Variable whole life insurance is a type of permanent life insurance that provides lifelong protection with death benefits, fixed premiums, and the ability to build up cash value. It is designed for those who want to actively manage their life insurance and are willing to take on investment risk. The policy includes a guaranteed minimum death benefit as long as premiums are paid, and the cash value can be invested in a variety of options, such as stocks, bonds, or a fixed account. The cash value earnings grow tax-deferred but are not guaranteed, and any dividends may be used to purchase additional insurance or increase the cash value. Variable whole life insurance is a complex product that may not be suitable for those who do not have a long-term need for life insurance or who are averse to risk.

| Characteristics | Values |

|---|---|

| Type of insurance | Permanent life insurance |

| Payout | Death benefit |

| Investment component | Yes |

| Investment options | Mutual funds, stocks, bonds |

| Tax advantages | Yes |

| Risk | High |

| Premium | Fixed |

| Coverage | Until death |

| Cash value | Yes |

| Cash value access | Yes |

| Cash value growth | Tax-deferred |

| Cash value tax | Taxed as income |

What You'll Learn

Variable life insurance is a permanent life insurance policy

Variable life insurance policies carry an investment component known as their cash value. This is a cash-value account with money that is invested, typically in mutual funds. The value of the cash account can rise or fall depending on market performance. This means that variable life insurance policies carry more risk than other life insurance policies. However, they also offer the potential for greater returns.

Variable life insurance policies are intended to meet certain insurance needs, investment goals, and tax planning objectives. The cash value of a variable life insurance policy can be invested, offering the potential for greater returns than other types of permanent life insurance. This makes variable life insurance appealing to investors who want to get more out of their life insurance than just a death benefit.

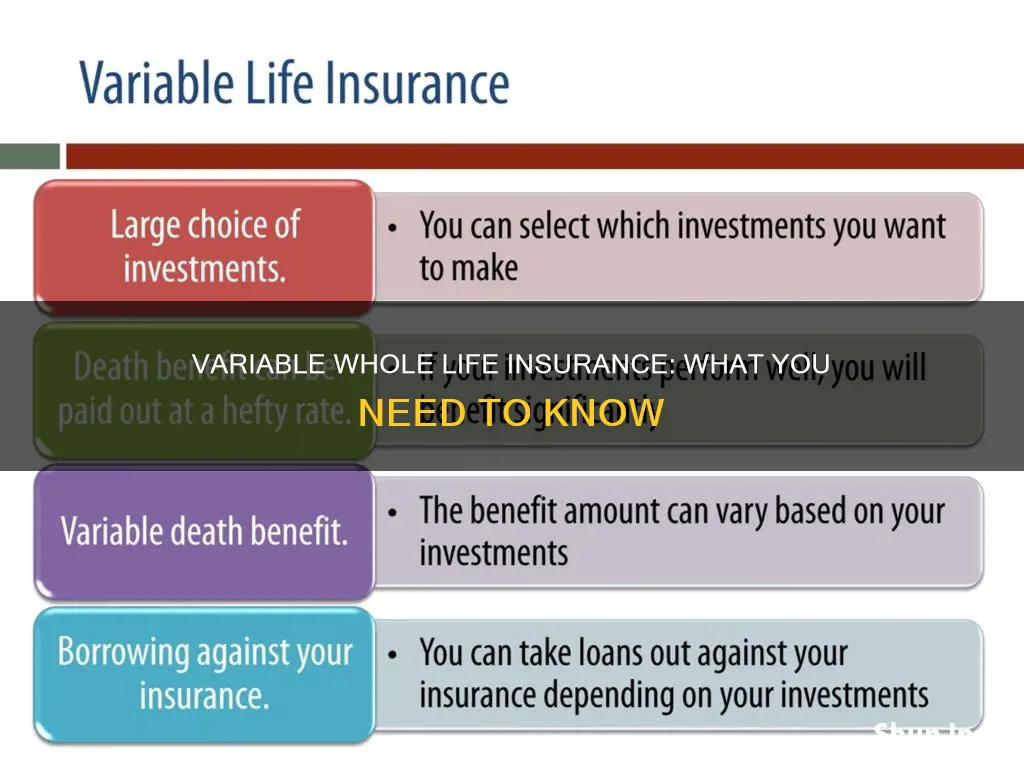

Variable life insurance policies are also flexible. They allow the policyholder to choose how to allocate the cash value across a series of investment vehicles or sub-accounts. Depending on the policy and insurer, the policyholder may be able to invest a portion of their cash value in a fixed-rate sub-account as well.

Variable life insurance policies are only suitable for individuals with specific life insurance protection needs. The fees, expenses, and tax implications associated with these policies generally make them unsuitable as a short-term savings vehicle.

Finding Your Life Insurance License: Quick and Easy Steps

You may want to see also

It has a fixed death benefit

Variable universal life insurance is a type of permanent life insurance policy that includes an investment component. This means that it combines life insurance with an investment account, typically invested in mutual funds. The cash value of the policy can be invested, and the returns on these investments are tax-free.

Variable life insurance policies have a fixed death benefit, which is the amount of money that is paid out to the policyholder's beneficiaries upon their death. This is different from other types of life insurance, such as whole life insurance, where the death benefit can be increased over time. With variable life insurance, the death benefit is set at the beginning of the policy and remains the same throughout the life of the policy.

The fixed death benefit provides several advantages. Firstly, it guarantees a specific amount of money will be paid out to beneficiaries, providing certainty and peace of mind. Secondly, it allows policyholders to plan their finances more effectively, as they know exactly how much money will be paid out and can make plans accordingly. Finally, a fixed death benefit can help to keep costs down, as policies with increasing death benefits typically have higher premiums.

However, it's important to note that while the death benefit itself is fixed, the total payout to beneficiaries may vary depending on the performance of the investments within the policy. Any returns on these investments will be added to the death benefit, potentially increasing the total amount paid out. On the other hand, if the investments perform poorly, the total payout may be lower than expected.

Guardian Life Insurance: Is It Worth Your Money?

You may want to see also

It has a cash value component

Variable whole life insurance (VWL) is a type of permanent life insurance that provides life-long protection with a death benefit, fixed premiums, and a cash value component. The policy remains in force for the entire life of the insured individual, provided that premiums are paid annually and the policy does not lapse or get cancelled.

The cash value component of VWL is a key feature that sets it apart from other types of life insurance. This component offers policyholders the opportunity to invest their premiums in a variety of investment options, such as stocks, bonds, or a fixed account. The performance of these investments will then determine the cash value of the policy, which can fluctuate over time. While this provides the potential for higher returns, it also comes with greater risk.

The cash value in a VWL policy can be accessed by the policyholder during their lifetime. It can be used for various purposes, such as paying for major expenses or supplementing retirement income. The cash value grows on a tax-deferred basis, meaning taxes are only owed upon withdrawal. Policyholders can also take out loans against the cash value, although this may reduce the final death benefit if not repaid.

It's important to note that the cash value of a VWL policy is not guaranteed and can decrease if the chosen investments perform poorly. Therefore, VWL is more suitable for individuals who are comfortable with taking on investment risk and actively managing their policy.

Warren Buffett's Whole Life Insurance Philosophy Explained

You may want to see also

It is a contract between the insurance company and the insured

Variable whole life insurance is a contract between the insurance company and the insured. It is a permanent life insurance policy, meaning it is designed to last for the insured person's lifetime. It combines insurance and investment elements, with the dual purpose of providing a death benefit to beneficiaries and building cash value for the insured over time.

The contract guarantees a minimum death benefit as long as the insured continues to pay the premiums. The premiums are typically fixed and invested in the insurance company's general account or a variety of other investment options. The cash value of the policy is tied to the performance of these investments and may include stocks, bonds, or mutual funds. This means that the cash value can fluctuate and is not guaranteed, introducing an element of risk to the policy.

The contract offers the insured the ability to select a payment schedule and the option to borrow against the cash value of the policy. However, loans or withdrawals will reduce the policy's cash value and may require additional premium payments to maintain the policy.

Variable whole life insurance is suitable for individuals who are comfortable with investment risk and want to actively manage their life insurance policy. It provides the potential for greater returns compared to traditional whole life insurance policies but carries a higher level of risk due to the variable nature of the cash value.

Gerber Life Insurance: Whole or Term?

You may want to see also

It is designed for those who can absorb potential losses

Variable life insurance is a permanent life insurance policy with a fixed death benefit: the amount paid to your beneficiaries when you die. It is designed for those who can absorb potential losses.

Variable life insurance is a complex product that requires buyers to tread carefully. It is designed for people who are willing to take on the additional risk of investing their cash value in the stock market. This means that if the market performs well, the cash value of the policy will increase, but if it performs poorly, the cash value will decrease. In the worst-case scenario, the policy could lose all its value, and the investment principal could be lost.

Variable life insurance is not suitable for those who are risk-averse or who are looking for a short-term savings vehicle. Instead, it is designed for those who are comfortable with risk and who are looking for a long-term investment strategy as part of their life insurance policy.

Those considering variable life insurance should carefully review the policy prospectus, understand the fees involved, and be prepared to actively manage their investments. It is also important to work with a financial advisor or life insurance agent who can help navigate the complexities of the policy.

Variable life insurance offers the potential for higher returns than other types of permanent life insurance, but it also comes with greater risk. It is important to understand the risks and potential losses before purchasing this type of policy.

Colonial Life: Health Insurance Options and Benefits

You may want to see also

Frequently asked questions

Variable whole life insurance is a type of permanent life insurance that provides lifelong protection with death benefits, fixed premiums, and the potential for cash value growth. The policy remains in force for the entire life of the insured, provided that premiums are paid and the policy does not lapse or is not cancelled.

Variable whole life insurance typically includes a guaranteed minimum death benefit, fixed premiums, and the ability to build up cash value over time. The cash value can be invested in a variety of options, such as stocks, bonds, or a fixed account, each with different levels of risk and potential rewards.

Variable whole life insurance offers more flexibility and growth potential than traditional whole life insurance. It is similar to variable universal life insurance (VUL), but VUL offers adjustable premiums and a flexible death benefit, whereas variable whole life insurance has fixed premiums.

Variable whole life insurance provides permanent coverage, the ability to build cash value, and the potential for higher returns compared to other types of permanent life insurance. It also offers tax advantages, as the cash value grows tax-deferred, and withdrawals are not taxed as ordinary income.

Variable whole life insurance carries more risk than traditional whole life insurance due to its investment component. The cash value can fluctuate based on the performance of the chosen investments, and there is a chance of losing money if the investments perform poorly. Additionally, policy loans or withdrawals can reduce the cash value and death benefit, and high fees can impact the overall growth of the policy.