Term life insurance is a policy that offers coverage for a specified number of years. If the insured person passes away within the time frame, their beneficiary receives the death benefit. The cost of a term life policy is low, and it’s still customisable to your situation. The question of whether term life insurance rates are locked in is a complex one. While term life insurance rates are not locked in, they are often fixed for the duration of the policy. This means that your monthly premium will not increase during the policy’s life, regardless of what happens in the market. However, your rates will likely increase if you decide to renew your policy at the end of the term. This is because insurance companies base their rates on your age and health at the time of renewal. So, your rates will be higher if you are older or have developed health problems since you first purchased the policy.

| Characteristics | Values |

|---|---|

| Are term life insurance rates locked in? | Both yes and no. The rates are not locked in but are often fixed for the duration of the policy. |

| Will the monthly premium increase during the policy's life? | No, the monthly premium will not increase during the policy's life. |

| Will the rates increase if the policy is renewed at the end of the term? | Yes, the rates will increase if the policy is renewed at the end of the term. |

| What factors are the insurance rates based on? | The insurance rates are based on age and health at the time of renewal. |

| How to lock in the rate? | By purchasing a "level term" life insurance policy or by availing "conversion privileges" offered by many insurance companies. |

What You'll Learn

- Term life insurance rates are often fixed for the duration of the policy

- Rates will increase if you renew your policy at the end of the term

- You can lock in your rate by purchasing a level term life insurance policy

- Insurance companies base their rates on your age and health at the time of renewal

- Life insurance rates increase with age

Term life insurance rates are often fixed for the duration of the policy

Term life insurance is a type of insurance that offers coverage for a limited time, usually over a 10-, 20-, or 30-year period. It is often chosen by people who want to protect their family financially if they pass away unexpectedly. The main appeal of this type of insurance is its affordability, especially for younger, healthy individuals.

The fixed rates of term life insurance policies make them an attractive option for those who want to lock in affordable rates for the long term. However, it is important to note that if the policy is renewed after the initial term ends, the rates will increase. Additionally, term life insurance policies do not build cash value, which is a feature offered by some permanent life insurance policies.

When considering a term life insurance policy, it is essential to weigh the benefits of fixed rates against other factors such as the lack of cash value and the need to renew at a higher rate after the initial term. It is also important to consider the length of the term, as it should ideally cover the period during which your family would depend on your income.

Overall, term life insurance with fixed rates can be a good option for those seeking affordable coverage for a specific period, such as the duration of a mortgage or until children become financially independent.

Life Insurance Proceeds: Are LLCs Tax Exempt?

You may want to see also

Rates will increase if you renew your policy at the end of the term

Term life insurance policies are often chosen for their affordability and simplicity. However, it's important to understand that if you renew your policy at the end of the term, your rates will increase.

When you initially purchase a term life insurance policy, you lock in a rate for the level term period, which is typically 10, 15, 20, or 30 years. During this period, your monthly premiums remain the same. However, once the level term period ends, you have the option to renew the policy, and the premiums will be recalculated based on your age at the time of renewal.

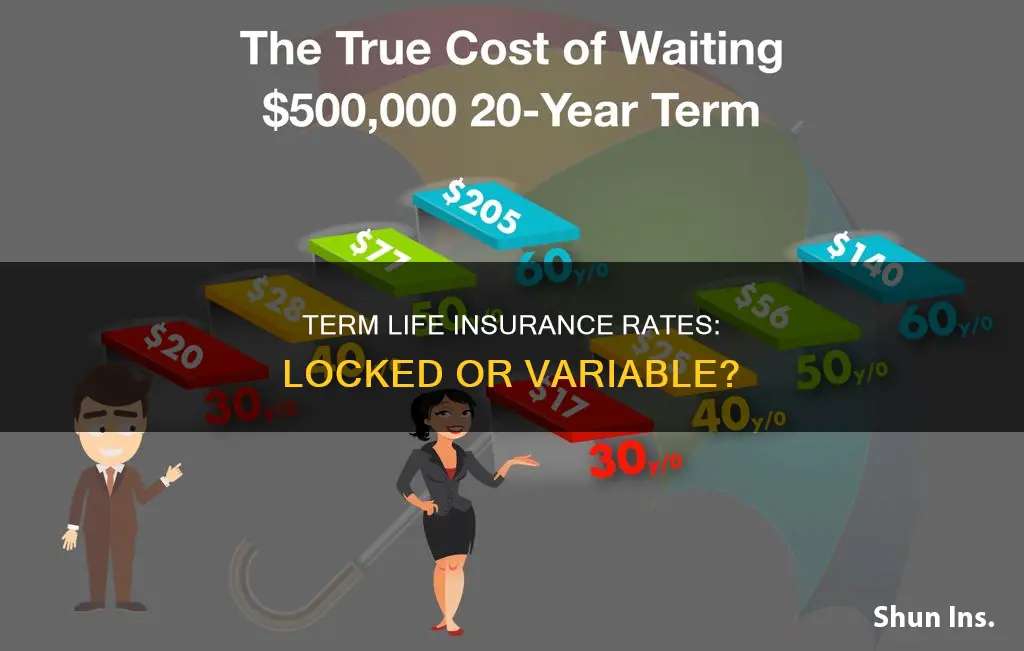

The increase in premiums upon renewal can be significant and may even become unaffordable. For example, a 30-year-old man who buys a 20-year term life policy for $700 a year would see his annual cost jump to $11,310 if he renews at age 50—a more than 16-fold increase. The rates will continue to rise with each year of renewal.

While the renewal rates may be shocking, they are clearly outlined in the policy documents at the time of purchase. It's important for policyholders to be aware of these future renewal rates and plan accordingly.

If you find yourself nearing the end of your level term period and still requiring life insurance coverage, there are a few options to consider. One option is to shop for a new life insurance policy, as your health status may have changed, making it difficult to qualify for a new policy in the future. Another option is to convert the term life policy to a permanent policy, such as whole life or universal life insurance. While this will result in higher premiums, it provides coverage for the remainder of your life.

Life Insurance for Non-Profits: Funding Peace of Mind

You may want to see also

You can lock in your rate by purchasing a level term life insurance policy

Term life insurance is an affordable and straightforward option for many people. You pay premiums every month, and the coverage typically lasts for 10, 15, 20, 25, or 30 years. However, the premium you pay each month can change over time, depending on the type of term life insurance coverage you choose.

If you opt for a term life insurance policy with guaranteed level premiums, you will pay the same premium rate every month until the end of the term, regardless of how long your coverage lasts. This means that your rate is locked in for the duration of the term. For example, a 35-year-old woman in excellent health can purchase a 30-year, $500,000 term life insurance policy starting at $29.15 per month, and this rate will remain the same over the next 30 years.

To lock in your rate, you can purchase a level term life insurance policy. With this type of policy, your rate is guaranteed to stay the same for the entire policy term, regardless of market fluctuations. As long as you continue to pay your insurance premiums each month, your rate will remain unchanged.

The level term rate is determined by factors such as your age, health, specific term policy, insurance provider, and benefit amount or payout. During the application process, you will be asked about your health history, family health history, and lifestyle choices to assess your risk factors. Most applicants will also need to complete a short medical exam. Being honest during the application process is crucial, as it forms the basis for issuing the policy and paying its benefits.

While a level term life insurance policy can lock in your rate, it's important to remember that term life insurance rates are not permanently locked in. If you choose to renew your policy at the end of the term, your rates will likely increase due to your older age and any changes in your health. However, purchasing a level term policy can provide you with stable rates for a significant period, giving you peace of mind and financial protection for your loved ones.

Life Insurance Checks: Impact on Social Security?

You may want to see also

Insurance companies base their rates on your age and health at the time of renewal

Term life insurance is a popular option for those seeking coverage for a limited time, such as until their children are adults or their mortgage is paid off. It is also a more affordable option compared to permanent life insurance.

When it comes to term life insurance, insurance companies base their rates on your age and health at the time of renewal. The older you are, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that predict your likelihood of dying while the policy is in force. The closer you are to your life expectancy, the higher the risk for the insurance company of having to pay out a claim.

In addition, your health status also plays a significant role in determining your premium rates. If you decide to renew your policy, your premiums will increase based on your age and health. The presence of pre-existing conditions, such as heart disease, stroke, diabetes, or cancer, can result in higher premiums. Lifestyle factors, such as smoking or participation in risky hobbies, can also impact your rates.

The premium amount typically increases by about 8% to 10% for every year of age. However, this can vary depending on your age group. For example, it can be as low as 5% annually if you're in your 40s and as high as 12% annually if you're over 50.

When considering term life insurance, it is essential to keep in mind that the rates are not locked in for the duration of the policy. The insurance company will adjust the premium to reflect your new age and health status at the time of renewal. Therefore, it is beneficial to purchase term life insurance when you are younger and healthier, as you will be offered the most affordable rates.

Life Insurance and Physicals: What's the Connection?

You may want to see also

Life insurance rates increase with age

Life insurance rates are dependent on a number of factors, including age, health, term length, and coverage amount. While term life insurance rates are not locked in, they are often fixed for the duration of the policy. This means that your monthly premium will not increase during the policy's life. However, if you decide to renew your policy at the end of the term, your rates will likely increase as insurance companies base their rates on your age and health at the time of renewal.

There are two main types of term life insurance: level term and annually renewable. With level term life insurance, your rate is locked in, and you will pay the same premium every month for the duration of the term, regardless of any changes in your age or health. The term can last for 10, 15, 20, 25, or 30 years, and once it ends, you can either choose to end your coverage or renew your policy at a higher rate. Level term policies are a good option for locking in affordable rates for the duration of your coverage.

On the other hand, with annually renewable term life insurance, your premiums will increase each year you renew. While the premiums may be lower than those of a level term policy in the initial years, the cost will increase over time, and you may end up paying more in premiums than you would have with a level term policy. Annually renewable policies are a good option for those who only need coverage for a short period of time.

When choosing a term life insurance policy, it is important to consider your long-term needs and budget. While level term policies offer the stability of locked-in rates, they may not be suitable for everyone. Annually renewable policies provide flexibility but come with the risk of increasing premiums over time. By understanding how life insurance rates increase with age and the different types of policies available, you can make an informed decision about which type of term life insurance is right for you and your family.

Life Insurance: Haven's Affiliate Program Explained

You may want to see also

Frequently asked questions

Term life insurance rates are not locked in, but they are often fixed for the duration of the policy. This means that your premium will not increase during the policy's life, regardless of what happens in the market. However, your rates will likely increase if you decide to renew your policy at the end of the term.

There are a few ways to lock in your rate. One way is to purchase a "level term" life insurance policy, which guarantees that your rates will stay the same for the entire policy term. Another way is to take advantage of "conversion privileges" offered by many insurance companies, which allow you to convert your term life insurance policy into a permanent policy without going through underwriting again.

Your term life insurance rate is determined by several factors, including your age, health, specific term policy, insurance provider, benefit amount, and payout. The length of the term also affects your rate, with shorter terms generally having lower premiums than longer ones.