Navigating the intricacies of officer life insurance can be a complex task, especially when it comes to understanding where the proceeds go on Form 1065. This paragraph aims to shed light on this specific aspect, providing a concise overview of the process and its implications for officers and their beneficiaries.

What You'll Learn

- Tax Implications: Officer life insurance proceeds may be taxable as income

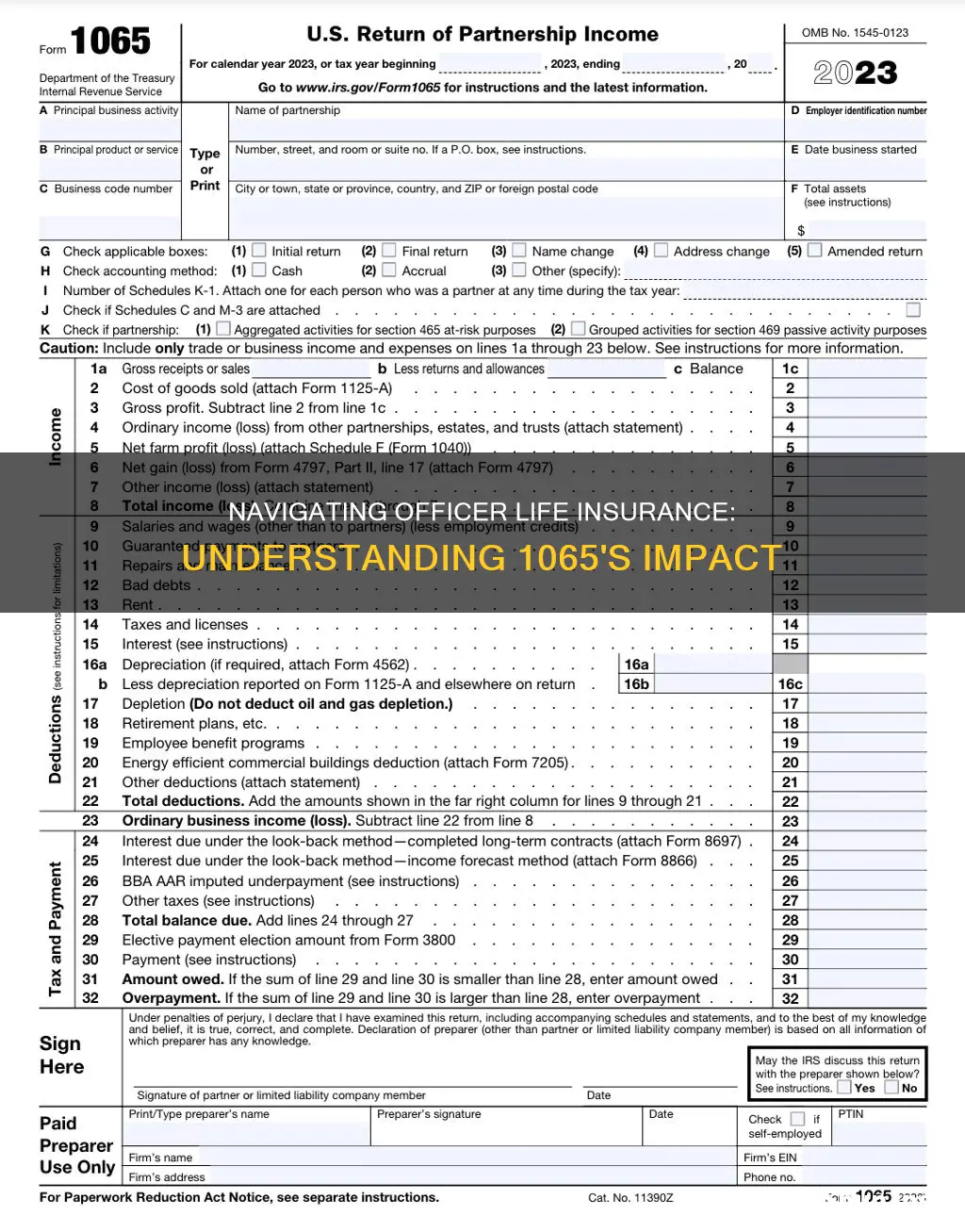

- Form 1065: Report insurance payments on Schedule K-1 of Form 1065

- Business Expenses: Premiums can be a deductible business expense

- Distribution Rules: Proceeds must be distributed according to IRS regulations

- State Laws: State-specific rules may vary regarding insurance proceeds

Tax Implications: Officer life insurance proceeds may be taxable as income

The tax implications of officer life insurance proceeds can be a complex matter, and understanding these rules is crucial for both the insured officer and the company. When an officer's life insurance policy is in place, the proceeds from the policy can have significant financial consequences for the beneficiary, especially in terms of taxation.

In the context of a 1065 form, which is typically used for tax purposes related to partnerships or S corporations, the treatment of officer life insurance proceeds can vary. If the insurance policy is owned by the partnership or S corporation, the proceeds may be considered a distribution or a return of capital. This means that the insurance money could be subject to income tax, depending on the specific circumstances. The tax treatment often depends on whether the policy is considered a personal asset or a business asset.

For individuals, the tax rules regarding life insurance proceeds can be straightforward. Generally, the proceeds from a life insurance policy are considered taxable income if the deceased individual had an insurable interest in the policy. However, there are exceptions and exclusions that can apply. For instance, if the policy is a term life insurance with no cash value, the proceeds may not be taxable. Additionally, if the policy is owned by a trust or a partnership, the tax treatment can be more complex, and the proceeds may be subject to different tax rules.

In the case of officers, the tax implications can be more nuanced. If the officer is a key employee or a significant contributor to the company, the life insurance proceeds may be treated as a form of compensation. This could result in the proceeds being subject to income tax, social security tax, and Medicare tax. The company may also be required to report the proceeds as a taxable distribution or a return of capital on the 1065 form, which could have implications for the partnership's or S corporation's tax liability.

To navigate these tax implications, it is essential to consult with tax professionals and insurance advisors. They can provide guidance on structuring the insurance policy, ensuring proper ownership, and understanding the tax consequences. Proper planning and documentation can help minimize the tax burden and ensure compliance with tax laws.

Kaizen in Life Insurance: Small Changes, Big Results

You may want to see also

Form 1065: Report insurance payments on Schedule K-1 of Form 1065

When it comes to reporting officer life insurance payments on Form 1065, it's important to understand the specific guidelines and requirements set by the IRS. Form 1065, also known as the "U.S. Return of Partnership Income," is used by partnerships to report their income, expenses, and other relevant financial information. One crucial aspect of this form is the reporting of insurance payments, including those related to officer life insurance.

Officer life insurance is a type of coverage provided by a partnership to its officers, which can offer financial protection in the event of the officer's death. These insurance payments are typically reported on Schedule K-1 of Form 1065. Schedule K-1 is a separate attachment to Form 1065 and is used to provide additional information about each partner's share of the partnership's income, expenses, and other items.

To report officer life insurance payments, the partnership must complete Part III of Schedule K-1, which is specifically dedicated to insurance benefits. This part requires the partnership to provide details about the insurance payments received by each partner. The information includes the type of insurance (in this case, officer life insurance), the amount of the payment, and the date it was received. It is essential to accurately report these details to ensure compliance with IRS regulations.

When filling out Schedule K-1, the partnership should ensure that the insurance payments are properly allocated to the individual partners. This allocation is based on each partner's share of the partnership's income and expenses. The IRS provides guidelines on how to determine these shares, and partnerships must follow these rules to avoid any potential issues during tax audits.

In summary, officer life insurance payments should be reported on Form 1065, specifically on Schedule K-1, Part III. This ensures that the partnership complies with IRS requirements and provides transparency regarding the insurance benefits received by each partner. Accurate reporting of these payments is crucial for maintaining proper financial records and avoiding any potential tax-related complications.

Life Insurance Benefits: Virginia's Exemption Law Explained

You may want to see also

Business Expenses: Premiums can be a deductible business expense

When it comes to business expenses, certain costs can be deducted, and one such expense is the premium paid for officer life insurance. This is a valuable benefit for business owners and their key employees, providing financial security and peace of mind. However, it's important to understand how this premium can be treated for tax purposes and how it fits into the broader context of business expenses.

For tax purposes, the premium paid for officer life insurance can be considered a deductible business expense. This means that the cost of the insurance can be subtracted from the business's taxable income, reducing the overall tax liability. This deduction is particularly beneficial for businesses, as it allows them to allocate resources more efficiently and potentially save on taxes. To claim this deduction, the business must provide evidence of the insurance premium payments, such as receipts or invoices, to support the claim.

The deduction for officer life insurance premiums is typically reported on Form 1065, which is the U.S. Return of Partnership Income. This form is used by partnerships to report their income, expenses, and other relevant financial information to the Internal Revenue Service (IRS). When filing Form 1065, partners must disclose their share of the partnership's income and expenses, including the deduction for officer life insurance premiums. It is essential to accurately report these expenses to ensure compliance with tax regulations.

To maximize the benefits of this deduction, business owners should carefully document and track the payments made for officer life insurance. This includes keeping records of the premium amounts, payment dates, and any relevant insurance documentation. Proper documentation is crucial when it comes to tax deductions, as it provides evidence of the expenses and ensures a smooth audit process if needed. Additionally, consulting with a tax professional or accountant can provide valuable guidance on how to properly categorize and report these expenses.

In summary, officer life insurance premiums can be a significant deductible business expense, offering financial advantages to both the business and its key personnel. By understanding the tax implications and proper reporting methods, business owners can effectively manage their expenses and potentially reduce their tax burden. Staying informed and organized regarding these deductions is essential for maintaining compliance with tax laws and optimizing the financial health of the business.

Coma Patients and Life Insurance: What's the Verdict?

You may want to see also

Distribution Rules: Proceeds must be distributed according to IRS regulations

When it comes to officer life insurance, understanding the distribution rules is crucial, especially for tax purposes. The Internal Revenue Service (IRS) has specific regulations that dictate how the proceeds of such insurance should be handled. These rules are essential to ensure compliance with tax laws and to avoid any potential penalties or legal issues.

According to IRS regulations, the proceeds from officer life insurance are generally considered taxable income. This means that the insurance company will report the death benefit as income to the deceased officer's estate. The estate then becomes responsible for paying any applicable taxes on this income. It is important to note that the tax treatment can vary depending on the type of insurance policy and the specific circumstances of the officer's death.

The distribution of these proceeds is subject to certain guidelines. Firstly, the insurance company must provide the death benefit to the designated beneficiaries as per the policy terms. These beneficiaries can be individuals, such as the officer's spouse, children, or other dependents, or they can be entities like a trust or a business. The proceeds should be distributed in a timely manner to ensure that the beneficiaries can utilize the funds appropriately.

Secondly, the IRS requires that the proceeds be distributed in a specific order of priority. This order is designed to protect the interests of creditors and ensure that the insurance proceeds are used for legitimate purposes. Typically, the distribution starts with any outstanding debts or claims against the deceased officer's estate. This includes any loans, mortgages, or other financial obligations. After settling these debts, the remaining proceeds are distributed to the beneficiaries as specified in the policy.

Lastly, it is essential to maintain proper documentation and record-keeping throughout this process. The insurance company should provide beneficiaries with the necessary paperwork, including proof of death, policy details, and distribution instructions. This documentation is crucial for tax purposes and may be required by the IRS for verification. By adhering to these distribution rules, individuals and organizations can ensure a smooth and compliant process when dealing with officer life insurance proceeds.

Missing 1099 Form: Annuity Life Insurance Tax Return Woes

You may want to see also

State Laws: State-specific rules may vary regarding insurance proceeds

When it comes to officer life insurance and its treatment on tax forms, such as Form 1065, it's important to understand that state laws play a significant role in determining how the insurance proceeds are handled. Each state has its own regulations and requirements regarding insurance benefits, and these can vary widely.

In some states, the insurance proceeds from an officer's life insurance policy may be considered taxable income for the estate or beneficiaries. This means that the amount received from the insurance company would be reported on the appropriate tax forms, potentially impacting the overall tax liability. For example, if an officer's life insurance policy has a substantial death benefit, the state's tax laws might dictate that this amount is subject to income tax when received by the beneficiaries.

On the other hand, certain states may exempt insurance proceeds from taxation, especially if the policy was owned by the deceased officer. These states might allow the proceeds to pass through the estate without being subject to income tax. This can significantly reduce the tax burden for the beneficiaries and provide a more favorable treatment of the insurance benefits.

Additionally, some states have specific rules regarding the allocation of insurance proceeds among beneficiaries. For instance, if an officer has designated multiple beneficiaries, state laws may dictate how the death benefit is distributed. This could involve a per stirpes distribution, where the proceeds are split among the beneficiaries based on their respective shares, or a per capita distribution, where each beneficiary receives an equal portion.

It is crucial for individuals and their financial advisors to research and understand the specific state laws applicable to their situation. Consulting with tax professionals or insurance experts who are well-versed in state-specific regulations can provide valuable guidance on how to navigate these variations in state laws regarding insurance proceeds and their reporting on tax forms like Form 1065.

Unlocking Permanent Life Insurance: Top Providers Revealed

You may want to see also

Frequently asked questions

Officer Life Insurance is a type of insurance coverage provided to officers of a corporation. It is designed to provide financial protection to the officer's family in the event of their death while serving in the role. The proceeds from this insurance can help cover expenses and provide financial security for the officer's beneficiaries.

The premium calculation for Officer Life Insurance is based on various factors, including the officer's age, health, occupation, and the amount of coverage desired. The insurance company uses actuarial tables and assessments to determine the premium rate. This rate is then applied to the chosen coverage amount to arrive at the annual premium payable by the corporation.

Yes, the premiums paid for Officer Life Insurance can be tax-deductible business expenses for the corporation. According to the Internal Revenue Code, the cost of life insurance on the life of an employee, including officers, is generally deductible as a business expense. However, the corporation must ensure that the insurance is not used for personal benefit and that the deduction is reasonable and related to the business.