Carbon monoxide is a colourless, odourless gas that is harmful when inhaled, as it displaces oxygen in the blood and deprives the heart, brain, and other vital organs of oxygen. It is produced during the incomplete burning of organic matter, such as from motor vehicles, heaters, or cooking equipment that run on carbon-based fuels. Carbon monoxide poisoning typically occurs from breathing in carbon monoxide at excessive levels, and can result in a range of symptoms, including headache, dizziness, weakness, vomiting, chest pain, and confusion. Large exposures can result in loss of consciousness, arrhythmias, seizures, or death. Life insurance covers death due to natural causes, illness, and accidents, but there are certain circumstances in which the insurance company can deny paying out the death benefit. So, does life insurance cover carbon monoxide poisoning?

| Characteristics | Values |

|---|---|

| Does life insurance cover carbon monoxide poisoning? | Yes, life insurance covers death due to accidents, including carbon monoxide poisoning. |

| What is carbon monoxide poisoning? | Carbon monoxide poisoning occurs when someone breathes in carbon monoxide (CO) at excessive levels, causing a range of symptoms and potentially leading to death. |

| How common is carbon monoxide poisoning? | Carbon monoxide poisoning is relatively common, resulting in over 20,000 emergency room visits and more than 400 deaths per year in the United States. |

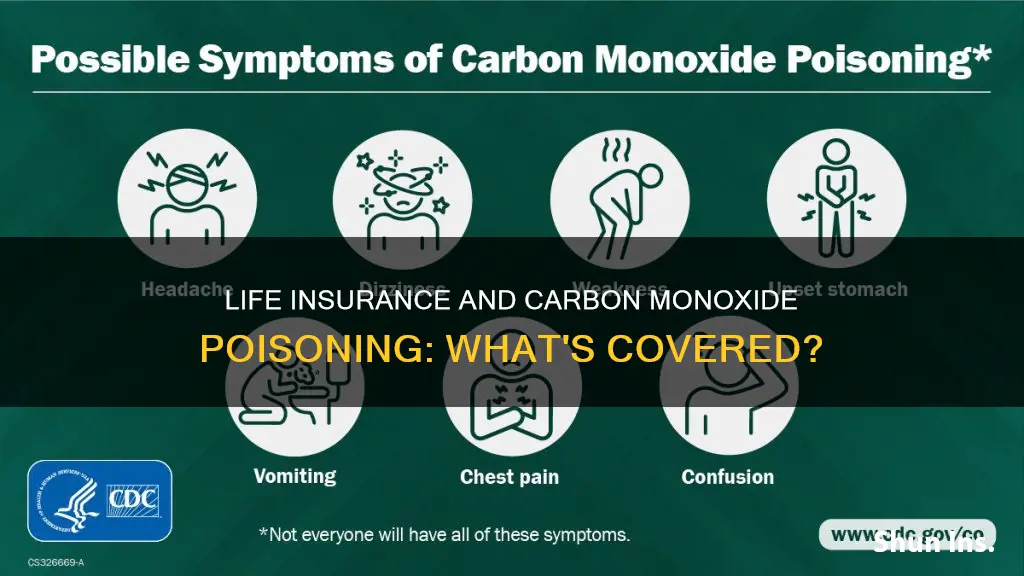

| What are the symptoms of carbon monoxide poisoning? | Symptoms of carbon monoxide poisoning are often described as "flu-like" and include headache, dizziness, weakness, nausea, chest pain, and confusion. Large exposures can lead to loss of consciousness, arrhythmias, seizures, and death. |

| Who is at risk for carbon monoxide poisoning? | Everyone is at risk, but certain groups are more vulnerable, including young children, elderly people, pregnant women, and individuals with existing health problems such as heart and lung disease. |

| What are the sources of carbon monoxide exposure? | Carbon monoxide is found in combustion fumes from vehicles, small gasoline engines, heating systems, appliances, and any enclosed or semi-enclosed spaces where these sources are present. |

| How can carbon monoxide poisoning be prevented? | By using carbon monoxide detectors, properly venting gas appliances, keeping chimneys and exhaust systems clean, and seeking medical attention if symptoms of carbon monoxide poisoning are suspected. |

| What is the treatment for carbon monoxide poisoning? | Immediate treatment involves removing the victim from the source of carbon monoxide and administering 100% oxygen. In severe cases, hyperbaric oxygen therapy may be used. |

What You'll Learn

Life insurance and accidental death

Life insurance covers death due to natural causes, illness, and accidents. However, it's important to note that life insurance companies can deny paying out your death benefit in certain circumstances. For example, if you lie on your application, engage in risky behaviours, or fail to pay your premiums, your insurer may refuse to pay your beneficiaries when you die.

Accidental death insurance, on the other hand, is a separate type of insurance that only provides coverage in the event of a covered accident. It is often added as a rider to a life insurance policy or purchased as a supplemental policy. Accidental death insurance is typically more affordable than life insurance, and it offers guaranteed approval based on age. It can be a good option for those who cannot qualify for other types of life insurance due to age, occupation, or health conditions, or for those who need additional coverage.

Accidental death insurance covers death sustained from any covered injury, which may be work-related or non-work-related. Some policies may provide additional benefits if the insured person is killed as a fare-paying passenger on public transportation or in a motor vehicle accident. It's important to carefully review the terms and conditions of accidental death insurance policies, as coverage may vary depending on the company.

In summary, while life insurance generally covers accidental deaths, accidental death insurance provides specialised coverage for accidents and can be a useful addition to your overall financial protection plan, especially if you work in a high-risk occupation.

Life Line Screening: Insurance Coverage Explained

You may want to see also

Life insurance and natural causes

Life insurance covers death due to natural causes, illness, and accidents. This includes death by poisoning, such as carbon monoxide poisoning. Carbon monoxide is a colourless and odourless gas that is harmful when breathed in as it displaces oxygen in the blood and deprives the heart, brain, and other vital organs of oxygen.

Carbon monoxide is produced during the incomplete burning of organic matter, which can occur from motor vehicles, heaters, or cooking equipment that run on carbon-based fuels. It can also be produced by burning charcoal, wood, and other fuels. Poisoning can occur when these items are used in enclosed or semi-enclosed spaces, such as inside a home or tent.

The symptoms of carbon monoxide poisoning are often described as "flu-like" and commonly include a headache, dizziness, weakness, vomiting, chest pain, and confusion. Large exposures can result in loss of consciousness, arrhythmias, seizures, or death. It is important to note that carbon monoxide poisoning can be difficult to diagnose as the symptoms can mimic other illnesses.

If you suspect carbon monoxide poisoning, it is crucial to remove the victim from the source of the gas and get them into fresh air immediately. Call emergency services and administer cardiopulmonary resuscitation (CPR) if necessary.

Life insurance policies typically cover death by natural causes, accidents, and illnesses, which includes poisoning. However, it is important to carefully review your specific policy to understand what is covered and what may be excluded.

In general, life insurance provides financial protection to your loved ones in the event of your death. It is important to be aware of any circumstances that may result in the insurance company denying or withholding the death benefit payout. For example, lying on your application, engaging in risky behaviours, or failing to pay your premiums may result in the insurance company refusing to pay out.

Additionally, life insurance policies typically have a "suicide clause" that spans the first two years of the policy. Suicide during this period will not be covered, but all premiums paid will be refunded. It is also important to disclose any risky activities or occupations during the application process, as these may result in higher premiums or exclusions in your policy.

Life insurance is designed to provide financial peace of mind and protect your loved ones in the event of your death. By understanding what is covered and what may be excluded, you can ensure that your beneficiaries receive the intended benefits.

Dying with Dignity: Impact on Life Insurance Policies

You may want to see also

Life insurance and carbon monoxide detectors

Carbon monoxide is a colourless, odourless, and tasteless gas that is harmful when breathed in. When too much carbon monoxide is in the air, it replaces the oxygen in red blood cells with carbon monoxide, which can lead to hypoxic injury, nervous system damage, and even death. Carbon monoxide is produced during the incomplete burning of organic matter, such as from motor vehicles, heaters, or cooking equipment that run on carbon-based fuels.

Carbon monoxide poisoning is preventable with modern technology, such as carbon monoxide detectors, proper venting of gas appliances, keeping chimneys clean, and keeping exhaust systems of vehicles in good repair. Carbon monoxide detectors are relatively inexpensive and widely available, and they can help alert you to increased levels of carbon monoxide in your home.

Life insurance covers death due to natural causes, illness, and accidents. In the case of accidental death, life insurance policies will pay death benefits to beneficiaries if the insured dies from a motor vehicle accident, drowning, poisoning, a fire, or another tragedy. Therefore, if someone dies from carbon monoxide poisoning, their life insurance policy will pay out benefits to their beneficiaries.

However, it is important to note that life insurance companies can deny paying out death benefits in certain circumstances. For example, if the insured lied on their application, engaged in risky behaviours, or failed to pay their premiums, the insurer may refuse to pay the death benefit. Additionally, if the beneficiary of the policy is involved in the murder of the insured, they will not receive the death benefit.

In the context of carbon monoxide poisoning, if the insured person was engaging in risky behaviours, such as intentionally inhaling carbon monoxide, or if they had high levels of carbon monoxide in their system due to negligence, the life insurance company may deny the claim. Therefore, it is important to have working carbon monoxide detectors and take the necessary precautions to prevent carbon monoxide poisoning.

Covid Shots and Life Insurance: What's the Verdict?

You may want to see also

Life insurance and carbon monoxide poisoning treatment

Carbon monoxide poisoning is a serious and sometimes fatal occurrence, with over 430 people dying each year in the United States due to carbon monoxide (CO) poisoning. It is caused by inhaling CO fumes, which can happen in enclosed spaces where gas, coal, oil, or wood-burning appliances are used without proper installation or maintenance. Symptoms of carbon monoxide poisoning include headaches, confusion, fatigue, dizziness, shortness of breath, and stomach pain, which can be confused with other common ailments. If you suspect carbon monoxide poisoning, it is important to get into fresh air immediately and seek medical attention.

Life insurance provides financial protection to your loved ones in the event of your death, covering deaths from natural causes, illnesses, and accidents. In the case of carbon monoxide poisoning, life insurance policies will generally cover the death benefit, as it falls under accidental death. However, it is important to note that life insurance companies can deny paying out the death benefit in certain circumstances, such as if the policyholder lied on their application, engaged in risky behaviors, or failed to pay premiums.

To ensure that your loved ones receive the life insurance payout in the event of a carbon monoxide-related death, it is crucial to take preventive measures and properly maintain fuel-burning appliances. Additionally, installing CO detectors and seeking medical attention at the first sign of symptoms can help reduce the risk of fatal carbon monoxide poisoning.

If you or someone you know is experiencing carbon monoxide poisoning, it is important to act quickly. Move to fresh air and seek medical attention immediately. Contact Poison Control or call 911 if the individual collapses, has a seizure, has trouble breathing, or can't be awakened. Treatment for carbon monoxide poisoning typically involves administering pure oxygen through a mask or ventilator, and in some cases, hyperbaric oxygen therapy may be prescribed.

In summary, carbon monoxide poisoning is a serious and preventable issue that can lead to fatal consequences. Life insurance policies generally cover accidental deaths, including carbon monoxide poisoning, providing financial protection to beneficiaries. However, it is important to be mindful of the circumstances that may lead to a denied payout and take preventive measures to ensure the well-being of yourself and your loved ones.

Life Coaching: Can You Claim It on Insurance?

You may want to see also

Life insurance and carbon monoxide poisoning prevention

Carbon monoxide poisoning is a serious and often deadly occurrence that can be prevented with modern technology. According to the Centers for Disease Control and Prevention (CDC), over 430 people die annually from carbon monoxide poisoning, with about 50,000 visiting emergency rooms across the United States.

Life insurance covers death due to natural causes, illnesses, and accidents, including poisoning. However, it is important to note that insurance companies can deny paying out death benefits in certain circumstances, such as if the policyholder engages in risky behaviors or fails to pay premiums.

To prevent carbon monoxide poisoning and ensure the safety of yourself and your loved ones, it is crucial to take the following precautions:

- Install carbon monoxide alarms in every sleeping area of your home and additional alarms in other areas, such as kitchens or living rooms. Regularly test and replace batteries to ensure they are functioning properly.

- Properly install and maintain fuel-burning appliances, such as central heating systems, stoves, and water heaters. Ensure these appliances are serviced and inspected by professionals at least once a year.

- Do not use grills, generators, or gasoline-powered tools indoors. These items produce high levels of carbon monoxide and should only be used in well-ventilated outdoor spaces.

- Keep chimneys and flues clean and clear of any blockages, such as bird nests or debris. Have them inspected regularly to ensure they are functioning properly.

- Be cautious when using fireplaces or wood-burning stoves. Ensure proper ventilation and never leave them unattended.

- Avoid running your car in an attached garage, even with the door open. Carbon monoxide can quickly accumulate and spread into your home.

- Be aware of the symptoms of carbon monoxide poisoning, which can include headache, confusion, fatigue, dizziness, shortness of breath, and stomach pain. If you experience any of these symptoms, seek fresh air immediately and contact a medical professional.

- Understand the high-risk groups for severe carbon monoxide poisoning, which include children, older adults, pregnant women, individuals with pre-existing health conditions, and smokers. Take extra precautions to protect these vulnerable individuals.

- Install carbon monoxide detectors in your home, especially if you have fuel-burning appliances or live in an area with high levels of carbon monoxide, such as near busy roads or industrial areas.

- Educate yourself and your family about the dangers of carbon monoxide and the importance of prevention. Share information about the signs and symptoms of poisoning, as well as the locations of carbon monoxide alarms and detectors in your home.

By following these prevention tips, you can significantly reduce the risk of carbon monoxide poisoning and ensure the safety and well-being of yourself, your family, and your loved ones. In the unfortunate event of a poisoning, seek medical attention immediately and contact a carbon monoxide poisoning attorney to discuss your legal options and rights.

Founders Federal Credit Union: Life Insurance Options?

You may want to see also

Frequently asked questions

Yes, life insurance covers death caused by carbon monoxide poisoning. However, it is important to note that carbon monoxide poisoning is preventable and treatable, and if negligence or malpractice is suspected, legal advice should be sought.

The symptoms of carbon monoxide poisoning are often flu-like and include headache, dizziness, weakness, nausea, chest pain, and confusion. In more severe cases, symptoms can include loss of consciousness, arrhythmias, seizures, and death.

If a carbon monoxide detector sounds an alarm or you experience symptoms of carbon monoxide poisoning, you should leave the building immediately, get fresh air, and call emergency services.