Group life insurance is a single contract for life insurance coverage that extends to a group of people. It is offered by an employer or another large-scale entity, such as an association or labor organization, to its workers or members. It is fairly inexpensive and may even be free for certain employees. Group life insurance is offered by governments in many countries, including India, Canada, and Singapore. In the United States, Veterans' Group Life Insurance (VGLI) is available for veterans who meet certain requirements.

| Characteristics | Values |

|---|---|

| Country | Singapore, Canada, India, United States |

| Target Group | Public officers, public service employees, veterans, government employees, state employees |

| Coverage | Death, disability, illness, accident, retirement |

| Cost | Affordable, low-cost, free |

| Requirements | Age range (18-50 or 55), employment status, income level |

| Application Process | Online, through employer or association |

| Benefits | Financial security, tax benefits, peace of mind |

What You'll Learn

Public Officers Group Insurance Scheme (POGIS)

Coverage and Benefits

POGIS offers high term life coverage of up to S$1,000,000 for the insured, their spouse, and children. This coverage includes protection in the event of death, total and permanent disability, or a terminal illness diagnosis. Additionally, children aged 12 months to 6 years old are eligible for free coverage if both parents are insured under POGIS.

The plan also includes an additional payout of 25% of the coverage amount for accidental death and an additional monthly payout of 1% of the coverage amount for 24 months in the event of total and permanent disability.

Eligibility and Enrollment

POGIS is available to public officers working in government ministries, statutory boards, or organs of state. Their spouses and children are also eligible for coverage. Enrollment is straightforward, and members can manage their policies online.

Continuation and Portability

POGIS members can continue their coverage even after leaving public service or retiring. The Extended Years Coverage benefit allows members to remain insured for up to S$500,000 until the age of 75. Additionally, former POGIS members can take advantage of the Singlife Group Portable Scheme, which offers the same trusted coverage and benefits even after leaving public service.

Add-ons and Discounts

POGIS members can enhance their coverage with critical illness add-ons, such as the Critical Illness rider and the Early Critical Illness rider. These add-ons provide protection against 37 critical illnesses and 10 early critical illnesses, respectively.

POGIS members also enjoy special savings and discounts on other Singlife insurance plans, including car, home, travel, and health insurance. These discounts range from 15% to 54% off the regular premium rates.

The Public Officers Group Insurance Scheme (POGIS) is designed to provide peace of mind and financial security to public officers and their families. With its high coverage amounts, affordable rates, and additional benefits, POGIS ensures that public servants can focus on serving the nation while knowing their loved ones are taken care of.

Maximizing Cash Value in Veterans Group Life Insurance

You may want to see also

Group Life Insurance: How It Works

Group life insurance is a type of insurance policy offered by employers or large-scale entities, such as associations or labour organisations, to their workers or members. It is typically inexpensive and may even be free for certain employees, as the cost is often covered by the employer or split among members. Group life insurance is a common benefit offered to employees, providing financial support to their families in the event of their death.

Group life insurance is purchased by an employer or organisation on behalf of its employees or members. It is a single contract that covers a group of people, allowing companies to secure lower costs for each individual than if they were to purchase an individual policy. This type of insurance is often offered as part of a larger benefits package and does not require members to undergo a medical examination or individual underwriting.

Coverage and Benefits

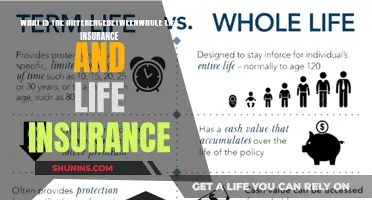

Group life insurance policies typically have a relatively low coverage amount, and the death benefits are generally limited. The typical policy is for term life insurance, which is renewable annually. This means that the policy only provides a death benefit and does not accumulate cash value over time, unlike whole life insurance policies. Whole life insurance policies are permanent, have higher premiums and death benefits, and are the most popular type of life insurance.

Requirements and Conditions

Group life insurance policies usually come with certain conditions. For example, some organisations require members to participate for a minimum amount of time before they are granted coverage. Coverage is normally only valid for as long as a member is part of the group, and it ends when the member leaves or is terminated.

Advantages and Disadvantages

The main advantage of group life insurance for employees is its value for money. Group members often pay very little or nothing at all, as premiums are drawn directly from their earnings. Qualifying for group policies is also easy, and coverage is guaranteed for all members without the need for a medical exam.

However, the low cost and convenience may be outweighed by the basic level of coverage provided. Group life insurance may not fulfil the needs of policyholders, and experts recommend supplementing it with a separate individual policy. Additionally, the employer controls the policy, which means premiums can increase based on their decisions. If an organisation discontinues the group policy or an employee switches jobs, coverage usually stops, although former employees may have the option to continue coverage at the individual level with higher premiums.

Examples of Group Life Insurance Schemes

- Public Officers Group Insurance Scheme (POGIS): Introduced by Singlife in Singapore, POGIS is a life protection plan exclusively for public officers, providing coverage of up to S$1,000,000 for the employee, their spouse, and children.

- Public service group insurance benefit plans in Canada: These plans are part of the Government of Canada's total compensation package for public service employees and include health, dental, disability, and life insurance benefits.

- Veterans' Group Life Insurance (VGLI): Offered by the United States government, VGLI allows veterans to maintain their life insurance coverage after leaving the military by paying premiums. Coverage ranges from $10,000 to $500,000, depending on the level of Servicemembers' Group Life Insurance (SGLI) coverage they had while in the military.

Variable Life Insurance: An Asset or a Liability?

You may want to see also

Public Service Group Insurance Benefit Plans

Features and Benefits

Group life insurance policies offer several advantages to public service employees:

- Affordability: Group life insurance is often inexpensive or even free for members, as the cost is shared among the group.

- No Medical Examination: Members are not required to undergo individual medical examinations or underwriting, making it convenient and accessible.

- Basic Coverage: Group life insurance typically provides a relatively low coverage amount, which may include death benefits and protection in case of total or partial permanent disability.

- Flexibility: Some organizations allow members to purchase additional coverage for themselves and their dependents, providing enhanced financial security.

- Portability: In some cases, group life insurance policies can be converted into individual policies if a member leaves the organization or retires, ensuring continued protection.

Examples of Public Service Group Insurance Plans

- Canada: The Government of Canada offers public service group insurance benefit plans that include health, dental, disability, and life insurance. These plans are part of the total compensation package for public service employees.

- Singapore: Singlife introduced the Public Officers Group Insurance Scheme (POGIS) exclusively for public officers and their families. It offers high term life coverage of up to S$1,000,000, worldwide coverage until the age of 75, and additional benefits such as accidental death payout and coverage for children.

- India: The Indian government has implemented various state and central-sponsored life insurance schemes, such as the Janashree Bima Yojana (JBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY). These schemes aim to provide financial security to individuals and their families, particularly those from low-income groups.

- United States: Veterans' Group Life Insurance (VGLI) is available for military service members, offering term life insurance benefits ranging from $10,000 to $500,000. VGLI allows individuals to maintain their life insurance coverage after leaving the military by paying premiums.

Considerations

While public service group insurance benefit plans offer advantages, there are a few considerations to keep in mind:

- Basic Coverage Limitations: Group life insurance typically provides only basic coverage, which may not fulfill the needs of all policyholders. It is often recommended to supplement it with a separate individual policy.

- Employer Control: The employer or organization controls the policy, and any changes they make can impact premiums and coverage. Leaving the organization may result in the termination of coverage, unless a conversion to an individual policy is made.

- Portability Constraints: Group life insurance policies may not be portable, meaning that once an individual leaves the organization, they may lose their coverage. This is an important factor to consider when deciding on an insurance plan.

In conclusion, public service group insurance benefit plans offer valuable life insurance coverage to public service employees and their families. These plans are designed to be affordable and accessible, providing peace of mind and financial protection. However, it is important to carefully review the specific benefits, limitations, and portability options offered by each plan to ensure it aligns with individual needs and circumstances.

Christians and Life Insurance: Gospel Coalition's Perspective

You may want to see also

Kerala State Employees' Group Insurance Scheme

The Kerala State Employees' Group Insurance Scheme is a low-cost, wholly contributory, and self-financing scheme that provides twin benefits to state employees. It offers an insurance cover to help their nominees in the event of death while in service and a lump-sum payment to augment their resources on retirement.

Who is it for?

The scheme applies to:

- All State Government employees appointed following the rules of recruitment.

- State Government employees on work-charged or contingent establishments on time scales of pay.

- Full-time teaching and non-teaching staff of private schools and colleges under the direct payment scheme.

- Employees of Local Self Government Institutions appointed as per the rules of recruitment.

- Employees of Universities, Public Sector Undertakings, and other semi-Government bodies.

- Employees to whom the scheme has been extended under Government orders, other than those mentioned above.

Who is it not for?

The scheme does not apply to:

- Persons in casual employment.

- Persons subject to discharge from service on less than one month's notice.

- Persons for whom appointment and other matters are made by law or contract.

- Re-employed defence personnel covered by the extended insurance scheme under the schemes applicable to armed forces members.

Membership

Membership of the scheme is optional for employees who were in service as of September 1, 1984, and compulsory for those who joined on or after that date. Employees who were in service as of that date can choose to continue or cease subscribing to the Kerala State Employees' Family Benefit Scheme. Those who choose to cease subscribing should enrol in the Group Insurance Scheme from the same date.

Employees who enter service in a month other than September, after the scheme has come into force, will be enrolled as members on the next anniversary of the scheme. Those joining in September will be enrolled immediately.

Subscription of members

The subscription for the scheme is Rs.10/- per unit, and it is recovered by deducting it from the member's salary/wages every month, including the month in which the member ceases to be in employment. If an employee or member is on leave without allowances, the subscription for that period will be recovered with interest upon resumption of duty or from payments to the family in the event of the member's death.

Insurance cover and payment

To provide an insurance cover, a portion of the monthly subscription, currently Rs.3.125 for each unit, is credited to an Insurance Fund. The amount of insurance cover is Rs.10,000 for each unit of subscription and is paid to the nominee(s) of a member who dies while in service, regardless of the cause of death.

Upon retirement, members can choose from the following options:

- Continue paying the premium until the policy matures.

- Take up a paid-up policy for a reduced sum.

- Surrender the policy and receive a surrender value of 40% of the total premium paid, plus any bonus due.

- Treat the premium due from the date of retirement to the date of policy maturity as a debt on the policy, bearing interest, which will be recovered from the sum assured and bonus payable at maturity.

If a member does not communicate their choice within one year of leaving service, they will be deemed to have chosen the third option, and the surrender value will be paid to them or their heirs.

Procedure for applying for insurance

To apply for insurance, an employee must submit a proposal in Form No.1, signed in the presence of the head of the office, along with the original chalan receipt for the first premium payment. For additional policies, a proposal in Form No.1 and the chalan for the first instalment of the premium must be submitted.

Procedure for sanction of loans against policies

Loans of up to 90% of the surrender value of the policy may be sanctioned by the Director of Insurance/District Insurance Officer, with the policy assigned as security. The loan carries an interest rate of 9% per annum and is to be repaid in monthly instalments, not exceeding 36, along with the premium.

Payment of claims

To claim the sum assured by a policy, the insured must produce the policy and establish the claimant's title. The sum assured, including any bonus, less any amount due to the fund, will be paid to the insured when the policy matures at 55 years of age or to the surviving nominee(s) in case of death. If there is no surviving nominee, the amount will be paid to the legal heirs as per the heirship certificate.

Miscellaneous

- The insured is responsible for ensuring that the premium is deducted from their pay. If the premium is not deducted, it must be paid in cash to the treasury within a one-month grace period.

- In the case of employees on leave without allowances on medical grounds, premium recovery will commence when they resume duty, and arrears will be treated as a debt on the policy, bearing interest and recovered from future pay.

- A lapsed policy with at least three years of paid premiums before the lapse date will automatically secure a fully paid-up assurance for a reduced sum. A claim arising within six months from the lapse date will be treated as good and paid in full, subject to revival charges.

- A lapsed policy with less than three years of paid premiums will be void, and no claim will be recognised.

- A lapsed policy may be revived within five years of the lapse date by paying all arrears with compound interest at 9% per annum.

Life Insurance Pre-Surgery: What You Need to Know

You may want to see also

Veterans' Group Life Insurance (VGLI)

Eligibility

To be eligible for VGLI, you must meet at least one of the following requirements:

- You had Servicemembers' Group Life Insurance (SGLI) while in the military and are within 1 year and 120 days of being released from an active-duty period of 31 or more days.

- You are within 1 year and 120 days of retiring or being released from the Ready Reserve or National Guard.

- You are within 1 year and 120 days of assignment to the Individual Ready Reserve (IRR) or Inactive National Guard (ING). This includes members of the United States Public Health Service Inactive Reserve Corps (IRC).

- You are within 1 year and 120 days of being put on the Temporary Disability Retirement List (TDRL).

- You had part-time Servicemembers' Group Life Insurance (SGLI) as a member of the National Guard or Reserve and suffered an injury or disability while on duty that disqualified you for standard premium insurance rates.

Benefits

With VGLI, you can receive between $10,000 and $500,000 in term life insurance benefits. The amount is based on your SGLI coverage when you left the military. When you leave the military, you can sign up for VGLI coverage up to the amount you had through SGLI. If you have less than the maximum coverage, you can increase your coverage by $25,000 per year after getting VGLI and then every 5 years until you turn 60.

Application Process

To apply for VGLI, you must do so within 1 year and 120 days of leaving the military. If you apply within 240 days, you don't need to prove you're in good health. However, if you apply after this period, you will need to submit evidence of your good health. You can apply through the Office of Servicemembers' Group Life Insurance (OSGLI) using their website or by mail/fax.

Premium Rates

VGLI premium rates depend on your age and the insurance coverage amount. As of April 1, 2021, the monthly premium rates range from $0.05 to $31.50 for coverage amounts between $10,000 and $500,000.

Beneficiaries

You can choose your beneficiaries and update them as needed. You can update your beneficiary information by accessing your policy online or by filling out a VGLI Beneficiary Designation form.

Converting VGLI Coverage

You can convert your VGLI coverage to an individual insurance policy by choosing a new insurance company from the list of participating companies and applying at their local sales office. You will need to provide a VGLI Conversion Notice from OSGLI to the agent taking your application. It's important to note that the conversion policy must be a permanent policy, such as a whole life policy, and cannot be converted to term, variable, or universal life insurance.

Freedom Life Insurance: Does It Exist?

You may want to see also

Frequently asked questions

Group life insurance is a single contract for life insurance coverage that extends to a group of people, typically offered by an employer or large-scale entity to its workers or members. It is commonly offered as part of an employee benefits package and tends to be inexpensive or even free for employees.

Group life insurance offers value for money, with low or no costs for members. It is also convenient, as it does not require individuals to undergo medical examinations or underwriting.

Group life insurance typically offers basic coverage, which may not meet the needs of all policyholders. The coverage amount is usually limited, and the policy is controlled by the employer or organisation, which can lead to premium increases or termination of coverage.

Yes, in some cases, it may be possible to add coverage for dependents to a group life insurance policy. This can provide financial security for your family.

Group life insurance coverage typically ends when an individual is no longer part of the group, including in cases of resignation, firing, or retirement. However, some policies may offer the option to convert group coverage into an individual policy, although this may result in higher premiums.