Variable life insurance is a type of permanent life insurance policy that provides lifelong coverage and includes a cash value account that the policyholder can decide how to invest. The cash value is usually invested in mutual funds, but can also be invested in index funds, equities, bonds or money market funds. The value of the cash account can rise or fall depending on the performance of the underlying securities, so variable life insurance carries more risk than other life insurance policies.

| Characteristics | Values |

|---|---|

| Type of Insurance | Permanent life insurance |

| Investment Component | Yes |

| Investment Type | Mutual funds |

| Death Benefit | Paid to beneficiaries |

| Cash Value | Yes |

| Cash Value Use | Increase death benefit, withdraw as cash, or use as collateral for a loan |

| Risk | Higher than other life insurance policies |

| Tax Advantages | Yes |

| Tax on Cash Value Withdrawals | Yes |

| Tax on Death Benefit | No |

What You'll Learn

- Variable life insurance is a permanent life insurance policy with an investment component

- The cash-value account is invested in mutual funds

- The value of the account depends on the premiums paid, investment performance, and associated fees

- Variable life insurance policies are considered more volatile than standard life insurance policies

- Variable life insurance is not recommended for those seeking basic life insurance or low-cost coverage

Variable life insurance is a permanent life insurance policy with an investment component

Variable life insurance is a type of permanent life insurance policy, meaning that it is designed to last for the entirety of the policyholder's life. It combines a death benefit with an investment component, making it a flexible option for those seeking life insurance.

Variable life insurance includes two components: a life insurance death benefit and a cash value account. When you pay your premium, a portion of the money goes towards the death benefit, while the rest goes into your policy's cash value account. This cash value is essentially an investment account, which you can choose how to invest. The most common way is to invest in mutual funds, but you may also be able to invest in index funds, equities, bonds or money market funds.

Pros of variable life insurance

Variable life insurance offers several benefits, including:

- Financial protection for your family: A permanent life insurance policy can help cover end-of-life expenses and provide financial support for your family in the event of your death.

- A potentially increased death benefit: You may have the option to convert your cash value into a higher death benefit amount, resulting in a larger payout for your beneficiaries.

- Flexibility and choice: Policyholders can choose from a range of funds when deciding where to invest their money, and premiums can be adjusted if there are sufficient funds in the cash value account.

Cons of variable life insurance

There are also potential downsides to variable life insurance:

- High premiums: Variable life insurance premiums are generally more expensive than other types of life insurance, and you may also have to pay management fees for your investments.

- Capped returns: The amount of money you can make on your cash value is limited and may not offer the same growth potential as other investments.

- Limited investment options: You will likely choose from a set number of funds, so if these don't meet your needs, you may be better off investing outside of a variable life insurance policy.

- Risk of loss: As with any investment, there is a risk of losing money. The insurance company typically does not guarantee a rate of return, so your cash value could depreciate if the market performs poorly.

Alternatives to variable life insurance

If variable life insurance doesn't seem like the right fit, there are several alternative types of life insurance policies to consider, including term life insurance, whole life insurance, universal life insurance, guaranteed life insurance, and final expense insurance. These options offer varying levels of flexibility, coverage periods, and investment opportunities, so it's important to carefully consider your personal needs and financial goals when choosing a policy.

Life Insurance Salesmen: Scammers or Misunderstood Professionals?

You may want to see also

The cash-value account is invested in mutual funds

Variable life insurance is a permanent life insurance policy with an investment component. It is a policy that pays a specified amount to your family or other beneficiaries upon your death. It also has a cash-value account that varies according to the amount of premium you pay, the policy's fees and expenses, and the performance of a menu of investment options.

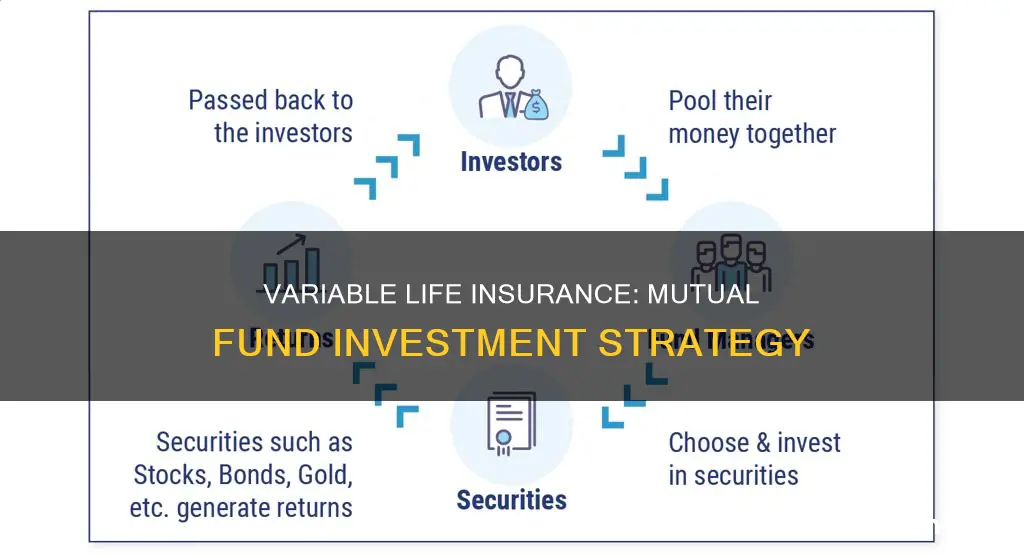

The cash-value account of a variable life insurance policy is similar to a brokerage account. The cash value can be invested in certain securities, often called subaccounts, which resemble mutual funds. The cash value of a variable life insurance policy can be invested in asset options, mainly mutual funds.

The cash-value account is subject to the same risks as any other investment in mutual funds. The value of your investment and any returns will depend on the performance of the investment options you choose. Each underlying fund may have its own unique risks. The cash value of variable life insurance policies can rise or fall in value. These policies carry more risk compared to other life insurance policies.

Life Insurance Proceeds: Criminal Restitution Entanglement

You may want to see also

The value of the account depends on the premiums paid, investment performance, and associated fees

Variable life insurance is a permanent life insurance policy with an investment component. It is a policy that pays a specified amount to your beneficiaries upon your death. It also has a cash-value account with money that is typically invested in mutual funds.

The more money you pay in premiums, the lower some of your policy's fees and expenses may be. This is because your net amount of risk determines some policy fees and expenses. Your net amount of risk is the difference between your policy's face amount and your policy's cash value, so it goes down if there is more money in your account.

The money in your account will vary according to the amount of premiums you pay, the amount of policy fees and expenses, and the performance of the investment options you choose. The value of your investment and any returns will depend, in part, on the performance of the investment options you choose. It is possible to lose money.

You will be required to pay a certain amount of premiums or maintain sufficient cash value to cover your policy's fees and expenses. Loans or poor investment performance may also lower your cash value. Failure to maintain sufficient cash value may cause your policy to lapse and terminate.

If your cash value performs well, you can use the money to increase the death benefit, withdraw the money as cash, or use it as collateral for a loan. However, most insurance companies put a cap on the maximum rate of return, so your earning potential is limited. You will also have to pay management fees based on how your cash value is invested.

Life Insurance and M&T Bank: What You Need to Know

You may want to see also

Variable life insurance policies are considered more volatile than standard life insurance policies

The volatility of variable life insurance policies can be further attributed to the fact that the insurance company does not guarantee a rate of return. The value of the policy is directly tied to the performance of the market, which can be unpredictable. If the market performs poorly, the policy's cash value could decrease, resulting in a loss for the policyholder. On the other hand, if the market performs well, the policy's cash value can increase, leading to higher returns.

The fees associated with variable life insurance policies also contribute to their volatility. These policies tend to have higher fees than other types of life insurance policies, including sales fees, surrender charges, mortality and expense risk fees, cost of insurance, administration fees, and loan interest. These fees can significantly impact the overall return on the policy and may offset any gains made through the investment component.

Additionally, variable life insurance policies offer flexibility in terms of premium payments and investment choices. Policyholders can choose how to invest their cash value, and in some cases, they can adjust the amount of their premium payments. This flexibility can be advantageous, but it also adds complexity and requires more hands-on attention.

Overall, the combination of investment risk, market volatility, high fees, and flexibility makes variable life insurance policies more volatile than standard life insurance policies. These policies may be suitable for individuals who are comfortable with taking on additional risk and are seeking the potential for higher returns. However, it is important for individuals to carefully consider their financial situation and risk tolerance before choosing a variable life insurance policy.

Life Insurance and Tobacco: Testing for Nicotine Use

You may want to see also

Variable life insurance is not recommended for those seeking basic life insurance or low-cost coverage

Variable life insurance is a permanent life insurance policy with an investment component. It is designed to meet specific insurance needs, investment goals, and tax planning objectives. While it offers a range of benefits, it may not be suitable for everyone, especially those seeking basic life insurance or low-cost coverage. Here's why:

High Premiums and Complex Structure

Variable life insurance policies typically have higher premiums than other types of life insurance. The complexity of these policies also requires more hands-on attention and financial expertise to manage the investment component effectively. The higher premiums and management costs make this type of insurance less affordable for those seeking low-cost coverage.

Investment Risk and Volatility

Variable life insurance policies carry more risk than traditional life insurance policies because the cash value component is invested in assets like mutual funds, stocks, or bonds. As a result, the value of the policy can rise or fall depending on market performance. This volatility means there is a potential for significant gains but also a risk of losing money, including the initial investment. This level of investment risk may not be suitable for those seeking basic life insurance, as it introduces an element of uncertainty to the policy's value.

Fees and Expenses

Variable life insurance policies come with substantial fees and expenses, including mortality and expense risk charges, sales and administrative fees, investment management fees, policy loan interest, and surrender charges. These costs can be significant and may increase over time. The high fees make variable life insurance less attractive for those seeking low-cost coverage, as the overall expenses can quickly add up.

Not a Short-Term Savings Vehicle

Variable life insurance is designed to provide a death benefit and meet long-term financial objectives. It is not intended as a short-term savings vehicle due to the substantial fees and the potential for investment losses. Those seeking basic life insurance or low-cost coverage may be better off with alternative savings or investment options that offer more stability and lower fees.

Alternative Options

For individuals seeking basic life insurance or low-cost coverage, there are more suitable options available. Term life insurance, for example, provides coverage for a specific term, usually 10, 15, 20, or 30 years, and is significantly less expensive than variable life insurance. Additionally, whole life insurance offers permanent coverage with lower fees and a guaranteed rate of return, providing more stability and predictability.

Overdose Death: Life Insurance Payouts and Consequences

You may want to see also