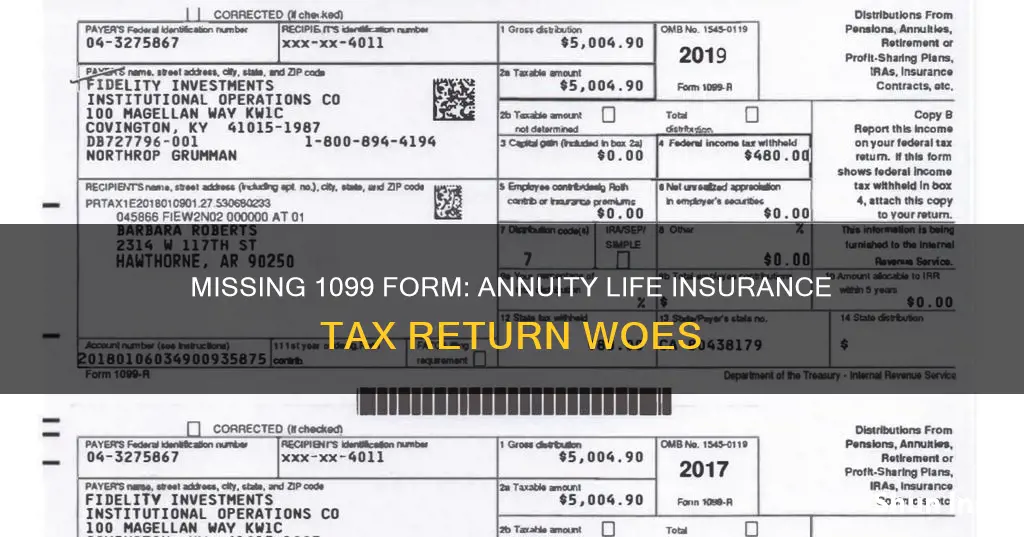

If you didn't receive a 1099 tax form for your annuity life insurance, there are a few possible reasons and steps you can take. First, it's important to understand that not all annuities are required to issue a 1099 form. The requirement to provide a 1099 depends on the type of annuity and how it is used. If you receive payments from an annuity you own or an inherited annuity, you will typically receive a 1099-R form, which reports the amount received and is used to calculate your tax liability. If you sell an annuity, you may receive a 1099-B form to report the sale and calculate capital gains or losses. If you haven't received a 1099 form by mid-February, you should contact the insurance company to request an electronic version. You can also refer to other sources, such as your bank statements or the insurance company's website, to obtain the necessary information for your tax return.

What You'll Learn

What to do if you didn't receive a 1099 form

If you didn't receive a 1099 form, don't panic. Here's what you can do:

Contact the Issuing Party

First, try to contact the employer, payer, or issuing agency directly and request a copy of the missing document. They are required to provide this to you. Make sure your address and other contact details are correct to avoid any further delays.

Contact the IRS

If you are unable to get a copy from the issuing party, your next step is to contact the Internal Revenue Service (IRS). You can call the IRS at 800-829-1040 and provide them with your personal information, including name, address, phone number, Social Security number, and dates of employment. You will also need to provide the employer's or payer's name, address, and phone number. The IRS will then contact the relevant party and request the missing form on your behalf.

Estimate Your Income

In the meantime, while waiting for the missing form, you can estimate your wages and earnings using Form 4852, Substitute for Form W-2, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. You can then attach the relevant form to your tax return when you file.

File Your Tax Return on Time

It is important to file your tax return on time, even if you are missing some documentation. You can still file an accurate return based on your own records of income and payments received. For example, if you are a freelancer, you can use your records of payments received, such as bank statements or invoices, to prepare your taxes.

File an Amended Return if Necessary

If you receive the missing 1099 form after filing your return and the information differs from your previous estimate, you will need to file an amended return. In this case, you would file Form 1040-X, Amended U.S. Individual Income Tax Return, to correct any discrepancies.

Consult a Tax Professional

If you are unsure about how to handle a missing 1099 form or have complex income sources, it is always a good idea to consult a qualified tax advisor or CPA. They can guide you through the process and ensure you are complying with all relevant tax laws and regulations.

Remember, it is important to keep accurate records of your income and payments, as this will make it easier to file your taxes, even if you don't receive a 1099 form.

Selling Life Insurance: A Path to Wealth?

You may want to see also

How to report interest income without a 1099-INT form

If you haven't received a 1099 form from your life insurance provider by January 31, you should contact them to request a copy. You can also call the IRS for further assistance.

If you haven't received a Form 1099-INT, you can still report your interest income. If you receive a 1099-INT, you may or may not have to pay income tax on the interest it reports, but you will need to include the information from it on your return. The same is true if you don't receive a 1099-INT form. Here's how to report interest income without a 1099-INT form:

- Understand your interest income: If you have any interest-bearing accounts or investments, you need to determine how much interest you earned during the tax year. This information is usually reported to you on a 1099-INT form, but you can also find it by reviewing your account statements or contacting the financial institution.

- Report your interest income on your tax return: If you don't receive a 1099-INT form, you can still report your interest income on your tax return. You will need to include the total amount of taxable interest you received for the year on the "taxable interest" line of your tax return. This information is typically reported on Schedule B of your tax return.

- Keep track of any tax-exempt interest: If you earned any tax-exempt interest, such as interest from municipal bonds, you will still need to report it on your tax return. This information is typically reported on the "tax-exempt interest" line of your tax return.

- Report any federal tax withheld: If any federal tax was withheld from your interest income, you will need to report this on your tax return as well. This information is typically reported in the "payments" section of your return and can reduce the amount of tax you owe or increase your refund.

- Be aware of any early withdrawal penalties: If you withdrew money from an account before the maturity date and were charged an early withdrawal penalty, you may be able to deduct this amount on your tax return. This is typically reported on Schedule 1 of Form 1040 as an adjustment to income.

- Consider any other tax implications: Depending on your specific situation, there may be other tax implications related to your interest income. For example, if you received interest income as a nominee, you will need to report it on Schedule B and issue a 1099-INT form to the person who actually earned the interest.

It's important to remember that even if you don't receive a 1099-INT form, you are still responsible for reporting your interest income on your tax return. The information provided above is a general guide, and you should consult a tax professional or the IRS website for more detailed instructions on how to report your interest income without a 1099-INT form.

Wealth Calculation: Does Life Insurance Count?

You may want to see also

When to expect to receive a 1099 form

If you're expecting to receive a 1099 form, it's important to know when to expect it so you can start preparing your tax return. Here's what you need to know about when to expect your 1099 form:

When to Expect Your 1099 Form

- In general, you should receive your 1099 forms by January 31st of each year. This deadline is set by the IRS, and it applies to most 1099 forms, including the commonly received 1099-NEC and 1099-MISC.

- If you receive your forms digitally, you can expect them by January 31st. If you receive paper forms by mail, they may arrive a few days later, but they should be postmarked by the end of January.

- The deadline for the 1099-R form, which is relevant for life insurance policies and annuity contracts, is also January 31st.

- However, there are different due dates for different types of 1099 forms. For example, the due date for the 1099-MISC form is February 1st or February 16th, depending on the specific type of payment it reports.

- If you haven't received your 1099 form(s) by mid-February, you should contact the person or business responsible for sending them to request a copy.

- Keep in mind that the IRS requires organizations to supply 1099 forms by January 31st of the year following the reported income earned. So, for income earned in 2023, you can expect to receive your 1099 forms by the end of January 2024.

Whole Life Insurance: Cashing Out a Lapsed Policy?

You may want to see also

How to request a 1099 form from the insurance company

If you haven't received your 1099 form by mid-February, you should contact the insurance company as soon as possible. You can also call the IRS's main customer service number for help if you can't get in touch with the insurance company.

The deadline for companies to mail 1099s to taxpayers is usually January 31 of the year following the tax year. If the deadline falls on a weekend, it rolls over to the next business day. However, it's important to note that you are still responsible for paying any taxes owed on income earned during the tax year, even if you don't receive a 1099 form.

If you receive an incorrect 1099 form, ask the insurance company to send and submit an amended form to the IRS. If you haven't received the expected 1099 form for income earned, you may be able to report it under miscellaneous income.

Remember, a 1099 form is a record of non-salary income, such as distributions from a retirement account, interest income, or income from an independent contractor work. It is used to report this income to the IRS, and you will need it to accurately report your income on your tax return.

Life Insurance: What Happens When You Die?

You may want to see also

What to do if you don't receive a 1099 form by mid-February

If you haven't received your 1099 form by mid-February, there are a few things you can do. Firstly, it's important to remember that you won't get into any trouble for a missing form. The responsibility for sending the form lies with your client, and they are the only ones who can be penalised for not sending it on time.

You should, however, still report your income, even if you don't receive a 1099 form. This is because, while clients are only required to send a 1099 form if they paid you $600 or more, there is no minimum threshold for taxpayers when it comes to reporting their own income.

Step 1: Contact the Issuing Party

If it's still early February, you can contact the issuing party, such as your employer or client, to request a copy of the missing document. Make sure your address is correct, and that they have your correct details.

Step 2: Don't Ask for the Missing Form

If it's well past mid-February, don't waste time requesting the missing form. There's a small chance that if you ask for it, you might end up with two of the same form, which could cause unnecessary complications. Additionally, there's nothing to gain from asking for the form, as any penalties for not sending it will be incurred by the other party.

Step 3: Report Your Income

Instead of worrying about the missing form, report your income yourself. You can reconstruct your income by looking through profit and loss statements, bank accounts, payment app accounts, and records of cash income. This income goes on Schedule C of your personal tax return.

Step 4: Be Proactive for Next Year

To encourage your clients to send you 1099s in the future, you can take matters into your own hands by filling out a W-9 form and sending it to your clients before the end of the year. This will help them fill out the 1099s they are required to send you, and ensure they have all the necessary information.

Remember, even if you don't receive a 1099 form, it's important to report your income accurately and on time to avoid any issues with the IRS.

Primerica Whole Life Insurance: Is It Worth the Investment?

You may want to see also

Frequently asked questions

Contact the insurance company that issued the annuity and request an electronic version of the form.

You may receive a 1099-R if the owner of the contract is an entity other than an individual, or if there was a change in ownership and a gain was made.

A 1099-R is generated if you received a distribution of more than $10 in cash, or as an unpaid loan balance or stock certificate from a benefit event like changing jobs.

If you haven't received it by mid-February, contact the payer. If you still don't get the form by February 15, call the IRS for help at 1-800-829-1040.

You can enter the interest income the same way you would if you had received a 1099-INT. The life insurance death benefits are not taxable and do not need to be reported.