A Professional Employer Organization (PEO) can be a valuable partner for small businesses looking to provide their employees with health and life insurance. By partnering with a PEO, small businesses can access health insurance options that would otherwise be unavailable to them. PEOs negotiate with insurance providers on behalf of multiple companies, leveraging their collective bargaining power to secure more competitive rates and terms for their clients. This allows small businesses to provide their employees with access to top-tier health benefits that would usually be out of reach.

In addition to health insurance, PEOs can also provide life insurance for employees, as well as other benefits such as disability insurance, unemployment insurance, and workers' compensation.

What You'll Learn

- PEOs can provide access to health insurance, including medical, dental, vision, disability, and life insurance

- PEOs can help small businesses access more competitive rates for insurance

- PEOs can reduce the administrative burden on businesses by managing insurance plans and helping employees

- PEOs can assist in annual planning for insurance renewal, open enrollment, and budgeting

- PEOs can negotiate with insurance providers to secure better rates and terms for small businesses

PEOs can provide access to health insurance, including medical, dental, vision, disability, and life insurance

A Professional Employer Organization (PEO) can be a great way for businesses to provide their employees with access to health insurance, including medical, dental, and vision insurance, as well as life, disability, and other types of insurance. PEOs can help small businesses access more competitive rates for these benefits, which can be a cost-effective solution. This is because PEOs leverage their larger pool of employees to negotiate better rates and terms with insurance providers. This collective bargaining power allows them to secure enhanced health insurance options at more affordable rates.

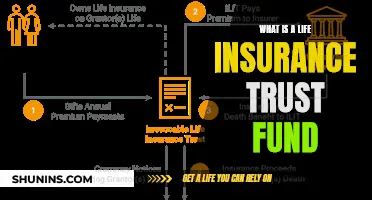

PEOs typically offer a co-employment model, where they share employer responsibilities with the client company. This has implications for insurance coverage as PEOs may provide coverage for employees under their own policies. This can help small businesses get better insurance options and reduce the administrative burden of managing multiple insurance policies.

In addition to health insurance, PEOs can also provide disability insurance, which offers financial support in case an employee becomes disabled and unable to work. Life insurance is another benefit offered by PEOs, providing a sum of money to the employee's beneficiaries upon their death.

Using a PEO for insurance purposes can be beneficial for businesses as it allows them to outsource certain HR functions and focus on their core operations. However, it's important to consider the potential downsides, such as limited flexibility in coverage and legal or compliance risks. Overall, PEOs can be a valuable partner for small businesses looking to streamline their HR and insurance processes.

Life Insurance: Who Gets the Payout When You Die?

You may want to see also

PEOs can help small businesses access more competitive rates for insurance

Small businesses often face challenges when it comes to providing competitive insurance benefits to their employees. This is where a Professional Employer Organization (PEO) can step in and make a significant difference. By partnering with a PEO, small businesses can access more competitive rates for insurance, offering their employees enhanced benefits packages.

PEOs work with multiple client companies, which means they have a larger pool of employees to leverage when negotiating with insurance providers. This collective bargaining power allows them to secure more favorable rates and terms that would typically be out of reach for individual small businesses. PEOs can provide access to a range of insurance types, including health, dental, vision, life, disability, and even pet insurance.

The benefits of PEOs for small businesses

The main advantage of using a PEO for insurance is the cost savings. PEOs can negotiate lower rates for insurance plans, reducing the financial burden on small businesses. Additionally, PEOs can also provide administrative support, handling the management of insurance plans, renewals, open enrollment, and employee education. This frees up time and resources for small business owners, allowing them to focus on their core business operations and growth strategies.

The co-employment model

PEOs typically offer a co-employment model, where they share employer responsibilities with the client company. This means that the PEO may provide insurance coverage for employees under their own policies, reducing the administrative burden of managing multiple insurance policies for the small business.

Other advantages of PEOs

In addition to insurance, PEOs can also assist with other HR functions such as payroll processing, benefits administration, workers' compensation claims, compliance with labor laws, and human resource management. They act as the employer of record, taking on responsibilities such as withholding payroll taxes. Overall, PEOs provide a valuable partnership for small businesses, helping them streamline their HR and insurance processes while also improving their competitiveness in the labor market.

Convertable Life Insurance: Cash Value and Benefits Explained

You may want to see also

PEOs can reduce the administrative burden on businesses by managing insurance plans and helping employees

A Professional Employer Organization (PEO) can be a valuable partner for businesses, especially small businesses, looking to streamline their HR and insurance processes. By partnering with a PEO, businesses can access health insurance options that would otherwise be unavailable to them.

PEOs allow businesses to outsource certain HR functions, including health insurance. This means that PEOs can reduce the administrative burden on businesses by managing insurance plans and helping employees.

The PEO acts as a gateway between a small business and the complex world of health insurance. PEOs select robust plans from best-in-class health insurance carriers for all their clients. The individual companies that partner with PEOs then offer those plans to their employees.

PEOs have access to health plans not offered to small businesses. This is because PEOs are considered large employers. This gives small businesses access to more competitive rates for small group insurance benefits such as health, dental, and vision.

PEOs can work with insurance providers to secure more competitive rates for these benefits, which can be a cost-effective solution for small businesses that may not have the bargaining power to negotiate on their own. PEOs can also provide access to other types of insurance, such as life insurance, disability insurance, and even pet insurance.

In addition to reducing the administrative burden, PEOs can also help small businesses attract and retain top talent. According to a study by the Society for Human Resource Management (SHRM), 46% of US adults say that health insurance was a deciding factor or a positive influence in choosing their current job.

Furthermore, PEOs can free up time and human capital, allowing small businesses to focus on their core competencies and scale their businesses faster. Overall, PEOs offer a flexible, cost-effective, and comprehensive solution for businesses looking to provide competitive health benefits to their employees without the financial and administrative burdens that often come with them.

Haven Life Insurance: BBB Ratings and Reviews Explained

You may want to see also

PEOs can assist in annual planning for insurance renewal, open enrollment, and budgeting

Professional employer organizations (PEOs) can be a valuable partner for businesses, especially small businesses, in their annual planning for insurance renewal, open enrolment, and budgeting. PEOs can help businesses access more competitive rates for insurance benefits such as health, dental, vision, life, disability, and more. They can also assist in reducing the administrative burden associated with managing multiple insurance policies and planning for subsequent years' insurance offerings.

One of the key advantages of working with a PEO is their ability to negotiate more favourable terms with insurance carriers due to their collective bargaining power. By representing multiple client companies and their employees, PEOs can secure enhanced health insurance options at more affordable rates. This is especially beneficial for small businesses that may lack the bargaining power to negotiate on their own.

In addition to cost savings, PEOs can also provide support throughout the insurance renewal and open enrolment process. They can help businesses navigate the complex and time-consuming tasks of reassessing insurance needs, selecting new plans, and communicating changes to employees. PEOs often act as the employer of record, taking on certain employer responsibilities such as withholding payroll taxes and providing workers' compensation coverage.

Furthermore, PEOs can assist businesses in budgeting for insurance costs by providing expertise in the annual planning process. Their experience in managing large group health insurance plans helps minimize surprises and ensures businesses have a clear understanding of how the plan is running and what to expect in terms of costs and benefits for the coming year.

Overall, partnering with a PEO can help businesses streamline their insurance renewal, open enrolment, and budgeting processes, allowing them to focus on their core operations while still providing competitive insurance benefits to their employees.

How Family History Impacts Your Life Insurance

You may want to see also

PEOs can negotiate with insurance providers to secure better rates and terms for small businesses

Professional Employer Organizations (PEOs) can be a great resource for small businesses looking to provide their employees with health insurance. By partnering with a PEO, small businesses can access better insurance rates and terms than they would be able to negotiate on their own.

PEOs work by allowing multiple companies to join forces, thus increasing their collective bargaining power. This model gives small businesses access to the kind of top-tier health benefits and insurance rates that are usually only available to much larger corporations. PEOs leverage their larger pool of employees to negotiate better rates and terms with insurance providers. This collective bargaining power allows them to secure more favourable health insurance options, which can be a cost-effective solution for the individual businesses they serve.

In addition to health insurance, PEOs may also handle other types of insurance, including life insurance, disability insurance, unemployment insurance, and more. They can also provide comprehensive HR solutions, such as payroll processing, benefits administration, and compliance with labour laws.

One of the key benefits of using a PEO for insurance is the cost savings. PEOs can negotiate lower rates for small businesses, which can result in significant cost savings for the business. Additionally, PEOs can also reduce the administrative burden on small business owners, allowing them to focus on growing their business.

When choosing a PEO, it is important to evaluate your options carefully. Consider the accreditation and certification of the PEO, as well as their pricing structure and the services they offer. By partnering with a reputable and reliable PEO, small businesses can secure better insurance rates and terms while also gaining access to a range of other valuable services.

Did Your Dad Have Life Insurance? How to Find Out

You may want to see also

Frequently asked questions

PEO stands for Professional Employer Organization. These companies, sometimes known as umbrella companies or staffing agencies, provide comprehensive payroll and HR solutions for client businesses.

A PEO can provide access to health insurance, including medical, dental, and vision, as well as life insurance, disability insurance, and even pet insurance.

Partnering with a PEO is a great option for small businesses looking to reduce costs while providing better health insurance to their employees. A PEO negotiates on behalf of all the employees and clients it serves, so it can access offerings and rates typically reserved for very large companies.

Using a PEO can result in cheaper group rates because they pool employees from different organizations together. This spreads the risk, allowing them to negotiate better rates from insurance carriers. PEOs can also provide access to insurance options that small businesses typically wouldn't qualify for based on company size.