Life insurance is a contentious issue in the Islamic faith. While some scholars argue that it is permissible for Muslims to have life insurance, others claim that it is forbidden. The disagreement stems from the interpretation of specific Islamic laws and principles. The three main arguments against life insurance are that it involves gharar (uncertainty), maysir (gambling), and riba (interest), all of which are considered haram in Islam. However, some scholars, such as Mustafa Ahmad Al-Zarqa, Abdelwahab Khallaf, and Monzer Kahf, argue that term life insurance is permissible because it embodies the spirit of caring within Islam and ensures the financial security of families. They emphasize that the necessity and need to protect one's family outweigh the potential issues. Ultimately, the decision to obtain life insurance is a personal one, and Muslims must carefully consider the various Islamic laws and principles before making a decision.

| Characteristics | Values |

|---|---|

| Is life insurance halal? | It can be halal if it is set up in the right way. |

| What makes it halal? | No elements of uncertainty (gharar), gambling (maysir) and interest (riba) |

| What is an example of halal life insurance? | Takaful, a form of insurance that is compliant with Sharia law principles. It involves the pooling and investment of funds. |

| What are the types of life insurance? | Whole life insurance and term insurance |

What You'll Learn

Uncertainty (Gharar)

Uncertainty, or gharar, is a significant concern in the Islamic perspective on life insurance. Gharar refers to the ambiguity in transactions, making the terms of the exchange unclear and introducing financial risk. This uncertainty is considered unacceptable in Islam, as it can lead to financial loss and is seen as a form of deceit.

Gharar in the context of life insurance means that the policyholder might be paying for something they may never benefit from, or they could receive more money than they have contributed, creating an uncertain and risky situation. This uncertainty is heightened when insurance funds are invested in various businesses or bank products to grow the payout, as the outcome of these investments is unpredictable.

To avoid gharar, due diligence is crucial. By thoroughly investigating a person's health and past, Islamic insurance companies can make risks measurable and contained. This due diligence ensures that policies provide certainty and guaranteed payouts while adhering to Islamic rules.

Additionally, some scholars argue that life insurance does not contradict Islamic teachings. They believe that Allah encourages Muslims to take necessary precautions and make preparations for their family's future, even after their death. Thus, life insurance can be seen as a form of responsible planning rather than encroaching on Allah's domain.

Who Gets the Payout? POA and Life Insurance Beneficiaries

You may want to see also

Gambling (Maysir)

The Quran forbids all transactions that are based on riba (usury, interest) and deceit. Some scholars argue that life insurance is haram because it involves gharar (buying/selling something where it is not known whether what is being bought/sold will be delivered or achieved) and riba.

However, others argue that life insurance is halal if it is set up in the right way. One source argues that insurance is the opposite of gambling (maysir) because it is a form of risk protection. In addition, some scholars consider life insurance based on takaful to be halal. Takaful is a risk-sharing arrangement where participants pool money into a fund that is used to pay out claims. This is considered halal because the premiums are invested in sharia-compliant assets and are given with the intention of being a gift (hibah).

On the other hand, some scholars argue that takaful is impermissible because it is similar to conventional insurance, which involves elements of gambling and interest. They argue that takaful premiums are not gifts but premiums, and if you do not pay them, you do not get coverage.

Overall, there are differing opinions on whether life insurance is halal or haram, with some scholars arguing that it involves gambling (maysir) and others arguing that it is a form of risk protection.

Tech-Enhanced Life Insurance: The Future of Protection

You may want to see also

Interest (Riba)

Interest, or riba, is a concept in Islamic banking that refers to charged interest. It is considered exploitative and is forbidden under Sharia law. The Quran explicitly prohibits riba in multiple verses, including:

> O, you who believe, do not consume riba, doubled and multiplied, but fear Allah. (Quran 3:130)

> Allah has permitted trade and forbidden riba. (Quran 2:275)

Riba is seen as harmful as it creates an imbalance between the borrower and the lender. The lender receives a guaranteed profit (the interest payment) over and above the actual loan amount, without assuming any of the risks. This goes against the Islamic principles of fairness, societal wellbeing, and justice, which emphasise the greater societal good and social wellbeing.

Riba is also considered harmful as it enables the concentration of wealth among the rich, while the poor get poorer. It is a risk-free gain that does not benefit society and is dependent on stable markets.

Muslims who partake in riba, whether by charging or paying interest, are encouraged to repent. This requires sincere regret and an immediate stop to the practice of riba.

While it can be challenging to avoid riba in modern banking systems, there are interest-free alternatives available, such as cost-plus financing loans (murabaha), partnerships or joint ventures (musharaka), benevolent loans (qard hasanat), safe custody accounts (wadiah), and Islamic bonds (sukuk).

Diabetes and Life Insurance: Impact and Implications

You may want to see also

Takaful (Sharia-compliant insurance)

Takaful is a type of Islamic insurance that is Sharia-compliant and based on Islamic religious law. It involves participants contributing money to a pooled fund that guarantees each other against loss or damage. Takaful insurance is designed as an alternative to conventional insurance, which is believed to go against Islamic restrictions on riba (interest), al-maisir (gambling), and al-gharar (uncertainty).

In a Takaful arrangement, policyholders agree to guarantee each other and make contributions to a mutual fund instead of paying premiums. The takaful fund is managed and administered on behalf of the participants by a takaful operator, who charges a fee to cover costs such as sales, marketing, underwriting, and claims management. Any claims made by participants are paid out of this fund, and any remaining surpluses belong to the participants, who may receive them as cash dividends or a reduction in future contributions.

Takaful insurance policies cover health, life, and general insurance needs. The principles of Takaful include cooperation between policyholders, sharing of losses and liabilities, elimination of uncertainty, and no advantage for one party over another. This concept of cooperative insurance is grounded in Islamic Muamalat, which refers to the commercial and civil acts or dealings branch of Islamic law.

The global Takaful insurance market was valued at $24.85 billion in 2020 and is projected to reach $97.17 billion by 2030, experiencing significant growth. Takaful is particularly attractive to the large demographic of young Muslims, who will comprise a sizeable customer base as their wealth grows over time.

While Takaful is considered a permissible form of insurance by many Islamic scholars, there is still some debate within the Islamic community. Some scholars argue that Takaful is similar to conventional insurance, with only a change in terminology and language of the contract. Additionally, there is criticism that Takaful participants are not involved in the management of the Takaful, with crucial decisions being made by the Takaful operator and its shareholders.

Life Insurance Cash Redemption: What's the Real Deal?

You may want to see also

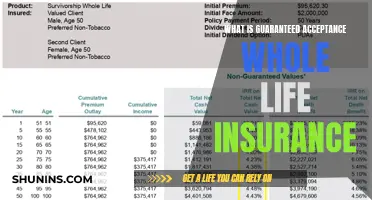

Whole life insurance

The cost of whole life insurance varies based on several factors, such as age, occupation, and health history. Older applicants typically have higher rates than younger applicants. People with a stellar health history normally receive better rates than those with a history of health challenges. The face amount of coverage also determines how much a policyholder will pay; the higher the face amount, the higher the premium.

Extended Term Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Islamic law permits Takaful, a form of insurance where policyholders pool premiums to support one another. This embodies the spirit of caring within Islam and is the only option for Muslims when available. However, Takaful is not available in the United States, so leading Islamic scholars permit term life insurance to ensure care for Muslim-American families.

Takaful is a Shariah-compliant insurance model where funds (premiums) are pooled from the insured members per an agreed-upon contract. These funds are invested in low-risk, halal investments, and profits and losses are shared. Takaful is based on the principles of cooperation and shared profit/loss, and Shariah scholars deem it permissible in Islam.

Conventional term-based life insurance is not permissible since this form of life insurance contains elements of gharar (uncertainty), maysir (gambling), and riba (interest), which are all deemed haram in Islam.

There are two main types of life insurance: term life insurance and whole life insurance. Term life insurance is valid for a specified time period, while whole life insurance pays out a lump sum to beneficiaries whenever the insured dies.