Haven Life was a digital insurance agency that offered an easy way to buy high-quality, affordable term life insurance online. The company offered two types of term life insurance: Haven Simple and Haven Term. Haven Life was founded in 2014, and its life insurance policies were issued by MassMutual and C.M. Life, a MassMutual subsidiary, and sold on the Haven website. In late 2023, Haven Life announced that it was ceasing new business and would no longer be accepting new applications for its life insurance products. Existing policies will continue to be administered and serviced by MassMutual. Haven Life received multiple recognitions for its term life insurance solutions, including being named Best for Cost for affordability and Best No-Exam for its Haven Simple product.

| Characteristics | Values |

|---|---|

| Number of Policies | 2 |

| Types of Policies | Term Life Insurance, Term Simplified Life Insurance |

| Policy Options | Haven Simple, Haven Term |

| Coverage Range | $25,000 to $3 million |

| Terms Range | 5 to 30 years |

| Age Range | 20 to 64 years |

| Medical Exam Required | Yes (for Haven Term) |

| Parent Company | MassMutual |

| Founded | 2014 |

| Website | havenlife.com |

| Customer Service | Email: [email protected], Phone: (855) 744-2836 |

What You'll Learn

Haven Life is no longer accepting new applications

Haven Life was founded in 2014 as a digital insurance agency. It offered an easy way to buy high-quality, affordable term life insurance online. The company provided two types of term life insurance: Haven Simple and Haven Term. Haven Simple offered maximum coverage of $1 million with term limits of up to 20 years, while Haven Term offered maximum coverage of $3 million with term limits of up to 30 years. Haven Life also offered disability income insurance and annuities to help protect individuals and their loved ones financially.

The process of applying for Haven Life insurance was simple and straightforward, as highlighted by positive customer reviews. The company's online calculator helped individuals estimate the right amount of coverage, making the experience less challenging, especially for those without a financial advisor.

Although Haven Life is no longer accepting new applications, individuals can still learn about insurance and protection products offered by MassMutual by visiting their website or following them on social media platforms such as Facebook, Instagram, and YouTube. For any questions or concerns, customers can contact Haven Life via email at [email protected] or by calling (855) 744-2836.

Life Insurance and COVID-19: What You Need to Know

You may want to see also

Haven Life's insurance products

Haven Life is a digital insurance agency that offers an easy way to buy high-quality, affordable term life insurance online. The company was founded in 2014 and its life insurance policies were issued by MassMutual and C.M. Life, a MassMutual subsidiary, and sold on the Haven website. Haven Life is no longer accepting new applications for its insurance products, but existing policies will continue to be administered and serviced by MassMutual.

Haven Life offered two types of term life insurance: Haven Simple and Haven Term. Haven Simple policies could be purchased online after answering a short series of questions and did not require a medical exam. Coverage began as soon as the payment was approved, with maximum coverage of $1 million and term limits of up to 20 years. Haven Term policies could also be applied for online, but medical exams may have been required for some applicants prior to approval. Haven Term offered maximum coverage of $3 million with maximum term limits of 30 years. Both Haven Simple and Haven Term offered a guaranteed, tax-free death benefit, payable to beneficiaries in a lump sum provided that the policy is current and premiums have been paid on time.

In addition to term life insurance, Haven Life also offered disability income insurance to help protect your income if you become disabled. Haven Life also offered annuities to help protect you and your loved ones from outliving your retirement savings.

The cost of Haven Life's insurance products depended on several factors, including health and medical history, the purchase of riders or other optional coverage, and engagement in risky activities. Haven Life's insurance products were available in all 50 states and the District of Columbia, with some variations in rider availability by state.

Life Insurance and VA Loans: What You Need to Know

You may want to see also

Haven Life's customer reviews

Haven Life Customer Reviews

Haven Life has received generally positive reviews from its customers. On Trustpilot, the company has an "excellent" rating of 4.8 out of 5 stars, with over 1,000 reviews. Many customers have praised Haven Life for its hassle-free online application process, responsive communication, and competitive rates. One reviewer mentioned that they "did [their] research and noticed Haven Life had received the best reviews" and that they now "see why". Another reviewer praised Haven Life for its "excellent customer service", with a particular agent responding promptly to their queries.

Customers have also appreciated the convenience and speed of Haven Life's services. One reviewer was pleased that they could complete the application in under 20 minutes, while another mentioned that they received approval in less than an hour. Haven Life's application process is also praised for being simple, quick, and painless.

However, there are also negative reviews from customers who faced issues with language barriers, discrimination, and long wait times. One reviewer complained about being treated badly by an agent because they did not speak English fluently. Another reviewer called Haven Life "highly discriminatory", stating that they were denied coverage based on their BMI without any consideration of their health history. Additionally, some customers experienced delays in obtaining their plans, with one reviewer mentioning that it took them 7 months and 3 failed appointments to lock in their plan.

It is worth noting that Haven Life has stopped selling new policies as of January 2024, but existing policies will continue to be serviced by its parent company, MassMutual.

Transamerica Life Insurance: Exam Requirements and Health Checks

You may want to see also

Haven Life's contact information

Haven Life is no longer accepting new applications for its life insurance products. However, you can contact the company for queries regarding existing policies.

Contact Information

You can reach out to Haven Life via email at [email protected] or by calling (855) 744-2836.

Existing Policies

Existing policies issued by MassMutual and subsidiary C.M. Life will continue to be administered and serviced by MassMutual. There is no change to your existing policy, and you can rest assured that your policy will remain in effect.

Parent Company

The parent company, MassMutual, is still offering its own insurance products and protection services. You can learn more about their offerings by visiting their website at massmutual.com. Additionally, you can follow MassMutual on social media platforms like Facebook, Instagram, and YouTube.

Address

Haven Life's address is New York, NY 10010, US.

St Farm Life Insurance: What You Need to Know

You may want to see also

Haven Life's insurance partners

Haven Life Insurance is no longer accepting new applications or customers for its life insurance products. Existing policies will continue to be administered and serviced by their parent company, MassMutual, and its subsidiary, C.M. Life.

Haven Life was founded in 2014 as a digital insurance agency and offered two types of term life insurance: Haven Simple and Haven Term. Haven Simple offered maximum coverage of $1 million with maximum term limits of 20 years, while Haven Term offered maximum coverage of $3 million with maximum term limits of 30 years. The company also offered disability income insurance and annuities.

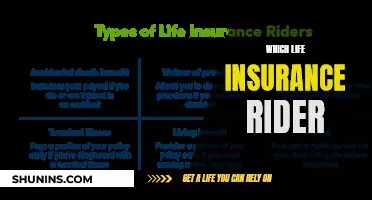

In terms of riders, Haven Life offered the Accelerated Death Benefit, Waiver of Premium, and Haven Life Plus. The Haven Life Plus rider was not available in all states, including Florida, New York, North Dakota, South Dakota, and Washington.

While Haven Life is no longer accepting new applications, prospective customers can explore alternatives such as Bestow Life, State Farm, Nationwide, Lincoln Financial, and Northwestern Mutual, as listed on US News.

KeyBank's Life Insurance Offerings: What You Need to Know

You may want to see also

Frequently asked questions

No, Haven Life is no longer accepting new applications for insurance. Existing policies will continue to be administered and serviced by MassMutual.

Haven Life offered two types of term life insurance: Haven Simple and Haven Term.

Depending on the policy, coverage ranges from $25,000 to $3 million.