Term life insurance is a popular and affordable way to protect your loved ones financially in the event of your untimely death. Unlike permanent life insurance, term insurance is designed to provide coverage for a specific period, typically 10, 20, or 30 years. During this term, if you pass away, your beneficiaries receive a death benefit, which can be used to cover expenses such as mortgage payments, children's education, or daily living costs. This type of insurance is particularly beneficial for those who want to ensure their family's financial security without the long-term commitment and higher costs associated with permanent policies. By choosing term life insurance, you can provide peace of mind and financial stability for your loved ones during the years when they need it most.

What You'll Learn

- Affordable Coverage: Term life insurance offers cost-effective protection for a specific period

- Fixed Premiums: Consistent payments ensure predictable expenses over the term

- No Lapse: Policies don't require investment, avoiding premium increases or policy lapses

- Clear Benefits: Provides clear financial security for loved ones during the term

- Peace of Mind: Knowing your family is protected can offer long-term reassurance

Affordable Coverage: Term life insurance offers cost-effective protection for a specific period

Term life insurance is a popular and affordable way to secure financial protection for a specific period of time, typically ranging from 10 to 30 years. It provides a straightforward and cost-effective solution for individuals seeking coverage during a particular phase of their lives, such as when they have a mortgage, children to support, or other financial commitments. The primary advantage of term life insurance is its affordability, making it accessible to a wide range of people.

During the term period, the insurance company guarantees a death benefit if the insured individual passes away. This benefit can be used to cover various expenses, such as outstanding debts, mortgage payments, or to provide financial security for loved ones. The beauty of term life insurance lies in its simplicity and predictability. Premiums are typically lower compared to permanent life insurance because the coverage is limited to a specific duration. This means that the insurance company's risk is reduced, allowing them to offer more competitive rates.

For those who want to ensure their family's financial stability without breaking the bank, term life insurance is an excellent choice. It allows individuals to protect their loved ones without the long-term financial commitment associated with permanent insurance policies. As the term progresses, the insured individual can decide whether to renew the policy or explore other insurance options that better suit their evolving needs.

When considering term life insurance, it's essential to evaluate your specific circumstances. Factors such as age, health, and the desired coverage amount will influence the premium rates. Younger individuals often benefit from lower premiums, while those with pre-existing health conditions might need to explore additional coverage options. Consulting with an insurance advisor can help you navigate these choices and find the most suitable term life insurance plan.

In summary, term life insurance provides an affordable and efficient way to safeguard your loved ones during a defined period. Its cost-effectiveness and flexibility make it a popular choice for individuals seeking temporary financial protection. By understanding the benefits and evaluating your personal needs, you can make an informed decision about securing the right term life insurance policy.

Haven Life Insurance: Maryland's Top Choice for Coverage

You may want to see also

Fixed Premiums: Consistent payments ensure predictable expenses over the term

When considering term life insurance, one of the most appealing aspects is the predictability and stability it offers in terms of financial planning. This is primarily due to the fixed premiums associated with this type of insurance. Unlike other forms of life insurance, where premiums can vary based on various factors, term life insurance provides a consistent and unchanging payment structure. This consistency is a significant advantage for individuals and families, ensuring that their financial obligations remain predictable over the term of the policy.

With fixed premiums, policyholders can budget and plan their expenses effectively. Each premium payment is the same throughout the term, typically ranging from 10 to 30 years. This predictability allows individuals to allocate their financial resources efficiently, knowing exactly how much they need to set aside each month or year. For those with long-term financial goals, such as saving for a child's education or planning for retirement, this consistency can be a valuable tool to ensure that their insurance coverage remains affordable and sustainable.

The predictability of fixed premiums also provides a sense of financial security. Policyholders can rest assured that their insurance premiums will not increase unexpectedly, which could otherwise strain their budget. This stability is particularly important for those who have already made financial commitments or have limited financial flexibility. By knowing exactly what they need to pay, individuals can make more informed decisions about their overall financial strategy.

Furthermore, the consistent payments of term life insurance can be a crucial factor in maintaining coverage for a specific period. This is especially relevant for those who require insurance for a particular duration, such as covering mortgage payments or providing financial security for dependent children. With fixed premiums, individuals can ensure that their insurance remains active and effective without the worry of sudden premium increases, allowing them to focus on other financial priorities.

In summary, the concept of fixed premiums in term life insurance is a powerful incentive for individuals seeking financial stability and predictability. It enables better financial planning, provides peace of mind, and ensures that insurance coverage remains accessible and affordable over the term of the policy. Understanding this aspect of term life insurance can help individuals make informed decisions about their insurance needs and overall financial strategy.

Understanding Life Insurance Illustrations: A Beginner's Guide

You may want to see also

No Lapse: Policies don't require investment, avoiding premium increases or policy lapses

Term life insurance is a straightforward and cost-effective way to protect your loved ones financially. One of its key advantages is the absence of investment components, which sets it apart from other insurance products. Unlike permanent life insurance, which often includes an investment component, term life insurance focuses solely on providing coverage for a specified period. This simplicity ensures that your premiums remain stable and predictable throughout the term, without the risk of premium increases or policy lapses.

The lack of investment in term life insurance means that the insurance company doesn't have to manage a portfolio of investments to generate returns. As a result, they can offer competitive rates, making it an affordable option for those seeking comprehensive coverage. This simplicity also means that the policy is easy to understand and manage, with no hidden fees or complex investment strategies to worry about.

Avoiding premium increases is another significant benefit. Term life insurance policies typically have fixed premiums for the entire term, ensuring that your monthly payments remain consistent. This predictability allows you to plan your finances effectively, knowing exactly how much you'll pay each month. In contrast, other insurance products might experience premium increases due to market fluctuations or changes in the insured's health, which can be unpredictable and costly.

Moreover, term life insurance policies are designed to provide coverage for a specific period, often 10, 20, or 30 years. This term structure ensures that you only pay for the coverage you need during that time. Once the term ends, you can choose to renew the policy or opt for a different type of insurance, depending on your changing needs and circumstances. This flexibility is particularly valuable for those who want to ensure their loved ones are protected during their most vulnerable years without the long-term financial commitment of permanent insurance.

In summary, term life insurance offers a no-frills approach to financial protection. By eliminating the investment component, insurance companies can provide stable premiums, avoiding the potential pitfalls of premium increases and policy lapses. This simplicity and predictability make term life insurance an attractive choice for individuals seeking affordable and comprehensive coverage for their families.

Cancer and Life Insurance: Can You Get Covered?

You may want to see also

Clear Benefits: Provides clear financial security for loved ones during the term

Term life insurance offers a straightforward and effective way to ensure your loved ones are financially secure during the specified term of the policy. This type of insurance is designed to provide a lump sum payment, known as a death benefit, to your designated beneficiaries if you pass away during the term. The primary purpose is to offer peace of mind and financial stability to your family, especially those who rely on your income.

One of the key advantages is its simplicity. Term life insurance is easy to understand and purchase. You can choose a policy with a specific duration, such as 10, 20, or 30 years, and select the amount of coverage you need to adequately support your family. This clarity in coverage ensures that your loved ones will have the financial resources to cover essential expenses, such as mortgage payments, education costs, or daily living expenses, even if you are no longer around.

The financial security provided by term life insurance is particularly valuable during the term because it allows your beneficiaries to focus on adjusting to life without you without the added stress of financial instability. It provides a safety net, ensuring that your family can maintain their standard of living and make important life decisions without the immediate worry of financial burdens. For example, the death benefit can be used to pay off debts, cover funeral expenses, or even be invested to grow over time, providing long-term financial support.

Moreover, the term nature of the policy means that you can plan and manage your finances effectively. You can choose a term that aligns with your family's needs, such as covering the years until your children finish school or until a mortgage is fully paid off. This flexibility ensures that the insurance remains relevant and beneficial throughout the specified period.

In summary, term life insurance provides clear and immediate financial security for your loved ones during the term of the policy. It offers a practical solution to ensure your family's well-being and peace of mind, allowing them to focus on creating new memories and building a future without the added financial strain. This type of insurance is a valuable tool for anyone seeking to protect their loved ones and provide a safety net for the future.

Retired Military: What Life Insurance Benefits Are Available?

You may want to see also

Peace of Mind: Knowing your family is protected can offer long-term reassurance

The concept of term life insurance is centered around providing financial security for your loved ones during a specific period, typically covering a mortgage, children's education, or other significant financial commitments. It offers a sense of peace of mind, knowing that your family will be taken care of if something happens to you. This reassurance is invaluable, as it allows you to focus on the present and future without constantly worrying about potential financial hardships.

When you purchase term life insurance, you're essentially creating a safety net for your family. This financial protection ensures that your loved ones won't face financial strain if you're no longer around to provide for them. It covers essential expenses, such as mortgage payments, which can be a significant burden without adequate insurance. By having this coverage, you're actively contributing to the financial stability of your family, even when you're not physically present.

The peace of mind that comes with knowing your family is protected is a powerful motivator. It enables you to make the most of your time, knowing that your loved ones are secure. This sense of security can reduce stress and anxiety, allowing you to enjoy your life more fully. Additionally, it provides a sense of control over your family's future, knowing that you've taken the necessary steps to ensure their well-being.

Term life insurance is a practical and affordable way to provide for your family's long-term needs. It is a temporary coverage, typically lasting 10, 20, or 30 years, which aligns with common financial goals. During this period, your family can rely on the financial support, knowing that their basic needs will be met. This type of insurance is a wise investment in your family's future, offering a sense of security that money can't always buy.

In summary, term life insurance provides a unique and essential service by offering peace of mind and long-term reassurance. It ensures that your family's financial future is secure, allowing you to focus on the present and create lasting memories. By taking this proactive step, you're not only protecting your loved ones but also ensuring a stable and comfortable life for them, even in your absence.

Getting Your Non-Resident Life Insurance License: A Guide

You may want to see also

Frequently asked questions

Term life insurance provides a straightforward and cost-effective way to secure financial protection for your loved ones during a specific period, typically 10, 20, or 30 years. It offers a death benefit if you pass away within the term, ensuring your family receives a tax-free lump sum or regular payments to cover expenses like mortgage, education, and living costs.

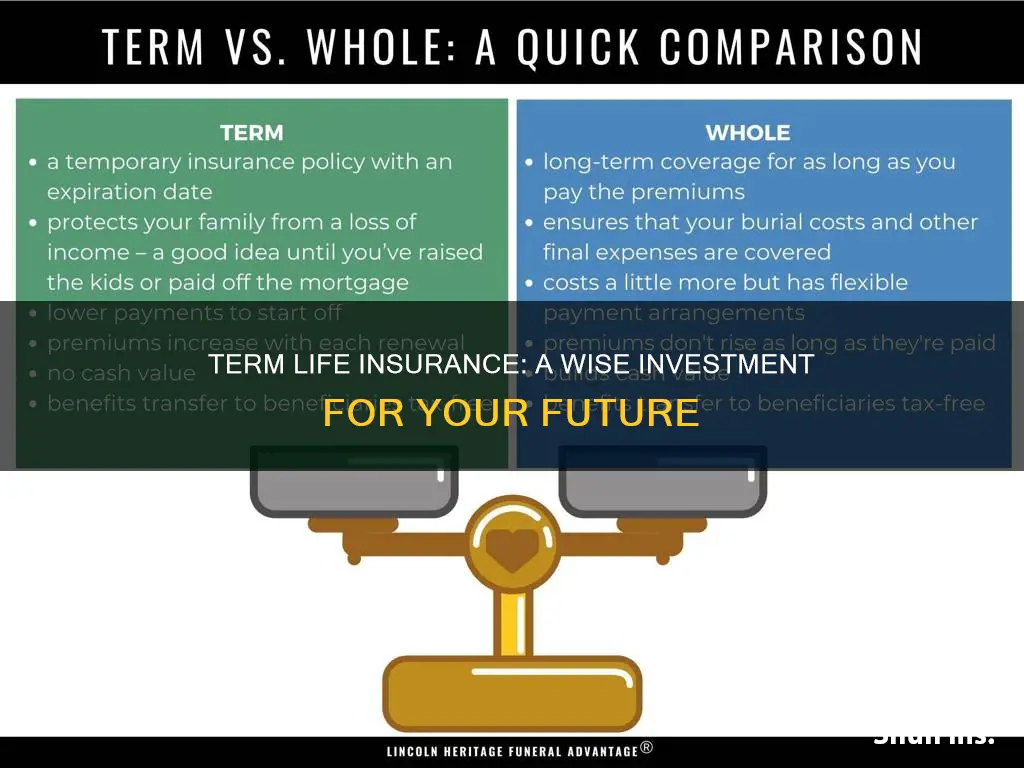

Term life insurance is designed for a specific duration and is generally more affordable than permanent life insurance. It offers pure insurance, focusing solely on providing coverage for a defined period. In contrast, permanent life insurance, including whole life and universal life, provides lifelong coverage and includes an investment component, allowing your policy to accumulate cash value over time.

Young families often have significant financial responsibilities, such as a mortgage, raising children, and education expenses. Term life insurance can be an excellent choice for this demographic as it offers substantial coverage at a lower cost. If something happens to the primary breadwinner, the death benefit can provide financial security, ensuring the family's long-term financial goals and daily living expenses are met.