Life insurance payouts are usually tax-free, but there are exceptions. If the payout causes the estate's worth to exceed a certain threshold, heirs might be charged estate taxes. This threshold is $13.6 million for individuals and $25.22 million for married couples in 2024. If the payout is rolled into your estate, it will be subject to estate tax. However, if you transfer ownership of the policy to another person or entity, or put the policy into an irrevocable life insurance trust, you can avoid estate taxes.

| Characteristics | Values |

|---|---|

| Life insurance proceeds taxable | Not usually subject to income or estate taxes |

| Death benefit taxable | Not usually subject to income tax |

| Federal estate tax exemption limit | $13.61 million for an individual in 2024 |

| Estate tax exemption for married couples | $10.98 million in 2017 |

| State estate tax exemption | $1 million in Massachusetts and Oregon in 2021 |

| Gift tax exemption | $15,000 in 2020 |

| Cash value of policy exemption | $16,000 in 2022, $17,000 in 2023 |

| Gifting limit | $16,000 per person in 2022, $17,000 in 2023 |

What You'll Learn

Naming your estate as the beneficiary of your policy

Naming your estate as the beneficiary of your life insurance policy is generally not recommended. This is because it could give creditors access to your life insurance death benefit, meaning your loved ones could ultimately receive less money.

When you name a person as the beneficiary of your insurance policy, the death benefit does not form part of your estate. This means your loved ones can access the money quickly and easily, without it first going through probate court.

However, if you name your estate as the beneficiary, the death benefit will be subject to probate. A judge will determine what debts you owe, and creditors will be able to collect repayment before the remainder of your estate is distributed according to your will.

If you want to ensure that your life insurance payout goes directly to your loved ones, it's best to name them as the primary beneficiaries on your policy. This will allow them to claim the money directly and without delay.

You should also keep your life insurance policy up-to-date and adjust your beneficiaries as necessary after any significant life events.

Medi-Cal Recovery: Life Insurance Proceeds and Your Assets

You may want to see also

Transferring ownership of your policy

Transferring ownership of your life insurance policy is a strategy for adapting to changing circumstances. For example, if your attorney suggests creating a life insurance trust, signing over your policy might be necessary. It can also help with estate tax planning and changes to your financial or life circumstances, such as a divorce or new financial obligations.

There are three methods to transfer a policy's ownership:

Absolute Assignment

Absolute assignment involves transferring all rights and ownership of a life insurance policy from yourself to someone else or a legal entity. This process is irreversible. If you are the insured person in the policy, you’ll remain insured, but the new owner can update coverage or designate new beneficiaries.

Collateral Assignment

A collateral assignment allows you to use a life insurance policy you own to obtain a loan. It is a temporary solution, and the original owner will regain control of the policy once they repay the loan or meet other specific criteria.

Irrevocable Life Insurance Trust (ILIT)

An ILIT is a type of trust that owns a life insurance policy as its primary asset. It can help reduce or avoid estate taxes if you anticipate leaving a sizable taxable estate to your beneficiaries. The proceeds from the life insurance policy in the trust can be used by the trustee to purchase assets from the estate of the deceased, providing the funds to pay the outstanding estate tax bill.

When considering transferring ownership of your life insurance policy, it is important to keep the following in mind:

- The transfer must be made at least three years before the original owner's death.

- The person covered by the policy cannot retain any "incidents of ownership", such as the power to cancel or change the beneficiary.

- Gifts over a certain amount may be subject to federal gift tax.

- The transfer may be irreversible, so it is important to choose a competent adult/entity as the new owner.

- The new owner will be responsible for making premium payments.

- You will give up all rights to make changes to the policy in the future.

Ulcerative Colitis: Life Insurance Considerations and Impacts

You may want to see also

Understanding the estate tax exemption

The estate tax is a federal tax levied on the transfer of a person's estate after their death. This tax is calculated based on the estate's fair market value (FMV) rather than what the deceased originally paid for the assets. The estate tax is only applied if the value of the estate exceeds an exclusion limit set by law. In this case, only the amount that exceeds the minimum threshold is taxed.

The Internal Revenue Service (IRS) requires estates with combined gross assets and prior taxable gifts to file a federal estate tax return and pay the estate tax. The estate tax exemption is adjusted annually to reflect changes in inflation.

The federal estate tax exclusion exempts up to $13.61 million in 2024 from the value of an estate, up from $12.92 million in 2023. This means that only the value over these thresholds is subject to the federal estate tax, unless otherwise excluded. A married couple has a combined exemption of $27.22 million.

The estate tax exemption is set to increase for inflation through 2025. In 2026, it will revert to a lower level—though Congress can adjust this at any time. The estate tax exemption for 2026 is set to drop back to $5 million, adjusted for inflation.

The estate tax should not be confused with the inheritance tax, which is assessed by the state in which the beneficiary is living. The estate tax is applied to an estate before assets are given to beneficiaries, whereas the inheritance tax is applied to assets after they have been inherited and are paid by the inheritor.

Life Insurance and Debt: Can Creditors Access Your Benefits?

You may want to see also

The impact of cash value on tax liability

The cash value of a life insurance policy refers to the savings component of a permanent life insurance policy, such as whole life or universal life insurance. This cash value grows over time and can be borrowed against, withdrawn, or used to pay premiums or purchase an annuity. While the cash value generally grows tax-free, there are certain situations where taxes may be owed.

Withdrawals

If you withdraw an amount that exceeds the total premiums paid into the policy, the excess amount may be subject to income tax. Withdrawals up to the total premiums paid are generally not taxable, as they are considered a return of premiums. However, if you withdraw any gains or dividends, these amounts are typically taxed as ordinary income. Withdrawals may also cause your policy to lapse, resulting in a loss of coverage, and could lead to increased premiums to maintain the same death benefit.

Policy Loans

Policy loans allow you to borrow money from the issuer using your cash value as collateral. The borrowed amounts from non-modified endowment contract (MEC) policies are generally not taxable, and you are not obligated to make payments on the loan. However, loan balances typically reduce the policy's death benefit, and an unpaid loan that accrues interest can reduce your cash value, potentially causing the policy to lapse. If the loan is still outstanding when the policy lapses or is surrendered, the borrowed amount may become taxable if the cash value exceeds your basis in the contract.

Surrendering or Cashing Out

Surrendering or cashing out a policy involves cancelling the policy and receiving the cash value, minus any surrender fees or unpaid loan balances. The gain on the policy, or the amount that exceeds the total premiums paid, is typically subject to income tax. Surrendering a policy during the early years of ownership may result in higher surrender fees, and it also means giving up the right to the death benefit protection.

Modified Endowment Contracts (MECs)

If a life insurance policy is classified as an MEC, meaning the funding exceeds federal tax law limits, there may be additional tax implications. Withdrawals and policy loans from MECs are generally taxed according to the rules for annuities, with cash disbursements considered to be made from interest first and subject to income tax. Additionally, withdrawals made before the age of 59½ may be subject to an early-withdrawal penalty.

Life Settlements

In a life settlement, you sell your life insurance policy to a person or company in exchange for cash. The taxation of life settlements can be complicated, and it is recommended to seek expert tax advice. Any gain in excess of your basis in the policy is typically taxed as ordinary income. Life settlements may also incur commissions and fees, reducing the net amount received.

Manhattan Life Supplemental Insurance: Silver Sneakers Access?

You may want to see also

The tax implications of group life insurance policies

Group term life insurance is a common part of employee benefit packages. Employers can provide up to $50,000 of group term life insurance coverage to their employees tax-free. This is because, according to Internal Revenue Service (IRS) Code Section 79, the cost of any coverage over $50,000 that is paid for by an employer must be recognised as a taxable benefit and reported on the employee's W-2 form as income. The taxable amount is calculated using an IRS premium table, based on the employee's age, and is subject to Social Security and Medicare taxes.

If an employer differentiates—which is allowed, by offering different amounts of coverage to select groups of employees—then the first $50,000 of coverage may become a taxable benefit to them. This includes corporate officers, highly compensated individuals, or owners with a 5% or greater stake in the business.

If your employer pays for a life insurance policy that exceeds $50,000, the premium paid is considered part of your taxable income. The taxable amount is based on IRS tables, regardless of the actual premium paid. For example, a 70-year-old receiving $50,000 in insurance coverage above the threshold is considered to have $103 per month in additional taxable income, or $1,236 per year.

If you have a group term life insurance policy, it's important to note that the coverage will automatically end when your employment terminates. Some insurance companies do offer the option to continue coverage by converting to an individual permanent life insurance policy, but this may require underwriting and carry a much higher premium.

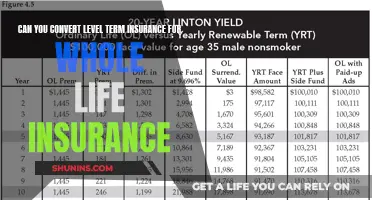

Whole Life Insurance: Growing Value, Growing Peace of Mind

You may want to see also