Permanent life insurance, which includes whole life and universal life, remains in force for your entire life and offers several features and options that can be strategically used to increase retirement security while you are still alive, as well as aid your beneficiaries when you pass away. One of the biggest benefits of permanent life insurance is that it offers a savings component that increases in value over time. You can borrow against the cash value of a permanent life policy or make a withdrawal that does not need to be repaid. AARP offers permanent life insurance plans and often states that their plans have no premium increases for the life of the policy. However, it is impossible for AARP to ensure that premiums will never change.

| Characteristics | Values |

|---|---|

| Borrowing from AARP life insurance | You can borrow against the cash value of a permanent life policy |

| Borrowing process | No need to make lots of financial disclosures or qualify for the money |

| Borrowing benefits | Easy access to cash without the need for a loan application |

| Withdrawal | Possible to make a withdrawal, which does not need to be repaid |

| Downsides | Any withdrawal or loan balance outstanding when you die reduces the benefit amount left to your heirs |

| Cancelling policy | You can receive the accrued cash value but may have to pay a surrender charge |

| Coverage | Coverage ranging from $10,000 to $100,000 |

| Acceptance | Guaranteed acceptance for those between the ages of 50 and 75 |

| Spouse coverage | Spouses of AARP members between the ages of 45 and 74 are also covered |

| Medical exam | No medical exam is required prior to acceptance |

| Application process | Applying is simple and only requires basic contact information, answering three medical history questions, and permitting independent verification of information |

What You'll Learn

Borrowing from permanent life insurance

Permanent life insurance policies, including whole life and universal life, remain in force for your entire life. They offer a savings component that increases in value over time and can be strategically used to boost retirement security while you're still alive, in addition to aiding your beneficiaries when you pass away.

Advantages

Borrowing against your permanent life insurance policy offers several unique benefits:

- No red tape: There are no long applications or approvals, credit checks, or invasive processes involved. If your policy has sufficient cash value, you can simply request the loan and access the funds within a few business days.

- Flexibility: You can use the borrowed funds for any purpose without having to justify your spending to anyone.

- Privacy: Life insurance loans are not reported to credit agencies or the government, so they won't affect your credit score.

- Repayment flexibility: There is no pressure to repay the loan immediately. You can choose to only pay the interest so that the loan doesn't eat into your cash value, or you may opt not to repay it at all. If you don't repay, the outstanding balance will be deducted from the death benefit before your beneficiaries receive it.

- No risk to assets: Borrowing from your life insurance policy only affects the policy itself. If you don't repay, the worst that can happen is a reduced death benefit and, in some cases, a tax bill. Your other assets, such as your home or car, are not at risk.

Disadvantages

However, there are also some serious disadvantages to consider before tapping into your policy's cash value:

- Interest accumulation: Interest accumulates over time, and if left unchecked, it can drain your policy's cash value. If the cash value runs out, your policy could lapse, leaving you without coverage and potentially facing tax penalties.

- Slower cash value growth: Taking out a loan will usually reduce the amount credited to your cash value or dividends, slowing down the accumulation of your nest egg.

- Reduced death benefit: Borrowing from your policy reduces the death benefit if the loan isn't repaid. The longer the loan remains outstanding, the more it diminishes the amount your beneficiaries will ultimately receive.

- Rider reductions: If your policy includes special features, such as an accelerated death benefit rider, borrowing from the policy may reduce the amount available for these benefits.

Process

Taking out a loan from your permanent life insurance policy is a straightforward process:

- Reach out to your agent or insurance company.

- Fill out a basic form.

- If your cash value is sufficient, you'll receive the funds within a few business days.

Considerations

When considering borrowing from your permanent life insurance policy, keep the following in mind:

- Interest rates: Some policies offer fixed interest rates, while others may adjust based on market indexes. Interest starts accruing immediately, so it's important to factor this into your repayment plans.

- Loan amount: Most insurers allow you to borrow up to 90% of your policy's cash value, and you can even take out multiple loans as long as the total loan amount plus interest doesn't exceed the policy's cash value.

- Loan balance: If the outstanding loan balance, including interest, surpasses the total cash value, your policy will likely terminate. This means losing both the coverage and any remaining value, as well as potentially incurring a phantom income tax gain.

AARP-specific Information

Regarding AARP life insurance, here is some additional information:

- Cash Value: According to the AARP website, cash value grows gradually over time as you make payments on your coverage. You can choose to borrow against this cash value, even to pay the premiums on your contract if needed.

- Term Rider Protect Plus: AARP offers a term rider as additional life insurance coverage that can be attached to your existing life insurance contract. This rider provides added protection until the age of 80 and can help close any gaps between your current coverage and the amount your loved ones may need.

- Guaranteed Exchange Option: AARP term life insurance includes the option to switch your coverage from term to permanent life insurance at any time, with no health questions or medical exams. The rate for permanent life insurance is higher but remains locked in for life, and it builds cash value.

In conclusion, borrowing from permanent life insurance can be a convenient way to access funds, but it's important to carefully consider the advantages and disadvantages before making a decision.

Primerica Life Insurance: Job Loss Protection and Benefits

You may want to see also

Pros and cons of AARP permanent life insurance

AARP permanent life insurance is a whole life insurance policy available for AARP members between 50 and 80 years old. It offers several benefits, such as:

Pros

- No medical exam is required for enrollment.

- The policy remains in force for your entire life as long as you pay the premiums.

- The premium rate is guaranteed for life and will never increase.

- It offers a savings component that increases in value over time and can be borrowed against or withdrawn.

- You can receive a regular payout instead of a lump-sum distribution, supplementing your retirement income.

- It can be used to cover the costs of long-term or critical care.

- Whole life policies may provide annual dividends.

- The cash value grows tax-deferred, and you can access it tax-free.

- Your beneficiaries don't owe income taxes on the insurance payout.

Cons

- Permanent life insurance is typically more expensive than term life insurance.

- The policy has low coverage limits, with a maximum of $50,000 available online.

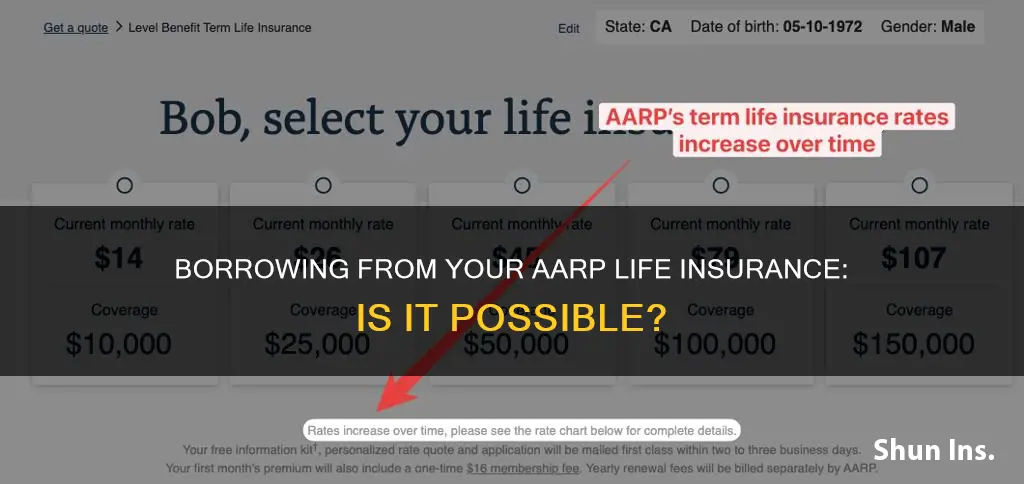

- Term life insurance premiums increase every five years.

- Withdrawing or borrowing from the policy reduces the benefit amount for your heirs.

- Cancelling the policy may result in a surrender charge.

- The ongoing retirement income option is not available with every permanent life insurance policy.

- The policy may not be available in all states.

Beneficiary Basics: Understanding Life Insurance Beneficiary Rights

You may want to see also

AARP life insurance for spouses

AARP life insurance is tailored for members aged 50 to 80 and their spouses aged 45 to 80. The program offers term, whole, and guaranteed life insurance without a medical exam. Coverage is available in all 50 states and Washington, D.C.

Term Life Insurance Options from AARP

Term life insurance provides coverage for a set amount of time and can help beneficiaries manage expenses such as funeral costs, unpaid bills, and other financial obligations after the policyholder's passing. Coverage ranges from $10,000 to $150,000 for members aged 50 to 74 and their spouses aged 45 to 74. Coverage lasts until the policyholder turns 80, and there is no waiting period for coverage to begin. While a medical exam is not required, a health questionnaire must be completed, and access to other medical information granted.

Permanent Life Insurance Options from AARP

Whole life insurance is a type of permanent life insurance that spans the entire lifetime of the policyholder and grows in cash value over time, provided policy premiums are paid on time. Coverage is available for $5,000 to $50,000 for members aged 50 to 80 and their spouses aged 45 to 80. According to the website, premiums are locked for life. No medical exam is required, but a health questionnaire must be completed.

Guaranteed Acceptance Life Insurance Options from AARP

AARP offers a second whole life policy, Guaranteed Acceptance. Coverage is guaranteed for members aged 50 to 80 and their partners aged 45 to 80, with no medical exam or health questionnaire required. The maximum death benefit is $25,000, and payouts are limited for the first two years. Beneficiaries will not receive a full death benefit if the policyholder dies during that time.

Riders Offered by AARP Life Insurance

In addition to whole and term life policies, AARP provides two additional riders: the AARP Term Rider Protect Plus and the Guaranteed Exchange Option. The former is added to an existing AARP term life insurance policy and raises coverage limits until the policy ends at age 80. The latter is included in AARP's term life insurance policy and allows policyholders to exchange their coverage from term to whole life insurance without proving their insurability.

Scheduling Your Life Insurance Exam: A Quick Guide

You may want to see also

Applying for AARP life insurance

AARP offers various life insurance options, including term life insurance, permanent life insurance, and guaranteed acceptance life insurance. When applying for AARP life insurance, there are a few things to keep in mind.

First, determine the type of life insurance that best suits your needs. AARP's term life insurance provides coverage up to $150,000 until the age of 80, while their permanent life insurance offers lifelong coverage with a maximum of $50,000 and guaranteed rates that never increase. Their guaranteed acceptance life insurance provides coverage of up to $30,000 with no medical exam required.

Once you have decided on the type of insurance, you can apply online or by phone. AARP life insurance is provided by New York Life, and you will need to be an AARP member to be eligible for their insurance program. During the application process, you will be required to provide health information and other relevant details, but no medical exam is necessary.

Additionally, AARP offers the option to add a term rider to your existing life insurance policy. This can provide extra coverage of up to $150,000 until the age of 80, and it includes benefits such as an accelerated benefit in case of a terminal illness and a waiver of premium for qualified nursing home stays.

It is important to note that specific products and features may not be available in all states, and online or phone applications may also have certain restrictions in some states.

Primerica Life Insurance: Is It a Smart Choice?

You may want to see also

AARP life insurance alternatives

AARP life insurance is provided by New York Life Insurance Company for AARP members. The insurance is available to anyone over the age of 50, as well as their spouses, although you must be a member to purchase it.

AARP offers term life insurance, whole life insurance, and guaranteed acceptance life insurance. Term life insurance offers temporary coverage with premiums rising every five years and can be converted to permanent insurance at any time up to the age of 80. Whole life insurance is a type of permanent life insurance that lasts for the duration of the policyholder's life and includes a cash value component that can be borrowed or withdrawn from. Guaranteed acceptance life insurance does not require a medical exam or health questions and guarantees approval for all applicants.

- Independent life insurance agents: If you want advice on life insurance policies from multiple companies, consider working with an independent agent. They can provide you with a range of options and help you find the best policy for your needs.

- Other insurance companies: There are many other insurance companies that offer life insurance policies, such as Legal & General America Life/Banner Life Insurance, Fidelity Life Insurance, Guardian Life Insurance, and Allstate Life Insurance. Compare quotes and policies from different companies to find the best option for you.

- Hybrid life insurance policies: Hybrid policies, also known as permanent life insurance, allow policyholders to convert their cash value into coverage for nursing home or skilled nursing care. This can help address the financial burden of long-term care.

- Life insurance riders: Life insurance riders are optional add-ons that allow you to customize your coverage. For example, you can add a term rider to increase your coverage during certain periods of your life, or a terminal illness rider that allows you to withdraw a portion of your death benefit if you are diagnosed with a qualifying illness.

- Permanent life insurance policies: If you're looking for a policy that lasts your entire life and offers a savings component, consider a permanent life insurance policy. This type of policy remains in force for your entire life and can provide retirement income, tax benefits, and dividend payments.

When considering alternatives to AARP life insurance, be sure to compare rates, coverage amounts, medical requirements, and consumer complaints to find the best option for your needs.

Haven Life Insurance: MyVisaJobs' Comprehensive Guide

You may want to see also

Frequently asked questions

Yes, you can borrow against the cash value of a permanent life policy.

You can take a loan against your coverage. If you pass away before the loan is paid back, the loan amount and any interest due will be deducted from the death benefit.

Borrowing from your life insurance means you won't have to make lots of financial disclosures or qualify for the money.

Any loan balance still outstanding when you die will reduce the benefit amount left to your heirs. You may also have to pay a surrender charge if you cancel the policy.

Term life insurance lasts for a set period and does not build cash value, whereas permanent life insurance remains in force for your entire life and offers a savings component that increases in value over time.