Life insurance is often taken out to provide peace of mind that loved ones will have financial support in the event of the policyholder's death. While the death benefit is typically not taxable, there are some situations where taxes may be owed. For example, if the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated. In addition, if the policyholder names their estate as the beneficiary, this could increase the estate's value and trigger estate taxes. It's important to understand the tax implications to ensure that beneficiaries receive the full benefit of the policy.

What You'll Learn

Life insurance proceeds are generally not taxable income for beneficiaries

Life insurance is often seen as a reliable way to provide for loved ones after you're gone, and one of its biggest advantages is the tax relief it offers. Typically, the death benefit your beneficiaries receive isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs, or securing their future. This is true for both term life insurance and permanent life insurance.

However, it's important to note that there are a few situations where taxes could come into play. For example, if your beneficiaries choose to receive the life insurance payout in installments instead of a lump sum, any interest that builds up on those payments could be taxed. That extra money from interest is considered taxable income, even though the original death benefit is not.

Another exception occurs when a policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary. If the estate's total value is large enough, it may trigger estate taxes, reducing what your loved ones ultimately receive.

In addition, if the policy is a modified endowment contract (MEC), the taxation rules are different. Withdrawals from a MEC are treated as taxable income until they equal all interest earnings in the contract.

Overall, while life insurance proceeds are generally not taxable income for beneficiaries, there are some exceptions and special circumstances that may apply. It's always a good idea to consult with a financial advisor or tax professional to understand how taxes could impact your specific situation.

Term Life Insurance: Cancel Anytime, No Strings Attached

You may want to see also

Interest on benefits is taxable income

Life insurance proceeds are generally not taxable if you are the beneficiary. However, any interest accrued on the proceeds is taxable and must be reported. This means that while the death benefit is not taxed as income, any interest generated during the period that the benefit is held by the life insurance company before being paid out is taxable. This interest is calculated from the date of the insured person's death until the date the insurance company sends the death benefit cheque to the beneficiary. The interest must be reported as interest received, and the insurance company reports it to the Internal Revenue Service (IRS).

For example, if the death benefit is $500,000 but earns 10% interest for one year before being paid out, the beneficiary will owe taxes on the $50,000 growth. This interest income is taxable at the regular income tax rate.

To avoid paying taxes on life insurance proceeds, an individual can transfer ownership of the policy to another person or entity. This strategy can help remove the proceeds from the taxable estate. It is important to note that the original owner must forfeit any legal rights to the policy and cannot pay the premiums to keep it active. Additionally, the transfer must occur at least three years before the owner's death to avoid federal estate tax.

Another strategy to minimise potential tax liabilities is to use an irrevocable life insurance trust (ILIT). In this case, the policy is held in trust, and the owner no longer has control over it. As a result, the proceeds are not included as part of the owner's estate. It is important to note that the owner cannot be the trustee of the trust and must give up all rights to revoke it.

It is also essential to regularly review beneficiaries and policy details to avoid any unexpected tax complications. By planning ahead and staying informed, individuals can protect their life insurance benefits and safeguard their beneficiaries from unnecessary tax burdens.

Supplemental Life Insurance: Enhancing Your Coverage and Peace of Mind

You may want to see also

Naming an estate as beneficiary may trigger estate taxes

Naming an estate as a beneficiary is generally considered a poor choice, especially when it comes to taxes. While it may seem easier than naming a person or two, there are several serious downsides to this approach.

Firstly, if an estate is named as a beneficiary, it will be subject to the probate process, which can be costly and time-consuming. This process may also expose the estate to additional fees, risks, and creditors. Secondly, naming an estate as a beneficiary can result in unfavourable post-death distribution options and the fastest possible payout, potentially increasing the total income tax liability on the funds. For example, if the beneficiary dies before the required beginning date for RMDs with the estate as the beneficiary, the funds must be distributed within five years of their death, as opposed to over a longer period if a spouse, child, or qualifying trust was named as the beneficiary.

Additionally, naming an estate as a beneficiary can lead to higher taxes. The shorter timeline for distribution results in larger annual payouts, which can increase the potential for paying more in taxes. This can also lead to higher Medicare charges and potentially more tax on Social Security payments. Lastly, assets in an estate do not have the same level of protection from creditors as assets left directly to a named beneficiary.

In summary, while naming an estate as a beneficiary may seem like a straightforward option, it can trigger estate taxes and create several other unwanted financial consequences. It is essential to carefully consider all options and seek professional advice when making these important financial decisions.

Group Life Insurance: Covering Your Immediate Family?

You may want to see also

Proceeds may be taxable income if the policy was transferred for cash

Generally, life insurance proceeds are not taxable income. However, there are certain situations where the proceeds may be taxable. One such situation is when the policy was transferred to the beneficiary for cash or other valuable consideration. In this case, the exclusion for the proceeds is limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. This means that if the beneficiary paid for the policy or provided other valuable consideration, the amount they can exclude from their gross income when filing taxes is limited.

For example, if a beneficiary paid $10,000 for a policy with a $100,000 face value, they would only be able to exclude $10,000 from their gross income and would need to include the remaining $90,000 as taxable income. It is important to note that there may be exceptions to this rule, and the specific circumstances of each case should be considered.

The reasoning behind this rule is to prevent people from using life insurance policies as a way to reduce their taxable income. By limiting the exclusion to the amount paid or the value provided, the IRS ensures that people cannot overpay for a policy to lower their tax liability.

In addition to the consideration paid, there may be other amounts that can be excluded from taxable income. These could include additional premiums paid by the beneficiary and certain other specified amounts. The specific amounts and circumstances that qualify for exclusion can be found in Publication 525, Taxable and Nontaxable Income, published by the IRS.

It is important for beneficiaries to understand their tax obligations when receiving life insurance proceeds. While the proceeds themselves may not be taxable, any interest earned on the proceeds is generally taxable income. This is true even if the beneficiary receives the payout in installments rather than as a lump sum. The beneficiary is responsible for reporting and paying taxes on any interest earned.

To report taxable proceeds, beneficiaries will generally use Form 1099-INT or Form 1099-R, depending on the type of income they received. These forms will help them calculate and report the correct amount of taxable income to the IRS. By staying compliant with tax regulations, beneficiaries can avoid penalties and ensure they are meeting their tax obligations.

Marketing Term Life Insurance: Strategies for Success

You may want to see also

Permanent life insurance policies have different tax rules

Policyholders can withdraw up to their premium payments tax-free. However, if they withdraw more than that, they owe income tax on their gains above what they paid. They can also access the cash value through a loan, which is not taxable as income. Nevertheless, the insurer will charge interest on the loan. If the size of the loan plus interest exceeds the total cash value, the policyholder would need to pay more into the policy or risk it lapsing.

Interest generated from whole life insurance policies is not taxed until the policy is cashed out. When a policyholder elects to take the cash value of their whole life insurance policy, they are taxed on the difference between the cash value received and the total amount paid in premiums.

The death benefit of permanent life insurance is generally paid out income tax-free. However, there are instances where federal and state estate taxes can apply to the proceeds of a life insurance payout, depending on the circumstances.

Life Insurance: Signing Up and Getting Covered

You may want to see also

Frequently asked questions

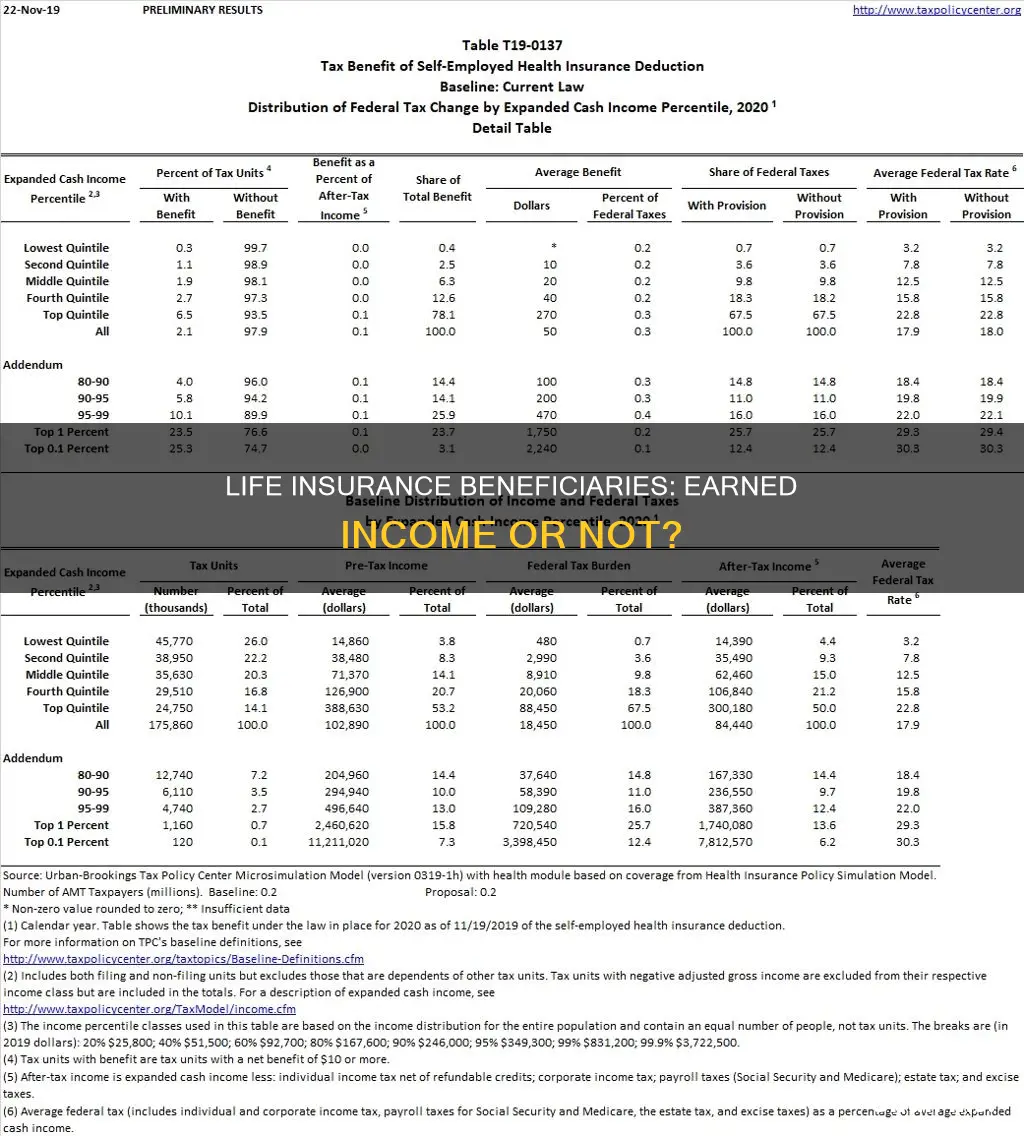

No, life insurance beneficiaries are not considered earned income. However, the beneficiary may have to pay taxes on any interest the policy accrued.

Generally, the proceeds from a life insurance policy that you receive as the beneficiary are not considered gross income and do not have to be reported on your income taxes.

If the beneficiaries of the proceeds are minor children, an irrevocable life insurance trust (ILIT) can be created to handle the money for the children under the terms of the trust document.

The IRS considers life insurance proceeds paid upon the insured's death as non-includable in gross income and the beneficiary is not mandated to report them.

Yes, there are two primary exceptions: transfers-for-value and employer-owned life insurance.