Long-term life insurance, often referred to as permanent or whole life insurance, is a type of coverage that provides financial protection for the insured's beneficiaries for the rest of their lives. Unlike term life insurance, which has a specific period of coverage, long-term life insurance offers coverage for the entire lifetime of the insured individual, ensuring that beneficiaries receive a death benefit regardless of when the insured passes away. This type of insurance is designed to provide financial security and peace of mind, knowing that a loved one will be taken care of even in the event of the insured's untimely death. It also includes an investment component, allowing the policyholder to build cash value over time, which can be borrowed against or withdrawn.

What You'll Learn

- Long-Term Coverage: Provides insurance for an extended period, often to age 100 or beyond

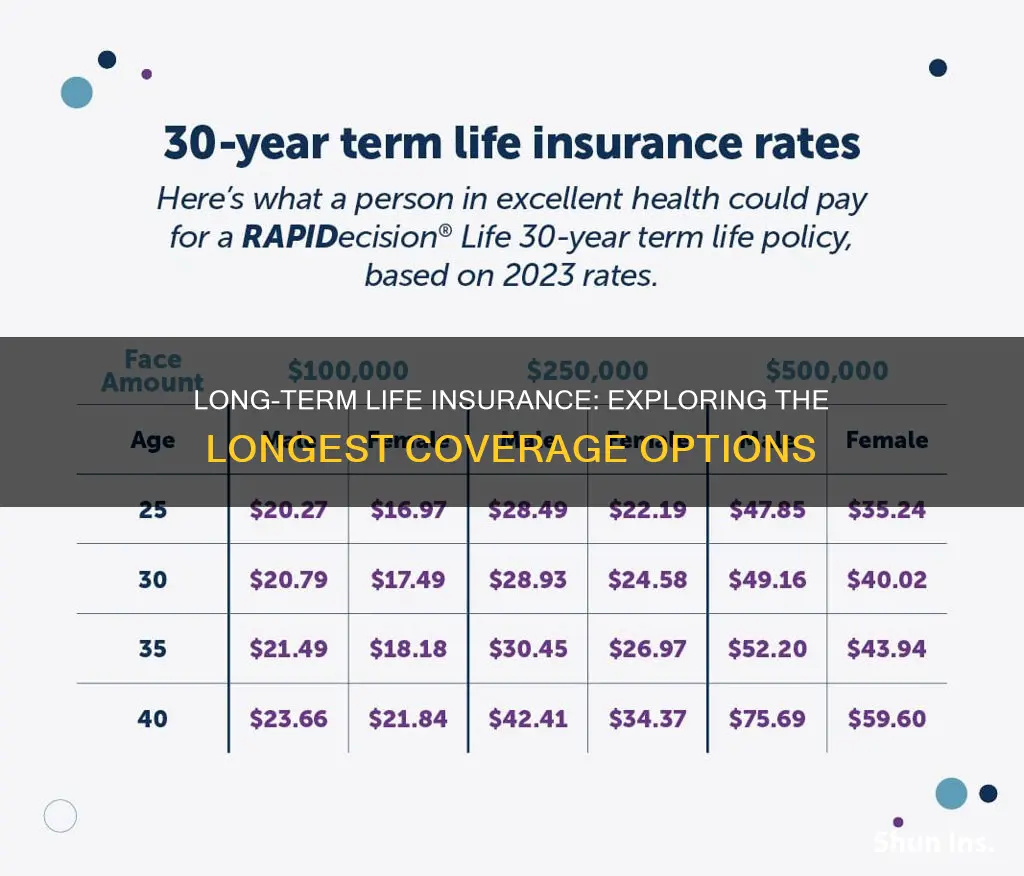

- Cost & Affordability: Longer terms may offer higher premiums but ensure long-term financial security

- Lapse & Renewal: Policies may lapse without payment, requiring renewal with potential premium increases

- Benefits & Flexibility: Offers various death benefits and allows customization to meet specific needs

- Medical & Underwriting: Underwriters assess health to determine eligibility and set premiums for long-term plans

Long-Term Coverage: Provides insurance for an extended period, often to age 100 or beyond

Long-term coverage, often referred to as long-term care insurance, is a type of policy designed to provide financial security and peace of mind for individuals and their families. This type of insurance is specifically tailored to offer protection for an extended period, typically covering individuals until they reach an advanced age, often 100 or beyond. It is a comprehensive solution for those seeking to ensure their long-term financial stability and well-being.

The primary purpose of long-term coverage is to assist individuals in managing the costs associated with extended care, which can include medical expenses, nursing home care, assisted living, and other related services. As people age, the risk of requiring long-term care increases, and having a dedicated insurance policy can be a valuable asset. This type of insurance policy is structured to provide financial support when and where it is needed most, ensuring that individuals can maintain their desired standard of living during their later years.

One of the key advantages of long-term coverage is its flexibility. Policies can be customized to suit individual needs, allowing policyholders to choose the level of coverage and benefits that align with their specific requirements. This flexibility ensures that the insurance can adapt to changing circumstances and provide tailored protection. For instance, individuals can opt for coverage that includes long-term care services, critical illness benefits, or even a combination of both, ensuring a comprehensive safety net.

When considering long-term care insurance, it is essential to evaluate various factors. These include the policy's duration, the age at which coverage begins, and the potential for policy adjustments over time. Many policies offer the option to increase coverage as individuals age, ensuring that the insurance remains relevant and beneficial throughout their lives. Additionally, understanding the policy's terms and conditions, such as waiting periods and benefit payout structures, is crucial to making an informed decision.

In summary, long-term coverage is a specialized insurance product that provides extended financial protection for individuals, often until their later years. It offers a sense of security and peace of mind, ensuring that individuals can age gracefully while having the necessary financial support. With its customizable nature and potential for long-term adjustments, this type of insurance is an essential consideration for anyone looking to secure their future and the well-being of their loved ones.

Cashing Out Whole Life Insurance: Options for Seniors

You may want to see also

Cost & Affordability: Longer terms may offer higher premiums but ensure long-term financial security

When considering the longest-term life insurance, it's essential to understand the cost implications and the value it brings to your financial plan. While longer-term policies may come with higher premiums, they offer a sense of security and peace of mind, ensuring your loved ones are protected over an extended period. This type of insurance is particularly beneficial for those who want to provide long-term financial security for their families, especially in cases where the primary breadwinner has a long-term career or business commitment.

The cost of life insurance increases with the term length for several reasons. Firstly, longer-term policies cover a more extended period, and insurance companies factor in the higher risk of death over an extended duration. Secondly, as the term lengthens, the likelihood of the insured individual outliving the policy increases, which can impact the overall cost. However, it's important to note that the premium structure is designed to provide comprehensive coverage, ensuring that your beneficiaries receive the full death benefit when needed.

Affordability is a critical consideration when choosing the longest-term life insurance. While longer-term policies may be more expensive, they can be more cost-effective in the long run compared to shorter-term options. Here's how: Longer-term policies often have lower monthly premiums, especially when compared to term life insurance that only lasts for a specific period. This lower monthly cost can be more manageable for individuals and families, especially those with limited budgets. Additionally, with longer-term insurance, you lock in a fixed premium rate for the entire term, protecting you from potential future rate increases.

Another advantage of longer-term life insurance is the potential for tax advantages. In many jurisdictions, life insurance death benefits are generally not subject to income tax, providing a significant financial benefit to your beneficiaries. This tax-free status can be particularly valuable for larger death benefits, ensuring that the full amount goes towards your intended financial goals.

In summary, while longer-term life insurance may come with higher initial costs, it offers long-term financial security and peace of mind. By understanding the cost structure and potential tax benefits, individuals can make informed decisions about their insurance coverage, ensuring they provide adequate protection for their loved ones without compromising their financial goals. It is always advisable to consult with a financial advisor or insurance specialist to determine the most suitable term length and coverage for your specific needs.

Understanding Cash Value Life Insurance Face Amounts

You may want to see also

Lapse & Renewal: Policies may lapse without payment, requiring renewal with potential premium increases

When considering the longest-term life insurance policies, it's important to understand the concept of lapse and renewal, which can significantly impact your coverage and financial planning. Life insurance policies, especially those with long-term coverage, can be a substantial financial commitment. These policies are designed to provide financial security for a prolonged period, often for the entire lifetime of the insured individual. However, like any long-term financial agreement, they come with specific terms and conditions that policyholders should be aware of.

One critical aspect is the potential for the policy to lapse. Lapse occurs when the insured individual fails to make the required premium payments as per the policy's terms. Life insurance policies typically require regular premium payments, and if these payments are missed, the policy may enter a lapse status. During a lapse, the policy's coverage is temporarily suspended, and the insurance company may take certain actions. It is crucial to understand that the insurance provider is not obligated to continue providing coverage if premiums are not paid, and the policy may not be automatically renewed.

Upon lapse, the policyholder has a limited period, often known as the grace period, to make the missed payments and restore the policy's active status. If the premiums are not paid within this grace period, the policy may be terminated, and the insurance company can cancel the coverage. This can result in the loss of the financial security that the policy was intended to provide. To avoid such a situation, policyholders should ensure they have a reliable method for making premium payments and consider setting up automatic payments to prevent lapses.

Renewal is another critical process associated with long-term life insurance policies. When a policy lapses, the insurance company may offer the policyholder the option to renew the coverage. Renewal can be subject to certain conditions, and the insurance provider may assess the policyholder's eligibility and health status at that time. During the renewal process, the insurance company can adjust the premium rates, and there is a possibility of premium increases, especially if the policyholder's health or lifestyle factors have changed. These changes can impact the overall cost of the policy, making it more expensive for the policyholder.

Understanding the lapse and renewal process is essential for individuals seeking the longest-term life insurance coverage. It ensures that policyholders are aware of their responsibilities and the potential risks associated with non-payment. By being proactive in managing their policies and staying informed about the renewal process, individuals can maintain their long-term financial security and ensure that their life insurance coverage remains effective throughout their lifetime. This knowledge is particularly valuable for those relying on long-term life insurance to secure their family's financial future.

Life Insurance Underwriter: Getting Your Dream Job

You may want to see also

Benefits & Flexibility: Offers various death benefits and allows customization to meet specific needs

Long-term life insurance, often referred to as permanent life insurance, offers a range of benefits and customization options that make it a versatile and valuable financial tool. This type of insurance is designed to provide coverage for an extended period, often for the entire life of the insured individual, hence the term "longest-term." One of the key advantages is the flexibility it offers in terms of death benefits, allowing policyholders to tailor the coverage to their unique needs and circumstances.

When it comes to death benefits, long-term life insurance provides a range of options. The primary benefit is a death benefit, which is a fixed amount paid to the policyholder's beneficiaries upon the insured's passing. This benefit can be customized to suit various financial goals. For instance, it can be set to cover essential expenses like mortgage payments, children's education, or daily living costs for the family. The flexibility lies in the ability to choose the amount and type of benefit that aligns with the insured's financial obligations and goals.

Policyholders can opt for a whole life insurance policy, which guarantees a death benefit and accumulates cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. Alternatively, term life insurance can be chosen, which offers coverage for a specific period, such as 10, 20, or 30 years, with the option to convert it to a permanent policy later. This flexibility ensures that the insurance can adapt to changing financial needs and priorities.

Customization is a significant feature of long-term life insurance. Policyholders can tailor the policy to include additional riders or endorsements, such as critical illness coverage, accident coverage, or waiver of premium. These add-ons provide comprehensive protection and ensure that the insurance meets specific health and financial concerns. For example, a critical illness rider would pay out a benefit if the insured is diagnosed with a specified critical illness, providing financial support during a challenging time.

Furthermore, the customization options allow individuals to choose the premium payment term, ensuring that the insurance fits within their budget and financial capabilities. Some policies offer the flexibility of converting the coverage to a different type of insurance or adjusting the death benefit amount over time. This adaptability is particularly beneficial for those who may experience changes in their financial situation or health status.

In summary, the longest-term life insurance provides a wide array of death benefits and customization features, ensuring that individuals can secure their loved ones' financial future according to their specific needs. With various options available, policyholders can create a tailored insurance plan that offers both long-term security and the flexibility to adapt to life's changing circumstances.

Canceling Aegon Life Insurance: A Step-by-Step Guide

You may want to see also

Medical & Underwriting: Underwriters assess health to determine eligibility and set premiums for long-term plans

Underwriting is a critical process in the insurance industry, especially when it comes to long-term life insurance policies. This process involves a thorough evaluation of an individual's health, lifestyle, and other relevant factors to determine their eligibility for coverage and to set appropriate premiums. The underwriting process for long-term life insurance is particularly rigorous due to the extended coverage period, which can span several decades.

Medical assessments play a pivotal role in this process. Underwriters carefully review an applicant's medical history, including any pre-existing conditions, chronic illnesses, or past medical procedures. They may request detailed medical records, lab results, and even consult with healthcare professionals to gain a comprehensive understanding of the individual's health status. This is essential because long-term life insurance policies are designed to provide financial security for beneficiaries over an extended period, and underwriters need to ensure that the insured individual can maintain the required health standards throughout the policy term.

During the underwriting process, underwriters also consider an individual's lifestyle choices. Factors such as smoking status, alcohol consumption, diet, exercise habits, and occupation can significantly impact health and longevity. For instance, a heavy smoker with a sedentary lifestyle may be considered a higher risk for certain health issues, which could affect their eligibility for long-term coverage or result in higher premiums. Underwriters use standardized rating scales and guidelines to assess these factors and make informed decisions.

The underwriting guidelines for long-term life insurance can vary depending on the insurance company and the specific policy. Some companies may offer guaranteed acceptance for certain age groups or provide simplified underwriting options for individuals with pre-existing conditions. However, for the longest-term policies, which often cover individuals until age 100 or beyond, underwriters tend to be more cautious and may require extensive medical information and a comprehensive review of the applicant's health.

In summary, the medical and underwriting process for long-term life insurance is a meticulous and detailed evaluation of an individual's health and lifestyle. Underwriters play a vital role in assessing risk, determining eligibility, and setting premiums to ensure that the insurance company can provide the intended financial protection over an extended period. This process is essential to maintain the integrity of the insurance industry and to offer suitable coverage options to policyholders.

Finding Life Insurance Your Parents Left Behind

You may want to see also

Frequently asked questions

The longest-term life insurance is typically referred to as "whole life insurance" or "permanent life insurance." It provides coverage for the entire lifetime of the insured individual, hence the term "permanent." This type of policy offers a guaranteed death benefit and a cash value component that grows over time.

Term life insurance is designed to provide coverage for a specific period, such as 10, 20, or 30 years. It is generally more affordable than permanent life insurance because it doesn't accumulate cash value. In contrast, the longest-term life insurance offers lifelong coverage and a savings component, making it more expensive.

The advantages include lifelong protection, a guaranteed death benefit, and the potential for cash value accumulation. The cash value can be borrowed against or withdrawn, providing financial flexibility. Additionally, permanent life insurance policies often have an investment component, allowing policyholders to potentially earn interest on their premiums.

Yes, many insurance companies offer conversion options, allowing you to switch from a term life policy to a permanent one. This can be beneficial if you initially purchased term life insurance and later realized the need for longer-term coverage. However, conversion rates and terms may vary, so it's essential to review the policy details.

Several factors contribute to the premium cost, including age, health, lifestyle, and the amount of coverage. Older individuals may face higher premiums due to increased life expectancy risks. Additionally, those with certain medical conditions or unhealthy habits might be considered higher-risk candidates, leading to more expensive policies.