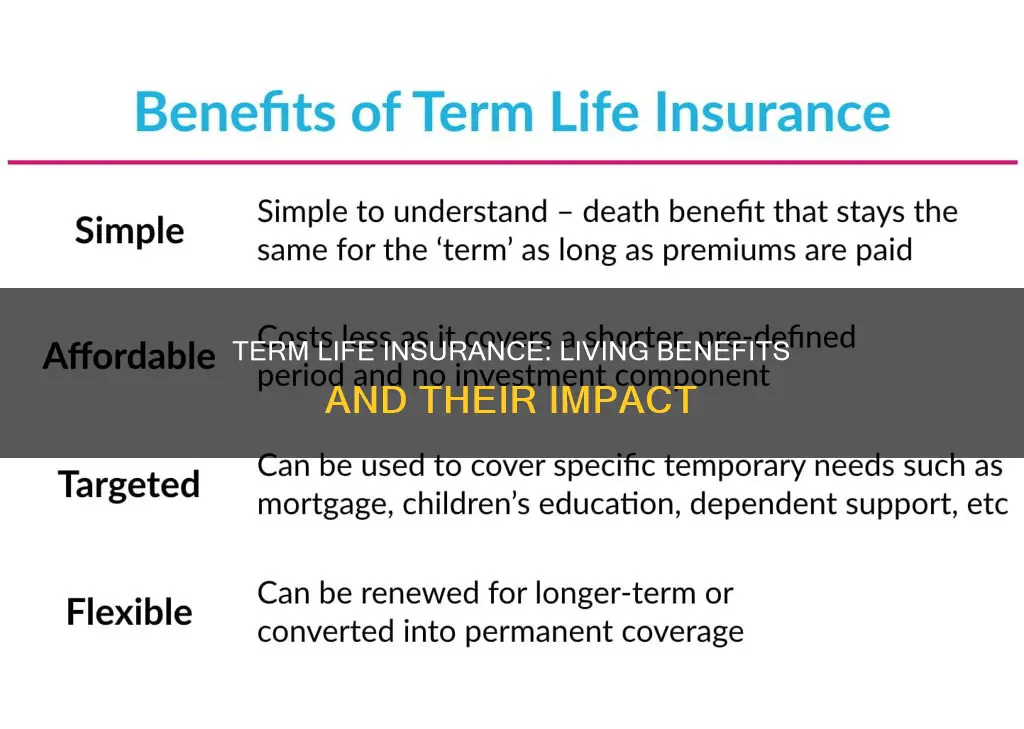

Life insurance is often viewed as a way to protect your family after you're gone. However, some policies have special features called living benefits that can offer financial support during your lifetime. Living benefits are typically viewed as riders that let you access a part of your death benefit before passing away, often after being diagnosed with a severe illness. While some policies may have built-in living benefits, others may require an extra fee to add these riders. Living benefits can provide an extra layer of financial security if you become sick or need an extra source of income, but they may reduce the policy's death benefit for your survivors.

Terminal illness

The benefit is included with or added to 'term' life insurance, where the policy lasts for a stated number of years. The idea is that a policyholder can use the pay-out to make plans and take care of their dependents before their death. Terminal illness benefits are included as part of many life insurance policies, but some insurers offer it as an optional extra for an additional fee.

The benefit amount will vary depending on the policy. Generally, the amount will be a minimum of $10,000 but not more than $250,000. The amount received will be reduced based on the policyholder's age, sex, and interest rates at the time of the claim.

To make a claim, a policyholder must provide proof of their diagnosis to their insurer's medical officer. The medical officer must then be satisfied that the policyholder's death will occur within a given period, usually 12 months.

If the policyholder survives beyond 12 months after a successful claim, nothing is owed back to the insurer. However, once a successful claim has been made, there is no additional pay-out when the policyholder dies.

Nicotine Detection: Life Insurance's Blood Test Secrets

You may want to see also

Chronic illness

Living benefits in life insurance refer to the ability to use some of the death benefits before death, in the event of a terminal, chronic, or critical illness. Both permanent and term life insurance coverage may provide living benefits. These benefits are known in the industry as 'Accelerated Death Benefits' (ADB).

The lump-sum benefit paid out after a triggering event can be used to cover medical expenses, recoup lost income, or for any other purpose. For example, if you suffer from a triggering event illness such as cancer, a heart attack, stroke, kidney failure, or major organ transplant, you can use the benefit payment to cover experimental medicine or prepare for final expenses.

Additionally, some carriers offer long-term disability protection by accessing the death benefit of a term policy. You can also access living benefits through carefully structured permanent cash value life insurance planning, such as building a large sum of cash for tax-free retirement distribution planning, college savings, major purchases, or debt reduction.

Fidelity's Ladder Life Insurance: What You Need to Know

You may want to see also

Critical illness

This type of insurance is generally low cost and can be purchased individually or through an employer, who may offer it as a voluntary benefit. It can also be added to a life insurance plan as a rider, which may be a more affordable option. However, critical illness insurance typically covers a limited range of illnesses, and it is important to carefully review the policy to understand the specific illnesses covered and any restrictions that may apply.

When considering critical illness insurance, it is important to weigh the benefits against the potential drawbacks. While it can provide financial peace of mind and help cover unexpected costs associated with critical illnesses, the coverage may be limited, and there may be exclusions or stipulations that affect the payout. Additionally, as with any insurance policy, it is crucial to read the fine print and understand the terms and conditions before purchasing.

In conclusion, critical illness insurance can be a valuable addition to a term life insurance policy, providing financial protection and support during a critical illness. However, it is important to carefully review the policy details, weigh the benefits against potential limitations, and shop around to find the best coverage for your specific needs.

PCOS and Life Insurance: What You Need to Know

You may want to see also

Long-term care

There are several ways to use life insurance to pay for long-term care services. Here are some options:

Combination (Life/Long-Term Care) Products

Some insurance companies combine life insurance with long-term care insurance. The idea is that policy benefits will always be paid, in one form or another. These products are relatively new, and the features are changing as they evolve. The amount of the long-term care benefit is often expressed as a percentage of the life insurance benefit.

Accelerated Death Benefits (ADBs)

A feature included in some life insurance policies allows you to receive a tax-free advance on your life insurance death benefit while you are still alive. ADBs may be included in the policy for little or no cost, or you may have to pay an extra premium to add this feature. There are different types of ADBs, each serving a different purpose. Depending on the type of policy you have, you may be able to receive a cash advance if you:

- Are terminally ill

- Have a life-threatening diagnosis, such as AIDS

- Need long-term care services for an extended amount of time

- Are permanently confined to a nursing home and incapable of performing Activities of Daily Living (ADL), such as bathing or dressing

The amount of money you receive from these types of policies varies, but typically, the accelerated benefit payment amount is capped at 50% of the death benefit. Some policies allow you to use the full amount of the death benefit.

For ADB policies that cover long-term care services, the monthly benefit you can use for nursing home care is typically equal to 2% of the life insurance policy's face value. The amount available for home care (if included in the policy) is usually half of that amount.

When you receive payments from an ADB policy while you are alive, the amount you receive is subtracted from the amount that will be paid to your beneficiaries when you die.

Viatical Settlements

Viatical settlements allow you to sell your life insurance policy to a third party and use the money to pay for long-term care. A viatical settlement is only possible if you are terminally ill. During the settlement process, a viatical company pays you a percentage of the death benefit on your life insurance policy, based on your life expectancy. The viatical company then owns the policy and becomes its beneficiary, and it takes over the payment of premiums. As a result, you get money to pay for care, and the viatical company receives the full death benefit after you die.

Money received from a viatical settlement is tax-free if you have a life expectancy of two years or less or are chronically ill, and the viatical company is licensed in the states in which it operates.

Living Benefit Programs

A living benefit program is a lump-sum payment available to people who meet specific medical criteria. It allows you to receive up to 50% of a life insurance policy's death benefit while still reserving some death benefits for the family. For example, if your loved one has $200,000 in coverage, it may be possible to secure up to a $100,000 living benefit. The cash advance can be used to pay for senior care expenses, and the beneficiaries will still receive the remaining death benefit.

To qualify for a living benefit program, you must have a life insurance policy with a death benefit of at least $100,000 in most cases. There are no other assets required, and your credit history won't be checked. Additionally, there are no out-of-pocket expenses. However, it's important to note that a living benefit is essentially a loan against the policy, and the entire loan, including any interest, must be repaid; otherwise, it will be deducted from the death benefit of the policy.

Living benefit programs work with all types of life insurance policies. Loan proceeds are not taxable, and interest rates can vary depending on the state.

Surrendering the Life Insurance Policy for Cash Value

When a policy owner surrenders a life insurance policy to the insurance provider, they give up ownership and the right to the death benefit. If the policy has accumulated cash, the insurance company writes a check for the full amount of cash value. In many cases, taxes must be paid on that amount.

"If the cumulative premium amount paid over the life of the policy is more than your current cash value, there are generally going to be no taxes," says Sam Price, an independent life insurance broker and owner of Assurance Financial Solutions. "However, if you’ve had the policy for several years and the cash value has grown beyond the premiums paid into the policy, then you’re going to owe taxes on the gain."

Taking a Loan from Cash Accumulation

If your loved one takes a loan from their life insurance policy's cash value, they won't have to pay taxes on it. They usually can't take the entire cash value, or the policy will lapse. However, a policyholder can typically take most of the cash value as a loan that they then pay back to themselves with interest.

"If your health care needs are more than the money you have in the policy, you’re going to surrender the policy because you need every dollar," says Price. "However, if your needs are less than the amount of cash value, then a loan might make more sense. That way, you can keep some portion of the death benefit in place."

Using Cash Value to Fund a New Long-Term Care Policy

If there's time to plan, you may be better off doing a 1035 exchange, which involves using one insurance policy's cash value toward a new policy without first cashing out and risking tax exposure.

A tax-free 1035 exchange also allows you to use an existing life insurance policy's cash value toward a new life insurance policy with long-term care insurance benefits. For example, you could use the cash value to fund premiums on a hybrid policy, which includes life insurance, long-term care benefits, and even living benefits for costs related to strokes, cancer, or illnesses that long-term care insurance may not cover.

Life Insurance and SSI: What Counts as an Asset?

You may want to see also

Cash value withdrawal

Term life insurance policies do not have a cash value component. However, permanent life insurance policies do.

If you have a permanent life insurance policy that has accumulated a significant amount of funds in its cash value, you can use that money while you’re alive to pay premiums, take out a loan, or withdraw cash permanently. Withdrawing cash from a life insurance policy will reduce the death benefit.

Withdrawing Cash from a Life Insurance Policy

Withdrawing cash is usually distributed as either a lump sum or in payments. Withdrawals are readily available up to a set limit, which is usually the amount you’ve contributed. Withdrawals are typically not taxable income if withdrawn from the policy basis (the premiums you’ve already paid). However, withdrawals may be subject to tax if they exceed the amount of premiums paid.

Borrowing Cash from a Life Insurance Policy

You can also take the funds as a loan from your insurance provider (using your policy as collateral) and then pay it back. Interest rates for loans from insurers are usually lower than personal or home equity loans. There is also no loan application or credit check required. However, loans may incur interest charges, and any unpaid balance will reduce your benefits.

Surrendering a Life Insurance Policy

When you surrender your insurance policy, you cancel it and take the surrender value cash payment, usually a lump sum. However, surrender fees and taxes could reduce the amount you receive. Also, your beneficiaries will not receive a death benefit from the policy when you die.

Selling a Life Insurance Policy

The fourth option for getting cash from your insurance policy is to sell it to a life settlement company. These companies typically buy policies on behalf of financial institutions and investors. You’ll receive a lump sum payment and will no longer owe premiums on the policy. However, your heirs won’t receive a death benefit from the policy, you may owe taxes on the sale, and proceeds from the sale may disqualify you from certain programs such as Medicaid.

Cancer and Term Life Insurance: What Coverage is Offered?

You may want to see also

Frequently asked questions

Death benefits refer to the payout that beneficiaries receive if the policyholder dies while the policy is active. Living benefits are an extension of the policy that allows the policyholder to access the death benefit while they are still alive under certain qualifying circumstances, such as a terminal illness.

Term life insurance living benefits typically include accelerated death benefits, which provide early access to a portion of the death benefit in the event of a terminal, chronic, or critical illness. Other living benefits include a return of premium, where all premiums paid during the term are returned if the policyholder survives the term, and a disability waiver of premium, which allows the policyholder to skip premium payments in the event of a long-term disability.

Living benefits directly impact the amount paid to beneficiaries upon the death of the policyholder. When a policyholder claims living benefits, they receive an advance on their death benefit, which reduces the total amount that will be paid out to beneficiaries.