Life insurance is a way to protect your loved ones financially in the event of your death. While term life insurance is a popular option due to its affordability, it differs from whole life insurance and other permanent policies in that it cannot be cashed out. However, there are alternative options for those seeking to extract monetary value from their term life insurance policy. This includes selling the policy to a third party, borrowing against the policy, or withdrawing a portion of the cash value. Understanding the specifics of your policy and consulting with a financial professional can help you make an informed decision about managing your term life insurance policy.

What You'll Learn

- Term life insurance policies can be sold to third-party companies

- Term life insurance policies don't have a cash surrender value

- Permanent life insurance policies can be cashed out

- Term life insurance policies can be converted into permanent policies

- Term life insurance policies can be cashed out through a life settlement

Term life insurance policies can be sold to third-party companies

Determine if your policy is convertible

The first step is to determine if your term policy can be converted into a permanent policy. This is because permanent insurance policies, such as whole or universal life insurance, tend to sell for more than term policies. You can review your policy documents or contact your insurance carrier to find out if your policy can be converted. Even if your policy cannot be converted, you may still be able to sell it through a life settlement.

Contact a life settlement company

To sell your policy, you will need to work with a life settlement company. They will handle most of the work for you, including contacting your insurance carrier to obtain the necessary documents and requesting medical records (with your consent). They will also underwrite the policy sale and identify potential institutional investors who may be interested in acquiring your policy.

Sign paperwork to finalise the transaction

If you accept the offer to purchase your policy, you will need to sign paperwork to officially transfer ownership. The life settlement company will guide you through this process. Once the paperwork is signed, a lump sum cash payment will be deposited into your account, and the buyer becomes the new policy owner.

Tax implications

There may be tax implications when selling your term life insurance policy. You will likely have to pay income tax if the proceeds from the sale exceed the amount you have paid in premiums. It is recommended to consult a tax consultant to understand the specific tax consequences of selling your policy.

Pros and cons of selling your term life insurance policy

Selling your term life insurance policy can be a good option if you no longer need the coverage or can no longer afford the premiums. It can also provide you with cash to boost your retirement savings or cover medical expenses. However, it's important to consider that your beneficiaries will not receive a death benefit unless you leave them a portion of the proceeds. Additionally, selling your policy may affect your eligibility for certain public assistance programs, such as Medicaid.

Life Insurance for Smokers: What You Need to Know

You may want to see also

Term life insurance policies don't have a cash surrender value

Term life insurance is designed to provide financial protection for your loved ones in the event of your death. It is a "pure insurance" product, meaning it only offers a death benefit with no additional features that can be utilised while you're alive. This makes term life insurance simple and affordable, but it also means you won't have access to the added benefits that come with a cash value account.

Term life insurance policies do not have a cash surrender value. This is because they are designed solely to provide a death benefit and do not accumulate cash value over time. As a result, you cannot cash out a term life insurance policy.

Permanent life insurance policies, on the other hand, do have a cash value component. This means that, in addition to providing a death benefit, they also allow you to build up a cash value that can be accessed during your lifetime. This cash value can be used in various ways, such as taking out a loan, withdrawing cash, or surrendering the policy entirely.

If you have a permanent life insurance policy, you may be able to access the cash value by:

- Surrendering the policy: You can cancel the policy and receive the cash surrender value, which is the total accumulated cash value minus any outstanding loans, prior withdrawals, and surrender charges. However, this will result in the loss of your life insurance coverage.

- Withdrawing cash: You may be able to withdraw a portion of the cash value, usually up to the amount you've paid in premiums, without paying taxes on the funds. However, this will likely reduce your death benefit.

- Taking out a loan: You can borrow money against your cash value, and the life insurance policy will serve as collateral. Interest will accrue on the loan, but there is typically no loan application or credit check required. If you choose not to repay the loan, the outstanding balance will be deducted from your death benefit.

- Paying premiums: In some cases, you may be able to use the cash value to pay your life insurance premiums, helping to offset the high costs of permanent insurance. However, if your cash value runs out and you can't pay your premiums, your policy may lapse.

It's important to note that the ability to access cash value may vary depending on the specific terms of your permanent life insurance policy. Additionally, permanent life insurance policies are typically more expensive than term life insurance policies due to the inclusion of the cash value component and lifetime coverage.

Who Are Your Life Insurance Beneficiaries? Inform Them Now!

You may want to see also

Permanent life insurance policies can be cashed out

Permanent life insurance policies, such as whole life and universal life insurance, can be cashed out. These policies are more expensive than term life insurance policies because they provide coverage for the entire life of the insured person and can build cash value. This cash value can be used to supplement income in retirement, cover college tuition, or make a down payment on a home, among other things.

There are four main ways to access the cash value in a permanent life insurance policy:

- Surrender: You can cancel the policy entirely and receive the surrender value in cash. However, this option comes with surrender fees, and you will no longer have life insurance coverage.

- Withdrawal: You can take a cash withdrawal from your permanent life policy, usually without paying income taxes as long as it's not more than the amount you've paid into the policy. However, your death benefit will likely be reduced.

- Loans: You can borrow money through your policy, with the insurer using your policy as collateral. Life insurance loans typically have lower interest rates than personal loans or home equity loans, and there is no loan application or credit check required. You can choose not to repay the loan, but the outstanding balance will be deducted from your death benefit.

- Use cash value to pay premiums: You can use the money in your cash value to pay part or all of your policy premiums, making it easier to keep your coverage.

It's important to carefully consider the pros and cons of each option before deciding to cash out your permanent life insurance policy. Withdrawing or borrowing cash from your policy can reduce your policy's death benefit, and surrendering your policy means giving up your life insurance coverage altogether. Additionally, there may be tax implications depending on the amount withdrawn and the type of policy you have.

How to Get Money Back from a Canceled Life Insurance Policy?

You may want to see also

Term life insurance policies can be converted into permanent policies

How to Convert Term Life to Permanent Life Insurance

First, check the terms of your policy to see if conversion is an option. Next, check the term conversion period, or the time frame during which you can convert. Some companies allow policyholders to convert at any point during the term of their policy, while others limit the conversion period. Then, contact your insurance agent or company to initiate the conversion. You won't need to take a life insurance medical exam or go through the underwriting process again, and the underwriting class you were assigned when you bought your term policy won't change.

The Cost of Converting

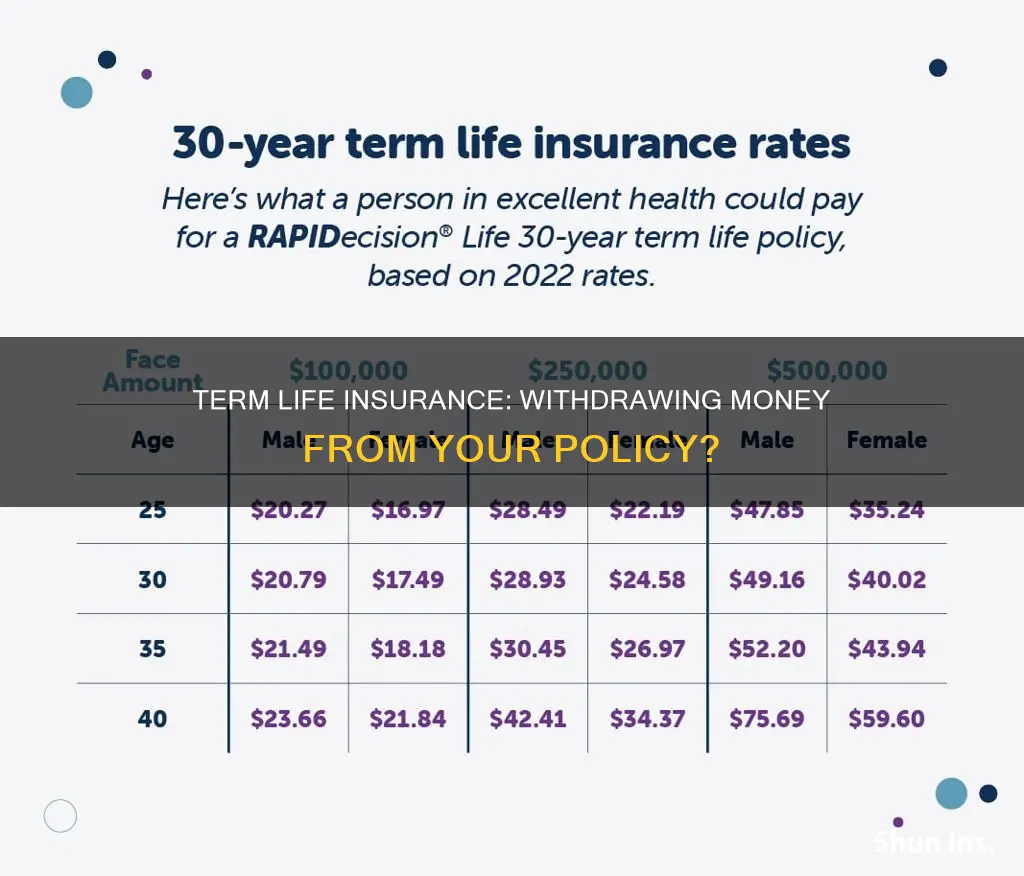

There are no fees to convert a term policy to a permanent policy. However, the rate you pay for coverage, or your premium, will increase. The amount by which your premium increases depends on several factors, including your age, the amount you convert, and the type of permanent policy you choose.

Reasons to Convert a Term Life Policy

There are several reasons why someone might choose to convert a term life policy to a permanent policy. These include:

- A change in health: Converting to a permanent policy allows you to extend your coverage without going through the underwriting process again, which can be valuable if your health changes for the worse.

- A change in budget: If your budget has increased, you may now be able to afford the higher premium of a permanent policy.

- The desire for a cash value asset: Permanent life insurance policies offer the benefit of building cash value, which can be accessed tax-free during retirement or for other reasons.

- The desire to leave a legacy: A permanent policy can guarantee a death benefit payout to your beneficiaries, allowing you to spend more liberally during retirement while still leaving money for your children.

- The need to cover final expenses: Converting to a permanent policy can ensure that your funeral expenses are covered without saddling your family with the payment.

Questions to Ask When Converting

Before converting a term policy to a permanent policy, there are several questions you should ask yourself and your insurance agent or company:

- What is your goal in converting?

- Can you afford the higher premiums now and in retirement?

- What permanent policies are available?

- Can you get a long-term care benefit?

- Can you get a rising death benefit?

Considerations

While converting a term life policy to a permanent policy can offer many benefits, there are also some potential drawbacks. Permanent policies typically cost more than term policies, with premiums for whole life policies being up to 10 times higher. Additionally, accessing the cash value of a permanent policy can be complex and may result in fees or taxes. It's important to carefully consider your financial goals and needs before making a decision.

Cigna Life Insurance: Drug Testing Requirements Explained

You may want to see also

Term life insurance policies can be cashed out through a life settlement

Term life insurance policies are designed to provide financial protection for your loved ones in the event of your sudden passing. They typically come with a death benefit and expire after a set number of years, such as 10, 20, or 30 years. While term life insurance policies do not have a cash value component that allows for a direct cash payout, there are still options available to access cash if needed. One option is to sell your term life insurance policy through a life settlement.

A life settlement involves selling your term life insurance policy to a third-party company or individual. This process is a viable option if you can no longer afford the premiums or if your circumstances have changed and you no longer require the coverage. By selling your policy, you can receive a lump sum payment that is less than the death benefit but more than the cash value. It's important to note that the buyer will take over the premium payments and receive the death benefit when you pass away.

To sell your term life insurance policy through a life settlement, you can follow these steps:

- Find a reputable broker: Share the necessary information and documents about your policy with a broker, who will assess whether it is feasible to sell.

- Make a sale: The broker will research and likely match you with a buyer who will take over your policy. The buyer will pay the agreed-upon price and make the premium payments. Once you pass away, the buyer will receive the death benefit payout.

It's important to keep in mind that selling your term life insurance policy through a life settlement has certain considerations. The sale will likely be for less than the full death benefit, and the new owner will have access to your medical records and updates on your health status. Additionally, the life settlement industry has limited regulations, which can make it challenging to determine the fair price for your policy.

While term life insurance policies cannot be directly cashed out, a life settlement provides an option to access cash by selling your policy. This option may be worth considering if your circumstances have changed and you need to generate cash. However, it's important to carefully weigh the pros and cons before making a decision.

Smokers' Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

No, term life insurance policies do not build up cash value. However, you may be able to sell your term life insurance policy to a third-party company, which is known as a life insurance settlement.

Term life insurance is typically less expensive than whole life insurance. It covers you for a specified period, after which it ends, whereas whole life insurance covers you for your entire life. Term life insurance also does not build cash value, unlike whole life insurance.

Cashing out a term life insurance policy can provide a lump sum of cash, which can be useful for large, ongoing, or unexpected expenses. However, a surrender fee may be charged, reducing the cash received. Additionally, your beneficiaries will not receive a death benefit from the policy when you die.

To cash out your term life insurance policy, you can sell it to a licensed life settlement provider. This involves finding a reputable broker, who will let you know whether your policy can be sold, and then matching you with a buyer.