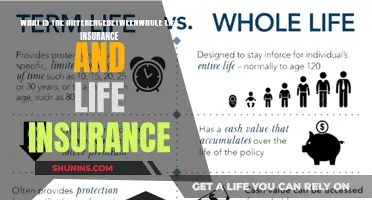

Convertible life insurance is a type of temporary term life insurance that can be converted into a permanent life insurance policy. It allows the policy owner to change a term policy into a whole or universal policy without undergoing a new health screening process. While permanent life insurance is more expensive than term life insurance, it provides lifelong coverage, level premiums, and tax-free cash value accumulation. On the other hand, term life insurance provides coverage for a specific period and is more affordable initially, but the cost of renewal increases substantially. Therefore, the question of whether convertible life insurance has cash value depends on whether the policy has been converted into a permanent policy, as term life insurance does not offer cash value.

| Characteristics | Values |

|---|---|

| Type of insurance | Temporary term life insurance that can be converted into permanent life insurance |

| Conversion | Can be converted without a health screening process |

| Cost | Higher premiums than term life insurance |

| Benefits | Life-long coverage, level premiums, and tax-free cash value accumulation |

| Cash value | Cash value accumulates in the policy and grows tax-deferred |

What You'll Learn

Whole life insurance policies have a cash value component

The cash value of a whole life insurance policy earns interest, and taxes are deferred on the accumulated earnings. While premiums are paid and interest accrues, the cash value builds over time. As the life insurance cash value increases, the insurance company's risk decreases, because the accumulated cash value offsets part of the insurer's liability.

Whole life insurance policies offer a fixed monthly premium, a fixed rate of growth for the cash value, and a guaranteed death benefit amount. Because of these guarantees, whole life insurance is typically more expensive than other life insurance options.

Some whole life policies do not have cash values in the first two years of the policy and don't pay a dividend until the policy's third year. It can take time to build up savings in a whole life insurance policy, but the cash value component is a useful avenue to generate tax-deferred savings.

Whole life insurance policies are also "participating," meaning that policyholders can potentially receive life insurance dividends if the policy is from a mutual insurance company. Dividends can be taken as cash, added to the cash value, used to pay premiums, or used to buy "paid-up additions" that increase the death benefit amount.

When considering a whole life insurance policy, it is important to understand how the cash value accumulation process works and how much risk is involved. Consulting an insurance advisor can help determine the potential cash value accumulation of a specific policy.

Colonial Life: Health Insurance Options and Benefits

You may want to see also

Cash value life insurance is permanent

Cash value life insurance is a permanent life insurance policy that lasts for the lifetime of the holder. It features a cash value savings component that the policyholder can use for several purposes, including borrowing or withdrawing cash, or using it to pay policy premiums. Permanent life insurance policies such as whole life and universal life can accumulate cash value over time.

Convertible term life insurance is a type of temporary term life insurance that can be turned into permanent life insurance. It gives you the option to buy low-cost temporary coverage now while keeping your options open to buy lifelong coverage later. When you convert a term policy to a permanent policy, the conversion can happen as long as the policy conditions have been maintained, including making payments on time.

While permanent life insurance carries higher premiums than term life insurance, it also provides benefits such as lifelong coverage, level premiums, and tax-free cash value accumulation. Permanent insurance, such as whole life and universal life, costs more than term life insurance, but the coverage does not expire as long as you keep paying the premiums. Whole life policies also charge the same premium for the entire duration of the policy, so your future costs will not increase.

Convertible term life insurance essentially gives you the option to change your type of insurance coverage as your life changes. For example, you may decide to convert term life insurance to whole life insurance to provide lifelong coverage and peace of mind. Whole life insurance provides long-term peace of mind, as there is no expiration date on the policy, and premiums remain level. Additionally, whole life insurance provides a cash value component that accumulates tax-free, allowing you to access the funds through loans or withdrawals.

Child Support: Life Insurance Coverage for Dependents?

You may want to see also

Cash value life insurance costs more than term life insurance

Convertible insurance is a type of life insurance that allows the policy owner to change a term policy into a whole or universal policy without undergoing another health qualification process. It is more expensive than a term life insurance policy as there is a built-in cost for the option of being able to make the conversion without a medical exam.

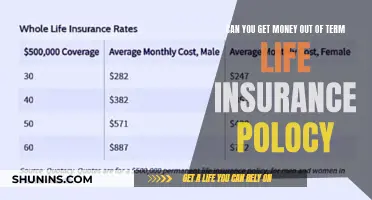

Cash value life insurance is permanent life insurance that has a cash value savings component. It is more expensive than term life insurance as it features coverage for the entire lifetime of the policyholder. Term life insurance, on the other hand, provides coverage for a specific number of years, such as 10, 20, or 30 years, and is therefore more affordable, especially for younger and healthier individuals.

Cash value life insurance policies, such as whole life and universal life insurance, tend to have higher premiums than term life insurance policies because a portion of each premium payment goes into the cash value savings account. This cash value component typically earns interest or investment gains and grows tax-deferred. The cash value can be used for various purposes, such as borrowing cash, withdrawing cash, or paying policy premiums.

While cash value life insurance offers the benefit of accumulating cash savings over time, it is important to consider the higher costs associated with it. If you are looking for temporary coverage at a lower cost, term life insurance may be a more suitable option. However, if you are interested in permanent coverage and the opportunity to build a nest egg, cash value life insurance could be worth considering.

Cigna Life Insurance: Drug Testing Requirements Explained

You may want to see also

Cash value can be used for loans and withdrawals

Cash value is a component of some types of life insurance. This is a feature that is typically offered within permanent life insurance policies, such as whole life and universal life insurance. Cash value is the portion of your policy that accumulates over time and may be available for you to withdraw or borrow against for long-term savings needs.

Convertible insurance is a type of life insurance that allows the policy owner to change a term policy into a whole or universal policy without going through the health qualification process again. Whole life insurance policies also come with a cash value component that appreciates through dividends. While it takes time to build up savings, the cash value component is a useful avenue to generate tax-deferred savings.

The cash value of permanent life insurance generally grows federal income tax-free. You can borrow against the cash value to buy a house or pay for your children's college costs, tax-free. Of course, accessing the cash value will reduce the available cash surrender value, and possibly the life insurance benefit, but it's comforting to know that this resource is available if needed.

You can also borrow against the cash value to cover significant expenses, like a down payment on a home. Cash value whole life insurance can enhance your retirement income, as it accrues guaranteed cash value that you can access later in life as your insurance needs decrease. You will owe taxes on 401(k) distributions, but you can generally access your insurance policy's cash value federal income tax-free.

The cash value isn't just available in retirement; you can access it at any time via policy loans if the policy is structured properly. You can borrow up to the maximum loan value from your policy's cash value through policy loans, generally on a tax-free basis.

Chlamydia's Impact on Life Insurance Rates: What You Need Know

You may want to see also

Cash value accumulates tax-free

Convertible insurance is a type of life insurance that allows the policy owner to change a term policy into a whole or universal policy without undergoing a new health qualification process. It is a temporary term life insurance that can be turned into permanent life insurance. This means that the policy owner can switch coverage at a future date without having to go through a new health screening process.

Permanent life insurance policies, such as whole life and universal life insurance, offer a death benefit and a secure cash value account, which grows tax-free. The cash value of life insurance grows tax-free, meaning that, in many cases, you won't have to worry about paying taxes on it. However, there are some instances where taxes may be owed on the cash value. For example, if you withdraw more than the total premiums paid, you may have to pay taxes on the amount withdrawn.

Whole life insurance policies also charge the same premium throughout the policy, so your future costs will not increase. Permanent policies can include a savings component that accumulates cash value tax-free, which can be accessed through loans or withdrawals. This cash value component is a useful avenue to generate tax-deferred savings.

It is important to note that while permanent life insurance carries higher premiums than term life insurance, it also provides benefits such as life-long coverage, level premiums, and tax-free cash value accumulation.

Chase Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Convertible insurance is a type of life insurance that allows the policy owner to change a term policy into a whole or universal policy without going through the health qualification process again. It is a temporary term life insurance that can be turned into permanent life insurance.

Convertible life insurance lets the policy owner convert a term policy that only covers the insured individual for a predetermined number of years into a policy that covers that individual indefinitely, as long as the policyholder continues to pay the insurance premium. It is a good option for those who can only afford a less expensive term policy now but may want permanent insurance later.

Yes, convertible life insurance can be converted into whole life insurance, which has a cash value component. Whole life insurance policies also come with a cash value component that appreciates through dividends.