Life insurance is designed to provide financial support to your loved ones after you pass away. There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides a death benefit for a certain period, often between one and 30 years, while permanent life insurance covers you for life and builds cash value over time. When shopping for life insurance, it's important to consider factors such as the amount of coverage you need, the type of policy, and your budget. You can get life insurance quotes from specialist brokers, comparison sites, insurers, and independent financial advisors. It's recommended to compare quotes from multiple insurers to ensure you get the best deal.

| Characteristics | Values |

|---|---|

| Types of life insurance | Term life insurance, permanent life insurance |

| Term life insurance types | Level, decreasing, increasing |

| Permanent life insurance types | Whole life insurance, universal life, variable life |

| Factors to consider when choosing a policy | Coverage needed, type of coverage, financial goals, family situation, age, health, occupation, income, debts, number of dependents, take-home pay |

| Ways to buy life insurance | Specialist brokers, comparison sites, directly from insurers, credit card companies, independent financial advisors, retailers, mortgage providers |

| Considerations when buying life insurance | Be honest about medical history, read the small print, understand cancellation policies, consider switching for a better deal, add extra features |

What You'll Learn

Know what coverage you need

Knowing what coverage you need is an important step in shopping around for life insurance. The coverage you need will depend on your financial goals and needs, as well as your family situation.

- Income replacement: If you are the primary breadwinner for your family, you will want enough coverage to replace your income for a certain number of years. A common guideline is to have a policy with a death benefit equal to 10 times your annual salary. However, you may need more or less depending on your financial situation.

- Debts and expenses: Consider any debts you have, such as a mortgage, car loans, student loans, credit card debt, etc. Your policy should include enough coverage to pay off these debts in full, including any additional interest or charges.

- Future needs: If you have children, you may want to include the cost of their college education in your coverage. You may also want to provide for final expenses such as funeral and burial costs, which can be substantial.

- Number of dependents: Think about how many people depend on your income and how long they will rely on it. This will help you determine the length of coverage you need.

- Spouse's income: Even if your spouse is not the primary breadwinner, their income may also be factored in when determining the coverage amount.

- Existing resources: Assess any resources you already have in place, such as emergency funds, retirement savings, or existing life insurance coverage.

- Financial goals: Consider your long-term financial goals, such as saving for retirement, buying a home, or starting a business. Your coverage should align with these goals.

- Living benefits: In addition to the death benefit, some life insurance policies offer "living benefits" such as coverage for long-term care or early access to the death benefit due to disability or illness. These features can provide additional financial protection for you and your family.

Once you have considered these factors, you can use an online life insurance calculator or consult a financial planner to help you determine the specific coverage amount that best suits your needs.

PCOS and Life Insurance: What You Need to Know

You may want to see also

Evaluate coverage and rates

Evaluating coverage and rates is a crucial step in shopping for life insurance. Here are some key considerations:

Understand the Types of Coverage

Before evaluating rates, it's essential to understand the two main types of life insurance coverage: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, often between one and 30 years, and typically doesn't return premiums at the end of the term. On the other hand, permanent life insurance covers you for life and builds cash value, which can be borrowed against or withdrawn. Permanent policies are more expensive due to their lifelong coverage and cash value component.

Determine Your Coverage Needs

The amount of coverage you need depends on various factors, including your financial goals, income, debts, number of dependents, and future expenses. Consider using a life insurance calculator to estimate how much coverage you may require. Think about any specific needs, such as replacing lost income, covering funeral expenses, or paying off debts.

Compare Quotes from Multiple Insurers

Obtain quotes from multiple insurers to ensure you get the best deal. Use online brokerages or visit insurers' websites to gather quotes. When assessing quotes, look beyond premiums and ensure the policies offer the features you want. For example, you may want a term life policy that can be converted into a permanent policy without providing additional evidence of insurability.

Assess the Financial Strength of the Insurer

Consider the financial strength and longevity of the insurance company. You want to ensure they will be around for the long haul, as it may be decades before you receive a payout. Research the financial stability of insurers through sources like the AM Best rating service.

Understand the Impact of Personal Factors

Recognize how personal factors affect your rates. Your age, health, occupation, hobbies, and habits can influence your premiums. For example, older individuals generally pay higher premiums due to decreased life expectancy. Additionally, risky occupations or hobbies, smoking, and drug use can increase rates or even lead to denied coverage.

Aflac Life Insurance Loan: Online Application Process

You may want to see also

Understand the different types of life insurance

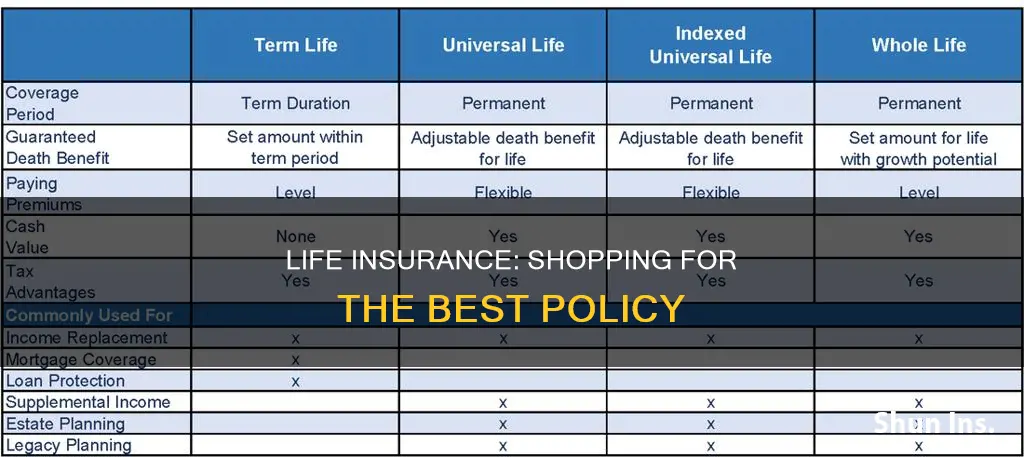

Understanding the different types of life insurance is essential to choosing the right coverage for your needs. Here is a detailed overview of the various types of life insurance policies available:

Term Life Insurance

Term life insurance is a simple and cost-effective policy that provides coverage for a specific period, typically ranging from one to 30 years. It is designed to replace your income in the event of your death during the policy term. Term life insurance is ideal for most people as it offers sufficient coverage at a lower cost compared to other types of life insurance. However, if you outlive the policy term, your beneficiaries will not receive any payout.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for your entire lifetime, as long as you continue paying the premiums. It is more expensive than term life insurance due to its permanent nature and the inclusion of a cash value component. There are several types of permanent life insurance policies:

Whole Life Insurance

Whole life insurance is a straightforward type of permanent life insurance that offers coverage for your entire life, with guaranteed rates of return on the policy's cash value. The premiums tend to be fixed, and the death benefit amount usually remains the same. Whole life insurance is ideal for those seeking lifelong coverage and are willing to pay higher premiums.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that allows you to adjust your premiums and death benefit within certain limits. The cash value of a universal life policy grows based on market interest rates, which means the rate at which it accumulates can vary over time. This type of insurance is suitable for those who want permanent coverage that can adapt to their changing needs.

Variable Life Insurance

Variable life insurance is a riskier form of permanent life insurance as it ties the cash value to investment accounts such as bonds and mutual funds. The cash value can fluctuate based on the performance of these investments, offering the potential for significant gains but also exposing you to higher risk. Variable life insurance is best suited for individuals with a higher risk tolerance who want more control over their investments.

Final Expense Life Insurance

Final expense life insurance, also known as burial or funeral insurance, is a type of whole life insurance designed to cover end-of-life expenses such as funeral costs, medical bills, and outstanding debts. It offers a smaller death benefit, typically ranging from $5,000 to $25,000, and does not require a medical exam, making it accessible to older individuals with pre-existing health conditions.

Other Types of Life Insurance

In addition to the main types mentioned above, there are other specialized forms of life insurance:

- Group life insurance is typically offered by employers as part of their benefits package.

- Mortgage life insurance covers the outstanding balance of your mortgage and pays out to the lender upon your death.

- Credit life insurance is designed to pay off a specific loan, such as a home equity loan, in the event of your death.

- Accidental death and dismemberment insurance (AD&D) covers death or serious injuries, such as loss of limbs, resulting from an accident.

- Joint life insurance insures two lives under one policy and pays out after the death of one or both policyholders, depending on the specific arrangement.

Paid-Up Additions: Life Insurance's Bonus Feature Explained

You may want to see also

Compare quotes from multiple insurers

Comparing quotes from multiple insurers is a crucial step in the process of shopping for life insurance. Here are some instructive guidelines and considerations to help you effectively compare quotes from multiple insurers:

Understand the Different Types of Life Insurance

Before comparing quotes, it is essential to understand the two primary types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, often between one and thirty years, and is generally the simplest and most affordable option. On the other hand, permanent life insurance offers lifelong coverage and includes a cash value component, making it more expensive. Permanent life insurance policies can be further categorized into whole life, universal life, and variable life insurance, each with unique features and benefits.

Determine Your Coverage Needs

The amount of coverage you need depends on various factors, including your age, income, mortgage, debts, and anticipated funeral expenses. Consider your financial obligations, income replacement, and future expenses to decide on the appropriate coverage amount. You can use a life insurance calculator or consult a financial planner to help you pinpoint your exact needs.

Research and Compare Multiple Insurers

Once you understand your coverage needs, it's time to research and compare multiple life insurance providers. Evaluate insurers based on their customer satisfaction ratings, financial strength ratings from agencies like AM Best, J.D. Power, and the features and costs of their policies. Shopping around can help you find the best value and ensure that you get the coverage that suits your unique needs.

Consider Using a Broker or Comparison Tool

Using a licensed agent, broker, or an online comparison tool can simplify the process of comparing quotes. Brokers can shop around on your behalf and provide expert guidance tailored to your specific circumstances. Online comparison tools allow you to generate quotes from multiple insurers simultaneously, making it easier to compare rates and policy details. However, keep in mind that brokers and comparison tools may not work with every insurer in the market.

Evaluate Policy Details and Features

When comparing quotes, ensure that you are comparing the same type of policy, coverage amount, and riders or add-ons. Look beyond the premium cost and consider the features and benefits offered by each policy. For example, some term life policies may offer the option to convert to a permanent policy without providing additional evidence of insurability. Additionally, consider the financial strength and stability of the insurer to ensure they will be able to pay out claims in the future.

Assess Your Health and Lifestyle

Your health and lifestyle choices can significantly impact your life insurance rates. Factors such as age, smoking status, medical history, family medical history, risky hobbies, occupation, and substance use are considered when determining your risk level and calculating your premium. Making positive health and lifestyle changes, such as quitting smoking or maintaining a healthy weight, can help improve your rates.

After gathering all the necessary information and evaluating your options, it's time to obtain quotes from multiple insurers. You can do this by visiting their websites, speaking to their agents, or using an online comparison tool. Comparing quotes will help you identify the most competitive rates and find the policy that best meets your needs and budget. Don't forget to consider the reputation and customer satisfaction ratings of the insurers as well.

Child Life Insurance: Voluntary Protection for Your Children

You may want to see also

Understand what factors affect your life insurance rates

When it comes to life insurance, there are several factors that influence the rates you'll be offered. Understanding these factors can help you navigate the complexities of life insurance and possibly lower your costs. Here are the key factors that affect your life insurance rates:

Age

Age is a significant factor in determining life insurance rates. The younger you are, the lower your premiums will be, as you are expected to live longer and have a lower risk of dying. Life insurance for seniors tends to be more expensive and may have shorter term periods.

Gender

Gender plays a role in life insurance rates due to differences in life expectancy. On average, women live longer than men, resulting in lower premiums for women.

Health

Your health status, including pre-existing conditions, has a significant impact on your life insurance rates. The insurance company will assess your health through a process called underwriting, which may involve checking your medical records, lab tests, and/or a medical exam. Serious health conditions or poor health habits can lead to higher rates or even denial of coverage.

Smoking and Nicotine Use

Smoking and any form of nicotine use, including cigarettes, cigars, vaping, and nicotine patches, will significantly increase your life insurance rates. Smokers may pay more than double the rates of non-smokers due to the associated health risks.

Family Medical History

The medical history of your immediate family, including parents and siblings, can also affect your rates. A family history of serious medical conditions, especially those that have contributed to premature deaths, may result in higher premiums.

Occupation and Hobbies

Dangerous occupations and high-risk hobbies, such as scuba diving or piloting planes, are considered risk factors by insurance companies. If you engage in these activities, you may be offered higher rates or additional terms and conditions.

Driving Record

Your driving record, including DUIs, reckless driving convictions, or license suspensions, will also be taken into account. Infractions within the last three to five years can lead to higher rates or even impact your eligibility for coverage.

Criminal Record

A criminal record, especially felonies or multiple convictions, can result in higher rates or even denial of coverage. There are typically waiting periods after a felony or DUI discharge before you can qualify for an underwritten life insurance policy.

Financial Issues

Recent bankruptcies and credit issues can affect your life insurance approval and rates. Insurance companies view these as indicators of financial instability, which may increase your risk profile.

Coverage Length and Amount

The type of policy and the amount of coverage you choose will also impact your rates. Term life insurance is generally the cheapest option, while whole life insurance and universal life insurance are more expensive due to their permanent coverage and additional features.

In summary, while some factors such as age and gender are beyond your control, there are many aspects of your lifestyle, health, and financial situation that you can address to improve your life insurance rates. By understanding these factors, you can make informed decisions when shopping for life insurance and find the best coverage for your needs.

Life Insurance, Annuities, and CDs: Are They Federally Protected?

You may want to see also

Frequently asked questions

Life insurance is a contract under which an insurance company agrees to pay a specified amount after the death of an insured party, as long as the premiums are paid. The payout amount is called a death benefit. Policies give insured people the assurance that their loved ones will have financial protection and peace of mind after their death.

There are two main types of life insurance: permanent and term. Permanent life insurance policies do not have an expiration date, meaning you’re covered for life as long as your premiums are paid. Term life insurance, on the other hand, only covers you for a set number of years and does not accumulate cash value.

This may be determined by the monthly payment you can afford, but a good rule of thumb is to aim for 10 times the annual income of the highest earner.