Life insurance provides a cash lump sum to your loved ones in the event of your death. Total and Permanent Disability (TPD) insurance, on the other hand, provides a cash lump sum if you suffer a permanent disability arising from an illness or injury and are unable to work again. Combined life and TPD insurance is when these two types of insurance are bundled together in one policy, often resulting in a more affordable premium. This type of cover is suitable for those who want comprehensive protection at a lower cost. However, it's important to note that claiming on one type of cover may reduce the benefits available for the other.

| Characteristics | Values |

|---|---|

| Purpose | To provide financial security for you and your loved ones in the event of death or permanent disability |

| Lump Sum Payment | Yes |

| Payment Recipients | You or your loved ones |

| Payment Triggers | Death, terminal illness diagnosis, permanent disability |

| Payment Amount | Up to $5 million |

| Additional Benefits | Financial advice benefit, future increase benefit, premium and cover pause benefit |

| Policy Management | Simplified, with the option to purchase additional cover types from the same insurer |

| Cost | Generally more affordable when combined |

| Pros | Cost savings, simplified policy management |

| Cons | Claiming on one cover type may affect benefits available for other cover types |

What You'll Learn

Life and TPD insurance can be linked

For example, if you have $1,000,000 in life insurance, $500,000 in TPD insurance, and $250,000 in trauma cover, and you claim on your trauma insurance, your life insurance will be reduced to $750,000 and your TPD insurance to $250,000.

If you don't want this to happen, you can include life and TPD buy-back on your policy for just a few dollars a month. This increases your life cover back to its original sum insured after a claim on your TPD. However, this will not reinstate the cover you have just claimed on.

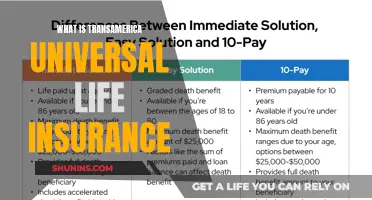

Linked life insurance policies can bundle multiple life insurance products together for a combined amount of cover, typically in exchange for a cheaper premium. This can help simplify policy management and make it more cost-effective. However, it is important to note that if benefits are paid out from one type of cover, the other benefits available for all covers attached to that specific plan will be affected.

Life Insurance: Death's Companion or Just a Myth?

You may want to see also

TPD insurance provides a cash lump sum

Total and Permanent Disability (TPD) insurance provides a cash lump sum if you suffer a permanent disability arising from an illness or injury and are unable to work again. This type of insurance is intended to cover permanent disabilities and does not provide cover for temporary disabilities, where you would be expected to recover and return to work.

The cash lump sum provided by TPD insurance can be used to cover medical fees, nursing care, home modifications, and other costs associated with your disability. It can also be used to repay debt and provide a sum that you and your family can draw down on to maintain your living standard.

The amount of TPD cover is usually limited to the amount of life cover purchased, as TPD insurance is typically purchased as an optional extra on a life insurance policy. However, standalone TPD insurance cover can be purchased separately if life cover is not required.

There are different types of TPD insurance, including "Any Occupation" and "Own Occupation". "Any Occupation" means that you will be paid if you are unable to work in any occupation for which you are reasonably suited by education, training, or experience. "Own Occupation" means that you will be paid if you are unable to work in your own or normal occupation.

TPD insurance can be linked to a life insurance policy, providing a cash lump sum benefit in the event of death or TPD. This type of combined cover can help save on insurance costs by bundling several cover types into one policy. However, it is important to consider the pros and cons of combined cover, as claiming on one type of cover may affect the payout and benefits available for the other types of cover included in the policy.

Banker's Life Insurance: Is It Still Around?

You may want to see also

TPD insurance does not cover temporary disabilities

Total and Permanent Disability (TPD) insurance provides a cash lump sum if you suffer a permanent disability that prevents you from ever working again. This is distinct from temporary disabilities, which TPD insurance does not cover. Temporary disabilities are short-term injuries or illnesses where the individual is expected to recover and return to work.

TPD insurance is intended for permanent disabilities that arise from illnesses or injuries and prevent the policyholder from ever working again. It provides a financial safety net to support the policyholder and their family, helping to cover living expenses, repay debts, and manage medical and rehabilitation costs.

Temporary disabilities, on the other hand, are short-term conditions where the individual is expected to recover. These may include temporary injuries or illnesses that prevent an individual from working full-time or at all for a limited period. Temporary disabilities are typically covered by income protection insurance or trauma insurance policies.

It is important to understand the difference between TPD insurance and coverage for temporary disabilities. TPD insurance is designed for permanent and total disabilities, while temporary disabilities are covered by separate types of insurance policies.

When considering insurance options, it is advisable to review your personal situation and requirements to determine the most suitable coverage. Combining life insurance with TPD insurance can provide comprehensive protection, but it is essential to understand the scope and limitations of each policy.

Life Insurance Lapse: Illinois Policy Penalties Explained

You may want to see also

Life and TPD insurance can be purchased as a standalone policy

Secondly, with standalone policies, the sum insured for each type of cover will not be affected by claims made on the other. In other words, if you make a claim on your TPD insurance, your life insurance payout will remain unchanged. This ensures that your loved ones will still receive the full sum insured in the event of your death.

Additionally, standalone policies allow you to choose the specific types of cover that best suit your needs. For instance, you may opt for "Own Occupation" TPD insurance, which provides a payout if you are unable to work in your specific occupation due to a disability. Alternatively, you could select "Any Occupation" TPD insurance, which covers you if you are unable to work in any occupation suited to your skills and experience.

Standalone life and TPD insurance policies also give you the flexibility to choose different insurers for each type of cover. This can be beneficial if you find that one insurer offers more favourable terms for life insurance, while another insurer has better conditions for TPD insurance.

While standalone life and TPD insurance policies offer greater flexibility and ensure that claims on one type of cover do not affect the other, it is important to consider the potential drawbacks. One key disadvantage is the increased cost associated with maintaining multiple policies. You will need to pay separate premiums for each policy, which can be more expensive than a combined policy with a single premium. Additionally, managing multiple policies can be more complex, as you will have different renewal dates and policy terms to keep track of.

Ultimately, the decision to choose standalone or combined life and TPD insurance depends on your unique circumstances and requirements. It is essential to carefully review the features and benefits of each option before making a decision to ensure that you have the most suitable cover for your needs.

Life Insurance Tax: Voluntary Benefits and Implications

You may want to see also

Life and TPD insurance can be purchased as a combined policy

TPD insurance provides a cash lump sum if you suffer a permanent disability that prevents you from ever working again. Life insurance, on the other hand, provides a cash lump sum to your loved ones in the event of your death.

Combining these two types of insurance can be a cost-effective way of obtaining comprehensive cover. It also makes it easier to manage your policies as you only pay one premium per month/year. However, it's important to note that claiming on one type of cover will reduce the amount of insurance you have in place for the other type. For example, if you have $1,000,000 in life insurance and $500,000 in TPD insurance, and you claim on your TPD insurance, your life insurance will be reduced to $500,000.

If you want to avoid this situation, you can include life and TPD buy-back on your policy for just a few dollars a month. This will increase your life cover back to its original sum insured after a claim on your TPD insurance.

When deciding whether to combine your life and TPD insurance, it's important to consider your unique situation and requirements. While combined cover can be more affordable and convenient, it may no longer meet your needs as your circumstances change. Additionally, if you claim from one cover type, your other benefits may decrease.

Changing Beneficiary on Life Insurance: Easy Steps to Follow

You may want to see also