insurance's purchase of MetLife | Farmers Insurance bought MetLife's home and auto insurance business in April 2021 for $3.94 billion. |

| Impact on MetLife customers | Current MetLife customers will see no changes to their policies, except for new paperwork with Farmers branding. |

| Impact on MetLife policies | Farmers assumed 2.4 million existing MetLife insurance policies. |

| Impact on MetLife staff | The people who handled the servicing and underwriting of MetLife's policies will continue to do so under Farmers. |

| New MetLife policies | No new home or auto policies will be written by MetLife; new policies must be purchased through Farmers. |

| Impact on MetLife's other insurance businesses | The acquisition did not affect MetLife's other insurance options, including life, health, and pet insurance, which remain available through MetLife. |

| MetLife's ownership | MetLife is owned by its shareholders as a publicly traded company. Its biggest shareholders include BlackRock, Dodge & Cox, and The Vanguard Group. |

| Farmers Insurance's ownership | Farmers Insurance is owned by its policyholders. Zurich Insurance Group manages the company's day-to-day operations and acts as its attorney-in-fact. |

What You'll Learn

Farmers Insurance bought MetLife's home and auto insurance business

Farmers Insurance, a subsidiary of Zurich Insurance Group, bought MetLife's home and auto insurance business in April 2021. The purchase agreement was reached in December 2020, and the deal was finalised for $3.94 billion in cash.

The acquisition included all aspects of MetLife's home and auto business, with Farmers assuming responsibility for 2.4 million existing MetLife insurance policies. Current MetLife customers will not see any changes to their policies, except for new paperwork with Farmers branding. The people who handled the servicing and underwriting of MetLife's policies will continue to do so under Farmers. However, new home or auto policies will not be written by MetLife, so anyone without a policy will need to purchase one through Farmers.

MetLife's life, health, and pet insurance options remain unaffected by the acquisition and are still available through MetLife. The company has assured that current coverage and premiums will remain the same during the transition to Farmers. However, rates, coverage, or discounts may change when policies are up for renewal or if policy details are updated before renewal.

Through this acquisition, Farmers Insurance has established a strategic partnership with MetLife Exchanges. Farmers will offer personal lines products on MetLife's U.S. Group Benefits platform, reaching 3,800 employers and approximately 37 million eligible employees. This partnership will allow MetLife to continue offering a broad range of benefits to its group customers while providing auto and home coverage through Farmers.

Rickie Fowler's Participation in the Farmers Insurance Open: What We Know

You may want to see also

Current MetLife customers will see no changes to their policies

Farmers Insurance bought MetLife's home and auto insurance business in April 2021. However, current MetLife customers will see no changes to their policies and will only receive new paperwork with Farmers branding. This means that if you already have a MetLife policy, the people who handled the servicing and underwriting of MetLife's policies will continue to do so under Farmers.

The acquisition included all aspects of MetLife's home and auto business, and Farmers assumed 2.4 million existing MetLife insurance policies. MetLife's home and auto insurance customers will now be served by Farmers Insurance or a subsidiary like Foremost. However, customers who have life, health, or pet insurance through MetLife will not see any changes to their policies or paperwork, as only the home and auto insurance business was sold.

MetLife has promised that if you have a current MetLife auto or home policy, your current coverage and premiums will remain the same during the transition. The only difference is that your policy will now be issued through Farmers or one of its subsidiaries, and you'll need to manage your policy through Farmers. While your rate, coverage, or discounts may change when your policy is up for renewal, you should be notified in writing of any changes. Your rates can also change if you update your policy before renewal, such as changing your address or adding or removing a driver or car.

MetLife and Farmers Exchanges have established a 10-year strategic partnership through which Farmers Insurance will offer personal lines products on MetLife's industry-leading U.S. Group Benefits platform, which reaches 3,800 employers and approximately 37 million eligible employees. This partnership ensures that MetLife employees across the U.S. will continue to have access to auto and home coverage through Farmers.

Unveiling the Truth Behind Farmers Insurance Ads: Creative License or Real-Life Accidents?

You may want to see also

Farmers Insurance is owned by its policyholders

Farmers Insurance is made up of three primary insurers: Farmers Insurance Exchange, Fire Insurance Exchange, and Truck Insurance Exchange. These exchanges are inter-insurance exchanges owned by their policyholders and are organised under the laws of the State of California. The policyholders of these exchanges elect a Board of Governors, which in turn appoints the Exchange's officers.

Farmers Insurance has a long history dating back to 1928, when its founders shared a dream of providing quality insurance at reasonable prices. Over the years, Farmers has adapted to meet the changing needs of Americans while maintaining its commitment to industry-leading products and first-rate services. Today, Farmers Insurance serves over 10 million households and provides coverage for vehicles, homes, and small businesses across all 50 states.

In April 2021, Farmers Insurance acquired MetLife's home and auto insurance business. This acquisition expanded Farmers' reach and allowed them to offer their products on MetLife's industry-leading U.S. Group Benefits platform. Despite this acquisition, Farmers Insurance remains owned by its policyholders, with Zurich Insurance Group continuing to manage the day-to-day operations.

The Cbiz and Farmers Insurance Merger: A New Era of Comprehensive Business Solutions

You may want to see also

MetLife is owned by its shareholders

MetLife, Inc. is a publicly traded company that is owned by its shareholders. The company was founded in 1868 and has been completely public since 2000. As of Q3 2021, the biggest shareholders are BlackRock, Dodge & Cox, and The Vanguard Group, with a combined ownership stake of almost 20%.

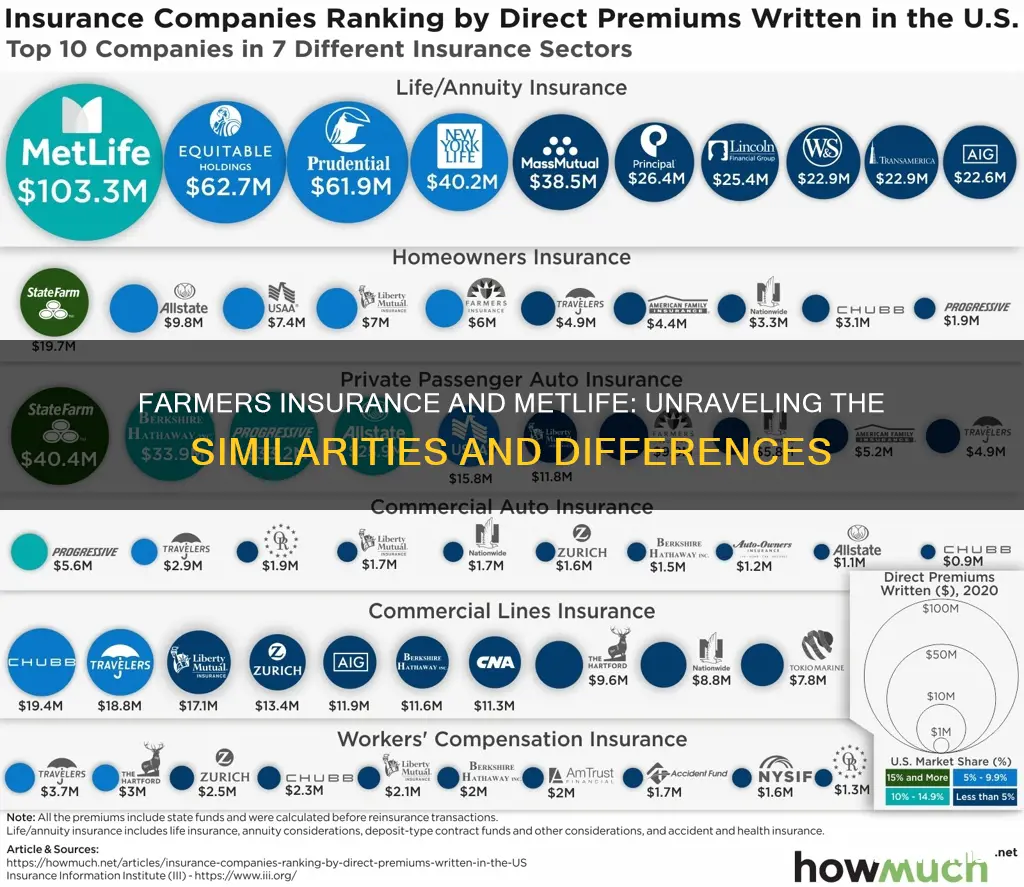

MetLife is among the largest global providers of insurance, annuities, and employee benefit programs, with around 90 million customers in over 60 countries. The company ranked 43rd in the 2018 Fortune 500 list of the largest United States corporations by total revenue. It is the largest life insurer in terms of life insurance "in-force" in North America and offers financial products and services to over 96 of the top 100 Fortune 500 companies.

In April 2021, MetLife sold its home and auto insurance business to Farmers Insurance Group, a subsidiary of Zurich Insurance Group, for $3.94 billion. This means that MetLife shareholders no longer have control of the company's home and auto insurance business. However, all other types of MetLife coverage, such as health and life insurance, are still available.

Farmers Insurance: Unraveling its Corporate Structure and Nature of Ownership

You may want to see also

Farmers Insurance is a subsidiary of Zurich Insurance Group

Farmers Insurance Group is a wholly owned subsidiary of Zurich Insurance Group Ltd, a Swiss insurance company headquartered in Zurich, Switzerland. Zurich Insurance Group is the country's largest insurer and ranked 112th in the world on Forbes' Global 2000s list in 2021. The group employs 55,000 people and has customers in 215 countries and territories.

Farmers Insurance Group, often referred to as Farmers, is an American insurer group that offers insurance for vehicles, homes, and small businesses, as well as other insurance and financial services products. The company has over 48,000 exclusive and independent agents and approximately 21,000 employees. Farmers is the trade name for three reciprocal exchanges: Farmers, Fire, and Truck Insurance Exchanges. These exchanges are managed by Farmers Group, Inc., which acts as the attorney-in-fact on behalf of their respective policyholders.

The acquisition of Farmers Insurance Group by Zurich Insurance Group Ltd occurred in two stages. Firstly, in 1998, Zurich merged with the financial division of British American Tobacco to form Zurich Financial Services. This entity then acquired Farmers Group, Inc. in 1998 for $5.2 billion. Subsequently, in 2000, the structure was reorganised under a single holding company, Zurich Financial Services, with shares listed on the Swiss and London stock exchanges.

In December 2020, it was announced that Zurich Group would purchase MetLife's property and casualty insurance business for $3.6 billion, with Farmers Insurance assuming responsibility for MetLife's previous retail property and casualty customers. This acquisition was finalised in April 2021, with Farmers Insurance paying a total of $3.94 billion for MetLife's property and casualty insurance business. As a result of this transaction, Farmers Insurance became the third-largest insurance group in the United States.

It is important to note that while Zurich Insurance Group is the parent company of Farmers Insurance Group, the policyholders of Farmers Insurance own the company. Farmers Insurance Group is structured as a reciprocal insurance exchange, meaning policyholders assume each other's risk. Zurich Insurance Group is responsible for the day-to-day management of Farmers Insurance and acts as the attorney-in-fact, handling tasks such as issuing policies and collecting premiums. However, they do not own the company.

Farmers Insurance: Navigating the Claims and Contact Process

You may want to see also

Frequently asked questions

Farmers Insurance bought MetLife's home and auto insurance business. The purchase was agreed upon in December 2020 and finalized on April 7, 2021. MetLife's home and auto insurance businesses are now owned by Farmers, a subsidiary of Zurich Insurance Group.

Current MetLife customers with home and auto insurance policies will see no changes to their policies and will only receive new paperwork with Farmers branding. Customers who have life, health, or pet insurance through MetLife will not see any changes to their policies or paperwork since only the home and auto insurance business was sold.

Farmers Insurance is a type of insurance company called a reciprocal insurance exchange, meaning that policyholders assume each other's risk. The day-to-day management of the company is done by Zurich Insurance Group, which acts as the attorney-in-fact for Farmers. MetLife, on the other hand, is a publicly traded company owned by its shareholders.