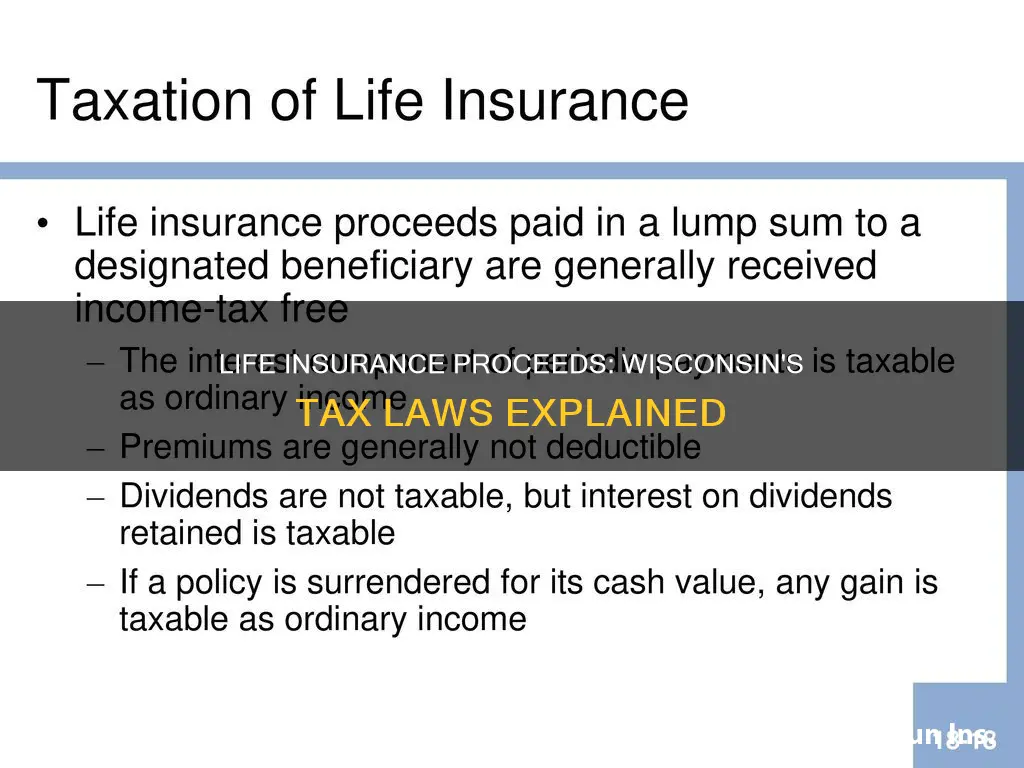

Life insurance proceeds are generally not taxable in Wisconsin. However, there are certain scenarios where taxes may apply. For instance, if the insured individual attains a specific age, such as 95 or 100, and the policy matures, the payout may be taxed as ordinary income if it exceeds the policy owner's cost basis. Additionally, if the beneficiary receives the life insurance payment in installments, they may have to pay income tax on the interest. On the other hand, if you leave life insurance directly to a beneficiary or set it up through a trust, the proceeds are typically excluded from their gross income and are not taxed. Understanding the tax implications of life insurance is crucial for effective estate planning, and consulting with legal and tax professionals is always recommended for specific guidance.

What You'll Learn

Life insurance proceeds are not taxable in Wisconsin

Life insurance proceeds are generally not taxable in Wisconsin. This means that if you leave life insurance directly to a beneficiary, there is no tax on that amount because it is considered a gift from the deceased. Similarly, if you set it up to leave it to a beneficiary through a trust, such as for minor children or people with special needs, the trust can distribute the proceeds to the beneficiaries without income tax. This is because the proceeds are considered a gift and are not generating income each year.

However, if the trust generates income each year, it may have to pay tax on that income. Additionally, if the beneficiary receives the life insurance payment as a series of installments, the insurer will typically pay interest on the outstanding death benefit. In these cases, the beneficiary would have to pay income tax on the interest.

It is worth noting that life insurance proceeds can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions. Federal estate taxes apply when the value of your estate exceeds $12.06 million per individual, with a tax rate of up to 40%. State estate and inheritance taxes vary by state, with exemption amounts ranging from $1 million to $7 million and tax rates as high as 20%.

To avoid life insurance payouts being taxed as part of your estate, you can set up an irrevocable life insurance trust (ILIT). By transferring ownership of the policy to the ILIT, you can ensure that the death benefit is not taxable as part of your estate. However, there may be some tax implications when setting up the trust, such as gift taxes if the policy's cash value exceeds the gift tax exemption. Additionally, if you pass away within three years of transferring the policy to the trust, it may become part of your estate for tax purposes.

Suicid and Life Insurance: What's the Verdict?

You may want to see also

Proceeds are not taxable at the federal level

Life insurance proceeds are typically not taxable as income. This is because life insurance proceeds are usually excluded from a beneficiary's gross income. In the state of Wisconsin, the proceeds from life insurance are not taxable. This is also true at the federal level.

If you leave life insurance directly to a beneficiary, there is no tax on that amount because it is a gift from you at death. Similarly, if you set it up to leave it through a trust, like for minor children or people with special needs, you can have the trust distribute the proceeds to the beneficiaries without income tax. This is because it is a gift at death and not generally generating income each year.

However, if you put money into a trust and have it generate income each year, the trust might pay some tax on the income it generates annually. But in general, if you are just thinking about the life insurance you bought, at your death, the beneficiaries would receive that money tax-free. This is a great way to provide for your heirs after your death.

It is important to note that while life insurance proceeds are not taxable as income, they can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions. Federal estate taxes apply when the value of your estate exceeds $12.06 million per individual and is subject to a tax rate of up to 40%. Additionally, there are 17 states, plus Washington, D.C., with an estate or inheritance tax, with tax rates as high as 20%.

Get Licensed: Life & Accident Insurance in California

You may want to see also

Proceeds paid to a beneficiary in instalments may be taxed

In Wisconsin, life insurance proceeds are generally not taxable. However, proceeds paid to a beneficiary in instalments may be subject to income tax on the interest accrued. This typically occurs when parents request that the insurance company pay out the death benefit in instalments because the beneficiary is a young child or someone dependent on their income. In these cases, the beneficiary would have to pay income tax on the interest received.

It is important to note that the tax implications of life insurance can vary depending on the specific circumstances and the structure of the policy. While the death benefit itself is generally not taxable, other factors may come into play. For example, if a policy is owned by an irrevocable trust, the trust is responsible for any tax owed, and the proceeds would not become part of the insured's estate if the insured had no incidents of ownership. Additionally, older life insurance policies may mature at a specific age, typically 95 or 100, and the payout from these policies may be taxed as ordinary income if it exceeds the policy owner's cost basis.

To avoid unexpected tax consequences, it is essential to understand the specifics of your life insurance policy and how it may be taxed. Consulting with a financial professional or a tax advisor can help you navigate the complex nature of tax laws and ensure that you are making informed decisions about your life insurance policy and its potential tax implications.

Furthermore, while the focus here is on Wisconsin, it is worth noting that different states have different tax laws, and the tax treatment of life insurance proceeds may vary depending on the state in which the beneficiary resides. Understanding the tax laws in the relevant state is crucial for proper tax planning and ensuring compliance with tax regulations.

In conclusion, while life insurance proceeds paid to a beneficiary in instalments may be subject to income tax on the interest, it is important to consider the broader context of your life insurance policy and seek professional advice to make informed decisions regarding tax implications.

Life Insurance Exam: Is New Jersey's Tough?

You may want to see also

Proceeds paid to a spouse are not taxed

Life insurance proceeds are generally not taxable as income. However, this changes if the beneficiary is someone other than the policyholder's spouse. In Wisconsin, if the beneficiary is the spouse of the policyholder, the life insurance payout is not taxed and will be passed on to them in full, along with the rest of the estate that was left to them. Spouses typically have an unlimited exemption with regards to estate taxes.

If the beneficiary is anyone other than the spouse, such as a child or parent, the life insurance payout will be added to the value of the estate. If the total value of the estate is less than the federal and state exemptions, there will be no tax. However, if the total value exceeds the exemption, any amount over that limit is subject to estate and inheritance taxes.

Federal estate taxes apply when the value of an estate exceeds $12.06 million per individual and the tax rate can be up to 40%. State estate and inheritance taxes vary but are applicable in 17 states, plus Washington, D.C., and the exemption amount ranges from $1 million to $7 million. The tax rate can be as high as 20%.

It is important to note that life insurance proceeds are only considered part of the estate for tax purposes. They are not included in the estate for other purposes, such as paying creditors, unless the estate is named as the beneficiary or all beneficiaries have passed away.

Understanding Life Insurance Conversion Periods: Flexibility and Options

You may want to see also

Proceeds paid to a non-spouse beneficiary may be taxed

In Wisconsin, life insurance proceeds are usually not taxable as income. However, proceeds paid to a non-spouse beneficiary, such as a child or parent, may be taxed. This is because the life insurance payout will typically be added to the value of the insured's estate. If the total value of the estate exceeds the federal and state exemptions, any amount over the exemption will be subject to estate and inheritance taxes.

The federal estate tax exemption is $12.06 million per individual, and the tax rate can be up to 40%. State estate and inheritance taxes vary by state, with exemptions ranging from $1 million to $7 million and tax rates as high as 20%. It's important to note that the life insurance policy would only be considered part of the estate for tax purposes and would not be included for other purposes, such as paying creditors, unless the estate was named as the beneficiary.

To avoid life insurance payouts being taxed as part of the estate, one option is to set up an irrevocable life insurance trust (ILIT). By transferring ownership of the policy to the ILIT, the trust becomes the beneficiary, and the proceeds are not included in the insured's estate. However, there may be tax implications when setting up the trust if the life insurance policy's cash value exceeds the gift tax exemption. Additionally, if the insured passes away within three years of transferring the policy to the trust, the policy may still be considered part of the estate for tax purposes.

It's always recommended to consult with a legal or tax professional for specific information and guidance regarding your particular situation.

Life Insurance: End-of-Term Payouts Explained

You may want to see also

Frequently asked questions

No, life insurance proceeds are not taxable in Wisconsin. They are typically excluded from a beneficiary's gross income.

Yes, if the beneficiary receives the life insurance payment as a series of installments, the insurer will pay interest on the outstanding death benefit. The beneficiary would then have to pay income tax on the interest.

No, life insurance proceeds are not taxable at the federal level.

Yes, if a policy matures at a specific age, typically 95 or 100, and the insured individual attains that age, the policy's cash value may be paid out to the policy owner instead of a death benefit payment. This payout may be taxed as ordinary income on the amount that exceeds the policy owner's cost basis.

One way to avoid taxes on life insurance payouts is to set up an irrevocable life insurance trust (ILIT). By transferring ownership of the policy to the ILIT, the payout will not be taxed as part of your estate. However, there may be tax implications when setting up the trust if the policy's cash value exceeds the gift tax exemption.