Insurance is a vital financial tool that provides protection and peace of mind for individuals and businesses. It is a contract between the policyholder and the insurance company, where the latter agrees to compensate the former for specified losses in exchange for a premium. Understanding the basics of insurance is essential for anyone looking to safeguard their assets, manage risks, and ensure financial security. This introduction will explore the key aspects of insurance, including its types, coverage options, claims process, and the importance of choosing the right insurance provider.

What You'll Learn

- Types of Insurance: Understand health, life, auto, home, and more

- Coverage and Benefits: Know what's covered and what's not

- Claims Process: Learn how to file a claim and what to expect

- Policy Terms: Familiarize yourself with policy language and conditions

- Cost and Premiums: Explore factors affecting insurance costs and how to manage them

Types of Insurance: Understand health, life, auto, home, and more

Insurance is a vital tool for managing risks and providing financial protection in various aspects of life. Understanding the different types of insurance available is essential to ensure you have adequate coverage for your needs. Here's an overview of some common types of insurance:

Health Insurance: This type of insurance is designed to cover medical expenses and healthcare costs. It provides financial protection against unexpected illnesses, injuries, and medical treatments. Health insurance plans typically include coverage for doctor visits, hospital stays, prescription drugs, and preventive care. With various options available, such as employer-sponsored plans, government-funded programs, and private insurance, individuals can choose a plan that suits their budget and medical requirements. Understanding the coverage, deductibles, and co-pays is crucial to ensure you receive the necessary care without incurring significant out-of-pocket expenses.

Life Insurance: A critical aspect of financial planning, life insurance provides financial security for your loved ones in the event of your passing. It offers a payout or death benefit to designated beneficiaries, helping them cover expenses like mortgage payments, education costs, or daily living expenses. Term life insurance offers coverage for a specified period, while permanent life insurance provides lifelong coverage. Understanding the different types, such as whole life and universal life, is essential to choose the right policy. Additionally, considering factors like term length and coverage amount will ensure your family's financial well-being.

Auto Insurance: Mandatory in most places, auto insurance provides coverage for damages and injuries resulting from car accidents. It typically includes liability coverage, which protects you against claims from other drivers for bodily injury or property damage. Comprehensive and collision coverage are optional but can protect your vehicle from non-collision incidents like theft, fire, or natural disasters. Understanding the different coverage options, deductibles, and policy limits is crucial to ensure you have the right protection for your vehicle and financial situation.

Homeowners or Renters Insurance: This type of insurance protects your home and belongings from various risks, including fire, theft, vandalism, and natural disasters. Homeowners insurance provides coverage for the physical structure of the house and its contents, offering financial protection against potential losses. Renters insurance, on the other hand, covers your personal belongings and provides liability protection. Understanding the policy's coverage limits, deductibles, and exclusions is essential to ensure you are adequately protected. Additionally, considering additional coverage for valuable items or natural disasters specific to your region can provide comprehensive protection.

Other types of insurance include disability insurance, which replaces income if you become unable to work due to illness or injury, and umbrella insurance, which provides additional liability coverage beyond your existing policies. Understanding your specific needs and risks will help you navigate the insurance landscape and make informed decisions to protect yourself, your loved ones, and your assets.

A Guide to Navigating Insurance Repository Changes: Strategies for a Smooth Transition

You may want to see also

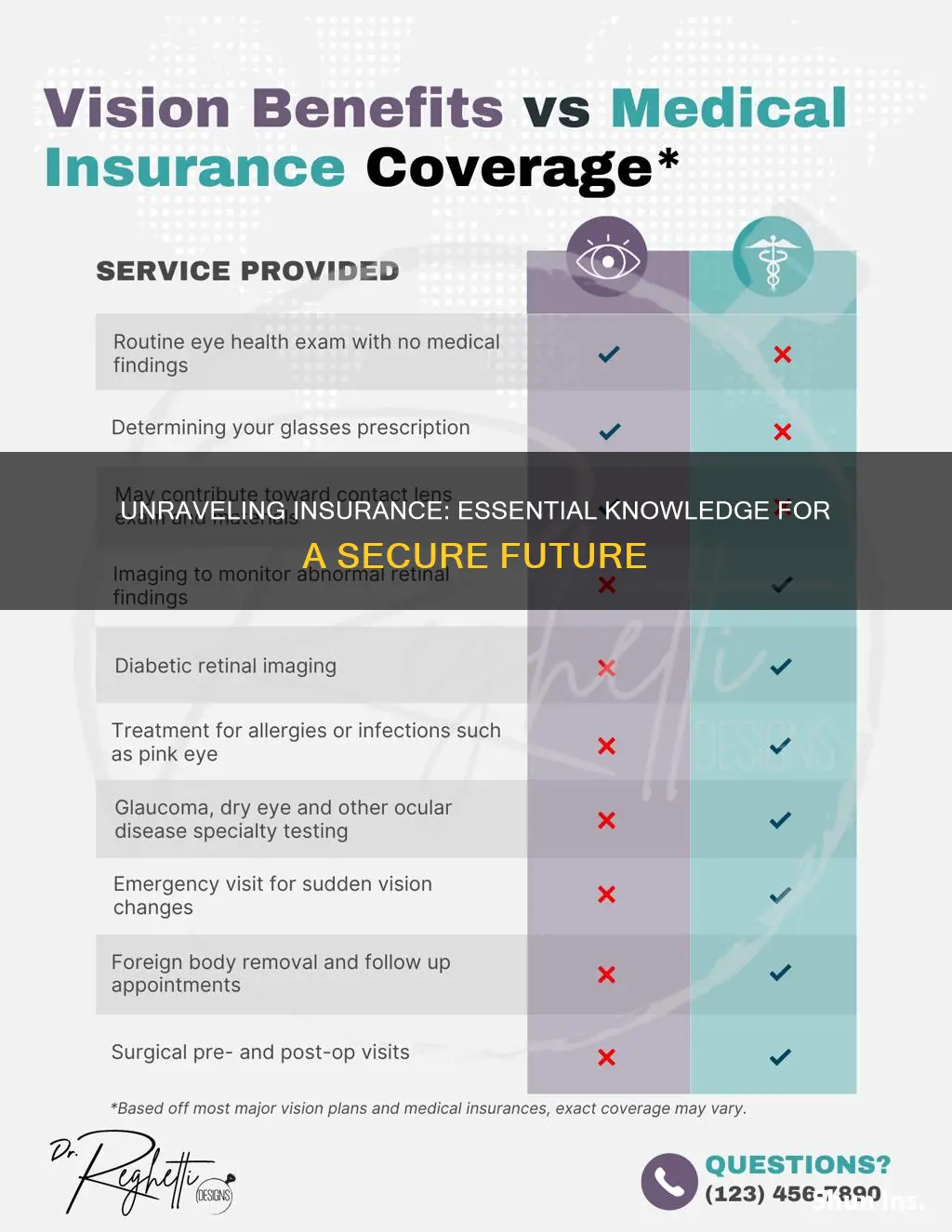

Coverage and Benefits: Know what's covered and what's not

When it comes to insurance, understanding the coverage and benefits is crucial to ensure you have the right protection for your needs. Insurance policies can vary widely, and it's essential to know what is covered and what is not to avoid any surprises when you need to make a claim. Here are some key points to consider:

Review the Policy Document: Start by thoroughly reading and understanding your insurance policy. This document outlines the terms, conditions, and coverage details. Pay close attention to the sections that describe the scope of coverage, exclusions, and any specific conditions or limitations. It is your responsibility to familiarize yourself with the policy to ensure you are aware of what is included and what is not.

Identify Covered Risks: Different types of insurance cover various risks and perils. For example, health insurance typically covers medical expenses, accidents, and illnesses, while property insurance protects your home or belongings from damage or loss. Understand the primary purpose of your insurance and identify the risks it is designed to mitigate. This knowledge will help you assess whether your policy adequately addresses your specific needs.

Exclusions and Limitations: Insurance policies often have exclusions, which are specific events or circumstances that are not covered. These can include acts of war, natural disasters, intentional self-harm, or pre-existing conditions. It is essential to be aware of these exclusions as they may impact your ability to make a claim. Additionally, look out for any limitations on coverage, such as maximum payout amounts or time restrictions for filing claims.

Additional Benefits and Add-ons: Insurance companies often offer optional add-ons or riders that provide extended coverage. These can include accident insurance, critical illness coverage, or rental reimbursement. While these benefits can enhance your protection, they may also come with additional costs. Evaluate whether these add-ons align with your requirements and consider the potential value they bring to your policy.

Understand Claim Process: Familiarize yourself with the process of making a claim. This includes knowing the necessary documentation, the time frame for filing a claim, and any specific requirements your insurance provider may have. Being prepared will help ensure a smoother experience when you need to make a claim and can prevent potential delays or issues.

By carefully reviewing the coverage and benefits, you can make informed decisions about your insurance choices and ensure that you have the appropriate protection in place. Remember, insurance is a valuable tool to manage risks, but it requires a clear understanding of the policy to maximize its benefits.

Streamline Your Sprint Insurance: A Guide to Replacing Your Phone

You may want to see also

Claims Process: Learn how to file a claim and what to expect

When it comes to insurance, understanding the claims process is crucial. Filing a claim is an important step to ensure you receive the coverage you're entitled to, but it can also be a complex and potentially stressful experience. Here's a guide to help you navigate the process and know what to expect.

The first step is to report the incident or loss to your insurance company as soon as possible. This is typically done by contacting your insurance provider directly, either via phone or through their online portal. Provide them with all the relevant details, including the date, time, and location of the incident, a description of the loss, and any supporting documentation. For example, if you have a car insurance claim, you would need to inform your insurer about the accident, providing details like the other party's information, police report (if applicable), and any photographs of the damage. Quick reporting ensures that the insurance company can initiate the claims process promptly.

Once the claim is reported, an adjuster will be assigned to your case. This adjuster's role is to investigate the claim, assess the damage, and determine the appropriate compensation. They will contact you to gather more information and may ask for additional documentation or evidence. It's important to cooperate fully with the adjuster and provide any requested information promptly. They might also conduct an inspection or appraisal of the damaged property to assess its value and determine the settlement amount.

During the claims process, you can expect regular updates and communication from your insurance company. They will keep you informed about the progress of the claim and may provide a timeline for resolution. If the claim is approved, the insurance company will issue a payment according to the terms of your policy. This could be in the form of a lump sum or installments, depending on the type of coverage and the agreement. It's essential to review the settlement offer and ensure that it aligns with your expectations and the extent of your losses.

If you disagree with the insurance company's decision or feel that your claim has been undervalued, you have the right to appeal the decision. This process typically involves submitting a written appeal, providing additional evidence or arguments, and potentially attending a hearing. It's advisable to seek legal advice or consult with a claims advocate to guide you through this process and increase your chances of a successful outcome.

Remember, the claims process can vary depending on the type of insurance and the specific circumstances of your claim. Always refer to your policy documents and communicate openly with your insurance provider to ensure a smooth and efficient resolution. Understanding your rights and responsibilities as a policyholder is key to navigating the insurance claims process effectively.

Obese Patients: Higher Insurance Charges?

You may want to see also

Policy Terms: Familiarize yourself with policy language and conditions

When it comes to insurance, understanding the policy terms and conditions is crucial. Insurance policies can be complex and filled with legal jargon, making it essential for policyholders to thoroughly review and comprehend the details. Here are some key points to help you navigate through the policy language:

Read the Entire Policy: Start by reading the entire policy document from cover to cover. Insurance policies often contain numerous pages, and every section is important. Pay close attention to the definitions, exclusions, and limitations mentioned in the policy. These sections outline what is covered and what is not, and they can significantly impact your claims.

Identify Key Coverage Details: Familiarize yourself with the specific coverage provided by the policy. Understand the types of risks and events that are insured against. For example, in health insurance, know the coverage for medical treatments, hospitalization, and any specific conditions or limitations. In property insurance, identify the coverage for structural damage, personal belongings, and potential natural disasters.

Understand Policy Exclusions: Exclusions are critical as they specify what is not covered by the insurance. These can include pre-existing conditions, certain types of accidents, or specific activities deemed high-risk. Knowing the exclusions ensures you are aware of any potential gaps in coverage and can help you make informed decisions regarding additional coverage or alternative insurance options.

Review Policy Limits and Subscriptions: Insurance policies often have limits on the amount the insurer will pay for a covered loss. These limits can vary for different types of coverage. Additionally, some policies may have subscription fees or premiums that are paid annually or monthly. Understanding these financial aspects is essential for budgeting and ensuring you have adequate coverage.

Ask Questions and Seek Clarification: If you come across unfamiliar terms or concepts, don't hesitate to ask questions. Contact your insurance provider or broker to clarify any doubts. They can explain complex policy language in simpler terms and provide guidance on what to expect in various scenarios. Being proactive in seeking clarification ensures you have a comprehensive understanding of your policy.

By taking the time to thoroughly review and understand the policy terms, you can make informed decisions, manage your expectations, and ensure that you are adequately protected. Remember, insurance is a valuable tool for managing risks, and a clear understanding of the policy language empowers you to make the most of this financial protection.

Plumbers: Insured or Bust

You may want to see also

Cost and Premiums: Explore factors affecting insurance costs and how to manage them

Insurance costs can vary significantly depending on several factors, and understanding these influences is crucial for managing your premiums effectively. One of the primary determinants of insurance prices is the type of coverage you require. For instance, health insurance premiums are typically higher than life insurance rates due to the extensive medical services and treatments that may be needed. Similarly, comprehensive car insurance policies, which include collision, comprehensive, and liability coverage, will be more expensive than basic liability-only policies. The level of coverage you choose directly impacts the cost, as higher coverage limits and lower deductibles generally result in higher premiums.

Age and health status play a significant role in insurance pricing, especially in health and life insurance. Younger individuals often benefit from lower premiums as they are considered less risky. As you age, premiums tend to increase due to the higher likelihood of health issues and potential medical emergencies. Similarly, pre-existing health conditions or a history of illnesses can lead to higher health insurance premiums. Insurance providers assess the overall health and lifestyle of individuals to determine the risk and set appropriate prices.

Another critical factor is your location. Insurance costs can vary by region due to differences in the cost of living, crime rates, and the frequency of natural disasters. For instance, car insurance in urban areas with high traffic density and a higher accident rate may be more expensive than in rural areas. Similarly, regions prone to severe weather events or natural disasters like hurricanes or earthquakes may have higher insurance premiums to account for potential damage and loss.

Driving record and credit history are essential considerations for auto insurance. A clean driving record with no accidents or traffic violations can result in lower premiums, as you are considered a safe driver. Conversely, a history of accidents or traffic violations will likely lead to higher costs. Insurance companies also consider your credit score, as it reflects your financial responsibility. A good credit score may result in lower premiums, while a poor credit history could increase costs.

To manage insurance costs, several strategies can be employed. Firstly, consider increasing your deductibles, which is the amount you pay out of pocket before the insurance coverage kicks in. Higher deductibles can lower your premiums, but ensure you can afford the initial cost in case of a claim. Shopping around and comparing quotes from different insurance providers is essential, as prices can vary widely. Additionally, maintaining a good credit score and driving record can significantly reduce costs over time. Finally, review your policy regularly and adjust the coverage as your needs change to avoid paying for unnecessary coverage.

Grundy Insurance: Customer Reviews and Ratings

You may want to see also

Frequently asked questions

Insurance is a financial protection tool that safeguards individuals and businesses from potential losses. It involves a contract between the policyholder and the insurance company, where the latter agrees to compensate the former for specified risks in exchange for a premium.

Insurance operates by pooling money from multiple policyholders to cover potential losses. When an insured event occurs, the insurance company assesses the claim and provides financial assistance to the policyholder, reducing the financial burden of unexpected events.

There are numerous types of insurance, including health insurance, life insurance, auto insurance, home insurance, property insurance, liability insurance, and more. Each type caters to specific risks and provides coverage accordingly.

Insurance is crucial as it offers financial security and peace of mind. It helps individuals and businesses manage risks, recover from losses, and protect their assets. Without insurance, unexpected events could lead to significant financial strain.