Life insurance dividends are calculated based on a few key factors, including the company's financial performance, interest rates, investment returns, and new policies sold. The amount of dividend is also tied to the price of the premiums paid by the policyholder, with higher dividends corresponding to more expensive policies. Dividends are typically paid out when a company performs better than expected, and they can be distributed as cash or used to purchase additional insurance or reduce premiums. While dividends are not guaranteed, most insurance companies strive to pay them consistently, and they can provide significant benefits to policyholders over time.

What You'll Learn

- Dividends are calculated based on a company's financial performance, including interest rates, investment returns, and new policies sold

- Dividends are distributed as cash, to purchase additional insurance, or to reduce premiums

- The dividend amount depends on the premium paid by the policyholder

- Dividends are not guaranteed and may vary depending on a company's performance

- Policyholders should consider a company's credit rating when evaluating the sustainability of dividends

Dividends are calculated based on a company's financial performance, including interest rates, investment returns, and new policies sold

At a high level, dividends are based on a company's profitability, which is influenced by interest rates, investment returns, and new policies sold. When a company performs better than expected, it can choose to pay out some or all of the excess profits to its shareholders and policyowners. This is known as a dividend.

Interest rates play a crucial role in dividend calculations. Insurance companies invest their reserves in conservative assets, such as bonds and commercial mortgages, and the returns on these investments contribute to the divisible surplus. The higher the interest rates, the greater the potential for investment income, which can lead to higher dividends.

Investment returns are another key factor in dividend calculations. Insurance companies strive to generate investment income that exceeds their guaranteed contract obligations. The excess income becomes profit, which feeds into the dividend payment. Strong investment returns can lead to higher dividends for policyowners.

The number of new policies sold can also impact dividend calculations. As a company sells more policies, it brings in more premium income, which can contribute to the divisible surplus. Additionally, insurance companies make assumptions about the number of claims they will need to pay each year, known as mortality. If the actual death claims are lower than expected, the company may have more funds available to distribute as dividends.

It's important to note that dividends are not guaranteed and can vary from year to year. Insurance companies consider their financial performance, including interest rates, investment returns, and claims experience, to determine the amount of divisible surplus available for distribution. The calculation also takes into account the company's expenses and other financial obligations.

Overall, dividends are a way for insurance companies to share their profits with policyowners, and the calculation is based on a combination of financial performance indicators, including interest rates, investment returns, and new policies sold.

Term Life Insurance: Living Benefits and Their Impact

You may want to see also

Dividends are distributed as cash, to purchase additional insurance, or to reduce premiums

Dividends are a great benefit of life insurance policies. They are calculated based on the performance of the company's financials, including interest rates, investment returns, and new policies sold. While dividends are not guaranteed, most insurance carriers strive to pay them consistently to eligible participating policyholders.

When a company performs better than expected, it can choose to pay some or all of the surplus money back to shareholders and policyholders. In the case of mutual companies, which are owned by their policyholders, the surplus is paid solely to policyholders in the form of dividends.

Dividends can be distributed in several ways, depending on the preferences of the policyholder:

- Cash or check: The policyholder may request that the insurer send a check for the dividend amount. This option provides immediate access to the dividend as a cash payment.

- Reduce premiums: Dividends can be used to lower the amount of future premiums owed on the policy. Over time, this can lead to significant savings for the policyholder. In some cases, the dividend may even cover the entire cost of the life insurance for the year.

- Purchase additional insurance: Policyholders can use the dividend amount to buy additional insurance or prepay their existing policy. This option helps to increase the death benefit and cash value of the policy more quickly than the guarantees built into the original policy. The additional insurance purchased with dividends also becomes eligible for future dividends, creating a compounding effect.

The choice of how to distribute dividends depends on the policyholder's financial goals and needs. It is important to carefully review the different options and consider how the dividends can be utilized to maximize the benefits of the life insurance policy.

Life Insurance Stacking: MetLife's Benefits and Drawbacks

You may want to see also

The dividend amount depends on the premium paid by the policyholder

The dividend amount is calculated based on the premium paid by the policyholder. The higher the premium, the higher the dividend amount. This is because the dividend amount is often a percentage of the policy's value. For example, a policy worth $50,000 that offers a 3% dividend will pay the policyholder $1,500 for the year. If the policyholder then contributes an additional $2,000 in value during the subsequent year, they will receive $60 more for a total of $1,560 for the year. Over time, these amounts can increase to levels that are high enough to offset some costs associated with premium payments.

The dividend amount is also influenced by the insurance company's financial performance, which is based on interest rates, investment returns, and new policies sold. If the insurance company performs better than expected, it may choose to pay out some or all of the surplus money to its policyholders in the form of dividends.

It's important to note that dividends are not guaranteed and can vary from year to year. The amount of the dividend and individual dividend payouts are subject to change, depending on the operating experience of the insurance company in a given year. Generally, when the insurance company performs well in a particular year, its policyholders will receive a share of its divisible surplus.

When choosing a life insurance policy, it is essential to carefully review the plan's details, including how dividends are calculated and whether or not they are guaranteed. Additionally, consider the insurance company's credit rating to assess the sustainability of dividends in the future.

Life Insurance for Seniors: Understanding Medicare's Offerings

You may want to see also

Dividends are not guaranteed and may vary depending on a company's performance

The amount of a dividend is tied to the price of the premiums paid by the policyholder. The higher the dividend, the more expensive the policy. The dividend amount often depends on the amount paid into the policy. For instance, a policy worth $50,000 that offers a 3% dividend will pay a policyholder $1,500 for the year. If the policyholder contributes an additional $2,000 in value during the subsequent year, they will receive $60 more for a total of $1,560 next year. These amounts can increase over time to sufficient levels to offset some costs associated with the premium payments.

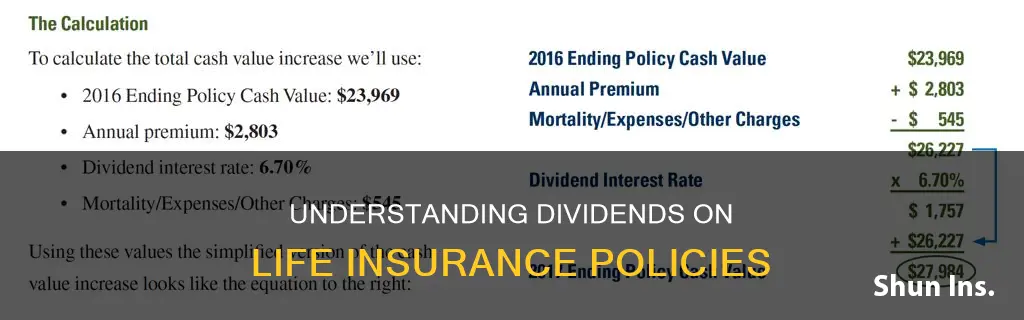

Dividends received are based on the performance of the company's financials, based on interest rates, investment returns, and new policies sold. The dividend interest rate is the input value the insurer uses to calculate the actual dividend payable on a whole life insurance policy. It is one variable of at least three: underwriting profits, administrative costs, and the dividend interest rate. Underwriting profits come from the profitability of being an insurance company, which happens when fewer people file claims than expected. Investment returns drive the cash value accumulation component of a life insurance contract, and when they exceed the guaranteed contract features, the excess feeds into the dividend payment. Administrative costs are the day-to-day expenses the insurer faces.

Dividends can be distributed as cash, to purchase additional paid-up insurance, or to reduce premiums due. Whole life insurance dividends may be guaranteed or non-guaranteed depending on the policy, so it is essential to carefully read through the plan's details before purchasing a policy. Policies that provide guaranteed dividends often have higher premiums to make up for the added risk to the insurance company. Those that offer non-guaranteed dividends may have lower premiums, but there is a risk that there won't be any dividends in a given year.

Life Insurance and Coronavirus: What's Covered?

You may want to see also

Policyholders should consider a company's credit rating when evaluating the sustainability of dividends

When considering purchasing a life insurance policy, it is important to evaluate the sustainability of the dividends it may pay out. Life insurance dividends are based on the performance of the company's financials, including interest rates, investment returns, and new policies sold. As such, policyholders should consider the insurance company's credit rating to determine its financial strength and ability to pay policyholder claims.

An insurance company's credit rating is an independent agency's opinion of its financial strength and ability to pay policyholder claims. It does not indicate how well the company's securities are performing for investors. While the rating is considered an opinion rather than a fact, it is a valuable tool for policyholders to assess the sustainability of dividends. Most insurance companies are rated A or better by major credit agencies, but those with a rating below A may warrant further investigation.

The four major insurance company rating agencies in the US are A.M. Best, Moody's, Standard & Poor's, and Fitch. Each agency has its own rating scale, so it is important to understand the differences between them. For example, A.M. Best's highest rating is A++, while Fitch's is AAA. Therefore, it is crucial to understand each scale to make an informed decision when purchasing a life insurance policy.

By considering the insurance company's credit rating, policyholders can make a more informed decision about the sustainability of dividends. It is also important to remember that dividends can change and are not guaranteed, so reviewing the insurance policy in its entirety is essential.

Citibank's Life Insurance Offer: What You Need to Know

You may want to see also

Frequently asked questions

The dividend payout is based on the company's performance in three key areas: mortality, expenses, and investment returns. The mortality component is based on the actual death claims compared to the company's estimates. The expense component reflects the difference between actual and assumed expenses. The investment component is based on the difference between actual investment returns and the guaranteed interest rate.

Insurance companies calculate the divisible surplus, which is the amount remaining after setting aside funds for contractual obligations, reserve requirements, operating expenses, and other commitments. The divisible surplus is then distributed to eligible policyowners as dividends. The amount of dividend payout depends on how much an individual policy contributes to the company's divisible surplus.

No, life insurance dividends are not guaranteed. The amount of dividend payout can vary depending on the company's performance and financial assumptions. While insurance companies strive to pay dividends consistently, they cannot guarantee dividend payments due to the unpredictable nature of these factors.