Understanding the status of your insurance coverage is crucial to ensure you are protected when you need it most. Knowing if your insurance is active can help you avoid gaps in coverage and provide peace of mind. This guide will outline the steps you can take to verify your insurance status, including checking your policy documents, contacting your insurance provider, and using online resources. By following these simple steps, you can confirm whether your insurance is active and ensure you have the coverage you need.

What You'll Learn

- Check Policy Documents: Review your insurance policy documents for activation dates and conditions

- Contact Insurance Provider: Reach out to your insurance company for confirmation of active status

- Online Account Access: Log in to your online account to view policy details and coverage

- Payment History: Verify recent payments to ensure your policy remains active

- Policy Renewal Reminders: Pay attention to renewal notices and follow-up actions required

Check Policy Documents: Review your insurance policy documents for activation dates and conditions

To determine if your insurance is active, the most direct approach is to review your policy documents. These documents, often provided by your insurance company, contain crucial information about your coverage, including activation dates and conditions. Here's a step-by-step guide on how to check them:

Locate Your Policy Documents: Start by finding the original documents that were provided when you purchased the insurance. These might include the insurance certificate, policy statement, or any other paperwork. They are typically sent to you via email, post, or provided in a physical office visit.

Identify Activation Dates: Within the policy documents, look for sections that specify the activation date of your insurance. This date is when your coverage officially begins. It's important to note that some policies might have a waiting period before coverage starts, so ensure you understand these terms.

Understand Exclusions and Conditions: In addition to activation dates, carefully review the terms and conditions of your policy. This section will outline what is covered and what is excluded. It's essential to know these details to ensure you understand the scope of your insurance. For instance, some policies might have specific conditions for certain types of claims or may require you to notify them of any changes in your circumstances.

Contact Your Insurance Provider: If you're unable to find the necessary information in the policy documents, or if you have any doubts, contact your insurance provider. They can provide clarification on any terms or dates you're unsure about. It's always better to seek clarification to avoid any potential issues with claiming.

By thoroughly reviewing your policy documents, you can ensure that you have a clear understanding of when your insurance is active and what it covers. This proactive approach can save you from potential confusion or delays when making a claim.

Switching Pharmacies with Changing Insurance: A Guide to Transferring Your Prescriptions

You may want to see also

Contact Insurance Provider: Reach out to your insurance company for confirmation of active status

If you want to ensure that your insurance is active and valid, the most direct way to confirm this is by contacting your insurance provider. This step is crucial, especially if you've recently purchased a new policy or made any changes to your existing coverage. Here's a guide on how to proceed:

When you reach out to your insurance company, you can typically do so through various channels. Many insurance providers offer multiple contact options for customer convenience. These may include a dedicated customer service phone line, an email address, or even a live chat feature on their website. Choose the method that is most convenient for you and ensures you receive a prompt response.

During your conversation or correspondence, clearly state your request for confirmation of the insurance's active status. Provide your policy number or any other relevant information that can help the representative quickly access your account. Be specific about the type of insurance you are inquiring about, such as health, auto, or home insurance, to ensure the correct details are retrieved.

The insurance representative will then verify your policy and provide you with the necessary information. They might confirm that your policy is indeed active and valid, or they may inform you of any potential issues or upcoming changes. It is essential to pay attention to any details they provide and ask for clarification if needed.

Additionally, the representative may offer guidance on how to manage your policy, such as making premium payments, updating personal information, or filing claims. They can also explain the coverage limits and any recent changes in your policy that you should be aware of. By taking this proactive step, you can ensure that your insurance is active and that you have a clear understanding of your coverage.

UPS Declared Value: Insurance or Not?

You may want to see also

Online Account Access: Log in to your online account to view policy details and coverage

To determine if your insurance is active, one of the most straightforward methods is to log into your online account. Most insurance providers offer this option on their websites or through dedicated mobile apps. Here's a step-by-step guide on how to access your policy information:

First, locate the official website of your insurance company. You can usually find this information on your insurance card or by searching for the company's name online. Once you're on the homepage, look for the 'Customer Login' or 'My Account' section. This area is typically designed to be user-friendly and may be prominently displayed. Enter your unique username or email address and the corresponding password to access your personal account. If you're accessing the account for the first time, you might need to reset your password or create a new one if you haven't already.

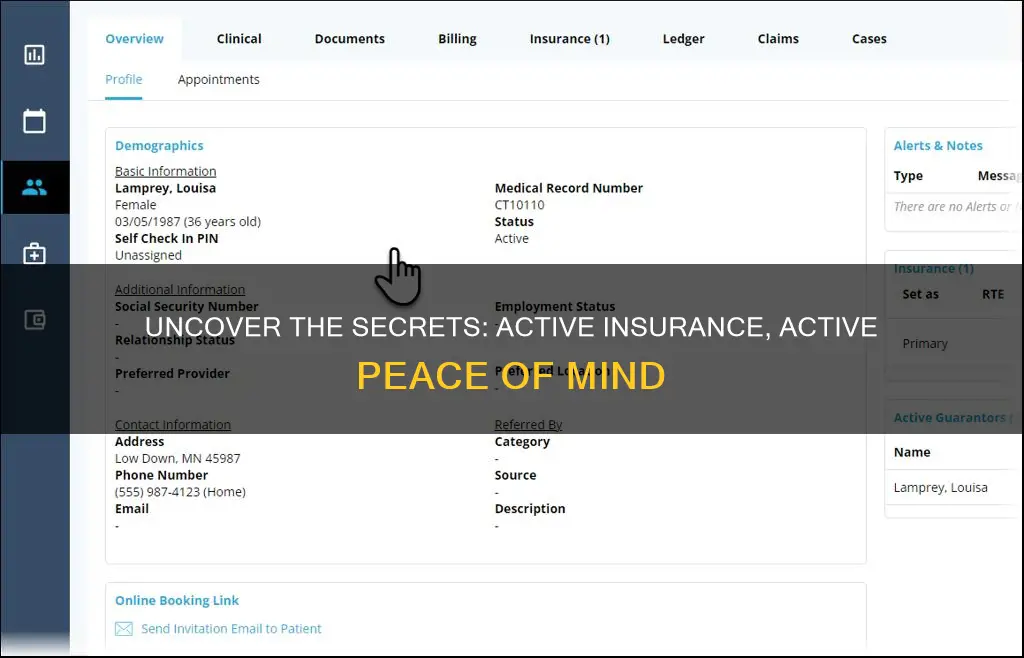

After successfully logging in, you will be directed to a dashboard or an overview page that provides a summary of your insurance policies. Here, you should be able to see the details of your active policies, including the policy number, coverage type, and any relevant dates. Look for a section labeled 'Policy Information' or 'Coverage Details' to find this data. The online platform might also display the status of your policy, clearly indicating whether it is active, inactive, or pending.

If you prefer a more visual representation, some insurance companies provide a calendar or timeline view of your policies. This feature allows you to see at a glance when your coverage starts and ends. You can also use this interface to update your personal details, make payments, or request changes to your policy.

In addition to policy details, your online account might offer other useful features. These could include the ability to view claim history, download documents, or contact customer support. Familiarize yourself with the various options available to make the most of your online account. Remember, having online access to your insurance information empowers you to stay informed and take control of your insurance needs.

Mileage Impact on Insurance Settlements

You may want to see also

Payment History: Verify recent payments to ensure your policy remains active

To ensure that your insurance policy remains active, it's crucial to keep track of your payment history. Here's a step-by-step guide on how to verify recent payments:

- Review Your Policy Documents: Start by locating your insurance policy documents, which should include important details such as the policy number, coverage details, and payment terms. Look for any specific instructions or guidelines provided by your insurance company regarding payment verification.

- Check Payment Due Dates: Identify the due dates for your insurance premiums. These dates are typically mentioned in your policy documents or on the billing statements you receive. Make a note of these dates to ensure you don't miss a payment.

- Access Your Online Account: Most insurance companies offer online portals or customer portals where you can view your policy details and payment history. Log in to your account using your credentials (usually your policy number and a secure password or PIN). Navigate to the 'Payment History' or 'Billing' section to see a record of all your recent payments. This section will provide information on the amount paid, payment date, and any relevant transaction details.

- Contact Your Insurance Provider: If you prefer a more direct approach, reach out to your insurance company's customer service department. Provide them with your policy number and any relevant personal details to access your account information. They can assist in verifying your payment history and provide a detailed report of recent transactions. You can usually find the customer service contact information on your billing statements or on the company's website.

- Keep Records: Maintain a record of all your insurance payments, including the payment amount, date, and method. This documentation will be useful if you need to dispute a payment or provide proof of coverage. It's a good practice to store these records in a secure place, either physically or digitally, for easy access when needed.

By regularly reviewing your payment history, you can ensure that your insurance policy remains active and avoid any potential coverage gaps. It's essential to stay organized and proactive in managing your insurance to protect your interests and financial well-being. Remember, timely payments are a fundamental aspect of maintaining an active insurance policy.

Verizon's Cell Phone Insurance: A Comprehensive Guide to Coverage and Benefits

You may want to see also

Policy Renewal Reminders: Pay attention to renewal notices and follow-up actions required

When it comes to insurance, staying on top of policy renewals is crucial to ensure continuous coverage and avoid any gaps in protection. Here are some essential reminders to help you navigate the process effectively:

Stay Informed About Renewal Notices: Insurance companies typically send renewal notices well in advance of the policy's expiration date. These notices provide important details about the upcoming renewal, including the new premium amount, any changes to the policy coverage, and the renewal date. It is essential to pay attention to these notices as they serve as a reminder of the upcoming changes and your responsibility to take action. Make sure to review the information carefully and keep the notice in a safe place to avoid missing any critical details.

Understand the Renewal Process: Policy renewals often involve a series of steps that you need to complete. This may include providing updated information, making premium payments, or confirming your coverage preferences. Familiarize yourself with the renewal process to ensure you don't miss any deadlines. In some cases, insurance providers might offer online renewal options, making it more convenient to manage your policy. Take advantage of these digital tools to streamline the process and stay organized.

Take Prompt Action: Renewal notices usually provide a specific timeframe for you to respond. It is crucial to act promptly to avoid any disruptions in your insurance coverage. If you need to make changes or have questions, contact your insurance provider as soon as possible. They can guide you through the necessary steps and ensure that your policy remains active and tailored to your needs. Prompt action also helps in avoiding any potential penalties or additional fees that might arise from late renewals.

Review and Update Your Policy: During the renewal process, take the opportunity to review your policy thoroughly. Check for any changes in your personal or financial circumstances that might impact your coverage. For example, if you've recently purchased a new asset or experienced a significant life event, you may need to adjust your insurance coverage accordingly. Insurance providers can assist in making these changes, ensuring that your policy remains relevant and effective. Regularly updating your policy helps in maintaining comprehensive coverage and maximizing the benefits of your insurance investment.

By being proactive and attentive to renewal notices, you can ensure that your insurance coverage remains active and aligned with your needs. Remember, staying informed and taking timely action are key to maintaining uninterrupted protection throughout the life of your policy.

Becoming an Insurance Examiner: Steps to Success

You may want to see also

Frequently asked questions

To verify the status of your insurance, you can contact your insurance provider directly. They will have the most up-to-date information on your policy and can provide details on whether it is active or not. You can reach out via phone, email, or through their online customer support portal.

Yes, many insurance companies offer online tools and portals for policyholders to access their information. You can log in to your account on their website or mobile app and navigate to the 'Policy Details' or 'Coverage Information' section to view the status of your active policies. Look for any indicators like 'Active' or 'In Force' to confirm your insurance coverage.

If you suspect there might be an issue with your insurance being inactive, it's essential to take action promptly. Contact your insurance provider and inquire about the status of your policy. They might need to review your account, update any missing information, or address any potential issues to reactivate your coverage. It's better to clarify the status early to ensure you have the necessary protection.