State Farm has been offering life insurance for almost a century and is one of the most prominent agencies in the US. The company has more than 19,000 agents nationwide and the highest possible AM Best financial strength rating of A++. State Farm offers a range of life insurance policies, including term, whole, universal, and variable, with additional options like the children's term rider and the care benefit rider. The company's life insurance policies provide a death benefit and, in some cases, a cash value account that can be accessed during the policyholder's lifetime.

| Characteristics | Values |

|---|---|

| Number of Policies | 10 |

| Types of Policies | Term, Whole, Universal, Variable |

| Term Lengths | 10, 20, 30 years |

| Coverage Limits | $25,000 - $1,000,000 |

| Age Restrictions | 45-90 years old, depending on the policy |

| Application Process | Must be purchased through a State Farm agent |

| Financial Strength Rating | A++ |

| Customer Satisfaction Ranking | #1 in J.D. Power's 2021 U.S. Individual Life Insurance Study |

What You'll Learn

State Farm's life insurance coverage

State Farm has been in the business of providing life insurance for nearly a century and is one of the most prominent agencies in the US today. The company offers a range of life insurance policies to suit different needs, including term life, permanent, whole life, universal, and variable.

State Farm's term life insurance policies are available in 10-, 20-, or 30-year terms, with coverage starting at $50,000 to $100,000. The maximum eligibility age varies depending on the term selected. The Return of Premium Term policy returns premiums to the policyholder if they outlive the term. The Instant Answer Term Insurance policy offers same-day approval and coverage of up to $50,000 without requiring a medical exam.

Whole life insurance policies provide permanent coverage as long as premium payments are made. State Farm offers four whole life policies: Whole Life, Limited Pay Whole Life, Single Premium Whole Life, and Final Expense. The Limited Pay Whole Life policy allows policyholders to stop making premium payments after 10 to 30 years, while still retaining coverage. The Single Premium Whole Life policy only requires a single premium payment for lifelong coverage. The Final Expense policy is designed to cover end-of-life expenses and is available to individuals aged 50 to 80, with coverage ranging from $10,000 to $15,000.

Universal life insurance is a type of permanent life insurance with adjustable coverage and premiums. State Farm offers three universal life policies: Universal Life, Survivorship Universal Life, and Joint Universal Life. The Survivorship Universal Life policy covers two individuals and pays out after the second insured's death. The Joint Universal Life policy also covers two individuals but pays out after the first insured's death.

State Farm's life insurance policies can be purchased by contacting a local State Farm agent or by calling their customer service line. The company has over 19,000 agents across the country, making it convenient for customers to find a local agent.

In addition to life insurance, State Farm also provides a range of other insurance products, including vehicle, home, and business insurance, as well as financial services such as loans and investment options.

Life Insurance: An Investment or a Safety Net?

You may want to see also

Pros and cons of State Farm life insurance

State Farm offers a range of life insurance policies, including term, whole, and universal life insurance. Here are some pros and cons of State Farm life insurance:

Pros:

- State Farm has a strong financial rating and is recognised for its financial stability and ability to pay claims.

- The company has a long history, dating back to 1922, and is committed to meeting customer needs.

- It offers a broad array of products, including term, whole, and universal life insurance, providing flexibility and options for customers.

- State Farm has a large network of over 19,000 local agents across the country, making it convenient for customers to find a local agent and get personalised guidance.

- State Farm's life insurance policies are available in all 50 states, although they are not currently accepting new applications in Massachusetts and Rhode Island.

- The company provides a life insurance calculator to help customers determine the right amount of coverage based on their individual needs.

- State Farm offers a multiline discount when purchasing multiple insurance policies, such as combining auto insurance and life insurance.

- State Farm's term policies can be converted to permanent policies, providing flexibility for customers.

- The company offers a conservative investing strategy, investing the majority of its bond portfolio in high-quality investment-grade bonds.

Cons:

- State Farm does not offer online quotes or applications for its life insurance policies. All policies must be purchased through a State Farm agent, which may be inconvenient for those who prefer a digital application process.

- Some of State Farm's policies have lower age cutoffs, with two of their three term policies having cutoffs at 45 or 60 years. This limits the options available for older applicants.

- State Farm's life insurance policies are not available in Massachusetts, New York, or Wisconsin, and new policies are not marketed in Rhode Island.

- The company offers fewer riders compared to some competitors, and the accelerated death benefit costs extra.

Understanding Excess Group Life Insurance and PA Tax Laws

You may want to see also

State Farm's term life insurance options

State Farm offers term life insurance options for those seeking coverage for a specific time frame. Term life insurance is ideal for those who need help with short-term debts, added protection during child-raising years, or other short-range goals.

State Farm offers at least 10 different life insurance policy options, including term, whole, and universal policies. Term policies can be converted to permanent policies, and some policies exclude applicants older than 65. All policies must be purchased through a State Farm agent.

- Return of Premium: Premiums remain level for the life of the policy, and if there is no payout at the end of the term, you will get your payments back. Coverage starts at $100,000.

- Instant Answer: This policy provides same-day approval and purchase for qualified applicants who are willing to go to an agent's office. It offers a $50,000 policy that can cover the insured up to age 50 or a maximum of 10 years, whichever comes first.

- Select Term: This policy provides a level premium for the term selected, with coverage starting at $100,000. New applicants must be 75 or younger to qualify, but renewals can extend up to age 95.

Depending on the policy, State Farm offers 10-, 20-, or 30-year terms. The initial premium is affordable, and you can choose to pay your premiums monthly or annually. You can also add optional riders to your policy, such as the Children's Term Rider and the Waiver of Premium for Disability.

Life Insurance and Cervical Cancer: What's Covered?

You may want to see also

State Farm's whole life insurance options

State Farm offers a range of whole life insurance options, providing permanent coverage and lifelong protection. Here is an overview of their whole life insurance options:

Whole Life Insurance

The standard whole life insurance policy offered by State Farm provides level premiums that remain unchanged for the duration of the policy. This policy earns cash value over time, and the death benefit, premium, and cash value are guaranteed as long as the premiums are paid as scheduled. Whole life insurance policies are also eligible to earn dividends, which can be paid in cash, used to reduce the policy premium, accumulate interest, or purchase additional insurance. The choice of how to utilize the dividends is left to the policyholder.

Limited Pay Whole Life Insurance

This policy option offers coverage for the insured's entire life but requires premiums to be paid for a limited number of years, either 10, 15, or 20 years. The coverage continues even after the premiums are paid off. This option provides flexibility in terms of payment frequency, allowing policyholders to choose to pay premiums monthly, quarterly, semi-annually, or annually. The coverage provided starts at $100,000.

Single Premium Whole Life Insurance

The single premium whole life insurance policy only requires a one-time premium payment, providing lifelong coverage in exchange for a single upfront cost. This policy has a minimum policy value of $15,000 and can be purchased by individuals up to 80 years of age.

Final Expense Whole Life Insurance

Also known as guaranteed acceptance life insurance, this policy is designed to cover expenses such as cremation, funeral costs, and medical bills. It does not require answering medical questions or undergoing a medical exam, making it accessible to those who might not qualify for other policies. This policy is not available in California, Florida, New York, North Dakota, South Dakota, or Wisconsin, and the coverage ranges from $10,000 to $15,000.

Midland Life Insurance: Accelerated Benefits and Their Availability

You may want to see also

State Farm's universal life insurance options

State Farm offers three universal life insurance policies: Universal Life, Survivorship Universal Life, and Joint Universal Life.

Universal Life

The Universal Life policy allows you to adjust your coverage and premiums to meet your changing needs. The policy builds cash value, which can be used during your lifetime, and the death benefit can be level or variable. Coverage starts at $25,000 or $50,000, depending on your age, and you can qualify as long as you're 85 or younger.

Survivorship Universal Life

The Survivorship Universal Life policy covers two people and pays out only after both insured individuals have died. Coverage starts at $250,000, and most applicants can qualify up to the age of 90, while the limit for Californians is 78. This policy also has flexible premiums and builds cash value. It is often used by couples with large estates to pay estate taxes or to leave a legacy or charitable gift.

Joint Universal Life

The Joint Universal Life policy also covers two individuals and builds cash value over time. Applicants must be 85 or younger to qualify, and the coverage must be at least $100,000. This policy is typically more affordable than two separate permanent policies, and it can provide financial security for loved ones by helping to pay the mortgage, fund a college education, and pay off monthly bills.

Riders

State Farm offers several riders that can be added to the universal life insurance policies, including the Flexible Care Benefit Rider, Level Term Rider (Additional Insured), Children's Term Rider, Guaranteed Insurability Option, and Waiver of Monthly Deduction for Disability. These riders provide additional benefits, such as long-term care coverage, temporary insurance for children, and the ability to increase coverage without a medical exam.

Gerber Life Insurance: Doubling Benefits for Parents

You may want to see also

Frequently asked questions

Yes, State Farm offers life insurance. The company has been offering life insurance for nearly 95 years and is one of the most prominent agencies in the U.S. today.

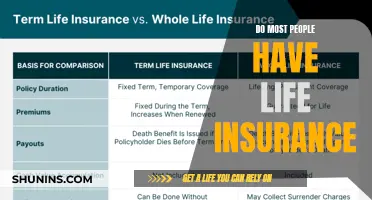

State Farm offers term life insurance, whole life insurance, and universal life insurance. Term life insurance covers you for a defined period, while whole life insurance and universal life insurance are permanent policies.

You can get a quote for term life insurance online, but for whole life and universal life insurance, you need to contact a State Farm agent directly or call them.