Life insurance can be a valuable financial tool, but it's also a target for fraudsters. Scams related to life insurance payouts can range from false claims and forged documents to identity theft and insurance fraud. These fraudulent activities can result in significant financial losses for both the insurance companies and the policyholders. Understanding the various types of scams and how they operate is crucial for anyone involved in the life insurance industry. This article aims to shed light on these deceptive practices, providing insights into their methods and potential impacts, to help protect individuals and organizations from falling victim to such schemes.

What You'll Learn

- False Claims: Scammers make false claims to fraudulently obtain life insurance payouts

- Identity Theft: Thieves steal personal info to impersonate the deceased and claim benefits

- Fraudulent Policies: Creating fake insurance policies to defraud beneficiaries is a common scam

- Phishing: Scammers use emails or calls to trick beneficiaries into revealing sensitive data

- Blackmail: Threatening to expose personal secrets to get life insurance money

False Claims: Scammers make false claims to fraudulently obtain life insurance payouts

Life insurance scams are a serious concern for both individuals and the insurance industry, and one of the most prevalent tactics employed by fraudsters is making false claims to obtain life insurance payouts. These scams can be highly sophisticated and often require a deep understanding of the insurance process, making them particularly challenging to detect and prevent.

Scammers may employ various strategies to make false claims. One common approach is to create a false identity or use an existing identity to apply for life insurance. They might forge documents, such as birth certificates or marriage certificates, to support their fabricated background. For instance, a fraudster could claim to be the beneficiary of a deceased individual, providing false identification and documents to the insurance company. This tactic can be especially dangerous as it often relies on the assumption that the insurance company will not thoroughly verify the information provided.

Another tactic involves making exaggerated or exaggerated claims about the insured's health or lifestyle. Scammers might provide false medical records or misrepresent the insured's medical history to suggest a higher risk profile, thereby increasing the potential payout. For example, they could claim that the insured had a terminal illness or engaged in dangerous activities, which would entitle the beneficiary to a larger death benefit. This type of fraud can be challenging to identify as it often requires a detailed understanding of the insured's medical records and lifestyle choices.

In some cases, scammers may also manipulate the insurance process by creating false witnesses or beneficiaries. They might pressure or deceive individuals into agreeing to be witnesses or beneficiaries, providing false statements or affidavits to support the false claim. This strategy can be particularly insidious as it often involves exploiting personal relationships or creating a sense of urgency to rush the process.

To protect themselves from such scams, individuals should be vigilant and take several precautions. Firstly, thoroughly verify the identity of the insured and the beneficiary, ensuring that all documents and information provided are genuine. Insurance companies often have robust verification processes, and individuals should encourage these steps to ensure the security of the policy. Additionally, maintaining open communication with the insurance provider and regularly reviewing policy details can help identify any discrepancies or unauthorized changes.

Sum Assured: Understanding Your SBI Life Insurance Coverage

You may want to see also

Identity Theft: Thieves steal personal info to impersonate the deceased and claim benefits

Identity theft is a serious concern when it comes to life insurance payouts, as it involves criminals stealing personal information to impersonate the deceased and claim insurance benefits. This type of fraud can have devastating consequences for the rightful beneficiaries and the insurance company. Here's an overview of this scam and how to protect yourself:

Thieves often target life insurance policies because they can be lucrative and relatively easy to exploit. When a person dies, their personal information, including their name, date of birth, Social Security number, and address, becomes valuable to fraudsters. These criminals may obtain this data through various means, such as stealing mail, hacking databases, or even purchasing stolen information on the dark web. Once they have the necessary details, they can begin the impersonation process.

The scam typically unfolds in the following way: After the death of the insured individual, the thief files a claim with the insurance company, providing false or stolen documents. They might use the deceased's identity to open a new bank account or credit card in their name, making it harder for the legitimate beneficiaries to access the insurance payout. In some cases, the fraudster may even attend the funeral or leave a fake obituary to create a sense of legitimacy.

To protect yourself and your loved ones, it is crucial to take proactive measures. Firstly, ensure that your personal information is kept secure and shared only with trusted individuals. Regularly review your financial statements and credit reports to detect any unauthorized activities. When purchasing life insurance, choose a reputable company and consider adding a beneficiary rider to your policy, which can help in the event of identity theft. Additionally, keep all important documents, such as birth certificates and Social Security cards, in a secure location, and shred any sensitive information before disposal.

In the unfortunate event of a loved one's passing, it is essential to act promptly and follow the proper procedures. Contact the insurance company directly and provide them with the necessary documentation to initiate the claims process. Be vigilant and report any suspicious activities to the relevant authorities to help prevent further fraud. By staying informed and taking these precautions, you can significantly reduce the risk of becoming a victim of identity theft in the context of life insurance payouts.

Group Life Insurance: Public Service Benefits Explored

You may want to see also

Fraudulent Policies: Creating fake insurance policies to defraud beneficiaries is a common scam

Fraudulent insurance policies, often referred to as "ghost policies," are a sophisticated scam that targets life insurance beneficiaries. This scam involves creating fake insurance contracts with the sole intention of defrauding the insurance company and the designated recipients of the payout. The scammer typically presents themselves as a legitimate insurance agent or broker, gaining the trust of the policyholder or the deceased's loved ones. They may even forge documents, use stolen identities, or manipulate the policy details to make it appear genuine.

The process usually begins with the scammer identifying a potential victim, often someone grieving the loss of a loved one. They may contact the bereaved individual, posing as an insurance representative, and offer to help with the claims process. During this interaction, the scammer collects sensitive information, such as personal details, bank account numbers, and even the deceased's medical records, which they use to create a false policy. This fake policy is then presented to the insurance company, aiming to obtain a payout.

In some cases, the scammer may even go to great lengths to make the fraud more convincing. They might create a detailed fake policy document, including fabricated beneficiary information, premium payments, and policy terms. The scammer could also use sophisticated methods to mimic the insurance company's processes, such as creating fake emails or letters that appear to be from the insurance provider. This level of deception often makes it challenging for the insurance company to detect the fraud immediately.

Once the insurance company processes the claim and disburses the payout, the scammer disappears, leaving the beneficiaries unaware of the fraud. This scam can result in significant financial losses for the insurance company and emotional distress for the intended beneficiaries. It is crucial for individuals to be vigilant and verify any insurance-related communications, especially when dealing with sensitive personal information.

To protect themselves, beneficiaries should always verify the authenticity of any insurance-related communications. They should contact the insurance company directly through official channels and never provide personal or financial information without prior verification. Additionally, being cautious of unsolicited offers or requests for sensitive data can help prevent falling victim to such scams. Awareness and due diligence are essential in safeguarding oneself from fraudulent activities in the life insurance payout process.

Whole Life Insurance: A Smart Tax Shelter Strategy?

You may want to see also

Phishing: Scammers use emails or calls to trick beneficiaries into revealing sensitive data

Phishing is a prevalent scam that targets life insurance beneficiaries, often through deceptive emails or phone calls. Scammers employ various tactics to manipulate and deceive individuals, aiming to obtain sensitive information such as personal details, login credentials, and financial data. These fraudulent activities can lead to significant financial losses and identity theft if beneficiaries are not vigilant.

The phishing scam typically begins with an email or phone call that appears to be from a legitimate source, such as the insurance company or a financial institution. Scammers may use sophisticated methods to mimic the company's branding, including similar email addresses, logos, and even personalized greetings. They might mention a recent life insurance payout or a pending transaction, creating a sense of urgency to prompt an immediate response. For instance, they may claim that a beneficiary's account has been compromised and requires immediate action to prevent further issues.

In these communications, scammers often request beneficiaries to provide personal information, such as their full name, date of birth, Social Security number, or bank account details. They might also ask for login credentials to access online accounts or even request that beneficiaries transfer funds to a specific account. The sense of urgency and fear created by these messages can be highly effective in tricking individuals into revealing sensitive data without careful consideration.

To protect themselves, beneficiaries should be cautious and verify the identity of the sender. It is essential to contact the insurance company directly through official communication channels, such as the company's website or a trusted phone number, to confirm any requests for personal information. Insurance companies will never ask for sensitive data via email or phone without prior verification of the beneficiary's identity. Additionally, beneficiaries should enable two-factor authentication for their online accounts and regularly review their financial statements for any unauthorized transactions.

By being aware of these phishing tactics and taking proactive measures, beneficiaries can significantly reduce the risk of falling victim to scams and protect their sensitive information. It is crucial to stay informed and report any suspicious activities to the relevant authorities to help combat these fraudulent practices.

Life Insurance and Tax Returns: What's the Connection?

You may want to see also

Blackmail: Threatening to expose personal secrets to get life insurance money

Blackmail is a sinister tactic often employed by fraudsters seeking life insurance payouts. This scam involves the perpetrator threatening to reveal sensitive personal information or secrets to the insurance company or beneficiaries unless they receive a financial reward. The fraudster may have obtained this confidential data through illegal means, such as hacking or social engineering, or they might have been given access by a victim who was manipulated into sharing their personal details.

In this scam, the blackmailer's strategy is to create a sense of fear and urgency. They might threaten to expose embarrassing information, such as illegal activities, infidelity, or other personal scandals, which could potentially ruin the reputation of the deceased or their loved ones. The fraudster may also use this tactic to pressure the insurance company into paying out a larger sum than what is rightfully owed, or to manipulate the beneficiaries into providing financial assistance.

Victims of this scam often find themselves in a difficult position, feeling trapped between the fear of the consequences of the exposure and the financial demands of the blackmailer. They might be encouraged to pay the demanded amount to avoid the potential fallout, which can lead to significant financial loss and emotional distress. It is crucial for individuals to recognize the signs of this scam and take appropriate action to protect themselves and their loved ones.

To avoid falling victim to blackmail, it is essential to maintain confidentiality and be cautious about sharing personal information. If you suspect that someone has access to your or your loved one's private data, report it to the relevant authorities and seek legal advice. Additionally, insurance companies should have robust security measures in place to protect personal information and detect any unauthorized access. By staying vigilant and informed, individuals can better protect themselves from this insidious form of fraud.

Aetna: Life Insurance Options and Features Explored

You may want to see also

Frequently asked questions

Scams related to life insurance payouts often involve fraudulent claims or attempts to manipulate the claims process. To safeguard yourself, ensure that you provide accurate and complete information when making a claim. Keep all necessary documents organized and easily accessible. Be cautious of any unexpected requests for personal or financial information, and always verify the identity of anyone contacting you regarding a claim.

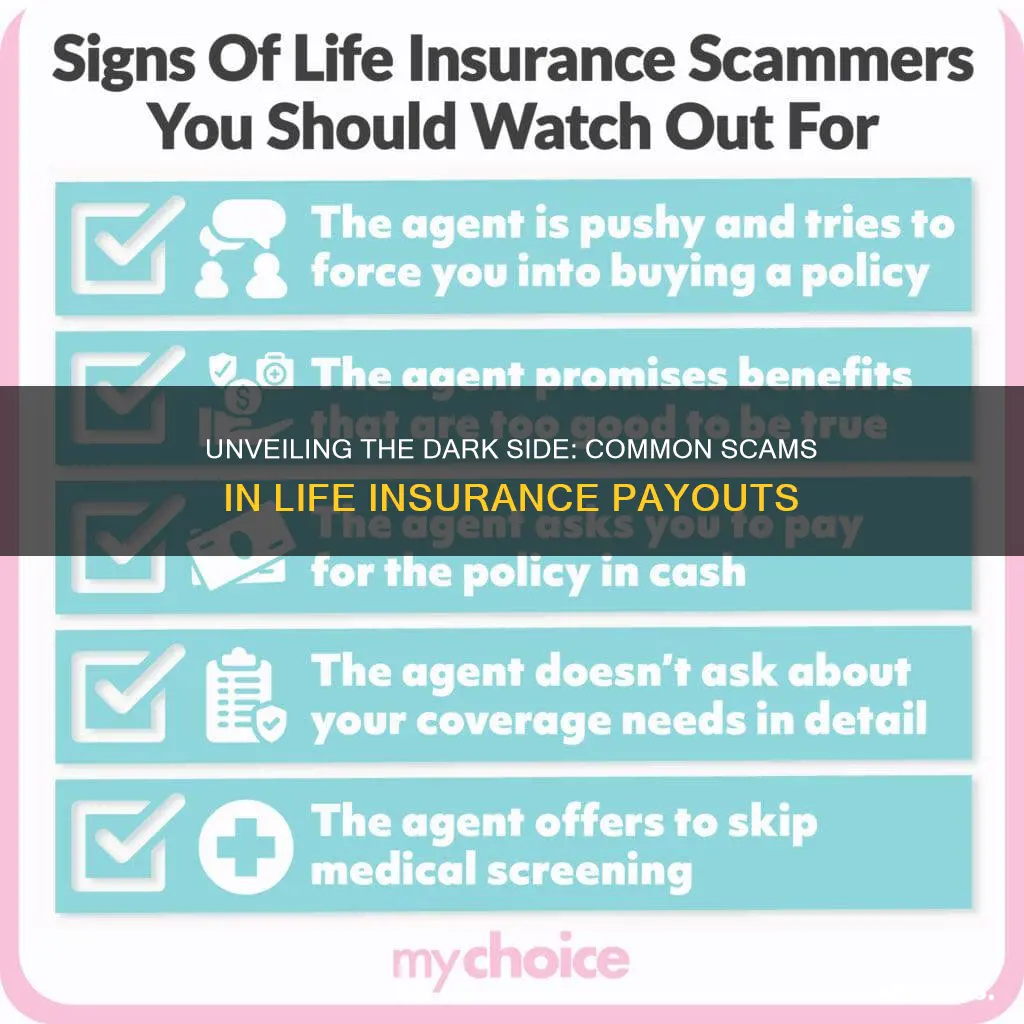

Scammers may employ various strategies to deceive and manipulate. One common tactic is impersonating a deceased individual's next of kin to file a claim. They might also try to pressure policyholders into providing sensitive information by posing as representatives of the insurance company. Additionally, they could offer quick cash loans or investments in exchange for policy assignment, which is illegal and risky.

If you encounter any suspicious activities or have doubts about the legitimacy of a claim, it's crucial to report it. Contact your insurance company's fraud department or the relevant regulatory authorities. Provide them with details of the suspected scam, including any communication you've received and any personal information that might have been compromised. Timely reporting can help protect yourself and others from potential financial losses.