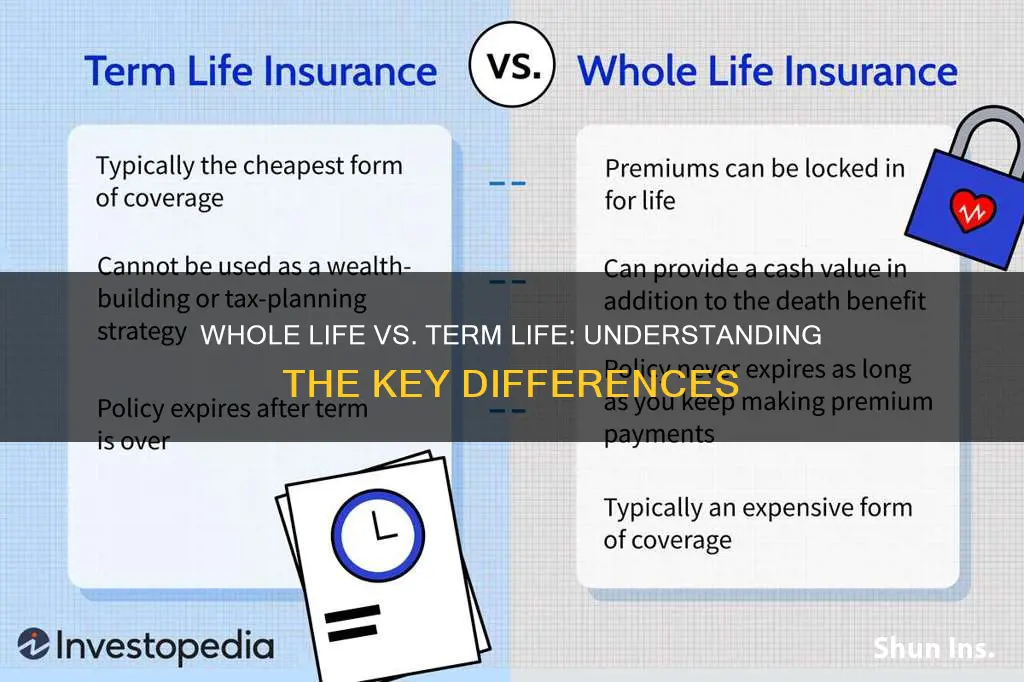

Whole life insurance and term life insurance are two distinct types of life insurance policies, each with its own unique features and benefits. While both provide financial protection for loved ones in the event of the insured's death, they differ significantly in terms of coverage, cost, and flexibility. Whole life insurance offers lifelong coverage, with premiums typically remaining level over time, and it also includes a savings component that grows tax-deferred. In contrast, term life insurance provides coverage for a specified period, such as 10, 20, or 30 years, and generally has lower premiums than whole life. Understanding these differences can help individuals choose the right insurance policy to meet their specific needs and financial goals.

What You'll Learn

- Term vs. Permanent: Whole life is permanent, while term insurance is temporary

- Cost: Whole life has consistent premiums, whereas term is cheaper initially

- Death Benefit: Both offer a death benefit, but whole life builds cash value

- Liquidity: Term insurance has no cash value, while whole life can be borrowed against

- Flexibility: Whole life offers more flexibility with investment options

Term vs. Permanent: Whole life is permanent, while term insurance is temporary

When it comes to life insurance, understanding the difference between term and permanent (whole life) policies is crucial for making an informed decision. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, and it offers a straightforward approach to protecting your loved ones financially. During this term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay a death benefit to the designated beneficiaries if the insured individual passes away within the agreed-upon period. This type of insurance is ideal for those who want coverage for a specific duration, such as until a child is financially independent or a mortgage is paid off.

On the other hand, permanent life insurance, also known as whole life insurance, offers lifelong coverage. This policy provides a death benefit and a cash value component that grows over time. The cash value is an investment account within the policy, and the policyholder can borrow against or withdraw funds from this account. Permanent life insurance is designed to remain in force for the entire life of the insured individual, providing long-term financial security. It offers a sense of stability and peace of mind, knowing that your loved ones will be financially protected indefinitely.

The key distinction lies in the duration of coverage. Term life insurance is a temporary solution, offering protection for a defined period. It is a more affordable option, especially for younger individuals, as the premiums are typically lower compared to permanent policies. Term policies are flexible and can be adjusted or canceled at any time, allowing policyholders to adapt to changing circumstances. This flexibility is particularly beneficial for those who may have fluctuating financial needs or want to explore other insurance options in the future.

In contrast, permanent life insurance provides long-term financial security. It is a more complex and expensive policy, but it offers several advantages. The cash value component allows policyholders to build a savings account, which can be used for various purposes, such as funding education expenses or starting a business. Additionally, permanent life insurance provides a guaranteed death benefit, ensuring that your beneficiaries receive the intended financial support regardless of when the insured individual passes away.

In summary, the choice between term and permanent life insurance depends on your specific needs and financial goals. Term insurance is suitable for temporary coverage and those seeking more affordable options, while permanent life insurance offers lifelong protection and a range of additional benefits. Understanding these differences will enable you to make an informed decision and ensure that your loved ones are adequately protected.

Life Insurance and Pre-Existing Conditions: What They Can Discover?

You may want to see also

Cost: Whole life has consistent premiums, whereas term is cheaper initially

When considering life insurance, understanding the cost structure is crucial as it directly impacts your financial planning. One of the primary differences between whole life and term life insurance is the cost, which is a significant factor in making an informed decision.

Whole life insurance offers a level of financial security with its consistent and predictable premium payments. Once you secure a whole life policy, your premium remains the same throughout the entire term of the policy, which can be for the entire lifetime of the insured individual. This predictability is advantageous as it allows you to plan your finances effectively, knowing exactly how much you will pay annually without any surprises. The fixed nature of these premiums is a significant draw for those seeking long-term financial stability.

On the other hand, term life insurance provides coverage for a specified period, known as the 'term'. During this period, the premiums are typically lower compared to whole life insurance. This initial cost advantage is particularly appealing to those seeking temporary coverage or those on a tight budget. Term life insurance is ideal for individuals who want affordable insurance during a specific life stage, such as when starting a family or during the years when mortgage payments are high. As the term ends, you can decide whether to renew the policy or switch to a different type of insurance.

The lower initial cost of term life insurance is a result of its temporary nature. Since the coverage is only valid for a defined period, the insurance company takes on less risk, which is reflected in the reduced premiums. This makes term life insurance an excellent choice for those who want to maximize their insurance coverage without a long-term financial commitment. However, it's important to note that once the term ends, you may need to consider the higher costs associated with converting a term policy into a permanent one or finding a new insurance provider.

In summary, the cost structure is a critical aspect of differentiating between whole life and term life insurance. Whole life insurance provides the benefit of consistent premiums, ensuring financial stability over the long term. In contrast, term life insurance offers a more affordable option for a specified period, making it a cost-effective choice for temporary coverage needs. Understanding these cost differences can help individuals make informed decisions about their insurance needs and financial planning.

Life Insurance Cash Value: Divorce-Proof or Not?

You may want to see also

Death Benefit: Both offer a death benefit, but whole life builds cash value

When it comes to life insurance, there are two primary types: whole life and term life. Both offer a death benefit, which is a financial payout made to the policyholder's beneficiaries upon the insured individual's death. This death benefit is a crucial aspect of life insurance, providing financial security and peace of mind to the policyholder's loved ones.

The primary difference between the two lies in how the death benefit is structured and the additional benefits that come with it. Term life insurance is a more straightforward policy, where the death benefit is guaranteed for a specific period, known as the term. This term can vary, ranging from a few years to several decades. Once the term ends, the policy may lapse unless it is renewed or converted to a permanent policy. Term life insurance is generally more affordable and provides coverage for a defined period, making it suitable for those who need insurance for a specific goal, such as covering mortgage payments or providing for children's education.

On the other hand, whole life insurance offers a more comprehensive and permanent solution. It provides a death benefit for the entire lifetime of the insured individual, hence the name "whole life." One of the key advantages of whole life insurance is that it builds cash value over time. A portion of the premium paid by the policyholder goes towards accumulating this cash value, which grows tax-free. This cash value can be borrowed against or withdrawn, providing financial flexibility and a source of funds that can be used for various purposes, such as starting a business, funding education, or supplementing retirement income.

The death benefit in whole life insurance is tied to the policy's cash value. As the cash value grows, the death benefit also increases, providing a higher payout to the beneficiaries. This feature ensures that the policyholder's family receives a substantial financial sum, even if the policy has been in force for many years. Additionally, the cash value in whole life insurance can be used to pay for future premiums, eliminating the need for the policyholder to make additional payments, which is a significant advantage over term life insurance.

In summary, while both whole life and term life insurance offer a death benefit, the key distinction lies in the permanence and additional benefits of whole life. Whole life insurance builds cash value, providing financial security, flexibility, and a higher death benefit, making it a more comprehensive and long-term solution for life insurance needs. Understanding these differences is essential for individuals to make informed decisions when choosing the right type of insurance policy for their specific circumstances.

Life Storage Insurance: Is It a Requirement?

You may want to see also

Liquidity: Term insurance has no cash value, while whole life can be borrowed against

When it comes to liquidity, the difference between term insurance and whole life insurance is significant. Term insurance, as the name suggests, is a temporary coverage that provides protection for a specified period, typically 10, 20, or 30 years. One of its key characteristics is that it has no cash value. This means that the policyholder does not accumulate any money within the policy, and the primary function is to provide financial protection during the agreed-upon term. Once the term ends, the policy expires, and the coverage ceases unless the policy is renewed, which may come with additional costs.

In contrast, whole life insurance offers long-term coverage and provides a cash value component. This cash value accumulates over time and can be borrowed against, providing a source of liquidity to the policyholder. The policyholder can access this cash value through loans or withdrawals, allowing them to use the funds for various purposes, such as starting a business, funding education, or investing in other opportunities. This feature of whole life insurance provides financial flexibility and security, especially during times of financial need.

The lack of cash value in term insurance means that the policyholder does not have an investment component to rely on. While term insurance is generally more affordable and offers straightforward coverage, it may not provide the same level of financial flexibility as whole life insurance. Policyholders should consider their long-term financial goals and the potential need for liquidity when deciding between the two.

For those seeking long-term financial security and the ability to access funds, whole life insurance is a more suitable option. The cash value accumulation allows for potential loan payments, providing a safety net and financial resources when needed. However, it's essential to understand the terms and conditions of borrowing against a whole life policy to ensure responsible usage and avoid any potential penalties or negative impacts on the policy's value.

In summary, the liquidity aspect highlights the difference in financial flexibility between term and whole life insurance. While term insurance offers temporary coverage without cash value, whole life insurance provides long-term protection and a valuable cash value component that can be borrowed against, offering a unique level of liquidity and financial security.

Cashing Out Life Insurance Dividends: What to Expect

You may want to see also

Flexibility: Whole life offers more flexibility with investment options

Whole life insurance provides policyholders with a level of flexibility that is often lacking in traditional term life insurance. One of the key advantages of whole life is the ability to customize the policy to fit individual financial goals and needs. When you purchase whole life insurance, you are not just buying a death benefit; you are also investing in a policy that can grow over time. This investment component allows you to make decisions about how you want to allocate your money.

With whole life, you can choose to allocate a portion of your premium payments towards building cash value, which grows tax-deferred. This cash value can be used for various purposes. For instance, you can borrow against it, providing a source of funds that can be used for major purchases, education expenses, or any other financial need. Additionally, the cash value can be used to increase the death benefit, ensuring that your loved ones receive a larger payout if something happens to you. This flexibility is particularly valuable for those who want to have more control over their insurance and investment strategy.

The investment options within whole life policies can vary. Some insurers offer fixed investment accounts, providing a guaranteed rate of return over a specified period. Others may offer variable investment options, allowing you to potentially earn higher returns but also carrying more risk. This variety enables individuals to align their investment strategy with their risk tolerance and financial objectives. For example, someone seeking a more conservative approach might opt for a fixed investment, while an investor comfortable with higher risk could choose a variable option to potentially maximize returns.

Furthermore, the flexibility of whole life insurance extends to policy modifications. If your financial situation changes, you can adjust your policy accordingly. You might increase the death benefit to cover the growing needs of your family or decrease it if your coverage is now sufficient. This adaptability is a significant benefit, especially for those who want to ensure their insurance remains relevant and effective over the long term.

In summary, whole life insurance stands out for its flexibility, offering policyholders a range of investment options and the ability to customize their coverage. This level of control allows individuals to create a comprehensive financial strategy that addresses both their insurance needs and investment goals. Understanding these features can help individuals make informed decisions when choosing between different types of life insurance.

Borrowing from Your AARP Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

Whole life insurance is a permanent, long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit and a fixed premium that remains the same for the policy's duration. In contrast, term life insurance is a temporary policy that provides coverage for a specified term, such as 10, 20, or 30 years. The premium is typically lower than whole life insurance, but it only provides coverage for the chosen term.

Whole life insurance premiums are generally higher because they include a savings component, allowing the policy to accumulate cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. Term life insurance, on the other hand, has lower premiums since it only provides coverage for a specific period. The cost of term life insurance increases with age, making it more expensive for older individuals to purchase.

Yes, whole life insurance policies build up cash value, which is the investment component of the policy. A portion of the premium goes into an investment account, and the policyholder can access this cash value through loans or withdrawals. The cash value grows tax-deferred and can be used for various purposes, such as paying for college tuition, starting a business, or supplementing retirement income.

If the insured individual survives the term of a term life insurance policy, the policy expires, and the coverage ends. The policyholder will not receive any death benefit, and the premiums paid during the term will not be refunded. However, if the individual dies during the term, the beneficiary receives the death benefit, and the policy is renewed for the remaining term at the original rate.

Yes, whole life insurance offers tax advantages. The cash value growth within the policy is tax-deferred, meaning it grows without being subject to annual income tax. Additionally, the death benefit paid to the beneficiary is generally tax-free. In contrast, term life insurance does not offer the same level of tax benefits, as the death benefit is typically taxable income for the beneficiary.