Supplemental life insurance is an additional layer of protection on top of the group policy provided by an employer. It is a voluntary insurance benefit, paid for by the employee, that can be purchased at work or through an organisation. It is also possible to buy supplemental life insurance from a private insurer to supplement an employer's basic plan. This type of insurance is typically offered as either term or permanent coverage. Term insurance is temporary and lasts for a stated period, such as 10 or 20 years, while permanent coverage continues as long as premiums are paid and includes whole and universal life policies.

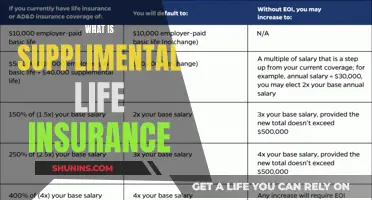

| Characteristics | Values |

|---|---|

| Type | Whole life insurance |

| Coverage | Lasts for the child's entire life |

| Coverage amounts are typically low, often under $50,000 | |

| Premiums | Locked in and won't increase |

| Average Annual Premium | $166 for a $25,000 policy on a newborn |

| Cash Value | Whole life insurance builds cash value that can be withdrawn or borrowed against |

| Ownership | The child can take ownership of the policy at certain ages, such as 21 |

| Guaranteed Purchase Option | The child can buy additional coverage without a life insurance medical exam |

| Coverage Amount | Up to $15,000 for dependent children up to age 26 |

What You'll Learn

Child life insurance is a type of permanent life insurance

Child life insurance policies usually include a guaranteed purchase option, which means that the child can buy additional coverage at a later date without undergoing a medical examination. This feature can be particularly useful if the child develops health issues or chooses a high-risk career path. However, it's important to consider that healthy applicants in their 20s can typically secure competitive rates, making this type of policy less necessary. Additionally, the coverage amounts are generally low and may not meet future life insurance needs.

Another advantage of child life insurance is that it can act as a savings vehicle for the child. The cash value of the policy grows over time, and the funds can be used for various expenses, such as school fees or a down payment on a home. However, it's important to note that building up this cash value takes time and relatively low premiums will result in a lower cash value. There may be other types of investments that are more suitable for this purpose.

Child life insurance also provides financial protection in the unfortunate event of a child's death. The policy pays out a lump sum, which can help cover burial costs and other expenses during a difficult time. While the likelihood of a child's death is relatively low, this type of insurance can provide peace of mind and financial support during a parent's bereavement period.

In summary, child life insurance offers permanent coverage, guaranteed future insurability, a savings component, and financial protection in the event of a child's death. When considering this type of insurance, it's essential to weigh the benefits against the costs and likelihood of needing the coverage.

Life Insurance: Substandard Rating and What It Means

You may want to see also

Coverage lasts for the child's entire life, provided premiums are paid

Child life insurance is typically purchased by a parent, guardian, or grandparent. It covers the life of a minor and is usually a type of permanent life insurance, meaning that coverage will last for the child's entire life, provided that the premiums are paid. This type of insurance is often marketed towards parents as a way to cover their child's future insurability, final expenses, and income replacement in the event of their death.

Child life insurance policies are usually whole life insurance products, which means that coverage will last for the child's entire life as long as the premiums are paid. Whole life insurance policies also build cash value over time, which can be used for loans or withdrawals. The cash value component of these policies grows over time and can provide added financial security for the child in the future.

The coverage amounts for child life insurance tend to be low, often under $50,000, and the premiums are locked in, meaning they will not increase over time. The average annual premium for a $25,000 policy on a newborn is $166. At certain ages, such as 21, the child can take ownership of the policy, giving them the option to continue coverage, buy more, or cancel the policy altogether.

While child life insurance can provide peace of mind and financial protection in the event of a child's death, it is important to consider the likelihood of such an event. According to data from the Centers for Disease Control and Prevention, it is relatively uncommon for a child to die in the United States. Therefore, parents may want to assess their budget and their own life insurance needs before purchasing a child life insurance policy.

U.S. Life Insurance: Checking on Your USAA Application

You may want to see also

Coverage amounts are typically low, often under $50,000

Child life insurance is typically purchased by a parent, guardian, or grandparent. It covers the life of a minor and is usually a whole life product, meaning the coverage lasts for the child's entire life as long as the premiums are paid. While the coverage amounts are typically low, often under $50,000, the premiums are locked in and won't increase. The average annual premium for a $25,000 policy on a newborn is $166.

One of the key benefits of whole life insurance is that it builds cash value over time. A portion of the premium goes towards the cash value, which the child can access later in life. At certain ages, such as 21, the child can take ownership of the policy, allowing them to continue coverage, buy more, or cancel the policy. This feature provides flexibility and ensures that the child has access to financial resources if needed.

The low coverage amounts in child life insurance policies are often sufficient to cover final expenses, such as burial or cremation costs, in the unfortunate event of a child's death. Additionally, the payout can help cover the income of a parent who may need to take time off work to grieve and cope with the loss. While the likelihood of a child's death is low, having this type of insurance can provide peace of mind and financial support during a difficult time.

Child life insurance also offers guaranteed insurability. The child can purchase additional coverage later in life without undergoing a medical exam. This can be especially valuable if the child develops a chronic health condition or chooses a risky career path. However, it's important to consider that healthy applicants in their 20s can usually secure competitive rates, making the need for child life insurance less crucial.

In summary, child life insurance with coverage amounts typically under $50,000 can provide financial protection and peace of mind for parents and guardians. It ensures that final expenses are covered and can help bridge the gap during a difficult time. While it may not be necessary for all families, it can be a valuable addition to existing life insurance policies, especially if there are concerns about future insurability due to health or career choices.

Family First Life Insurance: Pyramid Scheme or Legit Business?

You may want to see also

Premiums are locked in and won't increase

Child life insurance is a type of permanent life insurance that covers the life of a minor. It is typically purchased by a parent, guardian, or grandparent. The premiums for these policies are locked in at the child's current age, which means that the premiums will remain unusually low for the child's entire life. This is because life insurance premiums generally increase with age.

By locking in the premiums at a low rate, parents or guardians can ensure that they will be able to afford the coverage for their child's entire life. This can provide peace of mind and financial security, knowing that their child will always be protected.

In addition to locked-in premiums, child life insurance policies also offer other benefits. For example, these policies often include a guaranteed purchase option, which allows the child to buy additional coverage without completing a life insurance medical exam. This can be useful if the child develops a chronic health condition or chooses a risky career.

Furthermore, child life insurance can act as a savings vehicle for the child. The policies build cash value over time, which can be withdrawn or borrowed against by the child when they reach adulthood. This money can be used to cover costs such as school fees or a down payment on a home.

Overall, the locked-in premiums of child life insurance provide long-term financial security and peace of mind for parents or guardians, knowing that their child will always be protected under the policy.

Cancel Your Reliance Nippon Life Insurance: A Step-by-Step Guide

You may want to see also

The policy can be transferred to the child when they reach adulthood

Child life insurance is typically purchased by a parent, guardian or grandparent. It covers the life of a minor and is usually a type of permanent life insurance, meaning coverage lasts for the child's entire life as long as the premiums are paid. The policy can be transferred to the child when they reach adulthood, and they can continue coverage, buy more, or cancel the policy altogether.

Child life insurance policies are often whole life products, which means they build cash value over time. This cash value can be withdrawn or borrowed against by the policyholder. When the child reaches adulthood, they can choose to surrender the policy and receive the full cash value.

The ability to transfer ownership of the policy to the child once they reach adulthood, such as at age 21, is a significant advantage of child life insurance. This allows the child to have control over their own life insurance coverage and make decisions about continuing, altering, or cancelling the policy based on their financial needs and goals.

Additionally, child life insurance policies typically include or offer a guaranteed purchase option. This means that the child can buy additional coverage at certain ages or life events, such as marriage, without undergoing a life insurance medical exam. This can be especially useful if the child develops a chronic health condition or chooses a risky career path.

While child life insurance can provide peace of mind and financial protection in the unfortunate event of a child's death, it is important to consider the low probability of such an event and assess your budget and other financial priorities before purchasing a policy.

Life Insurance: Borrowing from Your Policy

You may want to see also

Frequently asked questions

Supplemental life insurance is extra coverage that can be purchased on top of the basic group policy provided by an employer. It is typically purchased by a parent or guardian to cover the costs associated with the loss of a child, such as burial or funeral expenses, and to provide financial support during a difficult time.

While it is a difficult topic to consider, the loss of a child can result in unexpected costs and a significant financial burden. Child supplemental life insurance provides a lump-sum payout to help cover these expenses, ensuring that you can focus on your well-being during a challenging time.

Child supplemental life insurance is specifically designed to provide financial support in the event of a child's death. It offers guaranteed coverage, often without the need for a medical exam, and can be purchased at group rates through an employer, making it more affordable than individual policies.

The amount of coverage you need will depend on your budget and specific needs. Consider the potential costs associated with the loss of a child, including burial expenses, time off work, and any other financial obligations. It is important to assess your situation and determine the level of coverage that would provide sufficient support during a difficult time.