Life insurance is a crucial financial safety net for your loved ones, but what happens when you can't pay your premiums? The consequences depend on the type of policy and its terms and conditions. Term life insurance policies will lapse if you miss a payment, whereas permanent life insurance policies offer more flexibility. Understanding the grace period offered by your insurance provider is essential, as it gives you extra time to make payments and maintain coverage. During this period, your policy remains in force, and your beneficiary will receive the death benefit minus any outstanding payments if you pass away. However, if you ignore your premium payments during the grace period, your policy will lapse, and your coverage will end. Reinstating your policy may be possible but may require a medical exam and higher premiums. To avoid missing payments, consider setting up automatic payments or annual payments, which are easier to manage and reduce the risk of late payments.

| Characteristics | Values |

|---|---|

| Grace period | Typically 30 days, but depends on the policy and provider |

| Reinstatement | Possible within five years of lapsing, but may require a medical exam |

| Payment options | Monthly, quarterly, semi-annually, annually |

| Payment methods | Electronic funds transfer, regular withdrawal, autopay |

| Payment frequency | The less frequent the payments, the lower the risk of missing one |

| Cash value | Can be used to cover premium payments in permanent life insurance policies |

| Waiver of premium rider | Allows you to skip payments due to disability or unemployment |

| Dividends | Can be used to pay premiums in whole life insurance policies |

Grace periods

It is important to note that if you ignore your premium payment during the grace period, your policy will lapse, and your coverage will end. Reinstating your policy after the grace period may be possible, but it will likely require you to undergo medical exam underwriting and pay higher premiums.

To avoid missing payments, consider setting up automatic payments or calendar reminders for due dates. Additionally, paying your premium annually reduces the risk of late payment as you only need to remember one payment date per year.

Life Insurance Rates: Can You Get a Better Deal?

You may want to see also

Payment options

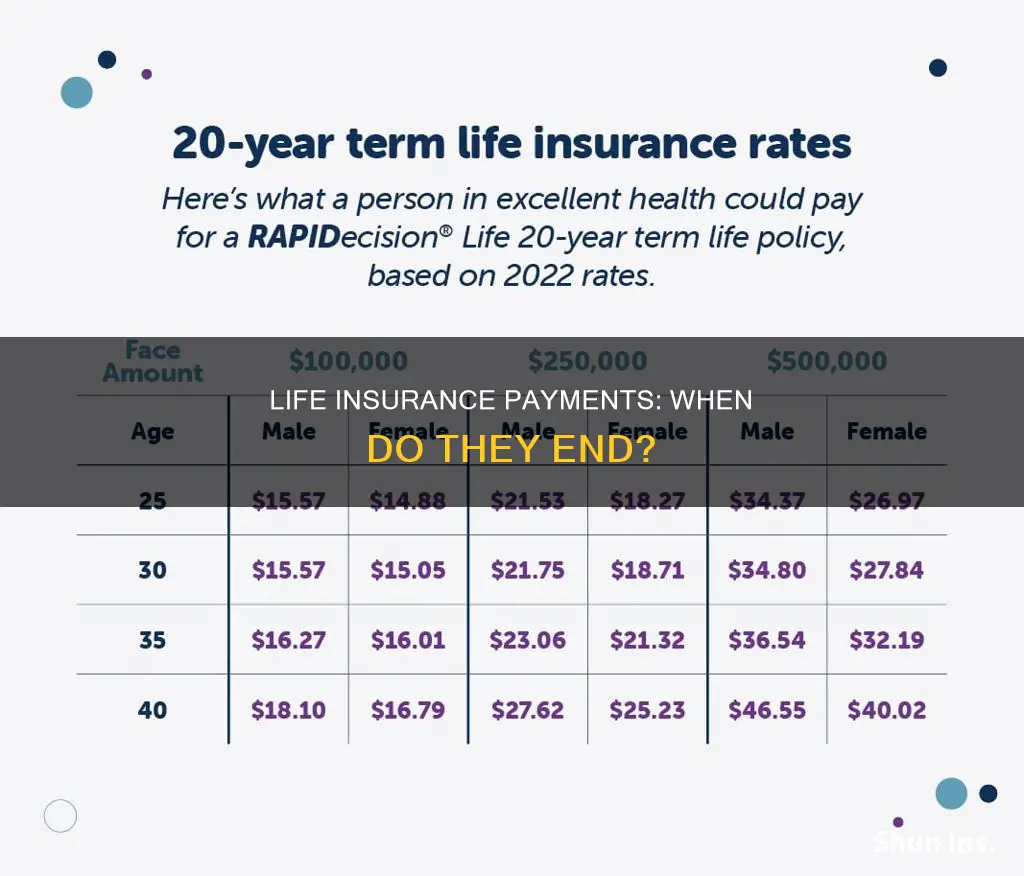

The frequency of your life insurance premium payments depends on the policy you select. Some insurance providers offer a variety of payment options:

- Annually (once per year)

- Semi-annually (twice per year)

- Quarterly (four times per year)

- Monthly

Monthly or quarterly payments are typically easier to budget for. However, some insurance companies charge additional fees to process these frequent payments, which can cost you more overall. Opting to pay premiums on a semi-annual or annual basis can help you avoid any added costs, but it'll mean making a large and infrequent lump-sum payment.

If you purchase life insurance through your employer, premium payments will likely be deducted from your paycheck. You may have the option to take the policy with you if you leave your employer, but you would need to work with your insurer to convert your plan to a whole life policy and make payments directly to the insurance company.

If you're going through a financial rough patch and can't afford to pay your life insurance premiums, there are several options to consider.

If you have a term life insurance policy, your coverage will lapse if you miss a payment. However, if you have permanent life insurance, you may be able to:

- Cash out the policy: You can stop paying the premium and collect the available cash savings, but you will no longer be covered by life insurance. You may also have to pay taxes on some of the cash value if the sum exceeds what you have paid in premiums.

- Take advantage of a non-forfeiture option: You can stop paying premiums in return for a reduced death benefit and no cash savings, or convert the permanent policy to an extended-term policy based on the accumulated cash savings in the policy.

- Use the grace period: Most life insurance companies give policyholders a 30-day grace period to pay the premium from when it is due. Typically, if you go another 30 days without paying, the policy will be in "lapse pending" status.

- Use your waiver of premium rider: If you bought this rider, you might be able to skip payments but continue your insurance benefits. Typically, the waiver kicks in if you're unable to pay the premium because of a disability, but some riders waive premiums for unemployment. There's usually a waiting period before the waiver rider kicks in.

- Use dividends to pay premiums: Whole life insurance policies pay out dividends to policyholders in years when the insurance company has performed well, and you can use these dividends to pay your premiums.

- Use the cash value to cover the payment: Policyholders can use a permanent life insurance policy's cash value to pay premiums by making a withdrawal from the cash value. If the amount you withdraw exceeds the amount you've paid toward the cash value portion of your policy, you'll pay taxes on the difference. Withdrawals also reduce the death benefit.

- Use the paid-up option: You may be able to use the cash value to convert your policy to paid-up status, allowing you to keep some coverage in place without paying additional premiums. However, this will likely reduce the death benefit paid to beneficiaries.

- Reduce your policy's face value: You can lower your premium by asking your insurance company to reduce the policy's face value.

- Switch to a level benefit: If you opted for a policy that allows you to increase the death benefit by paying higher premiums over time, you can reduce your premium by switching to a level benefit.

Remember, it's important to make sure your payment structure is factored into your budget and to take steps to free up cash for payments if money is tight. You can also consider setting up automatic payments or reminders to ensure you make your premium payments on time.

Mass Mutual Life Insurance: Drug Testing Requirements

You may want to see also

Policy lapse

A life insurance policy lapse occurs when you stop paying your policy's premium and the contractual grace period has expired. If you let your life insurance lapse, your coverage will end.

The repercussions of a lapsed policy vary depending on whether you have term or whole life insurance.

Term Life Insurance Lapse

A term life insurance policy usually has no cash value, so once you miss a payment, the policy immediately moves into a grace period. If a payment isn't received by the end of the grace period, the policy lapses. Your beneficiaries will likely not be able to claim your death benefit, and you'll lose the premiums you've already paid.

Permanent Life Insurance Lapse

Permanent policies with a cash value component, such as whole life policies, almost always have an automatic premium loan component. If so, the insurance company will use the cash value of the policy to cover your premium if you miss a payment. If there isn't enough cash value in the policy to pay the premium, or once the cash value has been used up due to continued non-payment, your policy will slip into the grace period. Your policy will officially lapse once the grace period ends, meaning your coverage will end and no death benefit will be paid.

Your policy's cash value might be used to fulfil your unpaid premium. If you have permanent life insurance, you might be able to take advantage of features that allow you to stop paying your premium without your policy lapsing. For example, the "reduced paid-up" feature allows you to reduce your guaranteed death benefit in exchange for your policy being considered fully paid.

Retired Military: Free Life Insurance Benefits Explained

You may want to see also

Cashing out

Option 1: Withdraw your entire cash value

If you have a whole life policy and want or need money, you can cash it out entirely to get the cash value you've built up. However, you will have to surrender your policy, which means the coverage for your loved ones will end. Additionally, you will have to pay "surrender charges" and income taxes on the money.

Option 2: Make a partial withdrawal

Another option is to take some but not all of the cash value from your life insurance policy. This allows you to keep your policy active, so your loved ones will still receive a death benefit when you pass away, although it will likely be smaller than originally intended. Check if the money you withdraw will be taxable.

Option 3: Borrow money from your life insurance

If you've had your life insurance policy for several years, you may be able to borrow from its cash value. Typically, you won't have to pay taxes on the borrowed money, but the insurance company will deduct interest payments from your cash value balance. The interest rate is usually lower than that of a credit card or bank loan, and the loan does not affect your credit score. Repaying the loan and interest in full before your death will ensure your loved ones receive the full death benefit. However, if you pass away before fully repaying the loan, the outstanding balance and interest will be subtracted from the death benefit.

Option 4: Surrender the policy for cash

You can surrender your life insurance policy to receive its full cash value, minus any surrender charges. However, you will have to pay taxes on any gains from the cash value portion of the policy, and you will lose your life insurance coverage.

Option 5: Sell your policy for cash

You can sell your life insurance policy to a third party for a lump sum greater than its cash value through a process called a life settlement. While you'll continue making premium payments, the death benefit will go to the third party when you pass away. To qualify for a life settlement, you typically need to be at least 65 years old or have a certain level of health impairments.

Before cashing out your life insurance policy, carefully consider your overall financial plan and ensure you have enough assets to leave behind for your dependents. Additionally, be aware of any taxes, fees, or reductions in the death benefit that may apply.

In-Laws and Life Insurance: Who Benefits from a Child's Policy?

You may want to see also

Non-forfeiture options

If you have a permanent life insurance policy and can no longer afford the premiums, you can take advantage of a non-forfeiture option. This is a provision included in certain life insurance policies that stipulates that the policyholder will not forfeit the value of the policy if it lapses after a defined period due to missed premium payments.

- Cash surrender value: The policyholder can terminate the policy and receive the remaining cash value within six months. The policy is then cancelled and cannot be reinstated.

- Extended-term option: The policyholder uses the cash value from their original policy to place the policy on extended-term insurance. This option also helps the policyholder to stop paying premiums for the original policy.

- Reduced paid-up insurance: The policy's cash value is used to buy a paid-up policy of the same type as the original. The policyholder pays no further premiums but receives a reduced death benefit.

- Single-premium, immediate annuity: Some insurance companies allow the policy owner to convert the policy to an annuity, which will pay the policy owner an amount for the rest of their life, based on the cash value of the lapsed or surrendered policy and the policy owner's age.

- Automatic premium loan: The insurer automatically deducts the premium amount overdue from the policy value. The insurance company makes a loan against the policy's cash value to pay the overdue premiums, provided the cash value is more than or equal to the premium amount due.

Variable Whole Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Most insurance providers are willing to work with you to bring your policy back into good standing. This is known as a grace period. The grace period is usually 30 days, but it depends on your policy and provider. If you miss a premium payment on a term life insurance policy, the grace period begins, after which the policy will lapse.

If you stop making payments on term life insurance, the policy will lapse and end after the grace period. If your payments stop on a cash value life insurance policy, the insurer will generally use any cash value in the policy to cover the premiums. Once the cash value is exhausted, the policy will end.

You can avoid missing premium payments by paying your premium annually, setting up an electronic funds transfer (EFT) or other regular withdrawals, or scheduling your premium payments at the beginning of the month several days before the due date.

If your policy lapses due to non-payment, reach out to your insurance provider promptly and ask what you can do to have it reinstated. This process could be as simple as making premium payments to bring the policy current if not much time has passed since the policy lapsed.