Choosing the right life insurance can be a challenging task, as it's a personal decision that depends on individual needs and circumstances. With various types of life insurance policies available, from term life to whole life and universal life, understanding the differences is crucial. Factors such as coverage amount, duration, and cost play a significant role in determining which policy is best suited for you. This introduction aims to explore the key considerations and benefits of different life insurance options to help individuals make an informed decision.

What You'll Learn

- Coverage Options: Compare term, whole life, and universal life policies

- Financial Strength: Assess the insurer's financial stability and ratings

- Customer Service: Evaluate claims processing, support, and overall customer satisfaction

- Cost and Affordability: Understand premiums, exclusions, and value for money

- Policy Flexibility: Consider customization options and policy adjustments over time

Coverage Options: Compare term, whole life, and universal life policies

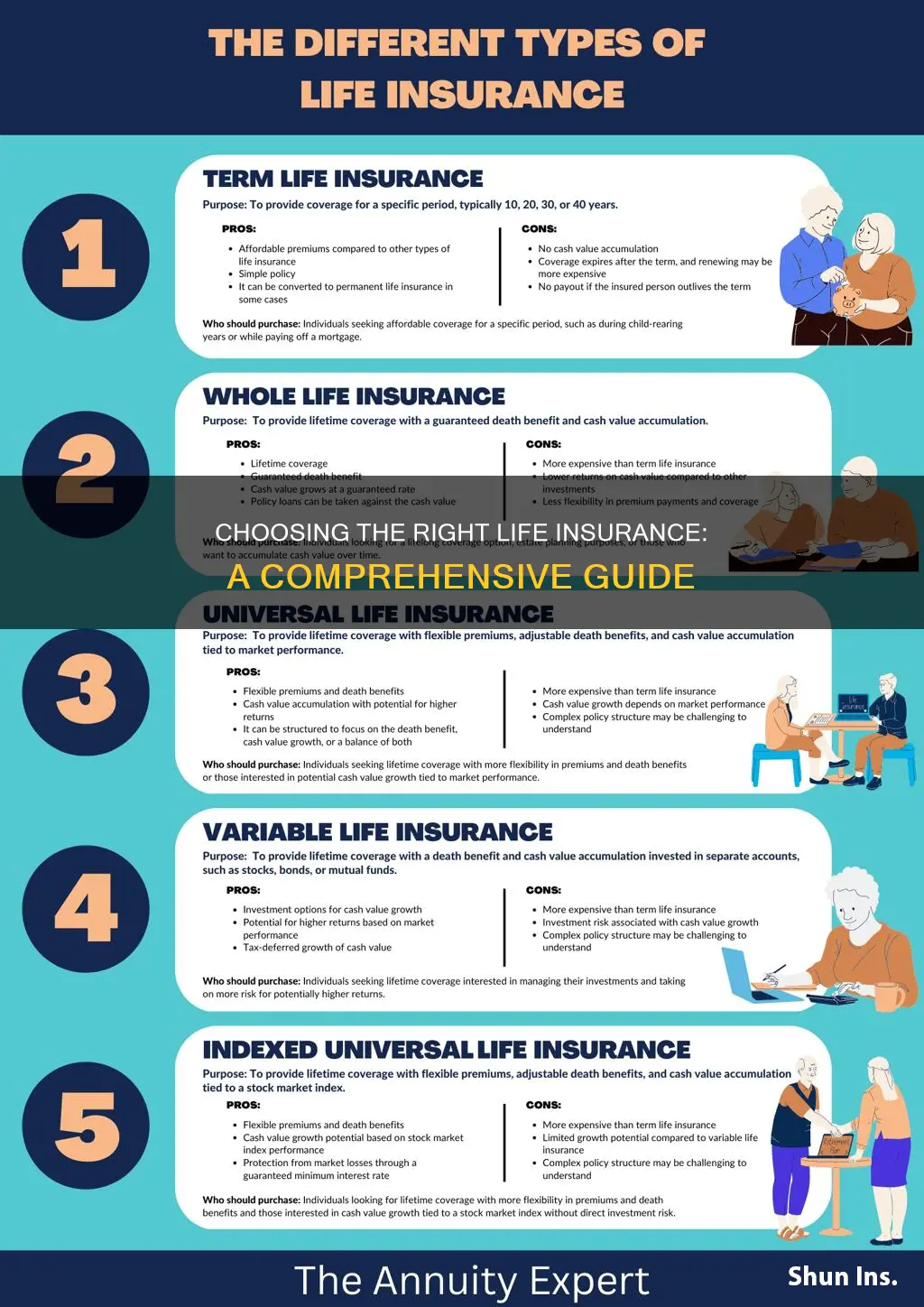

When considering life insurance, understanding the different coverage options is crucial to making an informed decision. Here's a breakdown of the three primary types of life insurance policies: term life, whole life, and universal life, along with their unique features and benefits.

Term Life Insurance:

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It is a straightforward and cost-effective option for those seeking temporary coverage. During the term, the policy offers a death benefit if the insured individual passes away. The key advantage is its simplicity and affordability, making it ideal for individuals who want coverage for a specific period, such as covering mortgage payments or providing financial security for their children's education. One of the most significant benefits is the predictable and fixed premium payments, ensuring that your budget remains stable over the policy term.

Whole Life Insurance:

Whole life insurance offers lifelong coverage, providing a death benefit to the policyholder's beneficiaries. This policy type is characterized by its long-term commitment and consistent premium payments. The premiums are typically higher compared to term life, but they remain the same throughout the policy's duration. One of the critical advantages is the accumulation of cash value over time, which can be borrowed against or withdrawn. This feature makes whole life insurance an attractive option for those seeking both financial protection and an investment component. Additionally, whole life insurance policies often have an investment component, allowing policyholders to grow their money within the policy.

Universal Life Insurance:

Universal life insurance offers flexibility and adaptability, providing both death benefits and an investment component. Policyholders can adjust their premium payments and death benefits over time, making it a customizable option. The premiums are typically higher than term life but lower than whole life, and they can vary based on the policyholder's needs. Universal life insurance allows for potential long-term savings and investment growth, making it suitable for those who want both financial protection and the opportunity to build wealth. This policy type is ideal for individuals who prefer a more flexible approach and want to tailor their coverage as their financial situation changes.

In summary, the choice between term, whole life, and universal life insurance depends on your specific needs and financial goals. Term life is excellent for temporary coverage, whole life provides lifelong protection with an investment aspect, and universal life offers flexibility and potential long-term savings. It is essential to assess your financial situation, risk tolerance, and long-term objectives to determine the most suitable life insurance policy for your circumstances.

Life Insurance and Taxes: What's the Write-Off Story?

You may want to see also

Financial Strength: Assess the insurer's financial stability and ratings

When evaluating life insurance options, understanding the financial stability and ratings of insurance companies is crucial. This aspect directly impacts the insurer's ability to fulfill their obligations to policyholders, ensuring that your premium payments are secure and your beneficiaries receive the intended benefits in the event of a claim. Here's a detailed guide on how to assess an insurer's financial strength:

- Financial Ratings: One of the most reliable indicators of an insurer's financial stability is its financial rating from independent agencies. These ratings are based on a comprehensive analysis of the company's financial health, including its assets, liabilities, capital structure, and profitability. Well-known rating agencies like A.M. Best, Moody's, and Standard & Poor's provide these assessments. A higher rating indicates a stronger financial position, suggesting that the insurer is more likely to honor its commitments over the long term. For instance, an 'A' rating from A.M. Best signifies an excellent financial strength, while a 'C' rating might indicate a weaker financial position.

- Solvency and Capital Adequacy: Insurers must maintain a certain level of financial solvency to meet their obligations. This is often measured by the capital-to-risk-adjusted assets ratio, which indicates the insurer's ability to absorb losses. A higher ratio suggests better financial stability. Additionally, insurers should have a robust capital structure, meaning they have a mix of equity and debt that supports their operations and risk management.

- Financial Statements and Reports: Reviewing an insurer's financial statements and annual reports can provide valuable insights. These documents offer a snapshot of the company's financial health, including its assets, liabilities, and net worth. Look for consistent profitability, steady growth in assets, and a strong balance sheet. Avoid insurers with significant financial losses or those that have undergone major financial restructuring, as this could indicate potential stability issues.

- Market Presence and Reputation: Consider the insurer's market presence and reputation. Established insurers with a long history often have a more robust financial foundation. They may have a larger customer base, which can be an indicator of trust and reliability. However, be cautious of very large insurers, as they might have more complex operations and a higher risk of systemic issues.

- Regulatory Compliance: Insurance regulators regularly monitor and assess insurers' financial stability. Check if the insurer is licensed and regulated by a reputable financial authority in your region. Insurers that comply with regulatory requirements are more likely to maintain financial stability and adhere to industry standards.

By carefully evaluating an insurer's financial strength, you can make an informed decision, ensuring that your life insurance policy is backed by a financially stable company. This due diligence is essential to protect your interests and the interests of your beneficiaries. Remember, a financially strong insurer is more likely to provide reliable coverage and honor claims when needed.

Life Insurance Proceeds: Ohio's Tax Laws Explained

You may want to see also

Customer Service: Evaluate claims processing, support, and overall customer satisfaction

When assessing the quality of life insurance, a critical aspect to consider is the customer service and claims processing efficiency. This is because, in times of need, a smooth and supportive claims process can make a significant difference in the overall experience and financial relief for the policyholder and their loved ones. Here's a breakdown of how to evaluate these aspects:

Claims Processing Efficiency:

- Response Time: A quick response is crucial. Evaluate how long it takes for the insurance company to acknowledge and initiate the claims process. The industry standard for a response within 24 hours is generally accepted, but faster is always better.

- Documentation and Paperwork: Efficient claims handling often involves minimal paperwork and clear communication. Assess if the company provides easy-to-understand claim forms and if they guide policyholders through the process effectively.

- Transparency: Keep an eye out for companies that provide regular updates and clear explanations of the claims process. Transparency ensures policyholders are not left in the dark, which can reduce stress during an already challenging time.

Customer Support:

- Availability: Good customer service is accessible. Check if the company offers multiple support channels like phone, email, and live chat. 24/7 support is ideal, ensuring assistance whenever needed.

- Expertise: The support team should be knowledgeable and empathetic. They should be able to answer queries about policy details, claims progress, and provide guidance on related matters.

- Problem-Solving: Evaluate how the company handles complaints and issues. A customer-centric approach, where the company takes responsibility and works towards a resolution, is essential for a positive customer experience.

Overall Customer Satisfaction:

- Reviews and Feedback: Scrutinize online reviews and customer testimonials. Positive feedback regarding claims processing and customer service can be a strong indicator of a company's reliability.

- Satisfaction Surveys: Many insurance providers conduct satisfaction surveys. Analyze the results to identify areas of improvement and the company's commitment to customer satisfaction.

- Awards and Recognition: Keep an eye out for companies that have received industry awards for customer service. These accolades often reflect a company's dedication to providing an exceptional experience.

In summary, when determining which life insurance is good, the claims process and customer service are vital. Efficient claims handling, responsive support, and a customer-centric approach contribute to a positive experience, ensuring that policyholders receive the support they need during difficult times. It is through these evaluations that one can make an informed decision, choosing an insurance provider that truly cares and delivers on its promises.

Fidelity Union Life Insurance: Contacting Customer Service

You may want to see also

Cost and Affordability: Understand premiums, exclusions, and value for money

When considering life insurance, cost and affordability are crucial factors that can significantly impact your financial well-being. Understanding the premiums, exclusions, and overall value for money is essential to making an informed decision. Here's a detailed guide to help you navigate these aspects:

Premiums: Life insurance premiums are the regular payments you make to maintain your policy. The cost can vary widely depending on several factors. Firstly, age plays a significant role; younger individuals often pay lower premiums as they are considered less risky. Additionally, the type of policy you choose matters. Term life insurance, which provides coverage for a specified period, typically has lower premiums compared to permanent life insurance, which offers lifelong coverage. Another critical factor is your health and lifestyle. Insurers may charge higher premiums if you have pre-existing medical conditions or engage in risky activities like smoking or extreme sports. It's essential to assess your health and lifestyle choices to get an accurate estimate of potential costs.

Exclusions and Limitations: Life insurance policies often come with certain exclusions and limitations that can impact the overall value. These may include specific causes of death that are not covered, such as suicide or accidents within the first few years of the policy. Some policies might also have waiting periods before coverage begins, which can affect the effectiveness of the insurance during critical times. Understanding these exclusions is vital to managing your expectations and ensuring you have adequate coverage. For instance, if you're considering a policy with a waiting period, you might want to explore additional riders or supplements to address this gap.

Value for Money: Assessing the value for money of a life insurance policy involves comparing the coverage and benefits provided with the premium cost. Look for comprehensive coverage that aligns with your financial goals and risk profile. Consider the policy's ability to provide financial security for your loved ones in the event of your passing. Evaluate the policy's flexibility, allowing you to adjust coverage as your life circumstances change. Additionally, check for any additional benefits or riders that can enhance the policy's value, such as critical illness coverage or accidental death benefits.

To make an informed choice, it's advisable to obtain quotes from multiple insurance providers. Compare the premiums, coverage amounts, and policy terms. Online comparison tools can simplify this process, allowing you to quickly assess different options. Remember, the cheapest option might not always be the best value, so strike a balance between cost and the level of coverage offered.

In summary, when evaluating life insurance, cost and affordability are key considerations. Understanding premiums, being aware of policy exclusions, and assessing the overall value for money will enable you to choose a life insurance plan that provides the necessary financial protection for your loved ones while remaining financially feasible for your circumstances.

Life Insurance Policies: Can You Sell Them?

You may want to see also

Policy Flexibility: Consider customization options and policy adjustments over time

When evaluating life insurance policies, policy flexibility is a crucial aspect to consider, as it allows you to tailor the coverage to your specific needs and circumstances. Life insurance is a long-term commitment, and your requirements may change over time due to various life events, financial goals, or personal preferences. Therefore, having a flexible policy can provide peace of mind and ensure that your insurance remains relevant and beneficial throughout your life's journey.

One key aspect of policy flexibility is the ability to customize your coverage. Many life insurance providers offer various options to personalize your policy. For instance, you can choose the amount of coverage you need, which is often referred to as the death benefit. This benefit is the payout that your beneficiaries will receive upon your passing. By selecting an appropriate coverage amount, you can ensure that your loved ones are financially protected according to your desired level of support. Additionally, you might have the option to add riders or optional benefits to enhance your policy. These riders could include additional coverage for critical illnesses, accidental death benefits, or waiver of premium provisions, providing extra protection and flexibility to meet your evolving needs.

Over time, life insurance policies should adapt to your changing circumstances. As you age, your health and financial situation may evolve, and your insurance needs could become more complex. A flexible policy allows for adjustments to accommodate these changes. For example, you might opt for a convertible term life insurance policy, which can be converted to a permanent policy later, providing long-term coverage without the need for a new medical examination. This flexibility ensures that your insurance keeps up with your life's progression, offering continued protection when it's needed most.

Furthermore, policy flexibility often includes the ability to make adjustments to your premium payments. Life events like marriage, the birth of a child, or a career change can impact your financial situation. With a flexible policy, you may be able to modify your premium payments to align with your current financial capabilities. This could involve increasing or decreasing the premium amount to match your budget while maintaining the desired level of coverage. Such flexibility ensures that your insurance remains affordable and accessible as your financial circumstances change.

In summary, when assessing life insurance, policy flexibility is essential for a personalized and adaptable solution. It empowers you to customize your coverage, adapt to life changes, and make necessary adjustments over time. By considering these customization options, you can find a life insurance policy that suits your current needs and provides the necessary support as your life unfolds. Remember, the goal is to have a policy that grows with you, ensuring financial security and peace of mind throughout your life's journey.

Life Insurance at 70: Is It Possible?

You may want to see also

Frequently asked questions

When selecting life insurance, it's essential to evaluate your specific needs and financial goals. Consider the following: coverage amount, term length, premium costs, and the insurer's reputation. Assess your risk profile, including age, health, and lifestyle, as these factors influence premium rates. Additionally, research different types of policies, such as term life, whole life, or universal life, to determine which aligns best with your requirements.

The choice between term life and permanent life insurance depends on your circumstances. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and is ideal for covering short-term financial obligations. It offers a straightforward and cost-effective solution. On the other hand, permanent life insurance, including whole life and universal life, offers lifelong coverage and includes a savings component. This type of policy is suitable for long-term financial planning and can accumulate cash value over time.

To secure favorable rates, consider the following strategies: maintain a healthy lifestyle by quitting smoking, exercising regularly, and managing any pre-existing health conditions. Shop around and obtain quotes from multiple insurers to compare rates and coverage options. Additionally, increasing your coverage amount can sometimes lead to lower premiums per dollar of coverage. Finally, being a non-smoker and a healthy weight can significantly impact your insurance rates.