The W-2 code is a crucial component of the tax filing process, and it plays a significant role in reporting life insurance benefits. When an individual receives a life insurance payout, the insurance company is required to provide a Form 1099-R, which includes the W-2 code. This code indicates the type of distribution, such as a death benefit from a life insurance policy. Understanding the W-2 code is essential for taxpayers to accurately report and claim the life insurance proceeds on their tax returns, ensuring compliance with the IRS regulations and proper financial management.

What You'll Learn

- Life Insurance Types: Understand the different types of life insurance policies

- W2 Code Definition: Learn what the W2 code means for life insurance

- Tax Implications: Explore how life insurance affects tax returns

- Benefits Reporting: Discover how life insurance benefits are reported on W2 forms

- W2 Code Examples: See examples of W2 codes for life insurance

Life Insurance Types: Understand the different types of life insurance policies

Life insurance is a crucial financial tool that provides protection and peace of mind for individuals and their loved ones. When it comes to life insurance, understanding the different types of policies available is essential to ensure you choose the right coverage for your needs. Here's an overview of the various life insurance types:

Term Life Insurance: This is a straightforward and cost-effective type of life insurance. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. During this term, the policyholder pays a fixed premium, and in return, the insurer promises to pay a death benefit to the beneficiary if the insured person passes away within the term. It is an excellent option for those seeking temporary coverage, especially for young families or individuals who want to cover specific financial obligations, such as mortgage payments or children's education. The simplicity of term life insurance makes it easy to understand and budget for, as the premium remains consistent throughout the policy term.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and includes an investment component. With whole life, the policyholder pays premiums that are typically higher than term life. However, the premiums are invested, and over time, the cash value of the policy grows. This type of insurance is ideal for those seeking long-term financial security and a consistent death benefit. The investment aspect of whole life insurance can also provide a source of funds that can be borrowed against or withdrawn, offering additional financial flexibility.

Universal Life Insurance: This policy combines the features of both term and whole life insurance. Universal life insurance offers flexible premiums and a variable death benefit. Policyholders can adjust their premiums and death benefit amounts over time, providing a level of customization. The premiums are typically higher than term life but lower than whole life. The cash value component of universal life insurance allows for potential investment growth, similar to whole life. This type of policy is suitable for individuals who want the flexibility to adapt their coverage as their financial situation changes.

Variable Life Insurance: Variable life insurance is a more complex policy that offers both death benefit coverage and an investment component. The death benefit can vary based on the performance of the underlying investment options chosen by the policyholder. This type of insurance provides more investment options and potential for higher returns compared to traditional life insurance. However, it also comes with higher fees and more complexity. Variable life insurance is often chosen by those who want to actively manage their investments and are comfortable with the risks associated with market fluctuations.

Understanding the different types of life insurance policies is crucial to making an informed decision. Each type has its advantages and considerations, and the choice depends on individual financial goals, risk tolerance, and long-term plans. It is recommended to consult with a financial advisor or insurance professional to determine the most suitable life insurance coverage based on your specific circumstances.

Canceling John Hancock Life Insurance: A Step-by-Step Guide

You may want to see also

W2 Code Definition: Learn what the W2 code means for life insurance

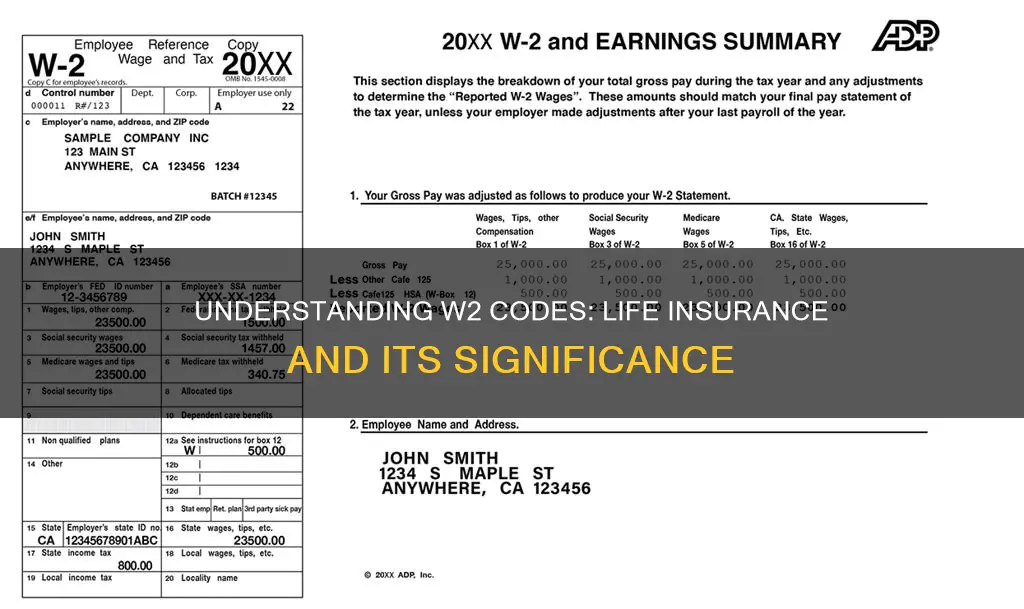

The W2 code is an essential component of the tax reporting process for life insurance policies in the United States. It is a unique identifier assigned to each policyholder by the insurance company, and it plays a crucial role in determining the tax implications of life insurance benefits. When you receive a life insurance policy, the insurance provider generates a W2 form, which summarizes the payments made to you during the tax year. This form is similar to the W2 form you receive from your employer, but it specifically relates to your life insurance benefits.

In the context of life insurance, the W2 code is used to report the proceeds or benefits paid out upon the death of the insured individual. It helps the insurance company and the tax authorities track and report these payments accurately. The code ensures that the tax laws regarding life insurance benefits are applied correctly, providing clarity for both the policyholder and the insurance provider.

For policyholders, understanding the W2 code is important as it directly impacts their tax obligations. When a life insurance policy pays out a death benefit, the insurance company reports this payment on a Form 1099-R, which is a summary of distributions and a separate tax form from the W2. The W2 code on this form indicates that the payment is a life insurance death benefit, and it helps determine if the payout is taxable. If the policy is considered a modified endowment contract (MEC), the W2 code might also be relevant in calculating the taxable gain.

Insurance companies use the W2 code to ensure compliance with tax regulations. It helps them report the correct amount of life insurance proceeds to the tax authorities and facilitates the proper allocation of taxes. This code is particularly important for high-value life insurance policies, as the tax implications can be significant. By providing a clear and unique identifier, the W2 code streamlines the tax reporting process and ensures that life insurance benefits are treated appropriately under the law.

In summary, the W2 code is a critical element in the administration of life insurance policies and tax reporting. It enables accurate tracking of life insurance benefits, ensures compliance with tax laws, and provides policyholders with transparency regarding their tax obligations. Understanding this code is essential for individuals receiving life insurance payments to navigate their tax responsibilities effectively.

Life and TPD Insurance: Combined Coverage Explained

You may want to see also

Tax Implications: Explore how life insurance affects tax returns

Life insurance can have significant tax implications, especially when it comes to the death benefit received by the beneficiary. Understanding these implications is crucial for individuals and their families to ensure proper financial planning and compliance with tax laws. Here's an overview of how life insurance impacts tax returns:

Death Benefit Exclusion: One of the most notable tax advantages of life insurance is the exclusion of the death benefit from the deceased's taxable estate. When an individual purchases a life insurance policy, they typically name a beneficiary who receives the payout upon their death. This death benefit is generally exempt from federal income tax for the beneficiary. The Internal Revenue Service (IRS) allows the first $1 million of life insurance death proceeds to be tax-free for most individuals. This exclusion ensures that the insurance proceeds are not subject to income tax, providing a significant financial benefit to the beneficiary.

Income Tax on Proceeds: However, if the death benefit exceeds the exclusion amount, the excess may be subject to income tax. The beneficiary must report the excess amount as income on their tax return. This can result in a significant tax liability, especially if the policy had a high death benefit. It's important to note that the tax treatment can vary depending on the type of life insurance policy. For instance, a term life insurance policy, which provides coverage for a specific period, may have different tax implications compared to a permanent life insurance policy, which offers lifelong coverage.

Tax Deductions and Adjustments: In some cases, life insurance premiums can be tax-deductible. If the individual itemizes their deductions, they may be able to claim a portion of the premiums as a medical expense deduction or a charitable contribution, depending on the type of policy. Additionally, if the life insurance policy is owned by an employer, the premiums may be taxable as a benefit to the employee. This means the employee would include the value of the policy in their income, and the employer would report it as a taxable benefit on their payroll taxes.

Gift Tax Considerations: Life insurance can also have implications for gift tax. If an individual gifts a life insurance policy to a beneficiary, the value of the policy may be subject to gift tax rules. The annual gift tax exclusion allows individuals to gift a certain amount tax-free each year, but if the policy value exceeds this limit, gift tax may apply. It's essential to consult tax professionals to ensure proper reporting and compliance with gift tax regulations.

Understanding these tax implications is crucial for effective financial planning. By considering the tax consequences, individuals can make informed decisions about their life insurance policies and ensure that the death benefit is utilized efficiently for their beneficiaries' financial well-being. Proper tax planning can help minimize the tax burden and maximize the benefits of life insurance.

Life Insurance Dividends: Taxable Post-Mortem?

You may want to see also

Benefits Reporting: Discover how life insurance benefits are reported on W2 forms

Life insurance benefits are an important aspect of financial planning, and understanding how they are reported on W2 forms is crucial for both employers and employees. When an employer offers life insurance as a benefit to their employees, it is essential to know the correct reporting procedures to ensure compliance with tax regulations. The W2 form, a crucial document for tax reporting, plays a significant role in this process.

On a W2 form, life insurance benefits are typically reported under the 'Group-Term Life Insurance' category. This code is used to indicate that the employer has provided life insurance coverage for the employee. The amount reported here represents the total value of the life insurance benefit provided during the tax year. It is important to note that this code is specific to group-term life insurance, which is a type of coverage where the employer pays the premiums and provides coverage for a group of employees.

When filling out the W2 form, the employer is responsible for accurately reporting the total amount of group-term life insurance benefits provided to the employee. This includes any premiums paid by the employer on behalf of the employee. The W2 form will have a designated section for this information, and it is crucial to ensure that the reported amount matches the actual value of the benefit. Inaccurate reporting can lead to tax-related issues and potential penalties.

Employees should also be aware of this reporting process, as it can impact their tax obligations. The W2 form is a summary of the employee's earnings and benefits for the year, and it is used to calculate income tax. By understanding the W2 code for life insurance benefits, employees can ensure that they report their income accurately and take advantage of any tax deductions or credits they may be entitled to.

In summary, the W2 code for reporting life insurance benefits is 'Group-Term Life Insurance'. This code is essential for employers to provide accurate tax information and for employees to understand their benefits and tax obligations. Proper reporting ensures compliance with tax laws and allows for a smooth tax filing process. It is always advisable to consult tax professionals or refer to official IRS guidelines for the most up-to-date and accurate information regarding W2 reporting.

Gerber Life Insurance: Getting a Loan Against Your Policy

You may want to see also

W2 Code Examples: See examples of W2 codes for life insurance

When it comes to reporting life insurance benefits on your tax return, understanding the W2 code is essential. The W2 code, also known as the "type of insurance" code, indicates the type of insurance coverage provided by an employer. For life insurance, the relevant W2 code is typically "10" or "11."

Code 10: This code is used for group term life insurance coverage provided by an employer. It represents a standard life insurance policy with a set benefit amount. For example, if your employer offers a group life insurance plan with a $50,000 death benefit, the W2 code 10 would be assigned to this coverage.

Code 11: This code is used for group universal life insurance, which provides flexible coverage and allows policyholders to adjust the death benefit amount. It is often offered as an additional benefit in retirement plans or as a voluntary benefit through an employer. For instance, if your employer provides a group universal life insurance policy with adjustable benefits, the W2 code 11 would be applicable.

It's important to note that the W2 code for life insurance is just one part of the reporting process. You will also need to provide the actual death benefit amount received and any applicable tax forms, such as Form 1099-R, to accurately report the insurance proceeds on your tax return.

Understanding these W2 codes is crucial for accurately reporting life insurance benefits and ensuring compliance with tax regulations. By recognizing the specific code assigned to your life insurance coverage, you can properly disclose the details of your insurance policy on your tax forms, allowing for accurate tax calculations and deductions.

Exide Life Insurance: Updating Your Mobile Number

You may want to see also

Frequently asked questions

The W-2 code for life insurance benefits is typically "1099-R" or "1099-S." This code indicates that the payment is a distribution from a retirement plan or a sale of property, respectively. When you receive a 1099-R or 1099-S form, it means that the insurance company has reported the payment of life insurance proceeds to the IRS, and you should include this amount in your income when filing your taxes.

Reporting life insurance benefits on your tax return depends on the type of payment received. If you received a 1099-R, you should report the total distribution amount as income on your tax return. This includes the death benefit or any other payments received from the insurance policy. For 1099-S forms, you report the proceeds from the sale of a property, which may be subject to capital gains tax.

Generally, life insurance premiums are not deductible as a direct expense, but there might be certain circumstances where you can claim deductions or credits. For example, if you are paying for a life insurance policy as part of your business expenses, you may be able to deduct the premiums. Additionally, in some countries or states, there might be tax credits or incentives for purchasing life insurance, especially for long-term care or disability insurance. It's best to consult tax professionals or refer to your local tax regulations for specific details.