Term life insurance repurchase refers to the practice of purchasing additional coverage for a term life insurance policy. This is a strategic move made by policyholders who want to ensure their loved ones are protected in the event of their death, especially if their initial coverage may have lapsed or become insufficient over time. By repurchasing the policy, individuals can maintain the level of protection they initially sought, providing financial security and peace of mind. This process involves reviewing the policy, assessing the current needs, and potentially adjusting the coverage amount or term to align with the policyholder's evolving circumstances.

What You'll Learn

- Definition: Term life insurance repurchase is a policy where the insurer buys back the policy from the owner at a predetermined price

- Benefits: It offers financial security and flexibility, allowing policyholders to access cash value

- Repurchase Options: Insurers provide repurchase options at specific intervals, allowing policyholders to sell back the policy

- Financial Planning: Repurchase strategies help individuals plan for long-term financial goals and manage cash flow

- Tax Implications: Repurchases may have tax consequences, requiring careful consideration of financial and legal aspects

Definition: Term life insurance repurchase is a policy where the insurer buys back the policy from the owner at a predetermined price

Term life insurance repurchase is a unique and lesser-known aspect of life insurance policies, offering policyholders a way to regain control and financial benefit. This concept involves an insurance company agreeing to repurchase the policy from the policyholder at a specified price, providing a means to exit the policy with a guaranteed return.

In simple terms, if you have a term life insurance policy and decide to opt-out early, the repurchase option allows you to sell it back to the insurer. The insurer, in this case, becomes the buyer, and the policyholder becomes the seller. The key element is the predetermined price at which this repurchase transaction occurs. This price is typically set when the policy is initially taken out and is agreed upon by both the insurer and the policyholder.

This feature is particularly useful for those who, after a certain period, no longer require the insurance coverage or wish to explore other financial opportunities. Instead of canceling the policy and potentially losing the entire premium paid, the repurchase option provides a structured way to recover a portion of the investment. It ensures that the policyholder receives a fair value for the policy, even if they decide to terminate it early.

The process usually involves the policyholder notifying the insurer of their intention to repurchase, after which the insurer will assess the policy's value based on the agreed-upon terms. If both parties agree, the insurer will purchase the policy, and the policyholder will receive the predetermined repurchase price. This arrangement can be especially beneficial for those who have paid a significant portion of the premium upfront and wish to recoup some of their investment.

Understanding the term life insurance repurchase option is essential for policyholders, as it provides an additional layer of flexibility and security. It empowers individuals to make informed decisions about their insurance policies and financial assets, ensuring they can adapt to changing circumstances without incurring significant losses.

Life Coaching: Covered by Insurance?

You may want to see also

Benefits: It offers financial security and flexibility, allowing policyholders to access cash value

Term life insurance repurchase, often referred to as a "repurchase option" or "survivorship life," is a unique feature offered by some life insurance policies. This option provides policyholders with a way to access the cash value of their policy during their lifetime, offering both financial security and flexibility. Here's a detailed breakdown of its benefits:

Financial Security: One of the primary advantages of term life insurance with a repurchase option is the financial security it provides. When you purchase this type of policy, you're essentially buying a term life insurance contract with a built-in investment component. The cash value accumulates over time, and this value can be a valuable asset for the policyholder. If the insured individual passes away during the term of the policy, the death benefit is paid out to the beneficiaries, ensuring their financial needs are met. This feature is particularly beneficial for those who want to provide financial protection for their loved ones without the complexity of traditional investment products.

Flexibility and Access to Cash Value: The repurchase option allows policyholders to access the cash value of their policy, providing financial flexibility. This can be done through various methods, such as taking out a loan against the policy's cash value or making partial surrenders. Policyholders can use this cash value for various purposes, such as funding education, starting a business, or covering unexpected expenses. This flexibility is especially advantageous for individuals who may not have other sources of immediate funds and want to avoid tapping into their retirement savings or other long-term investments.

Potential for Tax Advantages: The cash value in a life insurance policy can grow tax-deferred, meaning it can accumulate without being subject to income tax. When the policyholder accesses the cash value, they may be able to take out tax-free loans or make withdrawals without incurring significant tax liabilities. This feature can be particularly beneficial for long-term financial planning, allowing individuals to build a substantial cash reserve within their life insurance policy.

Preserving Wealth and Legacy: Term life insurance with a repurchase option can be a powerful tool for wealth preservation and legacy planning. By utilizing the cash value, policyholders can make strategic financial decisions, such as investing in their business, purchasing real estate, or funding charitable gifts. This ensures that the policy's benefits are not only for the insured's family but also contribute to their long-term financial goals and charitable intentions.

In summary, term life insurance repurchase offers a unique combination of financial security and flexibility. It provides policyholders with the peace of mind of knowing their loved ones are protected financially while also allowing them to access the policy's cash value for various financial needs and goals. This feature can be a valuable addition to an individual's financial strategy, offering both insurance coverage and investment potential.

Life Insurance: Billionaire's Safety Net?

You may want to see also

Repurchase Options: Insurers provide repurchase options at specific intervals, allowing policyholders to sell back the policy

Term life insurance repurchase refers to the option provided by insurance companies that allows policyholders to sell back their term life insurance policy at specific intervals. This feature is particularly useful for those who initially purchased the policy for a specific period, such as 10 or 20 years, and now wish to adjust their coverage or financial plans. The repurchase option offers a way to regain the cash value of the policy, providing financial flexibility for policyholders.

When an insurer offers repurchase options, it provides policyholders with the opportunity to return the policy to the insurance company and receive a predetermined amount of money. This amount is typically based on the policy's cash value, which accumulates over time as premiums are paid. The repurchase price is usually set at a specific interval, such as annually or at the end of a policy term, giving policyholders the chance to review and reassess their insurance needs.

The process of exercising the repurchase option is straightforward. Policyholders can notify the insurer of their intention to sell back the policy, and the insurer will then provide the agreed-upon repurchase price. This amount can be used by the policyholder for various purposes, such as paying off debts, investing in new ventures, or simply as a financial cushion. It is a convenient way to access the value built up in the policy without having to surrender it entirely.

One of the key advantages of repurchase options is the control it gives to policyholders. They can decide when and why to repurchase, allowing for better financial management. For instance, a policyholder might choose to repurchase if they have found a more suitable insurance plan or if their financial situation has changed, requiring a different level of coverage. This flexibility ensures that individuals can adapt their insurance strategies as their lives evolve.

Insurers offering repurchase options demonstrate a commitment to providing customers with comprehensive and adaptable insurance solutions. It encourages policyholders to review and update their insurance coverage regularly, ensuring that their protection remains relevant and adequate. By allowing policyholders to sell back policies, insurers create a win-win situation, fostering long-term customer relationships and ensuring that insurance remains a valuable and dynamic financial tool.

Endowments: Unlocking Life Insurance Benefits for a Secure Future

You may want to see also

Financial Planning: Repurchase strategies help individuals plan for long-term financial goals and manage cash flow

Repurchase strategies are an essential tool in financial planning, especially for those looking to secure their long-term financial goals and effectively manage their cash flow. This concept involves a structured approach to investing, where an individual strategically buys and sells assets, typically securities, at specific intervals to optimize their financial portfolio. The primary goal is to ensure that the investor's money works harder over time, providing a steady growth rate and potentially higher returns.

In the context of financial planning, repurchase strategies are often employed in retirement planning, education funds, or any long-term savings goal. For instance, an individual might set up a repurchase plan to invest in a diversified portfolio of stocks, bonds, and mutual funds. This strategy allows the investor to take advantage of the power of compounding, where the interest earned on the initial investment is reinvested, leading to exponential growth over time. By regularly buying and selling assets, the investor can maintain a balanced portfolio, ensuring that risk is managed while also maximizing potential returns.

The process typically involves setting a fixed amount to be invested at regular intervals, such as monthly or quarterly. This disciplined approach helps individuals stay committed to their financial plan, even during market volatility. For example, if an investor has a retirement goal of $1 million in savings, they might set up a repurchase strategy where they invest $5,000 every month. Over time, this strategy can accumulate a substantial amount, especially with the power of compound interest working in their favor.

One of the key advantages of repurchase strategies is the ability to manage cash flow effectively. By investing at regular intervals, individuals can ensure that they are not tied up in a single asset class and can take advantage of market fluctuations. This approach also helps in avoiding the risk of investing a large sum at an inopportune time, such as just before a market downturn. Additionally, repurchase strategies can provide a sense of financial security, knowing that one's money is actively working towards a defined goal.

In summary, repurchase strategies are a powerful financial planning tool that enables individuals to plan for the long term and manage their cash flow efficiently. By implementing this strategy, investors can benefit from the potential for higher returns, effective risk management, and a structured approach to achieving their financial objectives. It is a disciplined method that can help individuals stay on track with their savings goals and make the most of their investment journey.

Accidental Death Life Insurance: What Cover Does It Provide?

You may want to see also

Tax Implications: Repurchases may have tax consequences, requiring careful consideration of financial and legal aspects

The concept of repurchasing term life insurance is an important consideration for policyholders, especially when it comes to understanding the potential tax implications. When an individual decides to repurchase their term life insurance policy, it involves a strategic financial move that can have significant tax consequences. This process often occurs when a policyholder wants to ensure continued coverage or when they believe the current policy's terms are no longer suitable.

One of the primary tax considerations is the potential impact on taxable income. Repurchasing a policy may trigger a taxable event, especially if the policyholder has to pay a premium or make a lump-sum payment. This is because the act of repurchasing can be seen as a form of premium payment, which may be subject to income tax. The tax authorities may classify this transaction as a premium payment, and the amount paid could be considered a taxable event, potentially affecting the policyholder's overall tax liability.

Additionally, the tax treatment of any gains or losses from the repurchase can be complex. If the policyholder sells the policy at a higher value than the purchase price, it may result in a capital gain, which is generally taxable. The tax rate applied to this gain will depend on the individual's income tax bracket and the duration of ownership. On the other hand, if the policy is sold at a loss, it could be a tax-deductible expense, providing a potential benefit to the policyholder. Understanding these tax implications is crucial to making informed financial decisions.

Furthermore, the legal aspects of repurchasing term life insurance should not be overlooked. Policyholders must be aware of the terms and conditions set by the insurance company, as these may include restrictions or penalties for early policy termination or repurchase. These legal considerations can significantly impact the overall cost and feasibility of the repurchase. It is essential to carefully review the policy documents and consult with financial advisors or tax professionals to navigate these complexities.

In summary, repurchasing term life insurance is a strategic financial decision that requires careful tax planning. Policyholders should be mindful of the potential taxable events, including premium payments and capital gains or losses. Seeking professional advice to understand the specific tax implications and legal requirements associated with repurchases is highly recommended. By considering these factors, individuals can make informed choices to protect their financial well-being and ensure appropriate insurance coverage.

Converting Term Life Insurance: Making the Switch Easy

You may want to see also

Frequently asked questions

Term life insurance repurchase refers to the act of buying back or redeeming a term life insurance policy before its original maturity date. This option allows policyholders to return the policy to the insurance company for a refund, typically receiving a portion of the premiums paid plus any applicable fees.

There are several reasons why an individual might choose to repurchase their term life insurance. Firstly, if their financial needs have changed, they may no longer require the same level of coverage. Secondly, if the policyholder has found a more suitable or cheaper policy elsewhere, they can repurchase to switch providers. Additionally, some policies offer a repurchase option if the insured individual wants to access the cash value built up over time.

The repurchase process typically involves the policyholder contacting their insurance company and requesting to exercise the repurchase right. The insurance provider will then evaluate the policy, considering factors like the policy's performance, the insured's health, and any applicable fees. If approved, the company will buy back the policy, and the policyholder will receive a lump sum payment, which may include a return of premiums paid plus any accumulated cash value.

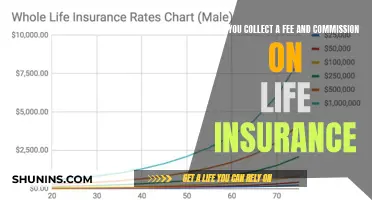

Yes, there can be fees and penalties involved. Insurance companies often charge a surrender charge or a penalty fee if the policy is surrendered early. These fees are typically a percentage of the premiums paid and are designed to cover administrative costs and any potential losses incurred by the insurer. It's essential to review the policy's terms and conditions to understand the specific fees and penalties associated with repurchasing.