Life insurance is an important way to help your loved ones cover the costs of your final expenses, and it can be obtained at any age. However, finding affordable senior life insurance can be challenging. Term life insurance for seniors over 70 is possible but not always necessary. It is essential to consider various factors, such as health, prescription usage, hobbies, profession, and income, when determining approval and coverage amounts. The death benefit amount is typically related to the insured's income, and there is a table factor used to determine the sufficient benefit amount. At 70, most companies offer term life insurance of up to 20 years, while 10- or 15-year terms are more common for those 71 and older. A guaranteed universal life policy (GUL) can provide protection based on age rather than a specific term. The cost of coverage generally increases with age, and health exams are often required for term life insurance, especially for higher death benefits. Burial insurance or final expense insurance is another option for seniors, offering lower premiums and simpler underwriting. It is important to compare policies and explore different options to find affordable coverage that meets your needs.

What You'll Learn

Term life insurance for seniors over 70: necessary or not?

According to the National Center for Health Statistics, a healthy 65-year-old has a 50% chance of living past 85 years. This means that if you are over 70, you may still have a mortgage to pay, financial obligations to meet, or dependents to support. In such cases, term life insurance can be necessary.

When Term Life Insurance for Seniors Over 70 Doesn't Make Sense

If you are over 70 and your mortgage is paid off, you have no major financial obligations, your children are financially independent, and you have enough savings to cover your burial expenses, then you may not need term life insurance. Additionally, if you already have a sufficient policy in place, term life insurance may not be necessary.

When Term Life Insurance for Seniors Over 70 Makes Sense

On the other hand, if you are still supporting your family, have outstanding debts, or want to leave a financial legacy for your loved ones, then term life insurance can be a good option. It is very possible to obtain term life insurance at this age, although there are some factors to consider.

Factors to Consider When Obtaining Term Life Insurance Over 70

Age is not the only factor that insurance companies consider when issuing a policy. Your health, prescription usage, hobbies, profession, and income will also be taken into account during the underwriting process. The death benefit amount for term life insurance is typically related to the insured's income, and as you get older, the benefit amount decreases relative to your income. For example, in your 40s, you may be able to get a benefit that is 35 times your income, while in your 70s, it may be limited to 5 times your income.

The length of the term will also depend on your age. If you are 70, you can find terms up to 20 years, while if you are 71 or older, the terms are usually limited to 10 or 15 years. If you need longer protection, you may want to consider a guaranteed universal life policy (GUL), which provides coverage based on age rather than a specific term. However, keep in mind that the longer the age, the more expensive the policy will be.

Most term life policies for seniors over 70 will require a health exam, especially for death benefits greater than $250,000. Undergoing a health exam can help you secure better rates if you are in good health. No-exam policies are also available but may come with higher costs. When deciding whether to opt for a no-exam policy, consider factors such as the coverage amount, how soon you need the policy, and your budget.

In conclusion, while term life insurance for seniors over 70 is not always necessary, it can be a valuable tool to protect your loved ones financially in case of unexpected death. It is important to carefully consider your individual circumstances, compare different policies, and seek advice from a broker or insurance agent to find the right option for your needs.

Life and Disability Insurance: Protecting Your Future

You may want to see also

Factors insurance companies consider for over-70s

When applying for term life insurance, insurance companies will consider several factors when determining approval and coverage amounts. Here are some of the key factors that insurance providers will take into account for individuals over 70:

Health Status

Health is a significant factor in determining insurance coverage for older adults. Insurance companies may request a health exam or ask questions about pre-existing medical conditions, prescription medication usage, and any health issues that could impact life expectancy. The healthier an individual is, the more favourable their insurance coverage and premiums are likely to be.

Lifestyle and Hobbies

Insurance providers often assess an applicant's lifestyle choices and hobbies. Factors such as smoking, alcohol consumption, and participation in risky activities or extreme sports can influence the approval process and premium rates. These factors can impact life expectancy and the likelihood of making insurance claims.

Prescription Medication Usage

Insurance companies will consider an individual's prescription medication usage when evaluating their application. The type and amount of medication taken can provide insights into an individual's health status and potential risks. This information helps insurance companies assess the applicant's overall health and determine the appropriate coverage and premium rates.

Profession and Income

An applicant's profession and income are also considered when applying for term life insurance. Insurance companies may evaluate an individual's current employment status, occupation, and income level. These factors can help determine the level of coverage needed and the ability to pay premiums. The death benefit amount for term life insurance is often related to the insured's income, with maximum coverage amounts based on a "table factor" calculation.

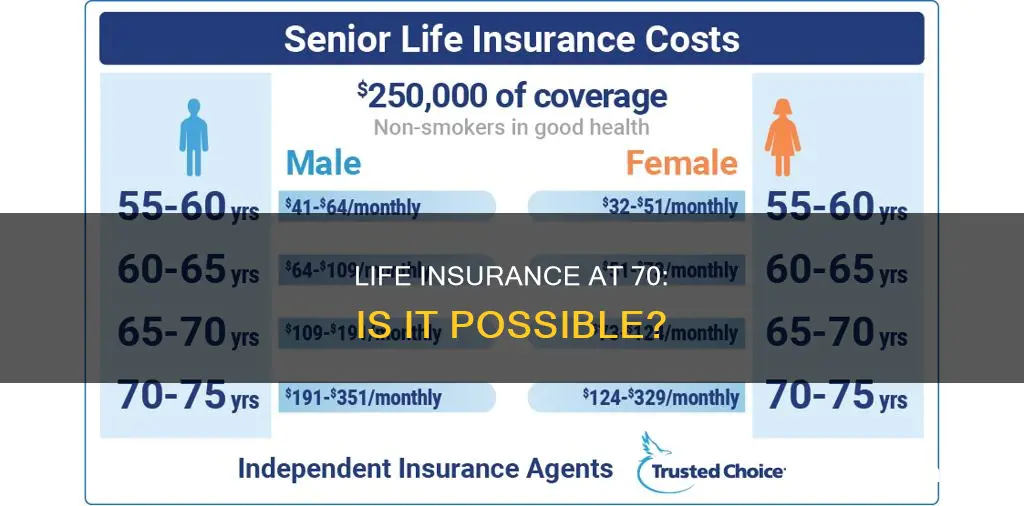

Age and Gender

Age is a critical factor, as insurance companies typically offer different coverage options and rates based on age groups. Older individuals may have fewer coverage options and shorter term lengths. Additionally, gender can play a role, as insurance companies often have separate pricing structures for men and women, reflecting differences in life expectancy and health risks.

Existing Policies and Coverage Needs

Insurance companies will consider whether the applicant already has a sufficient policy in place. They will also assess the applicant's financial obligations, such as mortgages, loans, and dependents, to determine the appropriate level of coverage needed.

Family Medical History

Insurance providers may inquire about an applicant's family medical history, particularly regarding conditions that could impact life expectancy. This information helps them assess potential genetic risks and predict future health issues, allowing them to make informed decisions about coverage and premiums.

Driving Record

For insurance policies that include driving-related coverage, such as accidental death coverage, insurance companies will consider the applicant's driving record. A clean driving record with no accidents or violations can result in more favourable rates, while a history of traffic offences or accidents may lead to higher premiums or restrictions.

Location and Lifestyle Choices

An individual's location and lifestyle choices can also impact their insurance coverage and rates. Insurance companies may consider the applicant's place of residence, including crime rates and access to healthcare facilities. Additionally, lifestyle choices such as diet, exercise habits, and stress management can influence health and life expectancy, thereby impacting insurance coverage and costs.

It is important to note that insurance companies use these factors to assess the overall risk and determine coverage options and premium rates for individuals over 70. By evaluating these factors, insurance providers can tailor their policies to meet the specific needs and circumstances of older adults.

Moose Life Members: Insurance for Women?

You may want to see also

Term life insurance rates for over-70s

Factors Affecting Rates

Age is a significant factor in determining insurance rates, as the probability of dying increases with age. Additionally, insurance companies consider an individual's lifestyle, health, and gender when calculating rates. For example, rates are typically higher for smokers and men, as they tend to have shorter life expectancies due to risk-taking and more dangerous jobs.

Average Annual Rates

Average annual term life insurance rates for individuals over 70 vary based on gender. For men over 70, the benefit amount typically ranges from $50,000 to $250,000, while for women, the range is similar, starting at $50,000 and going up to $250,000. These rates are estimated and do not reflect the exact rates of specific insurance companies.

Pros and Cons of Term Life Insurance for Over-70s

Term life insurance for over-70s has both advantages and disadvantages. On the positive side, rates remain the same throughout the policy as long as premiums are paid, making it appealing to seniors on fixed incomes. However, there are several drawbacks to consider. Many providers only offer 10-year plans for individuals over 70, and these plans often require a health test. Qualifying for these plans can be challenging unless the individual is in excellent overall health and does not take any medication. Additionally, term life insurance policies do not build cash value, and if the policyholder outlives the policy, they will not receive a payout.

Alternatives to Term Life Insurance

Final expense insurance, also known as burial or funeral insurance, is an alternative option for over-70s. This type of insurance has lower premiums and does not require a health test, only a few simple health questions on the application. The policies are primarily used to cover funeral costs but can also be used for other expenses. Whole life insurance and universal life insurance are other alternatives, but they tend to have higher premiums and may require health tests.

Tips for Getting the Best Rates

When seeking term life insurance as an over-70, it is advisable to work with a broker who represents multiple insurance companies and can help navigate the different underwriting criteria. Starting the process online and running initial rate estimates can also provide valuable information. Maintaining good health and avoiding delays in purchasing insurance are other ways to optimize rates, as costs increase with age, and longer terms may not be available to older individuals. Staying within one's budget is crucial, as it is essential to keep up with premium payments to maintain coverage.

Military Life Insurance: Discharge and Your Coverage

You may want to see also

Pros and cons of term life insurance for over-70s

Term life insurance is an option for over-70s who are looking for an affordable way to provide for their loved ones after they're gone. However, there are several pros and cons to consider before purchasing a policy.

Pros

- Affordability: Term life insurance is generally the most affordable type of life insurance available, as it only provides coverage for a specified period.

- No medical exam required: While many policies require a medical exam, there are also "no-exam" options available, which can be convenient for those with health issues.

- Flexibility: Term life insurance can be a good option for those who only need coverage for a specific period, such as until a mortgage is paid off or children become financially independent.

- Peace of mind: Term life insurance can provide peace of mind, knowing that your loved ones will receive a financial gift or be able to cover final expenses if something happens to you.

Cons

- Limited coverage: Term life insurance only provides coverage for a specified period, and if you outlive the policy, you won't receive any payout.

- Increasing premiums: The premiums for term life insurance increase with age, and it can become very expensive to renew the policy as you get older.

- Difficult to qualify: Many insurance companies have a maximum age limit for term life insurance policies, and it can be difficult to qualify if you're in poor health or taking medication.

- No cash value: Term life insurance policies do not build any cash value, so you won't be able to withdraw from the policy or take out a loan against it.

Mercury's Life Insurance: What's the Verdict?

You may want to see also

Alternatives to term life insurance for over-70s

While it is possible to obtain term life insurance if you are over 70, there are several alternatives to consider. Here are some options for life insurance alternatives for over-70s:

Final Expense/Burial Insurance

Final expense insurance, also known as burial or funeral insurance, is a popular alternative for seniors in their 70s. It has much lower premiums than many other types of life insurance, and instead of a health test, you only need to answer a few simple health questions on the application. These policies are typically used to cover funeral costs, but the funds can also be used for other expenses. Final expense insurance is a type of whole life policy, so it remains in effect as long as you pay the premiums. The premium rates are fixed, making them easier to manage on a fixed income, and the policies build cash value, which can be borrowed against to pay for expenses like medical bills.

Universal Life Insurance

Universal life insurance (UL) is a blend of whole and term life insurance. It offers permanent coverage with a guaranteed death benefit and low monthly premiums, but it usually requires a health test. Universal life insurance provides flexibility, allowing you to update your policy if your needs change. Some providers even offer refunds for your premium payments after holding the policy for a certain number of years. The cost of universal life insurance that requires a health test is typically lower than other UL products, but it may not be as affordable as final expense plans, which don't require a health exam.

Guaranteed Universal Life Insurance (GUL)

Guaranteed Universal Life Insurance (GUL) plans don't require a medical test or health questions, but their rates are higher than standard universal life insurance. GUL provides guaranteed acceptance for all seniors, but it's important to stay on top of your payments, as missing even one premium could result in coverage cancellation.

No-Exam Life Insurance

If you're not in good health, you may want to consider no-exam life insurance. This option generally offers more expensive coverage but eliminates the possibility of rejection. A guaranteed issue policy typically has a two-year waiting period before the insurance company will pay the full benefit, and they may only refund the premiums paid if the insured person dies within this period.

Combining Life Insurance with Long-Term Care

As you age, you may want to consider combining life insurance with long-term care insurance. You can either add a long-term care rider to your existing policy, depending on your insurer, or opt for a hybrid life insurance and long-term care policy, which offers more flexibility in terms of benefits.

Withholding Tax: Does It Affect Your Life Insurance?

You may want to see also

Frequently asked questions

Yes, it is possible to get term life insurance if you are over 70. However, it may be harder to find affordable options, and there may be certain conditions attached.

Insurance companies consider various factors such as health, prescription usage, hobbies, profession, and income when determining approval and coverage amounts.

The term length depends on your age. If you are 70, you can find term life insurance of up to 20 years with most companies. If you are 71 or older, you will typically find 10- or 15-year terms.

Most term life insurance policies for seniors over 70 will require a health exam, especially for death benefits greater than $250,000. However, there are no-exam policies available, although they may be more expensive.