Vol Life Insurance, short for Variable Life Insurance, is a type of permanent life insurance that offers both death benefit protection and an investment component. Unlike traditional fixed-rate life insurance, Vol Life Insurance provides a flexible approach to financial planning. It combines the security of a death benefit with the potential for investment growth, allowing policyholders to build cash value over time. This type of insurance is tailored to individuals seeking a customizable and adaptable financial strategy, where the cash value can be used for various purposes, such as funding education, retirement, or other financial goals.

What You'll Learn

- Definition: Vol life insurance is a type of policy that offers coverage based on the volatility of the insured's life expectancy

- Benefits: It provides financial security to beneficiaries through guaranteed death benefits, regardless of the insured's actual lifespan

- Features: Vol life insurance combines permanent coverage with an investment component, allowing policyholders to build cash value

- Risk Assessment: Underwriters use statistical models to assess the risk of insuring an individual based on age, health, and lifestyle

- Comparison: Vol life insurance is compared to term life insurance for its permanent nature and potential for long-term financial growth

Definition: Vol life insurance is a type of policy that offers coverage based on the volatility of the insured's life expectancy

Vol life insurance, also known as variable life insurance, is a unique and innovative approach to life coverage. This type of insurance policy is designed to provide a dynamic and personalized experience for the insured individual. The core concept behind vol life insurance revolves around the idea of tailoring the insurance coverage to the ever-changing nature of one's life expectancy.

In traditional life insurance, the coverage amount is typically fixed and predetermined, offering a set level of protection. However, vol life insurance takes a different path by incorporating the element of volatility. It calculates the insurance benefits based on the insured's life expectancy, which can fluctuate over time due to various factors such as health, lifestyle, and genetic predispositions. This volatility factor allows for a more flexible and adaptive insurance policy.

The policyholder can influence the volatility of their life expectancy through regular contributions or payments made into an investment account. These funds are invested in various financial instruments, and the performance of these investments directly impacts the value of the policy. As the insured individual's health and lifestyle choices affect their life expectancy, the policy's value adjusts accordingly, providing a dynamic coverage amount.

One of the key advantages of vol life insurance is its potential to offer higher cash values compared to traditional whole life insurance. The investment component allows the policy to accumulate cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. Additionally, the policy's adaptability ensures that the coverage remains relevant and appropriate as the insured's life circumstances change.

In summary, vol life insurance is a specialized policy that provides coverage based on the insured's life expectancy volatility. It offers a personalized and dynamic approach to insurance, allowing policyholders to influence their coverage through investment choices. This type of insurance can be particularly appealing to those seeking a more flexible and adaptable life insurance solution.

Life Insurance: Is Dependent Coverage Worth the Cost?

You may want to see also

Benefits: It provides financial security to beneficiaries through guaranteed death benefits, regardless of the insured's actual lifespan

Voluntary Life Insurance, often referred to as term life insurance, is a type of life insurance policy that offers a straightforward and cost-effective way to secure financial protection for your loved ones. This insurance is designed to provide a specific period of coverage, typically ranging from 10 to 30 years, and it is a popular choice for individuals seeking affordable life insurance without the complexities of permanent policies. The primary benefit of voluntary life insurance is its simplicity and the financial security it offers to beneficiaries.

When you purchase a voluntary life insurance policy, you agree to pay a premium for a set period, known as the term. During this term, the insurance company promises to pay out a predetermined death benefit to your designated beneficiaries if you pass away. The beauty of this arrangement is that the death benefit is guaranteed, meaning the insurance company will honor the payout regardless of whether you outlive the policy term or not. This is in contrast to permanent life insurance, where the death benefit is not guaranteed and may decrease over time.

The financial security provided by voluntary life insurance is particularly valuable for those who have financial dependents, such as a spouse, children, or other family members who rely on your income. In the event of your death, the death benefit can help cover essential expenses, such as mortgage payments, education costs, or daily living expenses, ensuring that your loved ones are financially protected. This type of insurance is especially beneficial for young families, as it provides a safety net during the years when financial responsibilities are often at their highest.

One of the key advantages of voluntary life insurance is its affordability. Since the coverage is limited to a specific term, the premiums are generally lower compared to permanent life insurance. This makes it an accessible option for individuals who may not have the financial resources to afford more comprehensive insurance. Additionally, the simplicity of the policy means that the application process is often quicker and less complex, allowing you to obtain coverage faster.

In summary, voluntary life insurance offers a practical solution for individuals seeking to provide financial security to their beneficiaries. With its guaranteed death benefits and affordable premiums, this type of insurance ensures that your loved ones are protected during the term of the policy. Whether you have a young family or are looking for a cost-effective way to secure your family's future, voluntary life insurance can be a valuable tool in your financial planning strategy.

Term Life Insurance: Filling Out Forms for Your Employer

You may want to see also

Features: Vol life insurance combines permanent coverage with an investment component, allowing policyholders to build cash value

Vol life insurance, also known as variable life insurance, is a type of permanent life insurance that offers a unique blend of protection and investment opportunities. It is designed to provide long-term financial security while allowing policyholders to potentially grow their money over time. Here are some key features that highlight the benefits of this insurance product:

Combining Permanent Coverage and Investment: One of the primary features of vol life insurance is its dual nature. It offers permanent coverage, ensuring that the insured individual's beneficiaries receive a death benefit in the event of the insured's passing. This permanent coverage is a crucial aspect of long-term financial planning, providing peace of mind and financial security for loved ones. Simultaneously, vol life insurance incorporates an investment component, allowing policyholders to allocate a portion of their premium payments into various investment options. These investment options can include stocks, bonds, or other financial instruments, providing an opportunity for the policyholder's money to grow and potentially earn higher returns compared to traditional savings accounts.

Building Cash Value: As the policyholder's investment grows, a significant feature of vol life insurance is the accumulation of cash value. This cash value is essentially the investment portion of the policy, and it can be used for various purposes. Policyholders can borrow against this cash value or even withdraw funds (subject to certain restrictions) to access their investment's growth. Over time, the cash value can become a substantial asset, providing financial flexibility and potentially increasing the overall value of the insurance policy. This feature is particularly attractive to those seeking a way to build wealth while also having a safety net in the form of life insurance.

Customizable Investment Strategies: Vol life insurance policies often offer a range of investment options, allowing policyholders to choose strategies that align with their financial goals and risk tolerance. These investment options can be diversified, providing a balanced approach to growing the policy's value. Policyholders can select from various investment accounts, each with its own set of risks and potential rewards. This customization enables individuals to tailor their vol life insurance policy to their specific needs, ensuring that their investment component is managed according to their preferences.

Long-Term Financial Planning: The combination of permanent coverage and investment opportunities makes vol life insurance an excellent tool for long-term financial planning. It allows individuals to secure their family's future while also working towards their financial objectives. With the potential for higher returns on investments, policyholders can build a substantial financial cushion over time. Additionally, the death benefit provided by the permanent coverage ensures that the insured's loved ones are financially protected, even if the investment component underperforms.

In summary, vol life insurance offers a unique and attractive approach to financial planning. By combining permanent coverage with an investment component, it provides policyholders with the opportunity to build cash value, customize their investment strategies, and secure their family's future. This insurance product caters to those seeking both financial protection and the potential for wealth accumulation.

Uncovering Your Parents' Life Insurance: A Step-by-Step Guide

You may want to see also

Risk Assessment: Underwriters use statistical models to assess the risk of insuring an individual based on age, health, and lifestyle

Underwriters play a crucial role in the insurance industry, especially in the context of life insurance. When an individual applies for life insurance, underwriters are responsible for evaluating the risk associated with insuring that person. This process involves a comprehensive risk assessment, and statistical models are at the heart of this assessment. These models help underwriters make informed decisions about insurance coverage and premiums.

The primary factors that underwriters consider are age, health, and lifestyle choices. Age is a significant determinant of risk; generally, the older an individual, the higher the risk associated with insuring them. This is because older individuals are more likely to have pre-existing health conditions or a higher likelihood of developing health issues over time. Statistical models take into account the age-related trends and provide a basis for assessing the potential long-term risks.

Health is another critical aspect. Underwriters review medical history, current health status, and any existing or previous medical conditions. Chronic illnesses, such as heart disease, diabetes, or cancer, can significantly impact the risk assessment. For instance, a person with a history of smoking or obesity may be considered higher-risk due to the increased likelihood of developing health complications. The statistical models are designed to consider various health indicators and their potential impact on longevity and overall health.

Lifestyle choices also play a role in risk assessment. Underwriters examine factors like smoking habits, alcohol consumption, occupation, and hobbies. For example, a high-risk occupation might include jobs with a higher likelihood of accidents or injuries. Similarly, extreme sports enthusiasts may be considered higher-risk due to the inherent dangers associated with their hobbies. These lifestyle factors are integrated into the statistical models to provide a comprehensive view of the individual's potential risks.

By utilizing statistical models, underwriters can make more accurate predictions about the likelihood of an individual's death or the occurrence of a critical event within a specific time frame. These models help in determining appropriate insurance coverage and setting competitive premiums. The process ensures that insurance companies can offer tailored policies while managing their risk exposure effectively. Ultimately, this risk assessment process is essential for maintaining the financial stability and long-term viability of life insurance providers.

Canceling Symetra Life Insurance: A Step-by-Step Guide

You may want to see also

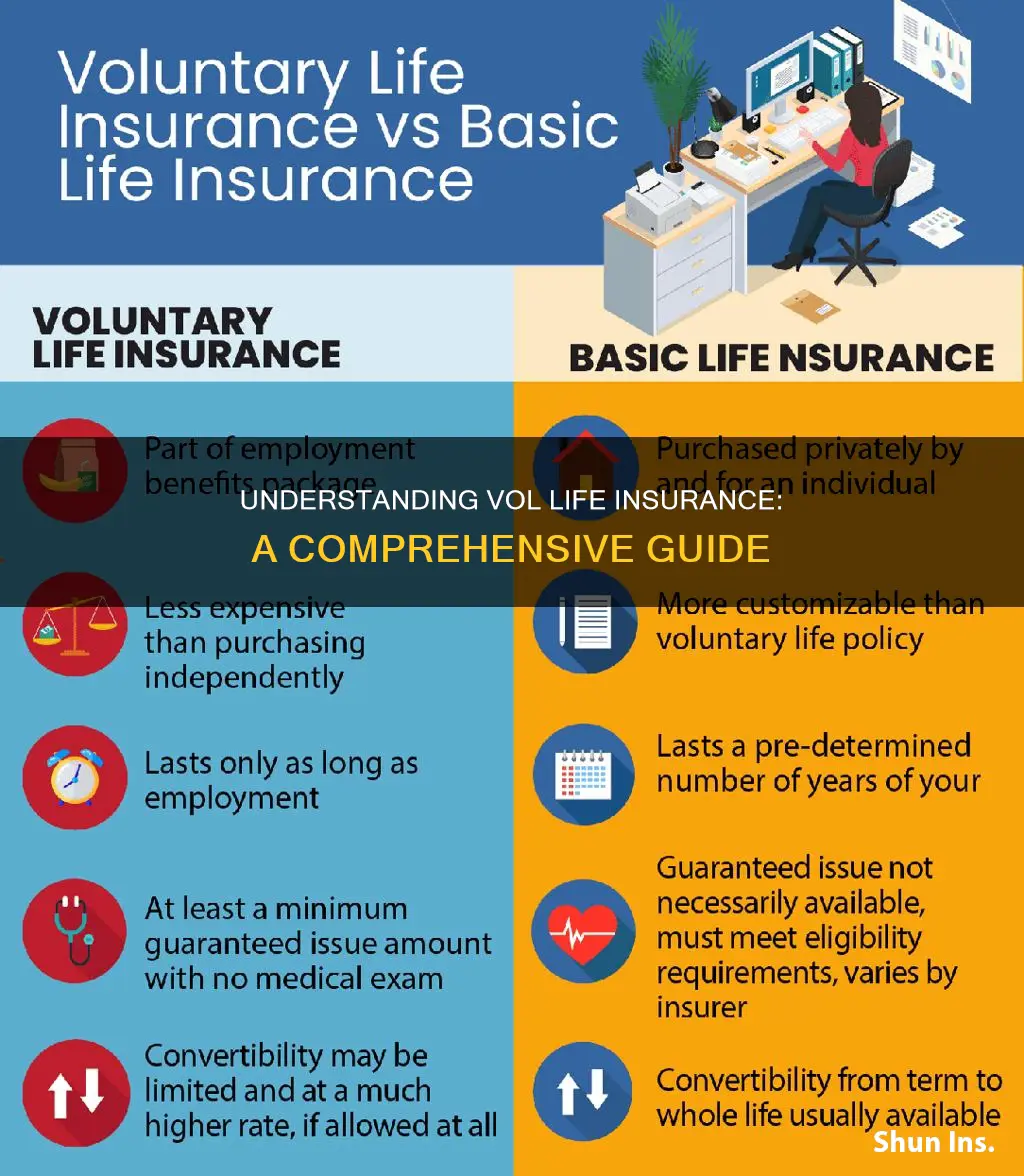

Comparison: Vol life insurance is compared to term life insurance for its permanent nature and potential for long-term financial growth

Vol life insurance, also known as variable life insurance, is a type of permanent life insurance that offers both insurance coverage and an investment component. It is a unique financial product that combines the security of a life insurance policy with the potential for long-term financial growth. This type of insurance is designed to provide permanent coverage, meaning it remains in force for the entire life of the insured individual, unlike term life insurance, which has a specific period of coverage.

When comparing vol life insurance to term life insurance, the key difference lies in their nature and long-term benefits. Term life insurance is a straightforward policy that provides coverage for a predetermined period, typically 10, 20, or 30 years. Once the term ends, the policy expires, and the coverage ceases unless the policyholder renews it. In contrast, vol life insurance is a permanent policy that continues to provide coverage throughout the insured's life, as long as the premiums are paid. This permanent nature ensures that the insured's beneficiaries will receive a death benefit, providing financial security for their loved ones.

One of the significant advantages of vol life insurance is its potential for long-term financial growth. The investment component of this policy allows policyholders to allocate a portion of their premiums into various investment options. These investment accounts can be customized to suit the policyholder's risk tolerance and financial goals. Over time, the value of these investment accounts can grow, providing a potential source of financial growth. This aspect sets vol life insurance apart from traditional term life insurance, which primarily focuses on providing a death benefit without the investment element.

In terms of long-term financial planning, vol life insurance offers a more comprehensive approach. The permanent nature of the policy ensures that the insured's beneficiaries are protected for their entire lives, providing a sense of security and peace of mind. Additionally, the investment component allows policyholders to potentially build a substantial cash value over time, which can be borrowed against or withdrawn to meet various financial needs. This flexibility and potential for growth make vol life insurance an attractive option for individuals seeking both insurance coverage and a long-term financial strategy.

In summary, when comparing vol life insurance to term life insurance, the permanent nature and investment potential of vol life insurance become evident. The permanent coverage ensures financial security for beneficiaries, while the investment component offers the opportunity for long-term financial growth. This comparison highlights how vol life insurance provides a more comprehensive and tailored approach to life insurance, catering to those seeking both insurance protection and a strategic financial plan.

Becoming a Life Insurance Agent: A Guide for Indians

You may want to see also

Frequently asked questions

Vol Life Insurance, also known as variable life insurance, is a type of permanent life insurance that offers both insurance coverage and an investment component. It provides a death benefit to your beneficiaries when you pass away, similar to traditional life insurance. However, the key difference lies in the investment aspect. The cash value of the policy, which grows over time, can be used to pay premiums or withdraw funds, providing flexibility and potential for investment growth.

When you purchase Vol Life Insurance, a portion of your premium goes towards funding the death benefit, while the remaining amount is invested in an investment account. This investment account can be linked to various investment options, such as stocks, bonds, or mutual funds. The cash value of the policy accumulates based on the performance of these investments. You can borrow against this cash value or withdraw funds, providing financial flexibility. The death benefit is paid out to your beneficiaries upon your passing, ensuring financial security for your loved ones.

Vol Life Insurance offers several advantages. Firstly, it provides permanent coverage, ensuring your beneficiaries receive a death benefit regardless of market fluctuations. Secondly, the investment component allows your money to grow, potentially outperforming traditional savings accounts. You also have the freedom to customize your policy by choosing investment options that align with your financial goals. Additionally, the cash value can be used for various purposes, such as borrowing for education expenses or business ventures, providing financial flexibility during your lifetime.