Term life insurance is a type of insurance that covers a policyholder for a set period, generally 10 to 30 years. If the insured person dies within this period, their beneficiaries will receive a death benefit. If the insured person doesn't die during this period, the policy lapses, and there's no payout. Term life insurance is usually the most affordable option when you want life insurance to cover financial obligations that are temporary. It is also generally the cheapest way to buy life insurance.

| Characteristics | Values |

|---|---|

| Purpose | To provide a death benefit for a specified period of time that pays the policyholder's beneficiaries. |

| Renewal | Can be renewed for another term, converted to permanent coverage, or allowed to lapse. |

| Cost | Cheaper than whole life insurance. |

| Coverage | Does not build cash value. |

| Payout | No payout if the policy expires before the policyholder's death or if they live beyond the policy term. |

| Considerations | Age, health, life expectancy, driving record, current medications, smoking status, occupation, hobbies, family history, etc. |

What You'll Learn

What is term life insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific period, such as 10, 20, or 30 years. It is a temporary form of insurance, offering coverage only during the specified term. If the insured person dies during the policy term, the insurance company pays a sum of money, known as a death benefit, to the designated beneficiaries. However, if the policy expires before the insured person's death, there is no payout, and the beneficiaries receive nothing.

Term life insurance is relatively inexpensive compared to other types of life insurance, such as whole life insurance. This affordability is due to the temporary nature of the coverage and the lack of a cash value component. In other words, term life insurance does not accumulate cash value over time, and there is no savings component. Instead, it purely provides insurance coverage for a specified term.

When purchasing term life insurance, individuals can choose from different types of policies, including level-premium term life, renewable term life, and decreasing term life. The premiums for term life insurance are based on factors such as age, health, and life expectancy. Additionally, the approval process may involve a medical exam and health-related questions to determine eligibility and set the premium amount.

Term life insurance is suitable for individuals who want to ensure their family's financial security in the event of their untimely death. It can be particularly beneficial for those with financial dependents, such as a spouse or children, or those with debts that will be paid off over a number of years, like a mortgage.

Life Insurance: Does It Expire or End?

You may want to see also

How does term life insurance work?

Term life insurance is a type of insurance that provides a death benefit for a specified period of time, known as the term. It is a contract between the policyholder and the insurance company, stating that if the insured person passes away within the term, the insurer will pay a death benefit to the beneficiaries named on the policy. The length of the term and the coverage amount are decided by the policyholder.

When you buy a term life insurance policy, the insurance company determines the premium based on the policy's value (the payout amount) and factors such as age, gender, and health. The premium is the cost of the policy, typically paid monthly, semi-annually, or yearly. The premium for term life insurance is usually lower than that of permanent life insurance because term life insurance does not build cash value and is only valid for a specified term.

If the insured person dies during the policy term, the insurer will pay the policy's face value to the beneficiaries, who can use the cash benefit to settle healthcare and funeral costs, consumer debt, mortgage debt, and other expenses. However, there is no payout if the policy expires before the insured person's death or if they live beyond the policy term. The policyholder can choose to renew the policy at the end of the term, but the premiums will be recalculated based on their age at the time of renewal.

Term life insurance is ideal for people who want substantial coverage at a low cost. It is often chosen by young people with children, as it provides a low-cost way to ensure their family is financially protected in the event of their early death. Additionally, it can be used to cover specific debts, such as a mortgage or a child's college education, for a certain number of years.

There are several types of term life insurance policies, including level-premium, yearly renewable, and decreasing term policies. Level-premium policies have fixed monthly payments for the life of the policy, while yearly renewable policies allow for renewal each year at an increased premium. Decreasing term policies have a death benefit that declines over time, with the policyholder paying a fixed premium.

Life Insurance and Adjusted Gross Income: Any Connection?

You may want to see also

How much does term life insurance cost?

The cost of term life insurance depends on several factors, including age, health, gender, and lifestyle.

Term life insurance is generally the most affordable type of life insurance. It is considered a temporary policy, providing coverage for a certain period, such as 10, 20, or 30 years. If the insured person dies within the term, the beneficiaries will receive a death benefit. However, if the insured person lives longer than the selected term, the policy will expire without any payout.

Age is a significant factor in determining life insurance rates. Younger people tend to pay lower premiums because they are less likely to die during the policy term. As age increases, life expectancy decreases, and the likelihood of the insurer having to pay out the policy goes up, resulting in higher premiums.

Health is another crucial factor. People with health issues may still be able to obtain life insurance, but the premiums will be higher. The insurer will consider any pre-existing conditions, as well as the applicant's height, weight, blood pressure, and cholesterol levels.

Gender also influences rates, with men typically paying more than women. This is because men have shorter life expectancies and are more likely to engage in dangerous jobs or lifestyles.

Lifestyle choices and hobbies can also impact rates. For example, those who smoke, engage in risky activities such as skydiving, or have hazardous occupations like firefighting or commercial fishing will usually pay higher premiums.

The length of the policy term and the coverage amount also affect the cost. Longer terms and higher coverage amounts result in higher premiums.

It is important to note that term life insurance rates can vary across different insurance providers, so it is advisable to compare quotes from multiple insurers to find the most suitable policy for your needs.

Divorce and Life Insurance: What Happens to Your Policy?

You may want to see also

Who is term life insurance for?

Term life insurance is a type of life insurance that provides coverage for a set number of years, such as 10, 15, or 20 years. It is designed to offer financial protection to your loved ones in the event of your death during the specified term. This type of insurance is ideal for individuals who are starting out or are on a tight budget as it tends to be more affordable than other types of life insurance, such as whole life or universal life insurance.

So, who is term life insurance for?

Term life insurance is suitable for those who:

- Are looking for short-term coverage or additional protection during specific periods. For example, if you have a mortgage and want to ensure it is covered in case of your untimely death, term life insurance can provide that peace of mind.

- Are on a budget and cannot afford the higher premiums of permanent life insurance. Term life insurance allows you to have the necessary coverage without breaking the bank.

- May want permanent life insurance in the future but cannot afford it at the moment. Term life insurance policies can often be converted into permanent coverage at a later date, giving you the flexibility to adjust as your circumstances change.

- Prefer not to accumulate cash value through their life insurance policy. Term life insurance does not offer cash value accumulation, so you can invest your money elsewhere if that aligns better with your financial goals.

Term life insurance is a popular choice for young families, as it can provide coverage during the years when children are financially dependent on their parents. It is also a good option for those who are paying off debt, as it can offer protection during that time without committing to a long-term policy.

In summary, term life insurance is ideal for individuals or families who want affordable, flexible coverage for a specific period, without the commitment or higher costs associated with permanent life insurance. It allows you to ensure your loved ones are financially protected in the event of your untimely death, providing them with a lump-sum death benefit to help cover expenses.

Whole Foods: Free Life Insurance for Employees?

You may want to see also

What are the pros and cons of term life insurance?

Term life insurance is a type of policy that offers financial protection for a set period, usually 10 to 30 years. It is generally the cheapest way to buy life insurance, but it does not build cash value or have an investment component. This makes it a good option for those who want to provide for their families in the short term, such as parents with young children or those with a mortgage or significant debt.

Pros of Term Life Insurance

- Affordability: Term life insurance is often the most affordable option when you want life insurance to cover financial obligations that are temporary.

- Simplicity: Term life insurance is easy to understand because it simply provides a death benefit when you pass away within the policy term, as long as premiums are paid.

- More coverage available: With a term life insurance policy, you can buy $10 million or more in life insurance at an affordable price.

- Tax-free death benefit: If you die during your policy term, your beneficiary will receive a tax-free lump sum from the life insurance company.

- Flexible payment and policy options: You can choose to pay your premiums monthly, quarterly, semi-annually or annually. You can also choose how long you need coverage, whether one year or 30.

- No penalty for cancelling: If you decide to cancel your term life insurance policy while it’s active, you can do so without incurring any fees or penalties.

Cons of Term Life Insurance

- Temporary coverage only: Term life insurance only offers temporary coverage, so it may not be suitable for those with permanent life insurance needs, such as funeral expenses or caring for a special-needs child into adulthood.

- No cash value: Term life insurance does not build cash value, meaning it does not include a savings account to borrow or withdraw from. If you cancel a term life insurance policy, you do not get any money back unless you get a policy that offers a return of a premium feature, which comes with higher costs.

- Lower age cap than permanent life insurance: The maximum age limit varies by company and term length, but most people can only apply for term life insurance up to the age of 50.

- Higher premiums upon renewal: You can choose to renew your term life insurance policy, but this might come at a higher premium due to your age or changes in your health.

Suicide and Military Life Insurance: What's the Verdict?

You may want to see also

Frequently asked questions

Term life insurance is a type of insurance that covers a policyholder for a set period, usually 10 to 30 years. If the insured person dies within this period, their beneficiaries will receive a death benefit. If the insured person doesn't die during this period, the policy lapses, and there is no payout.

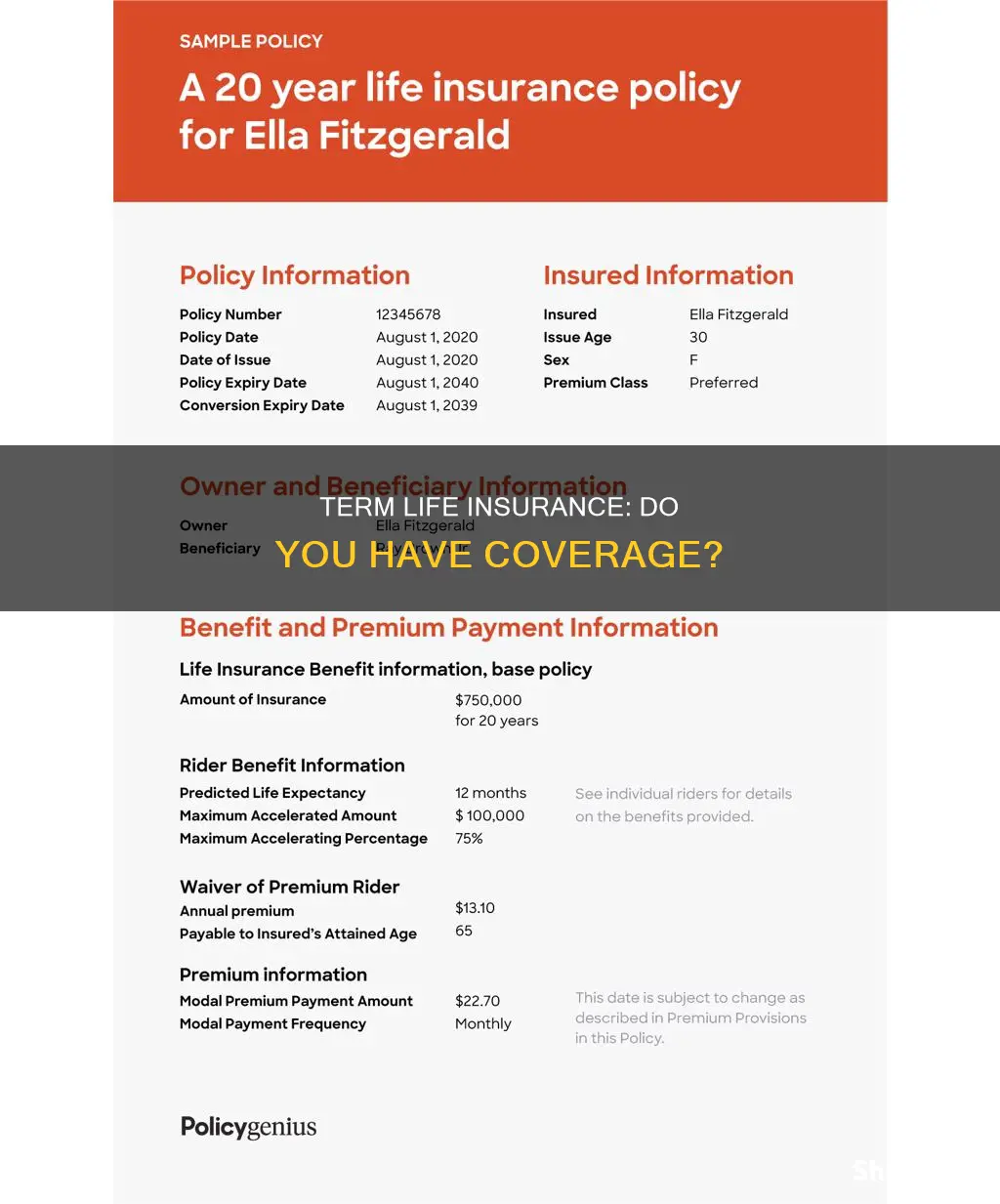

Check your insurance contract or policy documents. Term life insurance is a type of insurance that covers you for a specific period, typically 10 to 30 years. If you have any insurance documents, review them to identify the type of coverage you have.

Term life insurance provides a guaranteed death benefit to your beneficiaries if you pass away during the specified term. It is also generally the most affordable type of life insurance. Term life insurance is ideal for those who want substantial coverage at a low cost.