Voluntary child life insurance is an optional benefit provided by employers that pays out a cash benefit to the parents or guardians of an employee's child upon the child's death. It is usually purchased by an employee alongside their own voluntary life insurance policy, which is a separate financial protection plan that provides a cash benefit to a beneficiary upon the death of the insured. The cost of voluntary child life insurance is often $2 per month, regardless of the number of children covered.

| Characteristics | Values |

|---|---|

| Type of insurance | Voluntary life insurance is a financial protection plan that provides a cash benefit to a beneficiary upon the death of the insured. |

| Who offers it? | It is an optional benefit offered by employers. |

| Who pays the premium? | The employee pays a monthly premium in exchange for the insurer's guarantee of payment upon the insured's death. |

| Cost | Premiums are less expensive than individual life insurance policies sold in the retail market. |

| Payment method | The premium is often deducted from the employee's salary. |

| Timing | It is available to an employee immediately upon hiring or shortly thereafter. |

| Coverage | Coverage ends upon the employee's termination or if they quit. |

| Additional benefits and riders | Many insurers provide additional benefits and riders, such as the option to purchase insurance above the guaranteed issue amount, coverage portability, and the ability to accelerate benefits. |

| Types | There are two basic types of voluntary life insurance: voluntary whole life and voluntary term life. |

| Voluntary whole life insurance | This type of insurance protects the entire life of the insured and any spouse or dependent they choose to cover for an additional fee. Cash value accumulates over time. |

| Voluntary term life insurance | This type of insurance offers protection for a limited period, such as 10, 20, or 30 years. Premiums are less expensive than whole life insurance premiums. |

What You'll Learn

- Voluntary child life insurance is an optional benefit for employees

- It pays out a cash benefit to beneficiaries upon the death of the insured child

- It is usually cheaper than standard retail life insurance policies

- It is paid for by a monthly premium, often deducted from payroll

- It is available to employees immediately or soon after they join a company

Voluntary child life insurance is an optional benefit for employees

Voluntary child life insurance is a great way for employees to ensure their children are financially secure if the unexpected happens. It is especially beneficial for employees with long-term health conditions, as voluntary life insurance policies often don't require medical information and offer lower rates than traditional life insurance policies.

In addition to the death benefit, voluntary life insurance may offer other advantages. For example, employees can often purchase additional coverage for their children, providing a smaller fixed amount compared to their own policy. This type of insurance is also usually portable, meaning employees can continue their coverage even if they leave their current employer.

When considering voluntary child life insurance, employees should review the policy terms, including maximum coverage limits and the impact of the dependent's age on premium costs. It is also essential to compare the employer's offering with other firms' plans to ensure it is among the best available options.

Overall, voluntary child life insurance is a valuable benefit for employees, providing peace of mind and financial security for their loved ones.

THC Use and Amica Life Insurance: What's the Verdict?

You may want to see also

It pays out a cash benefit to beneficiaries upon the death of the insured child

Voluntary child life insurance is a type of life insurance that is optional and can be purchased in addition to a guaranteed issue group life policy offered by an employer. It is also known as supplemental life insurance or optional life insurance. Membership organizations and labour unions also offer voluntary life insurance.

Voluntary life insurance works by paying a death benefit to the beneficiaries if the insured dies while the policy is in force. The cash benefit, also known as the death benefit, can be used for any expense the beneficiary deems necessary and there are no limits on how it may be spent. Coverage amounts are typically determined as a percentage of the insured's base salary.

The cost of voluntary life insurance is usually much cheaper than the cost of a private, individual life insurance policy because the insured is paying group rates. The coverage amounts for voluntary life insurance are typically multiples of the insured's salary, and the premiums are often deducted directly from the insured's paycheck. The premiums are usually not taxable if the death benefit is less than $50,000.

Voluntary life insurance policies may be available as either term life or whole life insurance. Term life insurance offers coverage for a certain period, such as 10 or 20 years, while whole life insurance remains in place throughout the life of the insured. Whole life insurance policies build cash value that can be tapped into, whereas term life insurance policies do not have this characteristic.

In the case of voluntary child life insurance, the policy covers the life of a minor and is typically purchased by a parent, guardian, or grandparent. These policies are usually whole life products, which means the coverage lasts for the child's entire life as long as the premiums are paid. Coverage amounts tend to be low, often under $50,000, and premiums are locked in and won't increase.

Sun Life Insurance: Cataract Surgery Coverage Explained

You may want to see also

It is usually cheaper than standard retail life insurance policies

Voluntary child life insurance is usually cheaper than standard retail life insurance policies. This is because the company can leverage a cheaper premium through the negotiating power of multiple employees. In other words, the more people covered by a plan, the less overall risk the insurer takes, and the less they charge in premiums. This can make group coverage more affordable than buying the same policy on your own.

Voluntary life insurance is also traditionally cheaper than standard retail life insurance policies because it is an optional benefit offered by employers, who sponsor the policies. This employer sponsorship generally makes premiums less expensive than individual life insurance policies sold in the retail market.

Voluntary term life insurance plans are also usually cheaper than whole life insurance plans, as they don't allow for variable investing or build-up in value.

However, it's important to note that if you leave your job, your voluntary life insurance coverage will likely end, and if you want to keep your coverage, you will probably have to pay more for the privilege.

Whole Life Insurance: Injury Payouts Explained

You may want to see also

It is paid for by a monthly premium, often deducted from payroll

Voluntary child life insurance is an optional benefit that is often available to employees when they join a company or as part of their yearly selection of company benefits. It is usually offered to employees who already have basic life insurance coverage. The monthly premium for this type of insurance is often deducted from payroll, making it convenient for the employee and ensuring timely payment of premiums.

The cost of voluntary child life insurance is generally lower than that of standard retail life insurance policies. This is because the employer can negotiate a cheaper premium for a group of employees, leveraging their collective buying power. The premium is typically arranged as a salary deduction from the employee's regular pay. While the premium is usually paid by the employee, some employers may choose to cover the cost as part of their benefits package.

Voluntary child life insurance is typically available in two types: voluntary whole life insurance and voluntary term life insurance. Voluntary whole life insurance covers the insured for their entire life, while voluntary term life insurance covers them for a specific period, such as 10, 20, or 30 years. The premiums for voluntary term life insurance are generally lower than those for whole life insurance, as it does not allow for variable investing or a build-up in value.

The amount of coverage provided by voluntary child life insurance varies and is usually lower than the coverage for the employee themselves. It can be purchased in multiples of $10,000, with a maximum benefit ranging from $25,000 to 250,000, depending on the employer's plan. The cost of coverage decreases by 35% when the insured reaches the age of 70.

It is important to note that voluntary child life insurance is not the same as child life insurance, which is a separate type of insurance that covers the life of a minor and is typically purchased by a parent, guardian, or grandparent.

MetLife Group Insurance: Marijuana Testing and You

You may want to see also

It is available to employees immediately or soon after they join a company

Voluntary child life insurance is an optional benefit provided by employers that allows employees to purchase life insurance for their children. It is available to employees immediately upon hiring or shortly thereafter.

The cost of dependent-child life insurance is usually a fixed amount per month, regardless of the number of children covered. For example, Berklee offers dependent-child life insurance for $2 per month, regardless of the number of children covered. The benefit provided by this insurance is usually a fixed amount, such as $10,000, depending on the child's age.

Voluntary child life insurance is often available as part of a voluntary term life insurance or voluntary whole life insurance plan. Voluntary term life insurance lasts for a specific period, such as 10, 20, or 30 years, while voluntary whole life insurance lasts for the entire life of the insured.

The main benefit of voluntary child life insurance is that it provides financial protection for the employee's family in the event of the death of their child. This can help cover expenses such as burial costs or grief counselling. Additionally, it can provide peace of mind for employees, which can lead to increased engagement, innovation, and productivity in the workplace.

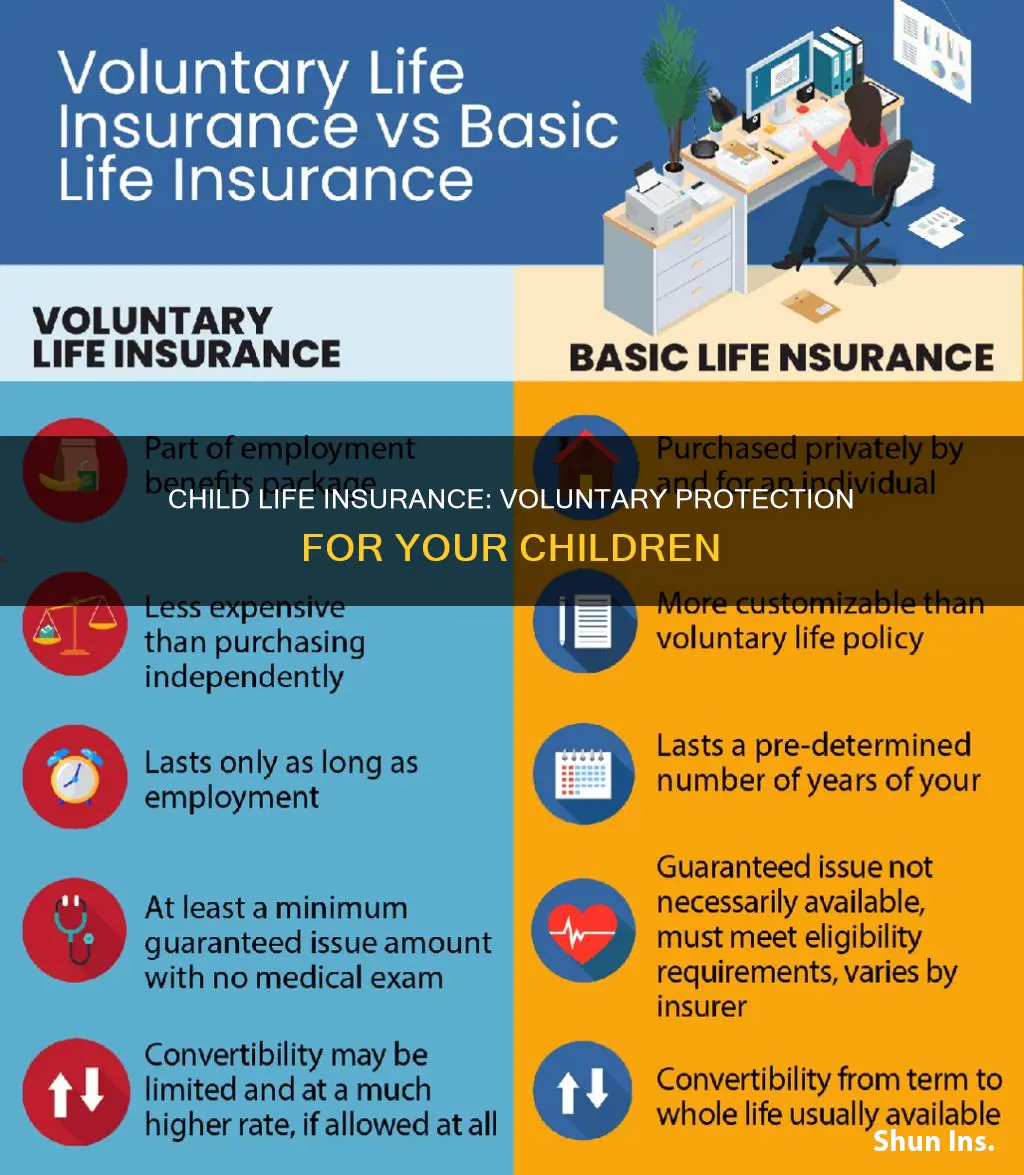

It's important to note that voluntary life insurance is separate from basic life insurance, which is often provided by employers at no cost to the employee. Voluntary life insurance is an optional benefit that employees can choose to purchase, typically through payroll deductions.

Prudential Life Insurance: Is It a Good Choice?

You may want to see also

Frequently asked questions

Voluntary child life insurance is an optional benefit provided by employers that allows employees to insure their children. It is a type of voluntary dependent life insurance.

The employee pays a monthly premium, which is often deducted directly from their salary. If the insured child passes away, the insurer pays out a cash benefit to the beneficiaries named in the policy.

Voluntary child life insurance is usually cheaper than a standard retail life insurance policy as employers can negotiate a cheaper premium for their employees. It also offers peace of mind to employees, which can increase productivity and engagement at work.

There are two main types of voluntary child life insurance: voluntary term life insurance and voluntary whole life insurance. Term life insurance covers a set period, such as 10, 20, or 30 years, while whole life insurance covers the child's entire life.

The cost of voluntary child life insurance depends on the age of the child and the coverage amount. Premiums are typically higher for older children and for whole life insurance policies.