Life insurance is a vital tool for financial planning and can offer peace of mind that your loved ones will be taken care of after you're gone. When considering life insurance, it's important to assess your individual circumstances and financial goals to determine the level of coverage you need and the type of policy that best meets your needs. There are two main types of life insurance: term life insurance and permanent life insurance, with the former being more affordable and the latter offering lifelong coverage and the opportunity to build cash value. When choosing a provider, it's essential to compare quotes from different companies, understand the application process, and be truthful to ensure your policy remains valid.

| Characteristics | Values |

|---|---|

| Type | Term, Permanent, Whole, Universal, No-Exam |

| Coverage Length | 5, 10, 15, 20, 25, 30, 40 years |

| Cost | Dependent on type, age, health, lifestyle, etc. |

| Death Benefit | Fixed, decreasing, or increasing |

| Riders | Accelerated Death Benefit, Child Term, Waiver of Premium, etc. |

| Provider | Financially stable, good customer satisfaction, good value |

What You'll Learn

Term vs permanent life insurance

When it comes to life insurance, there are two main types to consider: term and permanent. Both types of insurance are designed to protect the financial well-being of your loved ones in the event of your death. However, there are some key differences between the two.

Term Life Insurance

Term life insurance provides temporary coverage for a fixed period, typically between 10 and 30 years. If you pass away while the policy is in effect, your beneficiaries will receive a payout. Term life insurance is designed to provide money for your dependents during the years when they are most likely to need financial support, such as while they are raising children, saving for college, or paying off a mortgage. It is generally more affordable than permanent life insurance, making it a good option for those on a budget or who only need coverage for a specific period. However, if you outlive the policy, you will not receive any money unless you have a return-of-premium policy. Term life insurance policies also do not carry a cash value, meaning they do not accrue savings that can be accessed by the policyholder.

Permanent Life Insurance

Permanent life insurance, on the other hand, is designed to last a lifetime and provide a death benefit for your beneficiaries no matter when you die, as long as your premiums are paid. Permanent life insurance policies usually have a cash value component that can be withdrawn or borrowed against while you are still alive. This cash value grows tax-deferred and can be a useful financial tool, but any funds withdrawn will reduce the death benefit. Whole life insurance and universal life insurance are types of permanent life insurance. Whole life insurance has fixed premiums and a guaranteed death benefit, while universal life insurance offers flexible premiums and an adjustable death benefit.

Choosing Between Term and Permanent Life Insurance

When deciding between term and permanent life insurance, there are several factors to consider. Term life insurance is typically more affordable, especially if purchased early in life, making it a good option for those on a budget or who only need short-term coverage. Permanent life insurance, on the other hand, offers long-term financial protection and can be useful for creating an inheritance for your heirs or saving for future expenses in a tax-advantaged way. It is important to consider your assets, the needs of your loved ones, and your budget when choosing between term and permanent life insurance.

Maximize VA Life Insurance: Strategies to Boost Your Coverage

You may want to see also

Whole life insurance

- Lifetime coverage: Whole life insurance provides coverage until the death of the insured person, unlike term life insurance, which only covers a specific number of years.

- Guaranteed death benefit: The death benefit amount is established when the policy is issued and remains the same throughout the policy's duration.

- Cash value component: Whole life insurance has a savings component, known as the cash value, which the policy owner can draw on or borrow from. This cash value accumulates on a tax-deferred basis, and the policyholder can access it while still alive.

- Predictable premium payments: Whole life insurance policies typically have fixed premiums that remain unchanged throughout the duration of the policy.

- Limited flexibility: Whole life insurance policies do not allow for changes to the death benefit or premiums. The death benefit and premiums are set when the policy is issued.

When considering a whole life insurance policy, it is important to compare different options and choose a reputable insurer. Whole life insurance is generally more expensive than term life insurance, so it is crucial to ensure that the premiums are affordable. Additionally, reviewing the policy carefully, understanding how it works, and filling out the application honestly are essential steps in the process.

Combining Term and Whole Life Insurance: Is It Possible?

You may want to see also

Universal life insurance

One of the key advantages of universal life insurance is its flexibility. Policyholders can adjust their premiums and death benefits within certain limits. This flexibility can be particularly useful for those with variable income, such as the self-employed, business owners, or those earning royalties. Universal life insurance also allows policyholders to choose how much they pay and when they pay, as long as there is enough cash value to cover the monthly expenses. The cash value component of universal life insurance grows through tax-deferred interest earnings, and policyholders can use this cash value for anything without usually owing taxes.

However, it is important to monitor the cash value of a universal life insurance policy. If the cash value drops too low, policyholders may have to make large payments to keep the policy active or risk the policy lapsing. Additionally, the death benefit may be reduced if the policyholder borrows against the cash value. While universal life insurance offers flexible premiums, they can increase with age and investment market performance.

When considering universal life insurance, it is essential to compare different providers and policies to find the one that best suits your needs. Factors to consider include the financial strength of the insurance company, customer satisfaction ratings, available policy types, riders, and the application process. It is also important to understand how the policy works, be honest when filling out the application, and carefully review the details before making a decision.

Life Insurance, Health Insurance, and Taxes: What's the Link?

You may want to see also

No-exam life insurance

- Are in good health and want to save time by avoiding a medical exam.

- Have known health issues and need coverage for funeral and burial expenses as soon as possible.

- Need coverage immediately.

However, no-exam life insurance policies usually have a cap on the coverage amount and tend to be more expensive than policies that include a medical exam. You will also likely still need to answer health questions, and the insurance company will use other data, such as medical and driving records, to set your premium rates.

Term Life Insurance: Do You Have Coverage?

You may want to see also

Life insurance riders

Adding riders to a life insurance policy will often increase your premium, but not always. Riders typically need to be added when you purchase life insurance, so it's important to consider which features you want before you buy.

- Accelerated Death Benefit Rider: Also called a terminal illness rider, this lets you claim some or all of your death benefit while you're still alive if you meet certain conditions, such as being diagnosed with a qualifying serious or terminal illness.

- Accidental Death Rider: Also known as a double indemnity rider, this increases the death benefit paid out if you die from injuries sustained in a covered accident.

- Waiver of Premium Rider: This waives your policy's premium if you become permanently disabled or lose your income as a result of injury or illness prior to a specified age.

- Family Income Benefit Rider: This provides a steady flow of income to family members in the event of the insured person's death.

- Long-Term Care Rider: This provides monthly payments if the insured person has to stay in a nursing home or receive home care.

- Return of Premium Rider: This refunds all or some of your term life insurance premiums at the end of your policy's term if the death benefit hasn't been paid out.

- Guaranteed Insurability Rider: This lets you purchase additional insurance coverage during the stated period without the need for a further medical examination.

- Child and Spouse Riders: These are designed to pay out a small death benefit if the insured child or spouse passes away during the rider's term.

- Cost of Living Rider: This gradually increases your policy's coverage over time, so the value of your policy doesn't erode due to inflation.

- Term Conversion Rider: This allows you to convert a term life insurance policy into a whole life policy near or at the end of the term.

Changing Life Insurance Beneficiary: A Simple Step-by-Step Guide

You may want to see also

Frequently asked questions

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, usually between 10 and 30 years, and is more affordable. Permanent life insurance, on the other hand, offers lifelong coverage and often includes a cash value component that can be accessed while the policyholder is still alive.

Consider your financial situation, including your income, expenses, debts, and financial goals. Also, think about the needs of your dependents and how your income contributes to their daily lives.

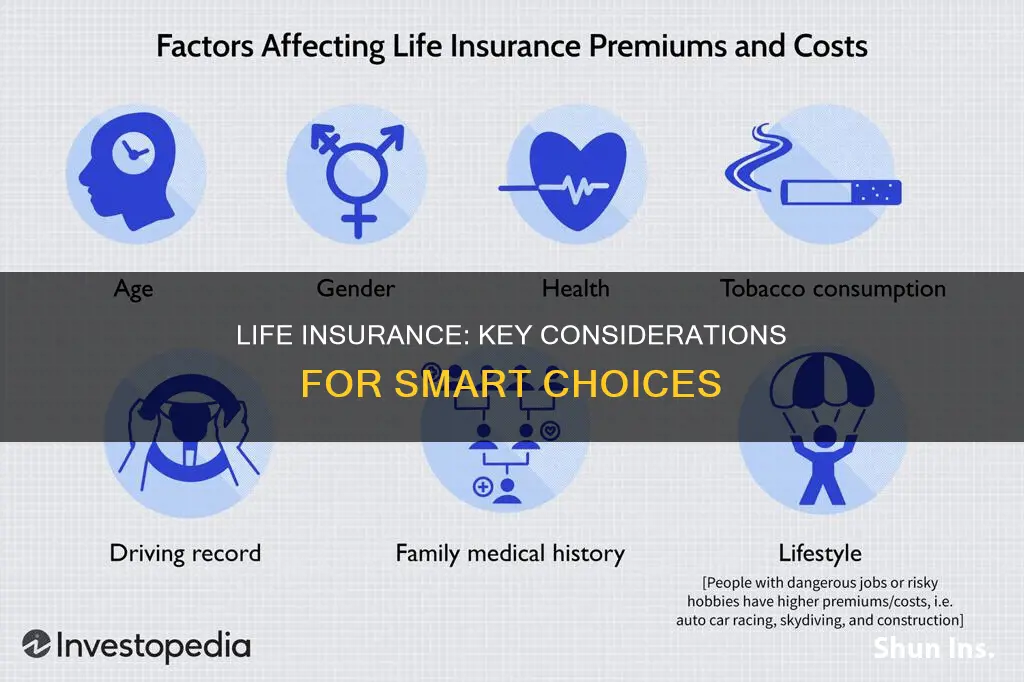

The two key factors that influence life insurance rates are your age and health. Other factors include smoking/nicotine use, coverage length and amount, family medical history, occupation, and high-risk hobbies.

It depends on the type of policy you choose. Some policies require a medical exam, while others are "no-exam" policies that don't require an exam but may have higher premiums.

Compare quotes from multiple companies and consider their financial strength ratings, customer reviews, and satisfaction rankings. Ensure they offer the type of coverage you need and any desired riders or add-ons.