Life insurance is a financial product that provides peace of mind and security for individuals and their loved ones. For those diagnosed with multiple sclerosis (MS), a life-altering condition that affects the central nervous system, the process of obtaining life insurance can be challenging but not impossible. While MS patients may face higher rates and more stringent requirements, it is still possible to obtain term life insurance coverage. This type of insurance provides a death benefit for a specified period, typically 10 to 30 years, and is more affordable than permanent life insurance. The approval process for MS patients involves disclosing medical history, treatments, and overall health, with rates dependent on age, gender, and progression of the condition. Understanding these factors and working with qualified agents can help MS patients navigate the process of obtaining term life insurance successfully.

| Characteristics | Values |

|---|---|

| Can you get term life insurance with MS? | Yes |

| Will you pay higher rates? | Yes |

| Do you need a medical exam? | Likely |

| Does the time since diagnosis matter? | Yes |

| Does the type of MS matter? | Yes |

| Do your lifestyle factors matter? | Yes |

| Do your overall health and age matter? | Yes |

| Do your medical records matter? | Yes |

What You'll Learn

Qualifying for term life insurance with MS

It is possible to get term life insurance if you have multiple sclerosis (MS), but your coverage options and the amount you pay for your policy will depend on several factors.

Factors that affect your eligibility for term life insurance with MS

When you apply for term life insurance with MS, insurers will assess your eligibility and determine your premiums based on various factors, including:

- The type and stage of your MS: The progression of your MS will play a significant role in determining your eligibility and premium rates. Mild forms of MS with early diagnosis and a history of remission may result in lower premiums. More severe forms of MS, such as primary-progressive MS (PPMS) or aggressive MS, may lead to higher premiums or even denial of coverage.

- Age: Younger individuals generally qualify for lower premiums as they are less likely to die during the term of the policy. The age at which you were diagnosed with MS will also be considered.

- Gender: Men often pay higher premiums than women, as they tend to have shorter life expectancies.

- Lifestyle habits: Smoking, alcohol consumption, and other lifestyle factors can impact your eligibility and premiums. Smoking, in particular, can aggravate MS and result in higher rates.

- Overall health profile: In addition to MS, your overall health, including any other medical conditions, will be evaluated. Maintaining a healthy lifestyle, managing stress, and following your doctor's treatment plan can improve your chances of qualifying for term life insurance.

- High-risk habits and occupations: Engaging in high-risk activities or working in dangerous occupations may increase your premiums or impact your eligibility.

Steps to improve your chances of qualifying for term life insurance with MS:

- Follow your doctor's treatment plan: Adhering to your prescribed medications and treatments can help demonstrate that you are taking the necessary precautions to manage your MS.

- Maintain regular medical appointments: Regular check-ups with your doctor are important. Insurance companies look for a history of regular physician visits to ensure that your MS is under control.

- Keep your medical records updated: Up-to-date medical records that show your level of control over the disease are crucial for a favourable underwriting assessment.

- Manage other health conditions: Ensure that any other health issues, such as high blood pressure, are also being treated and well-managed.

- Be honest on your application: Dishonesty on your application can lead to denial of coverage and future complications.

Understanding the term life insurance underwriting process for MS patients:

The underwriting process for term life insurance with MS involves assigning a health classification that determines your premiums. The classifications are generally based on the severity and control of your MS, as well as your overall health. The classifications, from most to least favourable, are:

- Preferred Plus: Assigned to individuals with no or well-controlled minor health conditions and no family history of serious illnesses.

- Preferred: For those with one or two well-controlled minor conditions and no family history of serious illnesses.

- Standard Plus: For individuals with well-controlled mild-to-moderate conditions and a limited family history of serious illnesses.

- Standard: For people with well-controlled moderate health conditions and a more significant family history of serious illnesses.

- Table Ratings: Assigned to applicants with more serious health conditions, including MS, and further divided into sub-ratings.

- Tobacco/Smoker ratings: Applied to individuals who use tobacco, nicotine, or marijuana products and usually result in higher premiums.

Examples of term life insurance rates for individuals with MS:

The cost of term life insurance for individuals with MS can vary depending on their specific circumstances. Here are a few examples:

- A 40-year-old non-smoking female with mild MS may pay approximately $56 per month for a 20-year term life insurance policy with a $500,000 payout.

- A 50-year-old non-smoking female with relapsing-remitting MS (RRMS) may pay around $222 per month for a similar policy.

- A 55-year-old non-smoking female with mild primary-progressive MS and regular doctor visits was approved for a Standard rating class and pays $365 annually.

- A 51-year-old non-smoking female with moderate primary-progressive MS and good follow-up results was approved at a Standard Table B rating, resulting in a $622 annual premium.

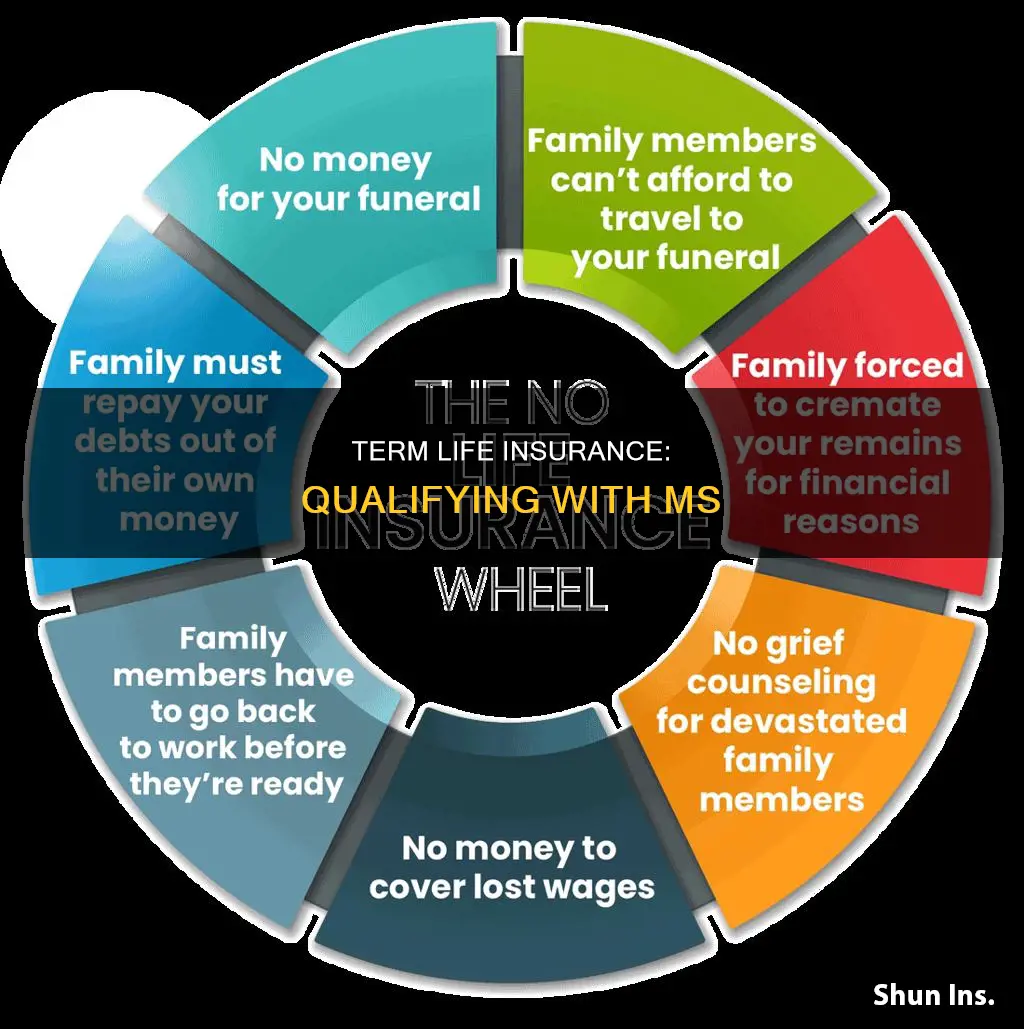

Alternative options if denied term life insurance due to MS:

If you are denied traditional term life insurance due to your MS, there are alternative options available:

- Guaranteed issue life insurance: This type of insurance is aimed at covering end-of-life costs and offers almost certain approval without medical questions. However, coverage amounts are typically lower, and premiums are higher.

- Group life insurance: This type of insurance is offered through your employer or a trade organization and usually does not require medical requirements. However, coverage may be limited, and you may lose the policy if you switch jobs.

In conclusion, while having MS may impact your eligibility and premiums for term life insurance, it is still possible to qualify by managing your health, comparing rates from different companies, and understanding the underwriting process. Maintaining a healthy lifestyle and following your doctor's recommendations can improve your chances of obtaining favourable coverage.

Green Card Life Insurance: What's the Deal?

You may want to see also

Factors that affect term life insurance premiums

When applying for term life insurance, insurers will assess your insurance risk based on several factors, including your age, gender, lifestyle habits, and overall health profile. These factors will then be used to assign you a health classification, which will determine your premiums. Here are some of the key factors that can influence the cost of your term life insurance premiums:

- Age: The younger you are, the lower your premiums will be. Age is the most important factor in determining your premium cost, as younger individuals have longer life expectancies and are less likely to become ill.

- Gender: Women generally live longer than men, resulting in lower insurance rates for women.

- Health: The insurance company will consider your current health status, including any pre-existing conditions such as high blood pressure, hypertension, or mental health issues. They may also look at your family medical history.

- Smoking Status: Smokers are considered high-risk and are charged higher premiums due to the increased likelihood of health problems.

- Lifestyle and Occupation: High-risk hobbies or occupations can increase your premiums as they pose additional risks to the insurer. Examples include motorsports, skydiving, and working in an industry with occupational hazards.

- Driving Record: A history of DUIs, reckless driving, or license suspensions may lead to higher rates.

- Coverage Amount and Length: The higher the coverage amount and the longer the policy term, the higher the premium, as the insurer takes on more risk.

When it comes to term life insurance for individuals with Multiple Sclerosis (MS), there are a few additional considerations:

- The type and stage of MS will play a significant role in determining eligibility and premium costs.

- The time since diagnosis, response to treatment, and impact on daily living activities will be evaluated.

- MS patients may fall under different health classifications, such as Standard or Table Ratings, which will influence their premium rates.

- Improvements in MS treatments and better medications can help MS patients maintain better control over their condition, potentially resulting in more favourable insurance rates.

Midland Life Insurance: Accelerated Benefits and Their Availability

You may want to see also

How to get the best rates

If you have multiple sclerosis, you can still get term life insurance, but you will likely pay higher rates. Here are some tips to help you get the best rates:

Understand the Landscape

The landscape for life insurance for MS patients is changing. Getting affordable term rates is challenging but not impossible. The first step is to shop around for quotes. Providing your insurance company with comprehensive information about your diagnosis and treatment program will help them determine your options. Improvements in MS treatments are constantly enhancing patients' quality of life, and insurance companies are paying attention to how their competitors are serving customers with MS and other chronic diseases.

Take Care of Your Health

Following your doctor's recommendations and gaining control of all medical conditions may help you obtain life insurance. Make sure to take your medications and visit your doctor when needed. Maintaining a healthy lifestyle, such as dieting and exercising, can also help lower your premiums.

Choose the Right Insurance Company

Different insurance companies view MS differently, so it's important to shop around and compare rates. Some companies, such as Prudential, Transamerica, Lincoln Financial, Mutual of Omaha, and Banner Life, tend to view MS more favorably and offer competitive rates. It's also worth considering both large and small insurance providers. Larger companies with more customers can often provide better rates, but smaller, localized insurers may be more willing to offer competitive rates to MS patients.

Work with an Independent Broker or Agent

Connect with an independent broker or agent who has expertise in MS life insurance. They can guide you to the companies that will view your MS most favorably and help you navigate the application process. They can also help you improve your rating class by advising you on how to better control your condition and improve lab results.

Be Prepared for the Application Process

Before applying for term life insurance, make sure you understand what information the insurance company will be looking for. They will want to know when you were diagnosed, your specific diagnosis, your response to treatment, and any steps you've taken since your diagnosis. They will also consider your overall health, including any other medical conditions, as well as high-risk habits such as smoking. Being prepared and honest on your application will improve your chances of getting the best rates.

Back Problems: Impacting Life Insurance Premiums?

You may want to see also

The impact of MS on your life insurance policy

Multiple sclerosis (MS) is a life-altering diagnosis that affects the central nervous system and disrupts the flow of information within the brain and between the brain and the body. While it is possible to obtain life insurance with MS, the condition is considered a pre-existing one by insurers, which increases your insurance risk and may impact your policy in several ways.

Underwriting and Premiums

Life insurance companies will assess your insurance risk by evaluating factors such as your age, gender, lifestyle habits, and overall health profile, as well as MS-specific criteria. This will determine your health classification, which in turn influences your premiums. The younger you are at diagnosis and the longer it has been since diagnosis, the better, as this provides more data points for insurers to assess. If you have mild or moderate MS, were diagnosed under the age of 40, and are a non-smoker, you are more likely to be offered a Standard rate. However, if you have a more severe form of MS, were recently diagnosed, or have other high-risk factors, you may be assigned a Substandard or Table rating, resulting in higher premiums.

Medical Exams and Information Disclosure

To apply for life insurance with MS, you will need to undergo a medical exam and disclose comprehensive information about your diagnosis, treatment program, response to treatment, current medications, and ability to perform activities of daily living (ADLs). Insurers will request additional information from your treating physician(s) to confirm your health status and prognosis. It is crucial to be honest and transparent during this process, as lying on your application could result in denial of coverage and future application challenges.

Policy Options and Coverage

The type of MS you have, the progression of your condition, your age, and other factors will determine your eligibility for traditional coverage options such as term life or whole life insurance. If you have a severe form of MS or were recently diagnosed, you may be declined for traditional coverage but could explore alternative options like guaranteed issue life insurance or group life insurance. These policies often have lower coverage amounts and are aimed at covering end-of-life costs.

Available Insurance Providers

While some insurance companies may be more MS-friendly than others, it is recommended to shop around and compare quotes from multiple providers. Both large and small insurance companies should be considered, as smaller, localized insurers may offer competitive rates for MS patients. Working with an independent insurance agent or broker who specializes in impaired risk can be beneficial in finding the right coverage for your circumstances.

Life Insurance: Optional Worth or Wasteful Expense?

You may want to see also

What to do if you're denied coverage

If you're denied term life insurance coverage, there are several steps you can take to understand and address the situation. Here's a detailed guide on what to do if you're denied coverage:

- Review the reasons for denial: Contact the insurance company to understand why your application was denied. This could be due to various factors, such as medical conditions, high-risk occupations or hobbies, lifestyle choices, financial considerations, or age. Understanding the specific reasons will help you address them effectively.

- Appeal the decision: If you believe the denial was based on incorrect or insufficient information, you have the right to appeal. Provide updated medical records or any other relevant documentation to support your case. You can also consult a financial advisor or insurance professional for personalized advice.

- Try a different insurance provider: Each insurance company has its own underwriting standards and criteria. Just because one insurer rejected your application doesn't mean others will. Consider working with an independent insurance broker or agent who can help you navigate the market and find a suitable provider.

- Explore alternative insurance options: Look into alternative life insurance policies such as guaranteed acceptance life insurance, simplified issue life insurance, or employer-sponsored life insurance. These options may offer less coverage or have higher premiums, but they can still provide financial protection.

- Reapply later: If your denial was due to health or lifestyle issues, consider making positive changes to improve your chances of approval in the future. This could include managing health conditions, quitting smoking, improving your financial situation, or giving up risky hobbies. Waiting and reapplying after a period of positive lifestyle changes can increase your chances of securing coverage.

Remember, being denied coverage by one insurance company doesn't mean you are uninsurable. Stay persistent, explore different options, and don't hesitate to seek expert advice to find the right coverage for your needs.

Obtaining a Non-Resident Life Insurance License: A Comprehensive Guide

You may want to see also

Frequently asked questions

Yes, it is possible to get term life insurance if you have MS. However, you may face higher rates and be required to undergo a medical examination.

Life insurance companies typically assess the following factors when evaluating applicants with MS:

- Age

- Gender

- Lifestyle habits

- Overall health profile

- Smoking status

- Treatment program

- Response to treatment

- Progression of the disease

- Medical history

- Frequency of symptoms

The chances of approval depend on the severity and progression of your MS. If you have a mild form of MS and were diagnosed early, you may qualify for a preferred rating class with lower premiums. However, if you have a more severe form of MS or were recently diagnosed, your application may be declined or approved at a higher rating class with higher premiums.

To improve your chances of getting approved for term life insurance with MS, it is recommended to follow your doctor's advice, maintain regular medical appointments, manage your stress levels, and keep your medical records updated. It is also beneficial to control any other medical conditions you may have and be honest on your application.