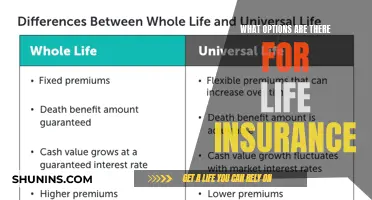

Whole life insurance is a versatile financial tool that can provide added protection for your loved ones. If you pass away, your beneficiaries can use your policy's death benefit payout to help replace some of your income or save for the future. Plus, its cash value growth component can offer a wealth-building opportunity. There are several ways to cash out whole life insurance, each with its own benefits, drawbacks, and potential tax consequences.

| Characteristics | Values |

|---|---|

| Whole life insurance | Whole life insurance is a versatile financial tool that can provide added protection for your loved ones. |

| Cashing out whole life insurance | There are several ways to cash out whole life insurance: taking out a policy loan, withdrawing cash from the policy, surrendering the policy, or selling the policy. |

| Taking out a policy loan | Whole life insurance lets you borrow at low rates with no credit check or fixed repayment date. In some cases, you may not owe taxes on borrowed amounts, and your death benefit doesn't decrease. |

| Withdrawing cash from the policy | You can withdraw up to the amount you've paid in premiums without paying taxes on the funds. Withdrawals will reduce the death benefit. |

| Surrendering the policy | Surrendering the policy will end the policy and allow you to receive the cash value minus any surrender fees. You may owe taxes on interest earnings. |

| Selling the policy | You can sell your policy to a third party for a lump sum that is greater than the cash value. This is known as a life settlement. |

What You'll Learn

Borrowing from your life insurance policy

When borrowing from your life insurance policy, you are essentially taking out a loan from the insurer, with the cash value of your policy acting as collateral. This means that the policy's cash value can continue to accumulate, but it's important to understand how interest and any dividends will be determined and paid while you have an active loan. The loan is not recognised as income by the IRS, so it remains tax-free as long as the policy stays active and is not a modified endowment contract.

Interest is added to the loan balance, and it's important to make timely payments on top of your regular premium payments. If unpaid, interest will accrue, and your loan may exceed the policy's cash value, causing it to lapse. In this case, you will likely owe taxes on the amount borrowed. If the loan is not repaid before your death, the loan amount, plus any interest owed, will be subtracted from the death benefit paid to your beneficiaries.

- No loan application or credit check is required, and your credit rating will not be affected.

- You can choose not to repay the loan, but the outstanding balance, including interest, will typically be deducted from your death benefit.

- The interest rate on a policy loan is usually lower than that of a bank loan or credit card.

- You can continue to earn interest on the outstanding loan amount. For example, if the interest rate on the loan is 5% and the return on your cash value is 7%, you will still earn 2% on the borrowed amount.

- Be careful not to borrow too much, as this could cause your policy to lapse if the loan amount plus interest exceeds the policy's cash value.

- You may be able to borrow up to 90% of the policy's cash value, depending on the insurance company's rules.

- It usually takes several years for the cash value to build up sufficiently to take out a loan.

In summary, borrowing from your life insurance policy can be a flexible way to access cash, but it's important to understand the potential risks, including the reduction of your death benefit and the possibility of lapsing your policy if the loan is not managed carefully.

Cashing in on Life Insurance: Redeeming Your Policy

You may want to see also

Withdrawing cash from your life insurance policy

Taking Out a Policy Loan

Whole life insurance lets you borrow money at low rates with no credit check or fixed repayment date. In some cases, you may not owe taxes on the borrowed amount, and your death benefit will remain the same. However, interest accumulates on the outstanding balance, and if this balance exceeds the cash value, your policy could lapse, resulting in a taxable event.

Withdrawing Cash

You can withdraw cash from the policy to avoid repaying a loan. However, withdrawing more than your total premiums paid or withdrawing interest gains may result in tax consequences. Withdrawing cash will also reduce your death benefit.

Surrendering Your Policy

If you no longer need coverage or don't want to continue paying premiums, you can surrender your policy to terminate it and receive the cash value, minus any surrender charges. This may result in tax consequences if your payout is higher than the cost basis. Surrendering your policy means your beneficiaries will not receive a death benefit.

Selling Your Policy (Life Settlement)

Another option is to sell your policy to a licensed life settlement company. This process may result in a larger payout than simply surrendering the policy, but it is more complicated. You will need to research and apply to reputable life settlement companies, and you may owe taxes on some of the proceeds.

Understanding Life Insurance: What Does One Unit Mean?

You may want to see also

Surrendering your life insurance policy

When to Surrender Your Policy

There are several reasons why you might want to surrender your life insurance policy:

- Cost: If you can no longer afford your premiums, you could surrender your policy to avoid monthly payments.

- Cash needs: Surrendering your policy will give you access to a lump sum of cash. However, there may be other ways to access your cash value without giving up coverage, such as a policy loan.

- Better coverage: You may find better coverage from a new policy and want to surrender your existing one.

- Better price: You might find a life insurance policy with a better price.

- No longer needed: If no one relies on you financially anymore, you may not need life insurance coverage.

How to Surrender Your Policy

Most life insurance companies make it straightforward to surrender your policy. You will need to contact your insurance company or agent, and you may have to sign paperwork. You will then receive the surrender value check.

Surrender Fees and Taxes

Most policies require you to pay surrender fees when surrendering a policy. Surrender charges often decrease over the policy's life, and some disappear entirely after a specific time. You may also have to pay taxes on your life insurance surrender value as taxable income. You will only pay income tax on interest or earnings over the amount you paid into the policy.

Alternatives to Surrendering Your Policy

If you want to access your cash value but keep your coverage, there are several alternatives to surrendering your policy:

- Withdrawal: You can take money out of the cash value with a withdrawal. Withdrawing up to the amount you've paid in premiums will not be subject to income taxes. However, withdrawals will reduce the death benefit.

- Loans: You can borrow money from your life insurance policy. There is no loan application or credit check, and you can choose whether or not to repay it. If you don't, the amount will be deducted from the death benefit.

- Use cash value to pay premiums: You can use the money in your cash value to pay part or all of your policy premiums.

- Sell your policy: You can sell your policy to a third party for a lump sum that is greater than the cash value. This is called a life settlement.

Hartford Basic Life Insurance: Understanding Term Coverage

You may want to see also

Selling your life insurance policy

There are some important things to consider before selling your life insurance policy. Firstly, you should consult your tax advisor, as there may be tax implications to selling your policy. Secondly, the proceeds from the sale may be accessible by your creditors. Thirdly, you may lose any public assistance benefits, such as supplementary social security benefits, food stamps, or Medicaid. Finally, the insured person may be contacted by the life settlement provider to determine their health status, although this is limited to once every three months if the insured has a life expectancy of more than a year, and once per month if the insured has a life expectancy of one year or less.

To sell your life insurance policy, you must typically be over the age of 65 and have a high-value policy of at least $100,000. Life settlement companies will pay more if you have a health condition that leads to a lower life expectancy. You can research and compare quotes from different life settlement companies to find the best offer. It is recommended to work with reputable companies and get offers from multiple sources. You can handle the process yourself or hire a life settlement broker to manage the more complex parts.

Once you have found a suitable buyer, the underwriters at the company will evaluate whether your policy is a good investment and may provide you with an offer. You can then finalise the details and sign the documents to transfer the policy to the life settlement firm.

Other ways to get cash from a life insurance policy

If you don't want to sell your life insurance policy, there are other ways to access the cash value. These include:

- Taking out a policy loan: Borrowing money from your life insurance policy is a fast and easy way to get cash. There is no loan application or credit check, and you can choose whether or not to repay the loan. However, if you don't repay it, the loan amount and interest will be deducted from the death benefit that your beneficiaries receive.

- Withdrawing cash: You can simply take money out of the cash value of your policy, up to the amount you've paid in premiums without paying taxes on the funds. However, withdrawals will reduce the death benefit.

- Surrendering the policy: You can cancel your policy entirely and take the surrender value cash payment. However, this will leave you without life insurance coverage, and there may be surrender fees that reduce the cash you receive.

Congress' Entitled Lifetime Insurance: Examining the Perks

You may want to see also

Using cash value to pay premiums

One of the ways to access the cash value in your life insurance policy is to use it to pay your premiums. This is a popular option for older policyholders who want to use retirement income for living expenses but still want to keep their life insurance coverage.

When you make premium payments on a cash-value life insurance policy, one portion of the payment is allotted to the policy's death benefit, another goes towards the insurer's costs and profits, and the third contributes to the policy's cash value. In the early years of the policy, a higher percentage of your premium goes towards the cash value. Over time, the amount allotted to cash value decreases and more of the premium is applied to the cost of insurance.

If you build up enough money in your cash value account, you may be able to use your cash value to cover premium payments. This could provide some relief if you are struggling to make payments and help you keep the life insurance policy in force.

However, it is important to note that the funds allotted to cash decrease and those paid to cover insurance increase as you age. Therefore, you should consult an insurance advisor to determine how to calculate the potential cash value accumulation of your specific permanent life insurance policy. Additionally, different kinds of whole life policies carry varying levels of risk when it comes to cash value accumulation. Whole life policies usually pose the least risk with guaranteed cash value accumulation, while variable life policies are more risky as they depend on the performance of an asset.

Life Insurance Options for People with Fatty Liver Disease

You may want to see also

Frequently asked questions

There are several ways to cash out your whole life insurance policy. You can borrow from your policy, withdraw funds from your policy, surrender your policy, or pay policy premiums using your cash value.

The main benefit of cashing out your whole life insurance policy is that you will receive quick funds without going through an extensive application process or a long waiting period. Additionally, you can typically lock in low-interest rates on cash value loans. However, cashing out your policy will reduce or eliminate your cash value, and your policy could lapse if you borrow a significant amount and your interest exceeds your cash balance.

Withdrawing up to the total premiums paid into the policy is typically tax-free. However, withdrawing more than this amount may result in taxes on the additional sum. Surrendering your policy may also result in taxes on any amount exceeding the total premiums paid.