Fidelity Life Insurance offers a range of policies, including term life, whole life, final expense, and accidental death insurance. While the company does not have a specific two-year weight requirement, it does consider weight as part of its medical underwriting process for certain policies. During this process, applicants may be required to undergo a medical exam, which includes checking weight and height, as well as collecting blood and urine samples. This information is used to assess the applicant's health and determine their eligibility and premium rates. It's important to note that Fidelity Life also offers several no-medical-exam options for individuals who prefer not to undergo a full medical examination.

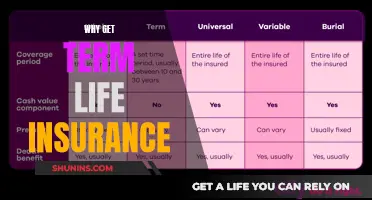

| Characteristics | Values |

|---|---|

| Type of insurance | Term, whole, final expense, and accidental death |

| Riders | Accidental death benefit, child insurance policy, inflation, accelerated benefits, return of premium |

| Availability | Not available in New York or Wyoming |

| Customer support | Not available on weekends |

| Claims process | By mail |

| Company history | Founded in 1896, $421 million in assets, $41 billion in life insurance in force, A- (Excellent) rating with A.M. Best |

What You'll Learn

Does Fidelity require a medical exam for life insurance?

Fidelity requires a medical exam in most instances to better understand your health and provide you with a personalized rate. The exam is conducted by a paramedic professional and can be done at a location and time convenient for you at no cost. You can expect blood pressure, weight, and height to be checked, and blood and urine samples will also be collected.

However, depending on the policy, a medical exam may not be required. For example, Fidelity's RAPIDecision Final Expense policy is ideal for those who do not wish to take a medical exam, but are okay with answering health questions and allowing Fidelity Life to access public health databases to qualify them. Similarly, the RAPIDecision Guaranteed Issue Life policy is ideal for those with pre-existing health conditions as it does not require a medical exam, answering medical questions, or a public database health search.

Life Insurance and CT: Taxing the Payout?

You may want to see also

What is the maximum life insurance coverage from Fidelity?

Fidelity offers a range of term and whole life insurance policies with different coverage limits. The maximum coverage available depends on the specific policy.

For term life insurance, the RAPIDecision Life policy offers coverage starting at $50,000 and maxing out at $2 million. This policy is available to those between the ages of 18 and 65 and can be renewed each year until the age of 95.

The RAPIDecision Senior Life policy is available to adults between the ages of 50 and 70, with coverage ranging from $10,000 to $150,000.

Fidelity also offers whole life insurance policies with maximum coverage of $150,000. The RAPIDecision Final Expense policy is for adults aged 50 to 85 and provides coverage ranging from $5,000 to $40,000. The RAPIDecision Guaranteed Issue policy has a maximum coverage of $25,000, while the RAPIDecision Senior Whole Life policy offers coverage from $10,000 to $150,000 for adults aged 50 to 85.

It's important to note that the availability and specifics of these policies may vary based on your location and other factors. Be sure to review the details of each policy and consult with a Fidelity representative to determine the maximum coverage available for your specific situation.

Dr. Scott Mosby: Sun Life Insurance Acceptance and Benefits

You may want to see also

Does Fidelity offer term life insurance?

Fidelity does offer term life insurance. Term life insurance covers individuals for a specific amount of time, for a predetermined dollar amount. This coverage serves as a safety net for a period of years and can provide financial security to those you love if something happens to you.

Fidelity's term life insurance is available to those 18 years and older, US citizens, and permanent residents of the United States. The term of the policy can be chosen by the customer, with options ranging from 10, 15, 20, 25, or 30 years. The premium is paid monthly, semi-annually, or annually throughout the duration of the policy term. The premium amount is based on the policy value, term, age, sex at birth, and health status.

Fidelity's term life insurance policies are not currently available to residents of New York.

Life Insurance and DSHS: Counting Assets and Impact

You may want to see also

Does Fidelity offer whole life insurance?

Fidelity offers both term and whole life insurance policies. Whole life insurance is a type of permanent life insurance, which means it provides coverage for your entire life. It often has fixed premiums and a guaranteed cash value and payout amount. Fidelity's whole life insurance policies are aimed at people aged 50 and older and have coverage limits of up to $150,000.

Fidelity's term life insurance policies, on the other hand, are available for a specific period of time, such as 10, 15, 20, or 30 years. These policies are available to individuals aged 18 and older and have coverage limits of up to $2 million.

Fidelity's life insurance policies are designed to provide financial security for your loved ones in the event of your death. The company offers a range of policy options to suit different needs and budgets.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

Does Fidelity offer universal life insurance?

Fidelity Investments Life Insurance Company offers term life insurance and whole life insurance. Term life insurance covers individuals for a specific amount of time, for a predetermined dollar amount, while whole life insurance is a type of permanent life insurance that covers the insured's entire lifetime. Fidelity's term life insurance policies are available in increments of 10, 15, 20, 25, or 30 years in most states.

Fidelity does not offer universal life insurance. Universal life insurance is a permanent life insurance policy that lasts the entirety of the policyholder's lifetime. It allows the policyholder to adjust their premium payments and how much of these payments go towards the policy's cash value.

Crate Carriers: Life Insurance Provision and Employee Benefits

You may want to see also

Frequently asked questions

Many Fidelity Life Insurance policies do not require a medical exam, although some use your answers to medical questions to determine your rates and eligibility. Its main term life insurance policy does require an exam but allows six months to undergo it.

No, Fidelity Life Insurance is not a scam. Although the company does draw some customer complaints for sending unwelcome emails and making policy changes difficult, it is legitimate based on its third-party ratings. The company, which is based in Chicago, Illinois, is accredited with the BBB and holds an A- AM Best rating for its financial strength.

The rates you pay for a Fidelity Life Insurance policy depend on several factors. The policy type, chosen death benefit, and results of the individual underwriting process all play a role. Fidelity Life offers online quotes and has insurance agents available to help with the application process.

Fidelity Life features a mix of positive and negative reviews on both Trustpilot and the Better Business Bureau (BBB). Positive reviews commonly mention quick claims and affordable prices. Negative reviews complain about the company's communication tactics, from difficulty reaching representatives to repeatedly receiving unwanted marketing emails.