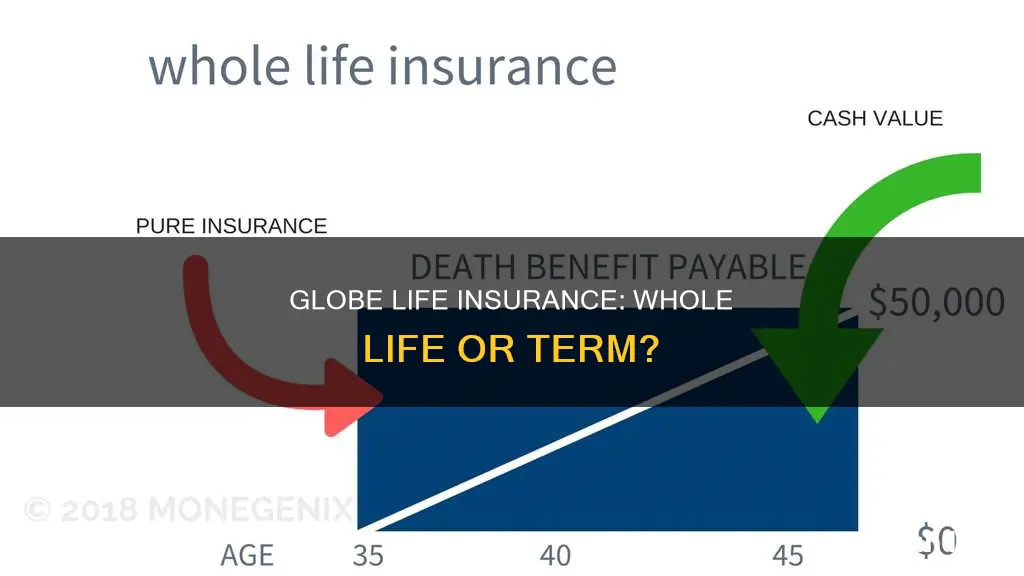

Globe Life Insurance offers both term life and whole life insurance policies. Whole life insurance, also known as permanent life insurance, covers individuals for their entire lives and offers a death benefit to beneficiaries upon death, in addition to building cash value over time. Globe Life's whole life insurance policies are available in coverage amounts ranging from $5,000 to $50,000, with no medical exam required. The company's whole life insurance rates are based on age and remain fixed for the duration of the policy.

| Characteristics | Values |

|---|---|

| Coverage Amounts | $5,000, $10,000, $20,000, $30,000, $50,000 |

| Medical Exam Required | No |

| Waiting Period | No |

| Application Process | Simple |

| Rates | Start as low as $3.49 per month for adults |

| First Month Cost | $1 |

| Rate Changes | Rates stay the same for life |

| Policy Builds Cash Value | Yes |

| Coverage Reduction | Coverage can never be reduced |

| Benefit Cancellation | Benefits can never be canceled or reduced as long as premiums are paid on time |

| Money-Back Guarantee | 30-day money-back guarantee |

| Customer Service | High level of complaints, difficult to speak to a live representative |

What You'll Learn

Globe Life Whole Life Insurance Coverage Options

Whole life insurance, also known as permanent life insurance, covers you for your entire life. It pays a death benefit to your beneficiaries when you die and builds cash value over time. Whole life insurance typically costs more than term life insurance.

Globe Life offers whole life insurance coverage for both adults and children. The company's whole life insurance policies are available in coverage amounts of $5,000, $10,000, $20,000, $30,000, and $50,000, with no medical exam required. The first month of coverage costs just $1, after which the rate is based on your age and remains the same for life. This means that your premiums will never increase for any reason.

For children, Globe Life's whole life insurance coverage choices are $5,000, $10,000, $15,000, $20,000, $25,000, and $30,000. After the first month of coverage, the rates are based on the child's current age and will also stay the same throughout their life.

One of the key advantages of Globe Life's whole life insurance policies is that they build cash value over time. This means that your policy can accumulate cash value that you can borrow against or withdraw under certain circumstances. Additionally, your coverage can never be reduced, and your benefits can never be canceled or reduced as long as premiums are paid on time.

It's important to note that Globe Life's whole life insurance policies also come with a 30-day money-back guarantee. If you are unsatisfied with the policy for any reason, you can simply return it within 30 days and receive a full refund from Globe Life.

When considering Globe Life's whole life insurance coverage options, it's worth noting that the company has received a high level of complaints, particularly regarding claims payments and policyholder service delays or lack of response. However, the company is rated "A (Excellent)" by A.M. Best Company based on their analysis of Globe Life's financial strength, management skills, and integrity.

Insurability Evidence: Life Insurance's Critical Requirement Explained

You may want to see also

Globe Life Whole Life Insurance Premiums

Globe Life offers whole life insurance, also known as permanent life insurance, which covers you for your entire life. It pays a death benefit to your beneficiaries after you die and also builds cash value over time. Whole life insurance typically costs more than term life insurance.

Globe Life's whole life insurance coverage amounts are $5,000, $10,000, $20,000, $30,000, and $50,000. The first month of coverage costs $1, after which the rate is based on the insured person's age and stays the same for life. This means that premiums will never increase for any reason, and the rate paid when the policy is issued is locked in.

The whole life insurance policy offered by Globe Life has several benefits. Firstly, it has a no-medical-exam requirement, making the application process simple and accessible. Secondly, there is no waiting period, so coverage starts immediately. Additionally, the policy builds cash value for the future, and the coverage and benefits cannot be reduced as long as premiums are paid on time.

It is important to note that Globe Life has received a high level of complaints, with issues surrounding claims payments, policyholder service delays, policy cancellations, and claim denials. Prospective customers may also find it difficult to get their questions answered, as speaking with a live representative through the customer service number is challenging.

Homeowner's Insurance: Does It Cover Loss of Life?

You may want to see also

Globe Life Whole Life Insurance for Children

Globe Life offers whole life insurance for children, which is a type of permanent life insurance that includes a cash value component. Whole life insurance for children can be a great way to give your child a financial head start as it offers both a financial advantage and protection for the parents.

The biggest difference between children's life insurance and adult life insurance is the reason for purchasing the policy. While adult life insurance is typically purchased to provide financial protection in the event of the insured person's death, children's life insurance is often bought to secure coverage for life and lock in lower premium rates while the child is still young and healthy. This means that even if your child develops any health issues early on, they will still be covered by the policy. Additionally, the policy can accumulate cash value over time, which can be used for various purposes, such as college education, medical bills, or other financial needs.

Globe Life's whole life insurance for children offers coverage choices of $5,000, $10,000, $15,000, $20,000, $25,000, and $30,000. The monthly rate is based on the child's current age and is guaranteed to remain the same throughout their life. There is no medical exam required for this policy, making it simple and convenient to apply.

It's important to consider both the pros and cons of purchasing life insurance for your child. One of the main advantages is that it can protect your child's future insurability. If your child develops any health issues, such as high blood pressure, diabetes, or obesity, they may have trouble qualifying for life insurance coverage later in life. By purchasing coverage early, you can ensure your child is protected regardless of any medical issues that may arise. Additionally, small policies can be affordable, with costs ranging from $5 to $15 per month, making it a financially manageable option for many families.

However, there are also some drawbacks to consider. The likelihood of a child developing a serious health issue or passing away at a young age is rare, so investing in a child life insurance policy may not be necessary for all families. Some experts suggest that alternative savings options, such as an emergency fund, could be a more flexible way to prepare for potential crises. Additionally, there are other ways to save for your child's financial future, such as through dedicated education funds or other investment opportunities, which may offer better returns.

Life Insurance Payouts After Suicide: What Spouses Need to Know

You may want to see also

Globe Life Whole Life Insurance Claims Process

Globe Life offers whole life insurance, also known as permanent life insurance, which covers you for your entire life. It pays a death benefit to your beneficiaries after you die, and it also builds cash value over time. While Globe Life does not require a medical exam for its whole life insurance policies, coverage limits are significantly lower than standard life insurance policies.

To file a claim with Globe Life, you will need to submit the required forms by mail, email, or fax, depending on the age and amount of the policy. The specific process varies depending on the age of the policy and the benefit amount.

If your Globe Life whole life insurance policy is less than two years old and your benefit amount is greater than $50,000, you must fill out the required forms and mail them to the company address listed on the Globe Life website. You can email [email protected] if you have any questions about your claim.

On the other hand, if your policy has been in force for more than two years and your benefit amount is $50,000 or less, you have the option to email ([email protected]) or fax ((405) 270-1496) the forms instead of mailing them.

It is important to note that Globe Life has received a high level of complaints, with complaints about its individual life insurance being more than six times the industry average in 2023, according to the National Association of Insurance Commissioners. Issues with claims payments, policyholder service delays, policy cancellations, and claim denials have been among the top concerns. Therefore, it is advisable to carefully review the terms and conditions of your policy and understand the claims process to ensure a smooth and timely payout.

Typically, Globe Life processes payouts within 30 days of filing a life insurance claim, provided the claim is uncontested. However, given the history of complaints, it is essential to be aware of your rights and seek assistance if needed.

Renewing Life Insurance Licenses: Oklahoma's Guide

You may want to see also

Globe Life Whole Life Insurance Customer Reviews

Globe Life Insurance offers a range of life insurance policies, including term life and whole life coverage. The company is notable for its lack of medical exam requirements for most policies, but it has received a high level of customer complaints.

In this review, we will take an in-depth look at Globe Life Whole Life Insurance, including customer reviews and ratings, to help you decide if it is the right choice for your needs.

Customer Reviews and Ratings:

According to the National Association of Insurance Commissioners (NAIC), Globe Life has received a significantly higher-than-average number of complaints. In 2023, the complaint index for Globe Life was 2.81, much higher than the average rating of 1.0. This indicates that overall customer satisfaction for Globe Life policyholders is lower than that of other insurance companies.

Common complaints from customers include refusal to cancel policies and refusal to pay out death benefit claims, even when the policy is active. Some customers have also reported issues with policy cancellations and claim denials, as well as delays in receiving responses from the company.

However, it is important to note that there are also positive reviews from customers who have had a good experience with Globe Life. Some customers have praised the company's representatives for being helpful and informative during their time of need. Others have expressed gratitude for the peace of mind that their Globe Life policies have provided.

> " [My Globe Life representative] was very patient and professional and calmly answered my every question and followed up asking if he could do anything else for me…I feel this was a great decision for my grandson, who will turn 7 in February, and wish I had signed up for my children." — Carl O., Google Reviews

> "In our household, we’re so thankful to be maintaining three policies with Globe Life! This brings our family such peace of mind, and is an absolute godsend! Their contact representatives are also friendly and knowledgeable, making the entire process especially affordable and easy to understand!" — L.B., Google Reviews

> "My 98-year-old father took out a life insurance policy on me when I was a child, which has been paid on time for many years. Now as an adult, I have my own insurance, and my father needs desperately to surrender this policy and obtain the cash value, which is rightfully his… Globe Life is refusing to pay my father his money, so I have filed a formal complaint with the Texas Insurance Commissioner to launch a full-scale investigation into this company and its practices." — Melette E., Trustpilot

> "They do everything possible to delay paying claims, look for a reason NOT to pay a claim. Will not allow me to cancel an auto draft on my account because the policy is for my adult child, though I purchased the policy 25 years ago." — Gary S., BBB

While Globe Life Whole Life Insurance may be a convenient option for those who want to avoid medical exams, the high volume of customer complaints is a significant concern. Potential customers should carefully consider their options and compare the pros and cons of Globe Life with other insurance providers before making a decision.

Life Insurance and Carbon Monoxide Poisoning: What's Covered?

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, covers you for your entire life. It pays a death benefit to your beneficiaries after you die, and it also builds cash value over time. Whole life insurance typically costs more than term life insurance.

Coverage amount choices for Globe's whole life insurance are $5,000, $10,000, $20,000, $30,000 and $50,000.

The first month of Globe Life coverage costs $1 for term life, and after that, your rate is based on your age. For adults, rates start as low as $3.49 per month, while families can pay as little as $2.17 per month for life insurance for children.