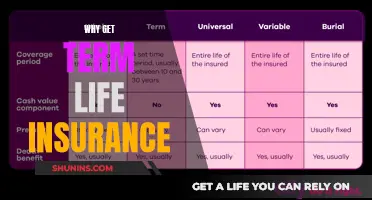

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and includes a cash value component that policyholders can access while they're alive. Custom Whole Life insurance is similar to traditional whole life insurance in that it offers guaranteed life insurance benefits and premiums. However, the key difference is that Custom Whole Life insurance allows policyholders to choose a shorter period for paying premiums rather than paying them for life.

When it comes to taxation, the cash value component of whole life insurance generally grows tax-free. However, if policyholders withdraw cash value that includes investment gains, that portion may be subject to taxation. Additionally, loans taken against the policy that exceed the sum of the insurance premiums paid may also be considered taxable income.

While life insurance proceeds received by beneficiaries due to the death of the insured are generally not taxable, there are certain situations where life insurance payouts may be subject to taxation. For example, if the policy is transferred to another owner for cash or other valuable consideration, the exclusion for proceeds is limited to the sum of the consideration paid, additional premiums, and certain other amounts.

It is important to consult with a tax professional to understand the specific tax implications of Custom Whole Life insurance as they can vary based on individual circumstances and the specific terms of the policy.

| Characteristics | Values |

|---|---|

| Tax advantages | Custom Whole Life Insurance offers tax advantages such as tax-deferred cash value growth and a tax-free lump sum paid to beneficiaries. |

| Taxation | Money paid out from a life insurance policy is generally not taxable, but there are some exceptions. For example, if the policy is transferred for cash or other valuable consideration, the exclusion for proceeds is limited to the sum of the consideration paid, additional premiums, and certain other amounts. |

| Tax Documents | Tax documents such as Form 1099-INT or Form 1099-R may be received to report any taxable amounts. |

| Tax Implications | Surrendering a life insurance policy may trigger tax consequences depending on factors such as the amount of funds received, outstanding policy loans, and changes to the cost basis. |

| Tax Reporting | Any taxable amounts should be reported based on the type of income document received. |

What You'll Learn

Tax benefits of custom whole life insurance

Custom whole life insurance is similar to traditional whole life insurance in that it offers guaranteed life insurance benefits and guaranteed premiums. However, instead of paying premiums for life, you can choose a shorter period. Once the premiums are paid, the policy stays in effect for as long as you live.

Custom whole life insurance offers several potential tax benefits:

- Tax-deferred growth of cash value: Similar to a 401(k) or IRA, the cash value component of a whole life insurance policy grows tax-free. This allows the cash value to compound over time without being reduced by taxes.

- Tax-free loans: You can take out a loan against the cash value of your whole life insurance policy, and this loan is typically tax-free. However, if you don't pay back the loan, it will reduce the death benefit paid out to your beneficiaries.

- Tax-free death benefit: The lump-sum death benefit paid out to your beneficiaries is generally tax-free. This means that your beneficiaries will receive the full benefit amount without having to pay taxes on it.

- Tax advantages during retirement: If you choose a shorter payment period for your custom whole life insurance policy, you may finish paying off the policy by the time you retire. This means that during your retirement years, you won't have to budget for insurance payments, giving you more financial flexibility.

It's important to note that if you take out cash value that includes investment gains, that portion may be subject to taxes. Additionally, if you surrender your policy or if the policy lapses, any outstanding loans may be considered taxable income.

Chest Pain: Can It Impact Your Life Insurance Eligibility?

You may want to see also

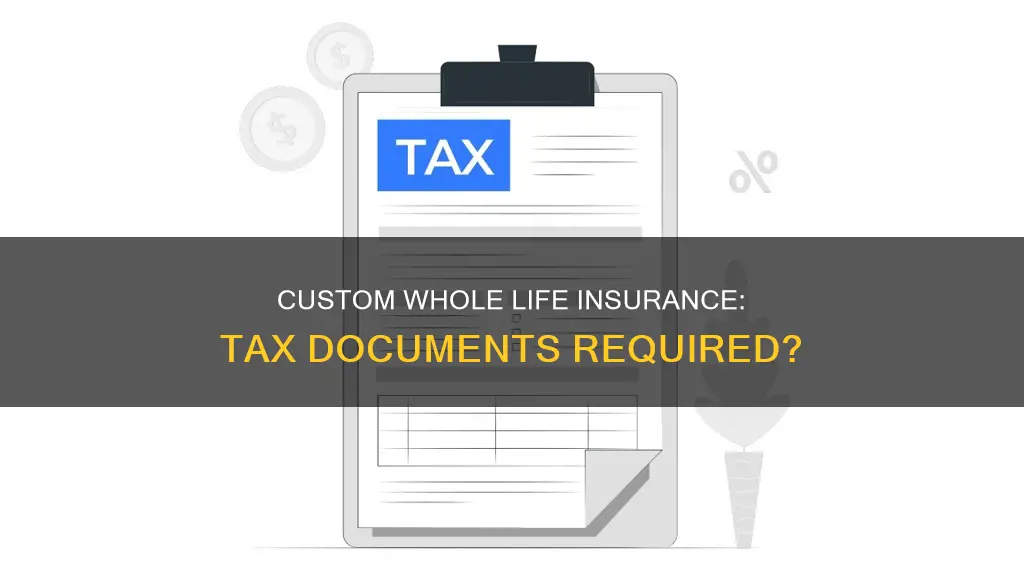

Tax documents for custom whole life insurance

Custom whole life insurance is similar to traditional whole life insurance in that it offers guaranteed life insurance benefits and guaranteed premiums. However, instead of paying premiums for life, custom whole life insurance allows you to choose a shorter payment period. Once the premiums are paid, the policy remains in effect for the rest of the policyholder's life.

Custom whole life insurance policies have fixed premiums that will never change. These premiums are set based on factors such as the coverage amount, age, health, and any additional benefits chosen. With custom whole life insurance, you can also choose the number of premium payments you make. For example, you may be able to pay off the entire policy in as little as five years.

While the death benefit paid to beneficiaries is generally tax-free, there are some tax implications associated with custom whole life insurance policies:

- Cash Value Growth: The cash value component of a whole life insurance policy grows tax-deferred. However, if you withdraw cash value that includes investment gains, that portion may be subject to taxation.

- Policy Loans: If you borrow against the value of your policy, the amount borrowed is generally not taxable as long as it is equal to or less than the sum of the insurance premiums you have paid. If the loan amount exceeds the sum of the premiums paid, the excess amount may be subject to taxation.

- Surrender or Lapse of Policy: If you surrender or allow your policy to lapse, any outstanding loans or gains in the policy may be subject to ordinary income taxes. If the policy is a Modified Endowment Contract (MEC), these loans or gains may be treated as ordinary income and could also be subject to a 10% federal tax penalty if the policyowner is under 59 1/2 years old.

- Interest Income: While life insurance proceeds received by beneficiaries due to the death of the insured are generally not taxable, any interest earned on the proceeds is taxable and should be reported as interest income.

- Transfer of Policy: If the policy is transferred for cash or other valuable consideration, the exclusion for the proceeds may be limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. There may be exceptions to this rule, and you should refer to tax forms such as Form 1099-INT or Form 1099-R to report the taxable amount.

Convertable Life Insurance: Cash Value and Benefits Explained

You may want to see also

Tax implications of surrendering a custom whole life insurance policy

Custom whole life insurance is similar to traditional whole life insurance. It offers guaranteed life insurance benefits and guaranteed premiums. The main difference is that, instead of paying premiums for life, you can choose a shorter period. Once the premiums are paid, the custom whole life policy will stay in effect for as long as you live.

Custom whole life insurance policies have fixed premiums that will never change. Your premiums are set by factors such as your coverage amount, age, health, and any additional benefits you choose. With custom whole life insurance, you can also generally choose how many premium payments you make, after which the policy is paid in full and remains in effect.

Whole life insurance combines an investment account called "cash value" and an insurance product. As long as you pay the premiums, your beneficiaries can claim the policy's death benefit when you pass away.

Tax Implications of Surrendering a Whole Life Insurance Policy

The cash surrender value of a life insurance plan is the amount you'll receive if you surrender your policy to your insurer. This amount is based on your cash value, the component of a permanent life insurance policy that can help you build cash value through regular premium payments.

A life insurance policy's cash surrender value can be taxable. Any amount you receive over the policy's basis, or the amount you paid in premiums, can be taxed as income.

Surrendering your policy may trigger tax consequences if any of the following occur:

- You receive more funds than the policy's cost basis.

- You have outstanding policy loans that exceed the policy's cost basis.

- Your cost basis changed while you had the policy, such as reducing the death benefit or adding riders.

When you surrender a cash value life insurance policy, you may get back more than the entirety of what you spent on premium payments. The IRS considers the difference as taxable income. What you'll owe in taxes depends on your marginal tax rate for the year, often called your income tax bracket.

Cash from surrendering your life insurance is taxed as ordinary income, which is taxed at the federal level between 10% and 37%, depending on your income level.

The taxable amount, subject to ordinary income tax, is the difference between the cash surrender value minus the total premiums paid.

If you take the cash surrender value, you'll have to pay income taxes on any investment gains that were part of the cash value.

Alternatives to Surrendering a Whole Life Insurance Policy

There are alternatives to surrendering a whole life insurance policy. These include:

- Borrowing against the policy from the cash value.

- Considering reduced paid-up insurance to free yourself of paying premiums.

- Selling the policy, often for more than the cash surrender value.

- Taking the cash surrender value of a whole life insurance policy.

- Asking about reduced paid-up life insurance.

- Opting for extended term life insurance.

- Doing a 1035 exchange.

Chlamydia and Life Insurance: Does It Affect Your Premiums?

You may want to see also

Tax on interest from custom whole life insurance

Custom whole life insurance is similar to traditional whole life insurance in that it offers guaranteed life insurance benefits and premiums. However, with custom whole life insurance, you can choose a shorter period for paying premiums. Once the premiums are paid, the policy stays in effect for the rest of your life.

Whole life insurance combines an investment account, called a "cash value", with an insurance product. This means that part of the premium payments will accumulate in a cash value account, which grows over time and can be accessed through a policy loan, withdrawal, or surrender of the policy. Similar to a 401(k) or IRA, the money in the cash value account grows tax-free. However, if you take out cash value that includes investment gains, that portion will be taxable.

In the United States, if you receive life insurance proceeds as a beneficiary due to the death of the insured person, you generally do not have to include this in your gross income or report it. However, any interest you receive is taxable and should be reported. If the policy was transferred to you for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration you paid, additional premiums you paid, and certain other amounts.

Colonial Penn: Term Life Insurance Options and Benefits

You may want to see also

Tax on custom whole life insurance proceeds

Custom whole life insurance is similar to traditional whole life insurance in that it offers guaranteed life insurance benefits and premiums. However, it differs in that it allows the policyholder to choose a shorter premium payment period, after which the policy remains in effect for their lifetime.

Custom whole life insurance, like other whole life insurance policies, has certain tax advantages and implications. Here are the key points to consider:

Tax-Free Death Benefits:

Generally, life insurance proceeds received by beneficiaries due to the insured person's death are not taxable and do not need to be reported to the IRS. However, if the policy was transferred to the beneficiary for cash or other valuable consideration, the exclusion for proceeds may be limited.

Interest on Whole Life Insurance:

Interest generated from whole life insurance policies is typically not taxed until the policy is cashed out or surrendered. At that point, the interest earned is considered taxable income.

Withdrawals from Whole Life Insurance:

Withdrawals made from whole life insurance policies are usually considered a return of premiums and are therefore not subject to taxation. However, if you withdraw more than the value of the premiums paid and begin withdrawing gains from interest or dividends, those amounts become taxable as income.

Loans Against Whole Life Insurance:

Policyholders can take out loans against the cash value of their whole life insurance policy. These loan proceeds are not taxable, even if they exceed the total premiums paid into the policy. However, taking out a loan reduces the death benefit value of the policy until the loan, along with any interest owed, is repaid.

Employer-Paid Whole Life Insurance:

When an employer provides whole life insurance as part of an employee's compensation package, the portion of the premium paid on policy amounts above $50,000 is considered taxable income for the employee. This means that if your employer pays for a life insurance policy exceeding $50,000 in coverage, you will need to pay taxes on the excess amount.

Prepaid Whole Life Insurance:

Some whole life insurance plans allow policyholders to pay a lump sum premium upfront, which grows in value due to interest. The growth of this money is considered interest income by the IRS and may be subject to taxation when applied to premium payments or when the policyholder withdraws funds.

Tax-Deductible Premiums:

Life insurance premiums are generally not tax-deductible. However, there are a few exceptions. You may be able to deduct the premiums as a business expense if you are not a beneficiary of the policy. Additionally, if you are divorced and your divorce agreement was executed before 2019, life insurance premiums paid as part of that agreement may be considered alimony and can be deducted from your income taxes.

In summary, while custom whole life insurance proceeds are generally tax-free for beneficiaries, there are several scenarios where taxes may apply. These include interest earned on the policy, withdrawals beyond the value of premiums paid, employer-provided policies exceeding certain limits, and prepaid policies with interest income. Understanding these tax implications is essential when considering custom whole life insurance.

Child Life Insurance: Rollover Options for Parents

You may want to see also

Frequently asked questions

Yes, custom whole life insurance has tax benefits. The cash value grows tax-deferred, and the lump sum paid to your beneficiaries is generally tax-free.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person are not taxable income and you don't have to report them. However, any interest you receive is taxable and should be reported.

The cash surrender value of a life insurance policy is generally taxable. Any amount you receive over the policy's basis, or the amount you paid in premiums, is taxed as income.