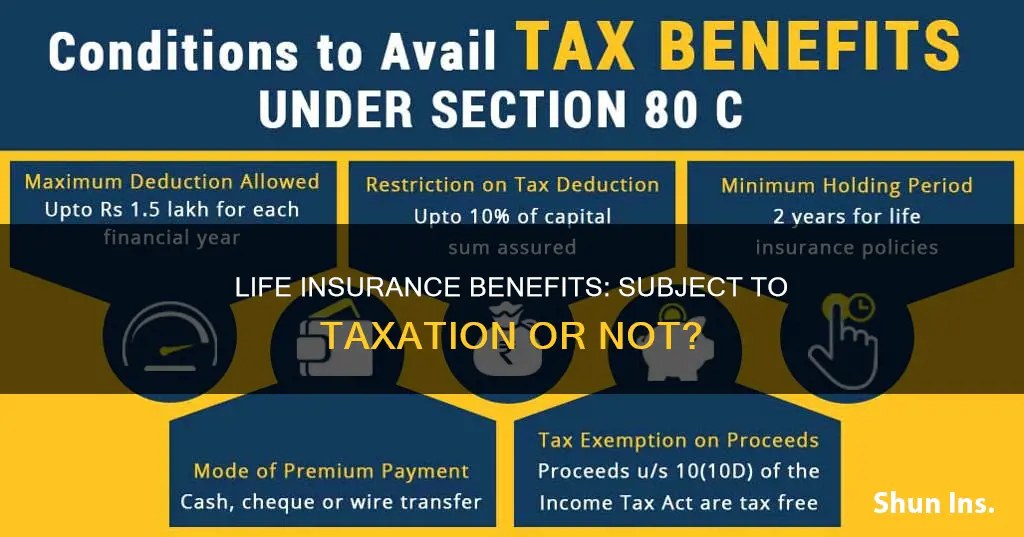

Life insurance is a financial safety net that ensures your family is taken care of in the unfortunate event of your passing. While the proceeds from a life insurance policy are generally not taxable, there are certain scenarios where taxes may apply. This paragraph aims to introduce the topic of whether life insurance benefits are subject to taxation and explore the various factors that can trigger tax liabilities for beneficiaries. By understanding these exceptions, individuals can make informed decisions and take appropriate steps to minimise potential tax burdens for their loved ones.

| Characteristics | Values |

|---|---|

| Tax on benefits | Generally, life insurance benefits are not taxable. However, any interest received is taxable. |

| Payouts | Payouts are made as a lump sum. |

| Coverage | Coverage includes final expenses, living expenses, chronic and terminal illnesses, and retirement savings. |

| Riders | Riders can be added to a policy for an additional cost. These include the accelerated death benefit rider, the long-term care rider, and the waiver of premium rider. |

| Cash value | Whole, universal, and variable life insurance policies accumulate cash value. |

What You'll Learn

Life insurance payouts are tax-free

Life insurance payouts are generally not considered income for tax purposes. This means that beneficiaries of a life insurance policy do not have to pay taxes on the lump sum death benefit they receive. However, if beneficiaries choose an instalment payout option, they may receive interest on the payout, which is taxable and must be reported.

Life insurance death benefits are tax-free because they are not considered income. When the insured person dies, the policy's named beneficiaries will receive the death benefit, which is typically paid out as a lump sum. This money can be used to cover final expenses, such as funeral costs, and to replace lost income for dependents.

The tax-free status of life insurance payouts is one of the main benefits of adding life insurance to your financial plan. It ensures that beneficiaries receive the full amount of the death benefit and can use it as needed without having to worry about paying taxes on it.

In some cases, life insurance benefits may be subject to estate taxes, but this can be avoided by purchasing permanent life insurance within a trust. This is a strategy used by wealthy individuals to preserve the value of their estate for their heirs.

It is important to note that while life insurance payouts are generally tax-free, there may be other tax implications associated with life insurance policies, such as taxes on any interest earned on the payout or on cash value accumulation within the policy. Additionally, if the policy has any outstanding loans or withdrawals, they may be subject to ordinary income taxes.

Haven Life Insurance: A Symbol of Trust and Protection

You may want to see also

Dependents will have money for living expenses

Life insurance is often taken out to provide peace of mind that loved ones will have financial support in the event of the policyholder's death. While no one wants to think about losing a spouse or child, it's important to consider the financial implications of such a loss.

Dependent life insurance is a type of voluntary or supplemental insurance that pays a death benefit or the policy's proceeds if a covered spouse, child, or another dependent dies. This type of insurance can be particularly useful for non-income-earning spouses or children, as it can help cover funeral expenses and other costs associated with the loss of a loved one.

Funeral and Burial Costs:

The average funeral can cost around $10,000, which can be a significant financial burden for a family. Dependent life insurance policies typically cover funeral and burial expenses, ensuring that dependents won't have to bear this cost directly.

End-of-Life Expenses:

In addition to funeral costs, there may be other end-of-life expenses that need to be covered, such as medical bills or outstanding debts. Dependent life insurance benefits can help pay for these expenses, providing financial relief during a difficult time.

Income Replacement:

For non-income-earning spouses, dependent life insurance can provide a source of income replacement. This can be especially important if the spouse contributes to the household in non-financial ways, such as childcare, home upkeep, or cooking. The death benefit can help cover the cost of replacing these services.

Education Costs:

If the deceased dependent was a child, the death benefit can help cover the cost of education for the surviving siblings or the parents' retirement planning.

Continued Support for Disabled Dependents:

In some cases, dependent life insurance can provide continued financial support for disabled dependents. This can include coverage for children with disabilities who were dependent on the policyholder for support.

It's important to note that the specifics of dependent life insurance coverage can vary by employer and insurance provider, so it's always a good idea to review the details of any policy before purchasing it. Additionally, while life insurance proceeds are typically not taxable, there may be certain situations where taxes could come into play, such as if the benefit is paid out in installments or if the policy is owned by a third party.

Overall, dependent life insurance can provide valuable financial support for dependents, helping to ensure that they have money for living expenses and can maintain their standard of living in the event of the policyholder's death.

Kansas Employers: Life Insurance Requirements and Employee Rights

You may want to see also

Coverage for chronic and terminal illnesses

Chronic and terminal illnesses can be devastating, and while they are both serious health conditions, there are important distinctions between the two. Chronic illnesses are defined by the CDC as conditions that last one year or longer and require ongoing medical attention, limit activities of daily living, or both. On the other hand, a terminal illness is defined as a condition from which the patient is not expected to recover and will likely result in death within 12 months.

Life Insurance for Chronic Illnesses

Having a chronic illness does not automatically disqualify you from getting life insurance. In fact, according to the CDC, six out of ten adults in the US live with at least one chronic illness. When applying for life insurance with a chronic illness, insurers will take a holistic look at your health, the specific chronic condition, and your treatment plan. The cost of your policy will depend on the type of chronic condition you have, its severity, the kind of treatment you are following, as well as other risk factors like your age, gender, overall health profile, habits, and hobbies.

There are several types of life insurance available for individuals with chronic illnesses, including term life insurance, permanent life insurance, final expense life insurance, guaranteed issue life insurance, and group life insurance. The best option for most people is term life insurance as it is affordable and comes with few tax restrictions or limitations. However, the right type of life insurance will depend on your budget and coverage needs.

Life Insurance for Terminal Illnesses

A terminal illness diagnosis does not prevent you from buying life insurance, but your options are limited. The only type of life insurance you can buy if you have been diagnosed with a terminal illness is guaranteed issue life insurance, which is a simple and straightforward policy. Guaranteed issue life insurance policies are modest in size, with most capping at $25,000, and they do not require a medical exam or health questions. Additionally, you can expect to have your policy issued in a matter of minutes as the application process is simple.

Terminal illness benefits are included as a feature of some life insurance policies or offered as an optional extra for an additional fee. This benefit pays out the 'sum insured' when a policyholder is diagnosed with a terminal illness, allowing them to make plans and take care of their dependents before their death. It is important to note that the criteria for what constitutes a terminal illness vary among insurers, and there may be limitations on when a claim can be made.

Login Credentials for SBI Life Insurance: A Step-by-Step Guide

You may want to see also

Policies can supplement retirement savings

Life insurance policies can be used to supplement retirement savings. Permanent life insurance policies such as whole, universal, and variable life insurance can offer cash value in addition to death benefits, which can augment other savings in retirement. The cash value of permanent life insurance serves as a savings account that the policyholder can use during their lifetime, and this cash accumulates on a tax-deferred basis.

The cash value of whole life insurance grows tax-deferred, meaning there are no income taxes accrued on the cash value (or its growth) until it is withdrawn. The cash value can be used to cover expenses, such as buying a car or making a down payment on a home. It can also be tapped into during retirement. If the policyholder decides to borrow against their cash value, the loan is not subject to income tax as long as the policy is not surrendered. However, the insurance company will charge interest on the loan amount until it is paid back.

Life insurance retirement plans (LIRPs) are another way life insurance can be used for retirement. LIRPs are paid through premiums from the policyholder to the insurance company. A portion of the premiums is placed into a cash-value account that is invested and grows over time. This cash-value account is then withdrawn as income in retirement years.

While life insurance can be a useful supplement to retirement savings, it should not replace traditional retirement accounts like a 401(k) or an IRA. Cash-value life insurance is considerably more expensive than term life insurance, which has no savings component. For most people, the best way to incorporate life insurance into retirement planning is to buy a simple term life policy and invest any other disposable income in tax-advantaged retirement accounts.

Mass Mutual: Life Insurance Availability in Canada

You may want to see also

Life insurance can cover final expenses

Life insurance is a contract between an insurance company and a policy owner, where the insurer guarantees to pay a sum of money to the beneficiaries when the insured person dies. Final expense insurance is a type of whole life insurance policy that pays medical bills and funeral expenses when the insured person dies. It is also known as burial or funeral insurance.

Final expense insurance is a popular choice among seniors due to its affordable price, smaller benefit amounts, and focus on covering funeral costs. The median cost of a funeral is around $8,000, and final expense insurance can help beneficiaries avoid a financial crisis when a family member passes away. This type of insurance offers competitive, fixed premiums that do not change over time, and the cash benefit can be used to cover funeral and burial costs, medical needs, or anything else that will help loved ones.

Final expense insurance typically does not require a physical exam, making it easier to obtain coverage. Instead, individuals answer a few health questions to apply for coverage. The final expense insurance coverage remains in place as long as the premiums are paid, and these policies also build cash value, which can be used to borrow against or as a non-forfeiture benefit.

Overall, final expense insurance can provide peace of mind and financial protection for individuals and their loved ones, ensuring that final expenses are covered without placing a burden on family members.

Term Life Insurance: Outliving and Navigating the Next Steps

You may want to see also